The incontestability clause prevents insurers from voiding a policy after it has been in force for a specified period, typically two years, except in cases of fraud. The suicide clause specifically excludes coverage if the insured dies by suicide within a defined contestability period, often the first two years of the policy. Understanding the distinction between these clauses is crucial for policyholders to know when claims may be denied under life insurance contracts.

Table of Comparison

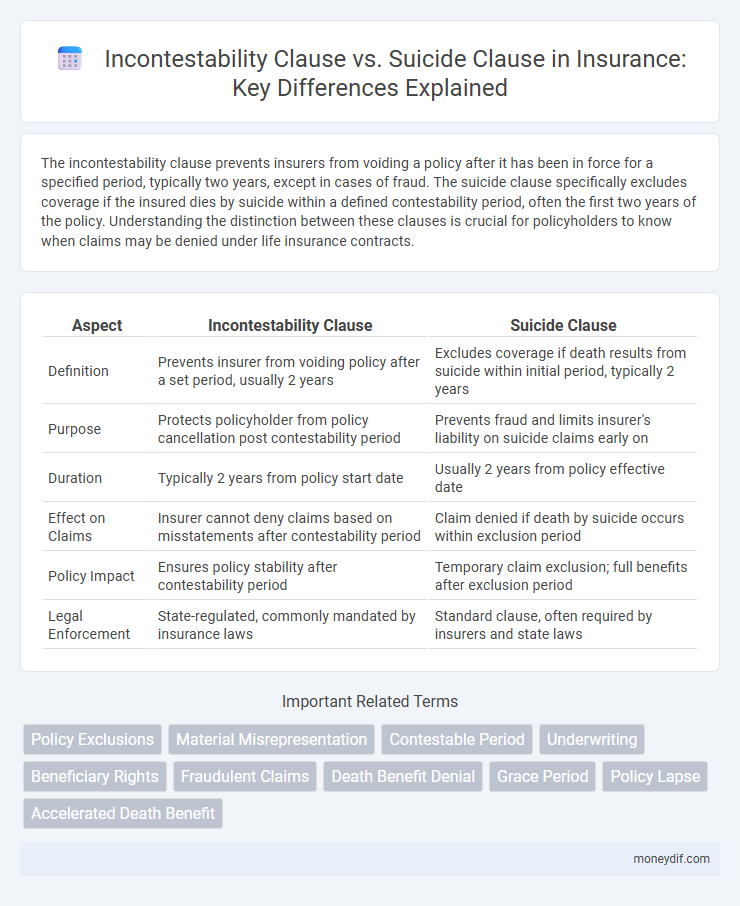

| Aspect | Incontestability Clause | Suicide Clause |

|---|---|---|

| Definition | Prevents insurer from voiding policy after a set period, usually 2 years | Excludes coverage if death results from suicide within initial period, typically 2 years |

| Purpose | Protects policyholder from policy cancellation post contestability period | Prevents fraud and limits insurer's liability on suicide claims early on |

| Duration | Typically 2 years from policy start date | Usually 2 years from policy effective date |

| Effect on Claims | Insurer cannot deny claims based on misstatements after contestability period | Claim denied if death by suicide occurs within exclusion period |

| Policy Impact | Ensures policy stability after contestability period | Temporary claim exclusion; full benefits after exclusion period |

| Legal Enforcement | State-regulated, commonly mandated by insurance laws | Standard clause, often required by insurers and state laws |

Understanding Incontestability and Suicide Clauses

The incontestability clause in insurance policies limits the insurer's ability to void coverage after a specified period, usually two years, ensuring claims cannot be denied based on misstatements in the application. The suicide clause specifically excludes death benefits if the insured dies by suicide within the first two years of the policy, providing protection against fraudulent claims. Understanding these clauses is crucial for policyholders to know their rights and the conditions under which benefits may be paid or denied.

Defining the Incontestability Clause in Insurance

The incontestability clause in insurance prevents an insurer from voiding a policy after it has been in force for a specified period, typically two years, even if the insurer discovers misrepresentations by the policyholder. This clause ensures policyholder protection by limiting the time frame during which the insurer can challenge the validity of the insurance contract. Unlike the suicide clause, which excludes benefits if the insured dies by suicide within a certain period, the incontestability clause primarily addresses the insurer's ability to contest claims based on application inaccuracies.

What Is the Suicide Clause?

The Suicide Clause in insurance policies is a provision that excludes coverage if the insured commits suicide within a specific period, usually two years from the policy's start date. This clause protects insurers from immediate payouts resulting from suicide, limiting the risk of moral hazard. After this contestability period, the policy typically pays out death benefits regardless of the cause of death.

Incontestability Clause: Purpose and Protection

The Incontestability Clause in insurance policies prevents the insurer from voiding coverage after a specified period, typically two years, ensuring the policyholder's protection against claim denials due to misstatements in the application. This clause strengthens the policyholder's confidence by guaranteeing claim acceptance despite errors or omissions once the contestability period lapses. Unlike the Suicide Clause, which restricts benefits if death results from suicide within the initial policy term, the Incontestability Clause secures long-term contract stability and claim certainty.

Suicide Clause: Key Provisions and Limitations

The Suicide Clause in insurance policies typically restricts coverage if the insured commits suicide within a specified period, usually two years from the policy's inception, to prevent immediate claims and policy abuse. Key provisions include a stipulated contestability period during which the insurer can deny claims based on suicide and limitations that do not apply once the contestability period expires, ensuring eventual payout to beneficiaries. Understanding these limitations is crucial for policyholders to avoid coverage denial and for insurers to mitigate risk in life insurance contracts.

Differences Between Incontestability and Suicide Clauses

The Incontestability Clause prevents an insurer from voiding a life insurance policy after it has been in force for a specified period, typically two years, regardless of misstatements in the application. The Suicide Clause allows the insurer to deny benefits if the insured commits suicide within a predetermined timeframe, usually within the first two years of the policy. These clauses differ fundamentally in purpose: the Incontestability Clause protects the policyholder's coverage from disputes after a set period, while the Suicide Clause specifically addresses the risk of early policy termination due to suicide.

How Each Clause Impacts Claim Payouts

The Incontestability Clause limits the insurer's ability to deny claims after a policy has been in force for a specified period, typically two years, ensuring claim payouts are more secure unless fraud is proven. The Suicide Clause restricts claim payouts if the insured commits suicide within a designated timeframe, usually within the first two years of the policy, after which full benefits are payable. Understanding these clauses helps policyholders and beneficiaries anticipate conditions affecting the timing and certainty of insurance claim payouts.

Common Misconceptions About Policy Clauses

Many policyholders confuse the Incontestability Clause with the Suicide Clause, mistakenly believing both serve similar protective functions in insurance contracts. The Incontestability Clause prevents an insurer from voiding a policy after it has been active for a specified period, usually two years, while the Suicide Clause typically excludes death benefits if the insured commits suicide within the first two years of the policy. Understanding these distinctions is crucial to avoid misunderstandings about claim eligibility and policy termination.

Legal Considerations for Policyholders

The Incontestability Clause legally limits the insurer's ability to void a policy after it has been in force for a specified period, usually two years, protecting policyholders from claims denial based on misstatements in the application. The Suicide Clause typically excludes benefits if the insured commits suicide within a defined period, often the first two years of the policy, which requires policyholders to understand this exception to avoid denial of claims. Policyholders must carefully review both clauses to ensure awareness of their rights and restrictions under state insurance laws, as these provisions significantly impact claim validity and coverage security.

Choosing Life Insurance: Evaluating Policy Clauses

When choosing life insurance, evaluating policy clauses such as the Incontestability Clause and Suicide Clause is crucial for understanding benefit guarantees and exclusions. The Incontestability Clause ensures the insurer cannot void the policy after a specified period, typically two years, protecting the beneficiary's claim. The Suicide Clause excludes coverage if the insured dies by suicide within a set timeframe, often two years, necessitating careful review to match personal risk considerations with policy terms.

Important Terms

Policy Exclusions

Policy exclusions commonly exempt claims arising from suicide within the incontestability period, ensuring insurers can deny benefits if death occurs by suicide shortly after policy inception. The incontestability clause limits the insurer's ability to contest claims after a specified period, typically two years, except for exclusion grounds such as suicide, which remains a valid cause for claim denial during this timeframe.

Material Misrepresentation

Material Misrepresentation occurs when a policyholder provides false or misleading information that significantly affects the insurer's risk assessment, potentially voiding coverage despite the Incontestability Clause, which limits the insurer's ability to deny claims after a policy has been in force for typically two years. The Suicide Clause specifically excludes coverage if the insured commits suicide within a defined period, usually two years, and this exclusion remains enforceable even if a material misrepresentation is alleged.

Contestable Period

The Contestable Period, typically lasting two years from policy inception, allows insurers to investigate and deny claims based on misrepresentations in the application under the Incontestability Clause, whereas the Suicide Clause specifically addresses claims resulting from the insured's suicide within this period, often leading to claim denial or return of premiums. Understanding the distinct legal frameworks of these clauses is crucial for assessing claim validity and insurer liability during the early stages of a life insurance policy.

Underwriting

The incontestability clause in life insurance policies limits the insurer's ability to deny claims after the policy has been in force for a specified period, typically two years, whereas the suicide clause excludes coverage if the insured dies by suicide within that initial contestability period. Underwriting processes carefully evaluate suicide risk to accurately price policies and apply these clauses effectively, ensuring financial protection while mitigating moral hazard.

Beneficiary Rights

Beneficiary rights under the incontestability clause prevent the insurer from denying a claim after a specified period, usually two years, even if the policyholder made misrepresentations, while the suicide clause specifically excludes coverage if the insured commits suicide within the initial contestability period. These clauses balance protection for beneficiaries by ensuring claims are honored after the contestability period, yet limit liability for insurers in cases of suicide shortly after policy inception.

Fraudulent Claims

Fraudulent claims filed under life insurance policies often conflict with the incontestability clause, which prevents insurers from voiding coverage after a specific period, typically two years, except in cases of suicide as outlined by the suicide clause; the incontestability clause limits denial of claims based on misrepresentations after this time while the suicide clause allows denial if death occurs within a predetermined initial period, usually two years. Understanding the distinct legal boundaries of the incontestability and suicide clauses is crucial in evaluating the validity of claims suspected to be fraudulent.

Death Benefit Denial

Death benefit denial often hinges on the interpretation of the incontestability clause versus the suicide clause in life insurance policies. While the incontestability clause limits the insurer's ability to contest claims after a specified period, the suicide clause provides an exclusion period during which death by suicide results in benefit denial.

Grace Period

The grace period in an insurance policy allows the policyholder extra time to pay premiums without losing coverage, crucial for maintaining the incontestability clause which prevents the insurer from voiding the policy after a specified time, typically two years. In contrast, the suicide clause usually excludes benefits if the insured dies by suicide within the first two years of the policy, a period that often overlaps with the grace period, impacting claim eligibility.

Policy Lapse

Policy lapse occurs when premium payments are not made on time, causing the insurance contract to terminate; the incontestability clause limits the insurer's ability to deny claims after a set period, typically two years, while the suicide clause excludes benefits if the insured commits suicide within the first one or two years of policy issuance. Understanding the interaction between these clauses is crucial, as a policy lapse it may override the suicide clause protections, potentially resulting in claim denial if policy conditions are not met.

Accelerated Death Benefit

Accelerated Death Benefit allows policyholders to access a portion of their life insurance payout early in cases of terminal illness, which is often unaffected by the Incontestability Clause that limits insurer disputes after two years. The Suicide Clause typically restricts benefit payment if death occurs by suicide within a specified period, contrasting with the Accelerated Death Benefit's provision for early claim access under qualifying conditions.

Incontestability Clause vs Suicide Clause Infographic

moneydif.com

moneydif.com