Fronting arrangements involve a licensed insurer issuing a policy on behalf of a risk retained by a captive insurance company, enabling regulatory compliance and risk transfer. Captive insurance allows a company to self-insure by creating its own insurance subsidiary, providing customized coverage and potential cost savings. Understanding the distinctions between fronting arrangements and captive insurance is essential for optimizing risk management and financial efficiency within complex corporate structures.

Table of Comparison

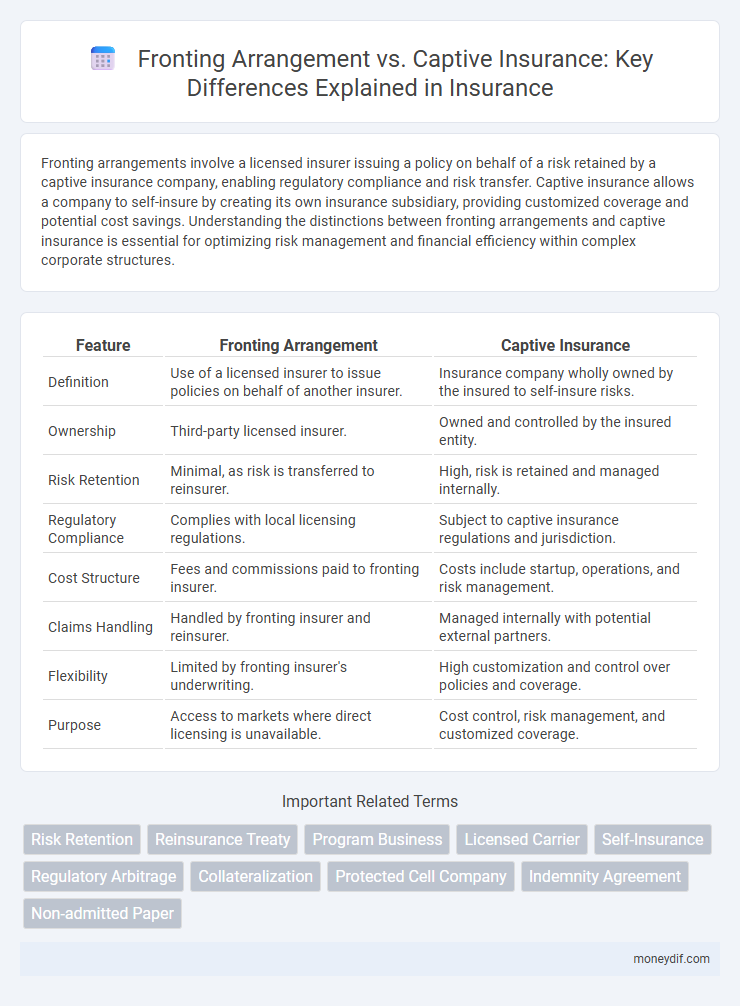

| Feature | Fronting Arrangement | Captive Insurance |

|---|---|---|

| Definition | Use of a licensed insurer to issue policies on behalf of another insurer. | Insurance company wholly owned by the insured to self-insure risks. |

| Ownership | Third-party licensed insurer. | Owned and controlled by the insured entity. |

| Risk Retention | Minimal, as risk is transferred to reinsurer. | High, risk is retained and managed internally. |

| Regulatory Compliance | Complies with local licensing regulations. | Subject to captive insurance regulations and jurisdiction. |

| Cost Structure | Fees and commissions paid to fronting insurer. | Costs include startup, operations, and risk management. |

| Claims Handling | Handled by fronting insurer and reinsurer. | Managed internally with potential external partners. |

| Flexibility | Limited by fronting insurer's underwriting. | High customization and control over policies and coverage. |

| Purpose | Access to markets where direct licensing is unavailable. | Cost control, risk management, and customized coverage. |

Understanding Fronting Arrangements in Insurance

Fronting arrangements in insurance involve a licensed insurer issuing a policy and then ceding most or all of the risk to a reinsurer, often a captive insurer owned by the insured company. This structure enables companies to comply with regulatory requirements while controlling risk through their captive. Understanding these arrangements is critical for optimizing risk management and cost-efficiency in corporate insurance programs.

What Is Captive Insurance?

Captive insurance is a self-insurance method where a company creates its own licensed insurance subsidiary to underwrite risks, providing greater control over coverage and cost. Unlike fronting arrangements, which involve third-party insurers issuing policies on behalf of the captive, captive insurance allows businesses to retain underwriting profits and customize risk management strategies. This approach is commonly used by corporations aiming to manage unique risks, reduce insurance expenses, and improve claims handling efficiency.

Key Differences Between Fronting and Captive Insurance

Fronting arrangement involves a licensed insurer issuing a policy and transferring most of the risk to a reinsurer, while captive insurance is a wholly-owned insurance company created by a parent firm to insure its own risks. Fronting offers regulatory compliance and market access benefits, whereas captives provide greater control over underwriting, claims, and cost management. Key differences include risk retention levels, regulatory requirements, and financial reporting implications.

Advantages of Fronting Arrangements

Fronting arrangements in insurance offer advantages such as immediate market access and regulatory compliance by leveraging licensed insurers to issue policies on behalf of unlicensed entities. They enable risk transfer with reduced capital requirements and provide flexibility in structuring reinsurance agreements to optimize risk management. Moreover, fronting arrangements facilitate enhanced underwriting expertise and the ability to tap into established claims handling resources.

Benefits of Captive Insurance Solutions

Captive insurance solutions provide enhanced risk management and cost control by allowing businesses to retain underwriting profits and customize coverage to their specific needs. They improve cash flow flexibility and offer potential tax advantages, distinguishing them from traditional fronting arrangements. Additionally, captives promote greater transparency and data-driven decision-making through direct access to claims and risk information.

Regulatory Considerations: Fronting vs Captive

Fronting arrangements require compliance with strict regulatory oversight, including licensing mandates and reinsurer collateral rules, to ensure risk transfer legitimacy and policyholder protection. Captive insurance entities benefit from regulatory flexibility, often subject to lighter solvency requirements and tailored governance frameworks depending on domicile jurisdictions. Regulatory scrutiny on fronting emphasizes transparency and risk distribution, while captives focus on internal risk management and compliance within controlled insurance environments.

Cost Implications: Fronting vs Captive Insurance

Fronting arrangements typically involve higher upfront costs due to fees paid to licensed insurers for assuming risk, whereas captive insurance often requires substantial initial capital investment to establish and maintain the captive entity. Operational expenses for fronting include ongoing premiums and administrative fees, while captives incur costs related to regulatory compliance, risk management, and professional services. Choosing between fronting and captive insurance hinges on evaluating long-term cost efficiencies against risk retention and control objectives.

Risk Retention and Transfer Mechanisms

Fronting arrangements enable companies to transfer insurance risk to a licensed insurer while retaining ultimate risk exposure through a reinsurance agreement, facilitating regulatory compliance and risk management. Captive insurance allows businesses to retain risk internally by creating a wholly-owned insurance subsidiary, providing greater control over underwriting and claims handling. Both mechanisms optimize risk retention and transfer but differ in structure, regulatory oversight, and capital requirements.

Best Use Cases for Fronting Arrangements

Fronting arrangements are best utilized by companies seeking to comply with regulatory requirements in foreign markets where direct licensing is unavailable or restrictive, allowing them to transfer underwriting risk while maintaining control through a licensed insurer. These setups are ideal for multinational corporations needing to manage local statutory insurance mandates and facilitate risk distribution without establishing a full insurance subsidiary. Fronting arrangements also streamline the administration of complex employee benefits plans across multiple jurisdictions, enhancing operational efficiency and regulatory compliance.

Choosing Between Fronting and Captive Insurance Strategies

Choosing between fronting arrangements and captive insurance strategies depends on a company's risk tolerance, regulatory environment, and financial objectives. Fronting provides access to broader markets and regulatory compliance through a licensed insurer but often at the expense of higher premiums and limited risk retention. Captive insurance maximizes control over underwriting and claims, enhances cash flow, and can generate tax efficiencies but requires significant capital investment and robust risk management infrastructure.

Important Terms

Risk Retention

Risk retention involves an organization assuming responsibility for its own losses rather than transferring risks to insurers, often leveraged through captive insurance entities to optimize control and reduce premiums. Fronting arrangements enable companies to access insurance markets by having a licensed insurer issue policies that are ultimately reinsured back to the organization's captive, balancing regulatory compliance with risk retention benefits.

Reinsurance Treaty

A reinsurance treaty in a fronting arrangement involves a licensed insurer issuing policies and ceding most or all risks to a reinsurer, often a captive insurance company, which assumes the risk while the fronting insurer handles regulatory compliance. This structure allows captives to benefit from licensed fronting carriers' market access and regulatory approval, optimizing risk transfer and capital efficiency.

Program Business

Program business leverages fronting arrangements by using licensed insurers to underwrite risks while ceding premiums to a captive insurance company, optimizing regulatory compliance and capital efficiency. Captive insurance, as a risk management tool, allows organizations to retain underwriting risk internally, reducing dependence on traditional reinsurers and enhancing control over claims and pricing.

Licensed Carrier

Licensed carriers in fronting arrangements assume regulatory and financial responsibility for insurance policies while transferring most risk to a captive insurer, enabling businesses to access licensed markets without full exposure. Captive insurance involves the creation of a wholly owned insurer by a parent company to manage risk internally, contrasting with fronting where a licensed carrier facilitates market access but does not retain significant underwriting risk.

Self-Insurance

Self-insurance involves a company retaining financial risk internally rather than transferring it to an insurer, often paired with fronting arrangements where a licensed insurance carrier issues policies but transfers risk to the self-insurer or captive. Captive insurance serves as a risk management tool by creating a wholly-owned insurance subsidiary that assumes risk, while fronting allows this captive or self-insurer to comply with regulatory requirements and access reinsurance markets.

Regulatory Arbitrage

Regulatory arbitrage exploits differences in regulations across jurisdictions, with fronting arrangements allowing insurers to transfer risk to licensed carriers while retaining exposure, contrasting with captive insurance where companies establish wholly-owned subsidiaries to insure their own risks, thereby optimizing regulatory compliance and capital requirements. Fronting arrangements often involve third-party reinsurers and higher regulatory scrutiny, whereas captive insurance offers greater control and potential cost savings through self-insurance mechanisms.

Collateralization

Collateralization in fronting arrangements involves the reinsurer posting assets to secure the ceding insurer's liabilities, ensuring financial stability and claim payment. In contrast, captive insurance typically uses internal reserves or letters of credit for collateral, reflecting its risk retention and self-insurance model.

Protected Cell Company

A Protected Cell Company (PCC) structure allows multiple segregated cells within a single legal entity, facilitating risk separation crucial for fronting arrangements where an insurer cedes risk to a captive. In contrast, captive insurance involves a company forming its own insurer to underwrite its risks directly, whereas a PCC enables multiple participants to share infrastructure but maintain distinct risk profiles under a fronting insurer's regulatory framework.

Indemnity Agreement

An indemnity agreement in a fronting arrangement involves the insured party agreeing to reimburse the fronting insurer for claims paid, ensuring risk transfer while complying with regulatory requirements, whereas in captive insurance, indemnity agreements primarily govern the internal risk-sharing between the captive insurer and its parent company, facilitating cost control and retention of risk. The distinction lies in fronting arrangements relying on third-party insurance with indemnity for risk reimbursement, while captive insurance centers on self-insurance mechanisms supported by contractual indemnity provisions.

Non-admitted Paper

Non-admitted paper refers to insurance policies issued by carriers not licensed in the insured's state, often used in fronting arrangements where a licensed insurer issues the policy but transfers most of the risk to a captive insurer. Fronting arrangements leverage non-admitted paper to facilitate captive insurance programs, allowing companies to maintain control over claims and underwriting while complying with regulatory requirements.

Fronting Arrangement vs Captive Insurance Infographic

moneydif.com

moneydif.com