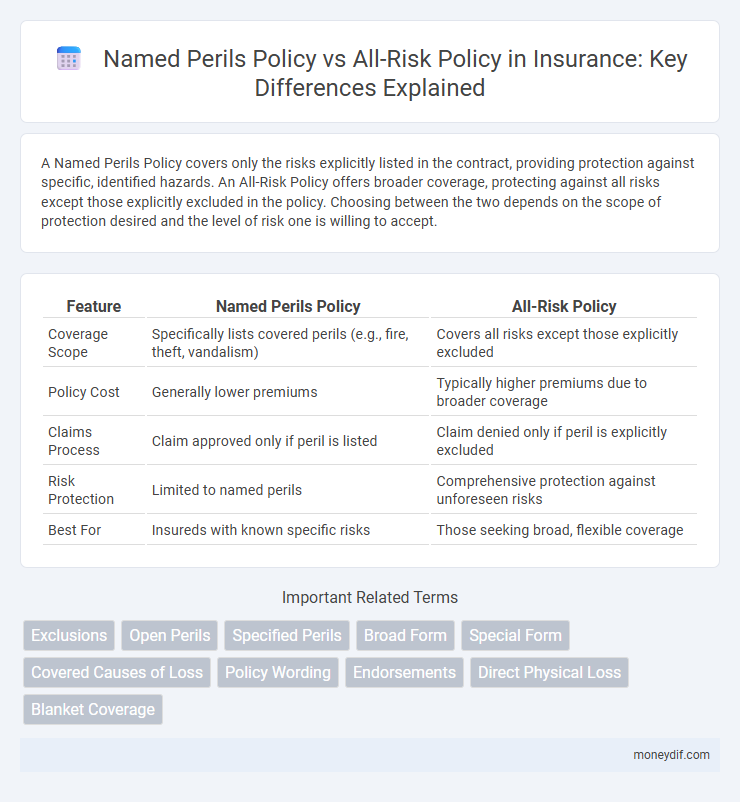

A Named Perils Policy covers only the risks explicitly listed in the contract, providing protection against specific, identified hazards. An All-Risk Policy offers broader coverage, protecting against all risks except those explicitly excluded in the policy. Choosing between the two depends on the scope of protection desired and the level of risk one is willing to accept.

Table of Comparison

| Feature | Named Perils Policy | All-Risk Policy |

|---|---|---|

| Coverage Scope | Specifically lists covered perils (e.g., fire, theft, vandalism) | Covers all risks except those explicitly excluded |

| Policy Cost | Generally lower premiums | Typically higher premiums due to broader coverage |

| Claims Process | Claim approved only if peril is listed | Claim denied only if peril is explicitly excluded |

| Risk Protection | Limited to named perils | Comprehensive protection against unforeseen risks |

| Best For | Insureds with known specific risks | Those seeking broad, flexible coverage |

Understanding Named Perils Policy

A Named Perils Policy covers only specific risks explicitly listed in the policy, such as fire, theft, or vandalism, limiting coverage to those perils. Policyholders must carefully review the listed perils to understand which damages qualify for claims, as any damage caused by unlisted perils is excluded. This type of coverage often results in lower premiums compared to All-Risk policies, making it a cost-effective choice for those seeking protection against common, defined hazards.

What Is an All-Risk Insurance Policy?

An all-risk insurance policy provides comprehensive coverage by protecting against all perils except those explicitly excluded in the policy document, offering broader protection compared to named perils policies. It typically covers damage or loss from events such as fire, theft, vandalism, and natural disasters, unless specifically stated otherwise. This type of policy reduces the need for detailed listings of covered risks, giving policyholders greater security and peace of mind.

Key Differences Between Named Perils and All-Risk Policies

Named Perils policies specifically list covered risks, providing coverage only for those explicitly mentioned, which often results in lower premiums but more limited protection. All-Risk policies cover all causes of loss except those explicitly excluded, offering broader protection and typically higher costs. Understanding the scope of coverage and exclusions in both policies is crucial for selecting the appropriate insurance based on individual risk tolerance and asset value.

Coverage Scope: Named Perils vs All-Risk

Named perils policies cover only specific risks explicitly listed in the policy, such as fire, theft, or vandalism, limiting protection to those events. All-risk policies provide broader coverage, protecting against all causes of loss except those explicitly excluded, offering more comprehensive security. Understanding the distinctions in coverage scope is essential for selecting appropriate insurance protection based on individual risk tolerance and asset value.

Exclusions in Named Perils and All-Risk Policies

Named Perils policies specify covered risks and exclude all others, often omitting damages from events such as flood, earthquake, or wear and tear unless explicitly stated. All-Risk policies broadly cover all causes of loss except those specifically excluded, commonly excluding losses due to war, nuclear hazards, or intentional damage. Understanding these exclusions is crucial for policyholders to ensure adequate protection against unforeseen perils.

Cost Comparison: Named Perils vs All-Risk Insurance

Named Perils insurance typically costs less than All-Risk policies because it covers only specific, listed dangers such as fire, theft, or wind damage, reducing the insurer's exposure. All-Risk insurance offers broader protection against all causes of loss except those explicitly excluded, resulting in higher premiums due to increased risk coverage. Policyholders seeking comprehensive protection often pay more upfront with All-Risk plans but benefit from fewer claim denials compared to the more affordable Named Perils option.

Pros and Cons of Named Perils Policy

Named Perils Policy specifically covers risks explicitly listed in the policy, offering lower premiums compared to All-Risk Policies by excluding unforeseen damages. This targeted coverage can lead to claim denials for damages not mentioned, creating potential gaps in protection. However, it provides clarity and predictability in coverage scope, benefiting policyholders with well-understood risk profiles.

Advantages and Disadvantages of All-Risk Policy

All-risk insurance policies provide comprehensive coverage by insuring against all causes of loss except those specifically excluded, offering broader protection for property owners. The advantages include fewer coverage gaps, greater peace of mind, and better protection for unforeseen risks, while disadvantages involve higher premiums and potential disputes over excluded risks. Policyholders must carefully review exclusions to avoid unexpected out-of-pocket expenses and ensure the policy aligns with their specific risk tolerance.

Choosing the Right Policy for Your Needs

Selecting between a Named Perils Policy and an All-Risk Policy depends on the scope of coverage required for your assets and budget considerations. Named Perils Policies cover only specific risks explicitly listed, often resulting in lower premiums but limited protection, while All-Risk Policies provide broader coverage against all risks except those specifically excluded, typically at a higher cost. Evaluating the value of your property, potential hazards, and financial tolerance ensures you choose a policy that balances comprehensive protection with cost-effectiveness.

Frequently Asked Questions About Named Perils and All-Risk Policies

Named perils policies specifically cover risks explicitly listed in the contract, such as fire, theft, or windstorm, limiting coverage to those events. All-risk policies, also known as open perils policies, provide broader protection by covering all causes of loss except those explicitly excluded. Understanding the difference helps policyholders select coverage that best matches their risk tolerance and asset protection needs.

Important Terms

Exclusions

Named Perils policies exclude coverage for risks not explicitly listed, limiting protection to specific perils such as fire or theft, whereas All-Risk policies cover all risks except those specifically excluded, providing broader protection. Common exclusions in both include wear and tear, intentional damage, and nuclear hazards, with All-Risk policies requiring careful review of exclusions to understand coverage gaps.

Open Perils

Open Perils insurance policies cover all risks except those explicitly excluded, offering broader protection compared to Named Perils policies, which only cover risks specifically listed. All-Risk policies, often synonymous with Open Perils, provide comprehensive coverage by insuring against unforeseen damages unless expressly excluded in the policy terms.

Specified Perils

Specified Perils refer to the exact risks explicitly listed in a Named Perils Policy, such as fire, theft, or windstorm, limiting coverage strictly to those outlined events. In contrast, an All-Risk Policy offers broader protection by covering all perils except those specifically excluded, providing more comprehensive insurance security.

Broad Form

Broad Form insurance extends coverage beyond Named Perils policies by including additional specified risks like falling objects, weight of snow, and water damage from plumbing, while still excluding unspecified perils found in All-Risk policies. It offers a middle ground by covering more perils than Named Perils but not the comprehensive protection of All-Risk policies.

Special Form

Special Form coverage in property insurance offers protection against a specific list of named perils, such as fire, theft, and vandalism, clearly defining the insured risks. Unlike All-Risk policies that cover all losses except those explicitly excluded, Special Form policies provide more limited but focused protection, often resulting in lower premiums and clearer claims processes.

Covered Causes of Loss

Covered Causes of Loss specify the types of risks insured under a policy, differing significantly between Named Perils and All-Risk policies; Named Perils insurance only covers losses from specifically listed perils such as fire, theft, or windstorm, while All-Risk policies provide broader protection by covering all causes of loss except those explicitly excluded. Understanding these distinctions is essential for businesses and homeowners to ensure adequate insurance coverage tailored to their exposure to potential risks.

Policy Wording

Named Perils Policy specifies coverage only for risks explicitly listed in the policy document, while All-Risk Policy provides broader protection by covering all risks except those specifically excluded. Understanding the detailed policy wording is essential for insured parties to accurately assess the scope of coverage and potential claims under either policy type.

Endorsements

Endorsements in Named Perils Policies specifically modify coverage by adding or excluding certain perils, whereas in All-Risk Policies, endorsements often clarify or limit coverage scope for broader protection. Named Perils Policies provide coverage only for listed risks, making endorsements crucial to tailor protection, while All-Risk Policies cover all risks except those explicitly excluded, with endorsements refining these exclusions or adding specialized terms.

Direct Physical Loss

Direct Physical Loss under Named Perils Policies covers damage only from specifically listed risks such as fire, theft, or vandalism, restricting claim eligibility to these predefined events. All-Risk Policies provide broader protection by insuring against all causes of loss except those explicitly excluded, offering more comprehensive coverage for unforeseen physical damages.

Blanket Coverage

Blanket coverage provides a single limit for multiple properties or locations under one Named Perils or All-Risk Policy, offering streamlined protection and simplified claims management. Named Perils policies cover only specified risks listed in the contract, whereas All-Risk policies protect against all risks except those explicitly excluded, making blanket coverage under All-Risk policies more comprehensive.

Named Perils Policy vs All-Risk Policy Infographic

moneydif.com

moneydif.com