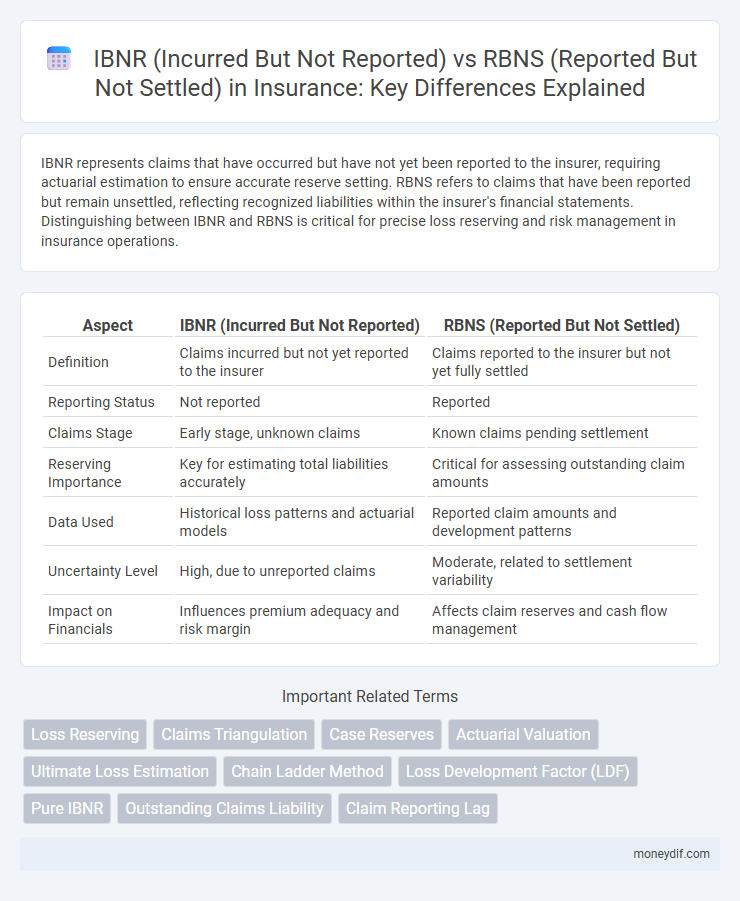

IBNR represents claims that have occurred but have not yet been reported to the insurer, requiring actuarial estimation to ensure accurate reserve setting. RBNS refers to claims that have been reported but remain unsettled, reflecting recognized liabilities within the insurer's financial statements. Distinguishing between IBNR and RBNS is critical for precise loss reserving and risk management in insurance operations.

Table of Comparison

| Aspect | IBNR (Incurred But Not Reported) | RBNS (Reported But Not Settled) |

|---|---|---|

| Definition | Claims incurred but not yet reported to the insurer | Claims reported to the insurer but not yet fully settled |

| Reporting Status | Not reported | Reported |

| Claims Stage | Early stage, unknown claims | Known claims pending settlement |

| Reserving Importance | Key for estimating total liabilities accurately | Critical for assessing outstanding claim amounts |

| Data Used | Historical loss patterns and actuarial models | Reported claim amounts and development patterns |

| Uncertainty Level | High, due to unreported claims | Moderate, related to settlement variability |

| Impact on Financials | Influences premium adequacy and risk margin | Affects claim reserves and cash flow management |

Understanding IBNR and RBNS in Insurance

IBNR (Incurred But Not Reported) represents insurance claims that have occurred but have not yet been reported to the insurer, requiring actuaries to estimate future liabilities based on historical data and claim patterns. RBNS (Reported But Not Settled) refers to claims that have been reported to the insurer but remain unsettled, necessitating reserve estimations to cover the expected payout. Accurate differentiation between IBNR and RBNS reserves is critical for insurers to maintain sufficient capital adequacy and ensure financial stability.

Key Differences Between IBNR and RBNS

IBNR (Incurred But Not Reported) represents insurance claims that have occurred but have not yet been reported to the insurer, whereas RBNS (Reported But Not Settled) refers to claims that have been reported but are still pending settlement. IBNR estimates are critical for reserving and risk management as they account for unknown liabilities, while RBNS involves known claims where the amount and occurrence are confirmed but final payment is outstanding. The primary distinction lies in the reporting status and the level of claim development, with IBNR being an actuarial estimate and RBNS involving active claims management.

Importance of IBNR and RBNS in Claim Reserving

IBNR (Incurred But Not Reported) and RBNS (Reported But Not Settled) are critical components in claim reserving, ensuring insurers accurately estimate liabilities for claims yet to be fully processed. IBNR represents claims incurred but not yet reported, capturing future obligations on current policies, while RBNS pertains to reported claims pending settlement, reflecting outstanding claim costs. Precise estimation of IBNR and RBNS reserves is vital for maintaining solvency, optimizing capital allocation, and enhancing financial reporting transparency.

Methods for Estimating IBNR Reserves

Methods for estimating IBNR reserves primarily include the Chain-Ladder method, Bornhuetter-Ferguson technique, and the Cape Cod approach, each leveraging historical claim development data and exposure information to predict unreported claim liabilities. The Chain-Ladder method assumes past claim development patterns will continue, using cumulative paid or incurred claims to project ultimate losses. The Bornhuetter-Ferguson method combines prior loss expectations with actual reported claims, providing stability in volatile claim environments, while the Cape Cod approach adjusts historical loss ratios based on emerging claim experience to refine reserve estimates.

Calculating RBNS: Process and Best Practices

Calculating RBNS (Reported But Not Settled) claims involves assessing outstanding reserves based on reported claims that have not yet been finalized. The process requires detailed claim data analysis, including evaluating case reserves, loss development factors, and historical settlement patterns to estimate ultimate liabilities accurately. Best practices emphasize using automated claims management systems, regular reserve reviews, and collaboration between actuaries and claims adjusters to ensure precision and timely updates.

Impact of IBNR and RBNS on Financial Statements

IBNR (Incurred But Not Reported) reserves represent estimated liabilities for claims that have occurred but not yet been reported, significantly impacting the accuracy of an insurer's loss reserves and ultimately affecting the balance sheet and income statement. RBNS (Reported But Not Settled) claims involve known liabilities with unsettled payments, directly influencing current liabilities and claim expense recognition in financial statements. Accurate estimation of both IBNR and RBNS is crucial for insurers to ensure proper financial reporting, maintain solvency ratios, and meet regulatory capital requirements.

Role of Actuaries in Managing IBNR and RBNS

Actuaries play a critical role in managing IBNR and RBNS by accurately estimating reserve liabilities to ensure financial stability for insurance companies. They use sophisticated statistical models and historical claims data to quantify IBNR, which represents claims incurred but not yet reported, and RBNS, comprising reported claims still unsettled. Their expertise ensures appropriate capital allocation, regulatory compliance, and risk assessment, optimizing reserve adequacy and pricing strategies.

Common Challenges in IBNR and RBNS Assessment

Accurately estimating IBNR and RBNS reserves presents challenges such as incomplete or delayed claim data, which can lead to underestimation or overestimation of liabilities. The variability in claims development patterns and changes in reporting behavior complicate trend analysis and predictive modeling for both IBNR and RBNS. Insurers must continuously refine actuarial models and leverage robust data analytics to address uncertainty and improve reserve adequacy.

Regulatory Requirements for IBNR and RBNS Reporting

Regulatory requirements mandate detailed actuarial evaluations and transparent disclosures for IBNR (Incurred But Not Reported) reserves to ensure solvency and accurate risk assessment in insurance companies. RBNS (Reported But Not Settled) claims reporting must comply with stringent timelines and documentation standards set by regulatory bodies to facilitate claim monitoring and financial stability. Both IBNR and RBNS reserve calculations are subject to audit and supervisory review to maintain consistency with industry accounting principles and regulatory frameworks.

Best Practices for Accurate IBNR and RBNS Management

Accurate IBNR and RBNS management relies on continuous data validation and actuarial method refinement to estimate ultimate claim liabilities precisely. Leveraging advanced predictive analytics and robust reserving models enhances the identification of latent claims and settlement timing, thereby reducing reserve volatility. Regular collaboration between underwriting, claims, and actuarial teams ensures comprehensive data integration and timely adjustments to reserve estimates, supporting regulatory compliance and financial stability.

Important Terms

Loss Reserving

Loss reserving involves estimating the liabilities insurers must hold for claims, including Incurred But Not Reported (IBNR) losses, which represent claims that have occurred but not yet been reported, and Reported But Not Settled (RBNS) losses, which are claims that have been reported but remain unpaid. Accurate differentiation and calculation of IBNR and RBNS reserves are critical for maintaining an insurer's financial stability and regulatory compliance.

Claims Triangulation

Claims triangulation enhances the accuracy of reserving by integrating IBNR (Incurred But Not Reported) and RBNS (Reported But Not Settled) data, enabling actuaries to reconcile timing and reporting lags effectively. This method leverages multiple data sources, such as claim development patterns, payment histories, and reporting delays, to produce more robust reserve estimates and mitigate uncertainties inherent in traditional reserving approaches.

Case Reserves

Case reserves represent the estimated amounts set aside for known claims, directly impacting RBNS (Reported But Not Settled) liabilities, while IBNR (Incurred But Not Reported) reserves cover claims that have occurred but are not yet reported and require statistical modeling for estimation. Accurate differentiation between IBNR and RBNS is crucial for effective risk management and financial reporting in insurance claims reserving.

Actuarial Valuation

Actuarial valuation relies heavily on accurately estimating IBNR (Incurred But Not Reported) and RBNS (Reported But Not Settled) liabilities to assess an insurer's reserve adequacy and ensure financial stability. IBNR represents claims incurred but not yet reported to the insurer, requiring predictive modeling for future claim emergence, while RBNS pertains to known claims that have been reported but remain unsettled, necessitating detailed claim-level analysis for reserve estimation.

Ultimate Loss Estimation

Ultimate Loss Estimation quantifies total claim liabilities by combining Incurred But Not Reported (IBNR) reserves, representing claims yet to be reported to insurers, with Reported But Not Settled (RBNS) reserves, which cover claims already notified but still under settlement. Accurate differentiation and modeling of IBNR and RBNS components enhance the precision of loss reserves, crucial for underwriting risk assessment and regulatory compliance.

Chain Ladder Method

The Chain Ladder Method is a widely used actuarial technique for estimating IBNR (Incurred But Not Reported) reserves by analyzing cumulative claims development patterns over time. It differentiates IBNR from RBNS (Reported But Not Settled) by projecting future claim amounts for incidents not yet reported, whereas RBNS reserves account for claims that have been reported but are still open and unsettled.

Loss Development Factor (LDF)

Loss Development Factor (LDF) quantifies the expected increase in claims from Incurred But Not Reported (IBNR) reserves, capturing the latent claims yet to surface in reported losses. In contrast, LDF adjustments for Reported But Not Settled (RBNS) claims focus on future development of known claims, refining reserve adequacy based on emerging payment and settlement patterns.

Pure IBNR

Pure IBNR represents the portion of incurred but not reported claims that excludes RBNS, focusing solely on claims that have neither been reported nor recognized within reserves. Distinguishing Pure IBNR from RBNS is essential for accurate loss reserving, as RBNS claims are known liabilities awaiting settlement, while Pure IBNR captures the latent exposure yet to surface in reporting systems.

Outstanding Claims Liability

Outstanding Claims Liability quantifies an insurer's obligation for claims incurred but not fully paid, comprising IBNR (Incurred But Not Reported) reserves for claims yet to be reported and RBNS (Reported But Not Settled) reserves for claims reported but still unresolved. Accurate estimation of IBNR and RBNS ensures adequate financial provisioning, reflecting real-time loss experience and enhancing solvency margins.

Claim Reporting Lag

Claim reporting lag significantly impacts the accuracy of IBNR (Incurred But Not Reported) reserves, as longer delays increase uncertainty in estimating unreported claims. Conversely, RBNS (Reported But Not Settled) reserves focus on claims already notified but pending settlement, making their valuation more dependent on claim development patterns rather than reporting delays.

IBNR (Incurred But Not Reported) vs RBNS (Reported But Not Settled) Infographic

moneydif.com

moneydif.com