Waiver of Subrogation prevents an insurer from seeking reimbursement from a third party responsible for a loss, ensuring the insured is not pursued for damages after a claim is paid. Hold Harmless Agreement shifts liability between parties, where one agrees to indemnify and protect the other from legal claims or damages. Understanding the distinctions is essential for managing risk and contractual obligations in insurance policies.

Table of Comparison

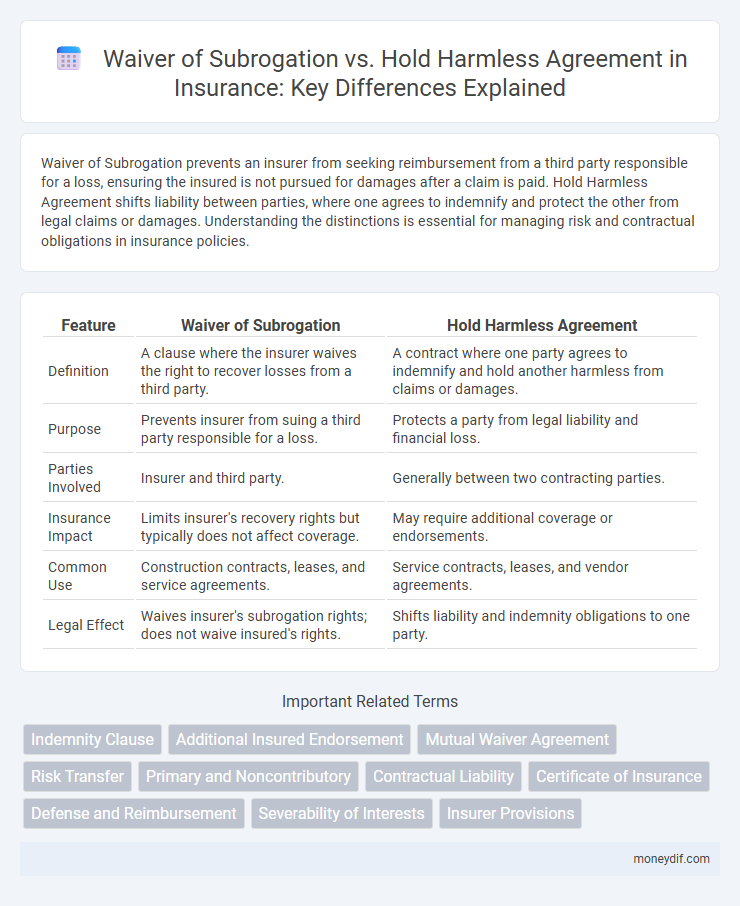

| Feature | Waiver of Subrogation | Hold Harmless Agreement |

|---|---|---|

| Definition | A clause where the insurer waives the right to recover losses from a third party. | A contract where one party agrees to indemnify and hold another harmless from claims or damages. |

| Purpose | Prevents insurer from suing a third party responsible for a loss. | Protects a party from legal liability and financial loss. |

| Parties Involved | Insurer and third party. | Generally between two contracting parties. |

| Insurance Impact | Limits insurer's recovery rights but typically does not affect coverage. | May require additional coverage or endorsements. |

| Common Use | Construction contracts, leases, and service agreements. | Service contracts, leases, and vendor agreements. |

| Legal Effect | Waives insurer's subrogation rights; does not waive insured's rights. | Shifts liability and indemnity obligations to one party. |

Understanding Waiver of Subrogation

Waiver of Subrogation is a contractual provision in insurance agreements that prevents an insurer from pursuing recovery from a third party responsible for a loss after compensating the insured. It shifts the financial responsibility by waiving the insurer's right to subrogate, thereby protecting the third party from litigation and preserving the business relationship. This waiver is critical in construction contracts and commercial leases where parties agree to bear their own losses without seeking reimbursement from one another.

What is a Hold Harmless Agreement?

A Hold Harmless Agreement is a contractual provision in insurance that protects one party from liability or legal claims arising from the actions of another party. It shifts the responsibility for potential damages or losses, ensuring the indemnified party is not held accountable for specific risks. This agreement is commonly used to allocate risk and prevent litigation between contractors, vendors, and clients.

Key Differences Between Waiver of Subrogation and Hold Harmless Agreement

Waiver of Subrogation prevents an insurer from seeking reimbursement from a third party responsible for a loss, effectively shifting financial responsibility away from the insured party. Hold Harmless Agreements require one party to assume liability and protect the other from legal claims or damages arising from specific activities or contracts. The primary difference lies in Waivers of Subrogation focusing on the insurer's rights after a loss, while Hold Harmless Agreements allocate risk and liability between contracting parties before any loss occurs.

Legal Implications for Policyholders

Waiver of Subrogation prevents an insurer from seeking reimbursement from a third party responsible for a loss, directly impacting a policyholder's ability to recover damages through subrogation rights. Hold Harmless Agreements shift liability by contract, requiring one party to assume responsibility for potential claims, which can limit a policyholder's legal recourse in indemnity disputes. Understanding these legal implications is critical for policyholders to manage risk exposure and ensure compliance with contractual obligations in insurance policies.

When to Use a Waiver of Subrogation

A Waiver of Subrogation is essential when a party wants to prevent their insurance company from seeking recovery from the other party after a claim is paid, commonly used in construction contracts or leases to avoid litigation between insured parties. It is advisable to use a Waiver of Subrogation when contractual relationships require risk sharing without transferring liability, helping maintain business relationships and reduce potential disputes. Choosing this waiver protects the indemnitee while allowing the indemnitor's insurance to cover losses without facing subrogation claims.

Situations Requiring a Hold Harmless Agreement

Situations requiring a Hold Harmless Agreement often arise in construction projects, property leases, and service contracts where one party needs protection from liability for damages or injuries caused by the other party's actions. This agreement shifts the legal responsibility, ensuring that one party is not held accountable for losses related to the other party's negligence or misconduct. It is commonly used to manage risk when multiple parties are involved in potentially hazardous activities or shared spaces.

Benefits and Risks of Each Provision

Waiver of Subrogation prevents an insurer from pursuing recovery from a third party, reducing litigation and preserving business relationships but may increase insurance costs due to limited recovery options. Hold Harmless Agreements allocate risk by requiring one party to indemnify another, offering clearer risk assignment but potentially leading to broader liability and higher financial exposure. Both provisions provide risk management tools tailored to contractual needs, and understanding their implications aids in balancing protection against potential legal and financial consequences.

Waiver of Subrogation in Commercial Insurance

Waiver of Subrogation in commercial insurance prevents an insurer from pursuing reimbursement from a third party responsible for a loss, shifting the risk to the insurance provider instead of the insured. This waiver is often included in contracts to maintain business relationships by avoiding legal claims between parties after a covered loss. Understanding the implications of Waiver of Subrogation clauses is critical for risk management and contract negotiation in commercial insurance policies.

Hold Harmless Agreements in Contractual Relationships

Hold Harmless Agreements in contractual relationships transfer the risk of loss or damages from one party to another, ensuring that one party agrees not to hold the other liable for certain claims or damages. These agreements are critical in construction contracts, service agreements, and leases, providing protection against potential lawsuits or financial liabilities. Properly drafted Hold Harmless Agreements clearly define the scope of indemnity, mitigating risks and fostering smoother business relationships.

Best Practices for Managing Liability in Insurance Contracts

Waiver of Subrogation and Hold Harmless Agreements are essential tools for managing liability in insurance contracts, with the former preventing insurers from pursuing recovery against a third party, and the latter allocating risk by requiring one party to indemnify another. Best practices include clearly defining the scope and responsibilities within these clauses, ensuring alignment with state laws, and regularly reviewing contract terms to address evolving risks. Properly structured agreements minimize disputes and enhance clarity, ultimately protecting all parties involved from unexpected financial exposure.

Important Terms

Indemnity Clause

An indemnity clause specifies financial responsibility for damages, with a waiver of subrogation preventing an insurer from claiming reimbursement from the indemnified party, whereas a hold harmless agreement shifts liability directly to another party to avoid legal claims.

Additional Insured Endorsement

An Additional Insured Endorsement extends insurance coverage to a third party, differing from a Waiver of Subrogation that prevents the insurer from seeking recovery from the third party, while a Hold Harmless Agreement contracts one party to assume liability for damages or claims against another.

Mutual Waiver Agreement

A Mutual Waiver Agreement typically involves parties agreeing to waive subrogation rights to prevent insurance claims against each other, while a Hold Harmless Agreement requires one party to indemnify and assume liability for certain damages or claims.

Risk Transfer

Risk transfer through a Waiver of Subrogation prevents an insurer from seeking recovery from a third party, whereas a Hold Harmless Agreement shifts liability protection to a party by contractually obligating another party to indemnify and defend against claims.

Primary and Noncontributory

Primary and noncontributory insurance clauses ensure the insurer pays first without contribution from other policies, while waiver of subrogation prevents the insurer from seeking recovery from third parties, and hold harmless agreements transfer liability to another party, each playing distinct roles in risk management contracts.

Contractual Liability

Contractual liability often involves distinctions between waiver of subrogation, which prevents an insurer from recovering losses from a third party, and hold harmless agreements, which shift liability to another party through indemnification clauses.

Certificate of Insurance

A Certificate of Insurance verifies coverage and may include a Waiver of Subrogation clause waiving the insurer's right to seek recovery from a third party, while a Hold Harmless Agreement legally protects one party from liability regardless of insurance.

Defense and Reimbursement

Waiver of Subrogation prevents an insurer from pursuing recovery from a third party, while a Hold Harmless Agreement shifts liability and defense obligations to one party, impacting defense and reimbursement responsibilities.

Severability of Interests

Severability of interests ensures that the waiver of subrogation remains effective independently of the hold harmless agreement, protecting parties from losing subrogation rights if one provision is invalidated.

Insurer Provisions

Insurer provisions for Waiver of Subrogation prevent insurers from recovering claim costs from third parties, while Hold Harmless Agreements shift liability between parties, reducing insurer exposure to certain losses.

Waiver of Subrogation vs Hold Harmless Agreement Infographic

moneydif.com

moneydif.com