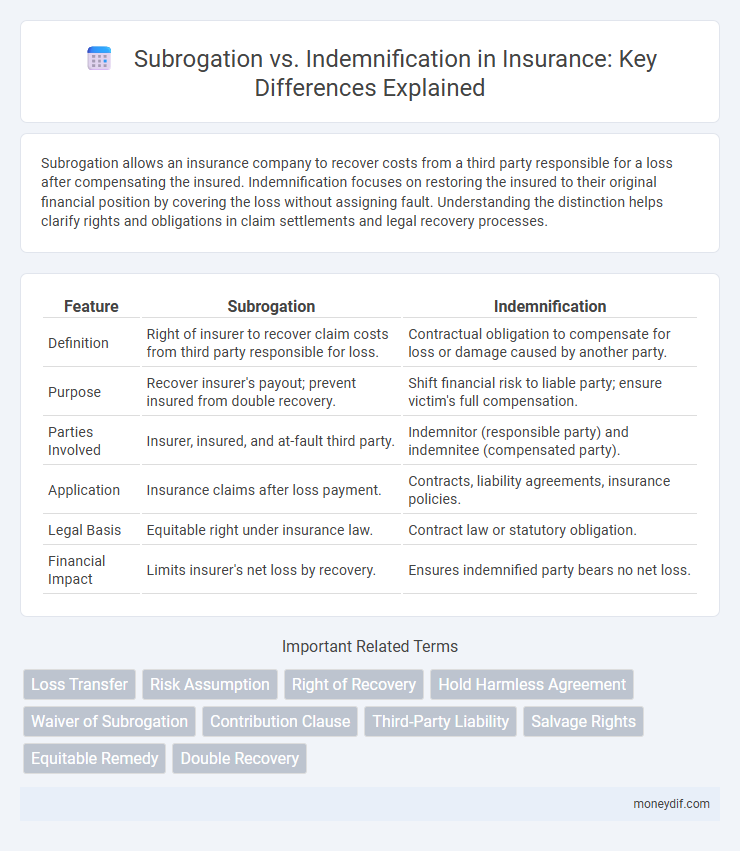

Subrogation allows an insurance company to recover costs from a third party responsible for a loss after compensating the insured. Indemnification focuses on restoring the insured to their original financial position by covering the loss without assigning fault. Understanding the distinction helps clarify rights and obligations in claim settlements and legal recovery processes.

Table of Comparison

| Feature | Subrogation | Indemnification |

|---|---|---|

| Definition | Right of insurer to recover claim costs from third party responsible for loss. | Contractual obligation to compensate for loss or damage caused by another party. |

| Purpose | Recover insurer's payout; prevent insured from double recovery. | Shift financial risk to liable party; ensure victim's full compensation. |

| Parties Involved | Insurer, insured, and at-fault third party. | Indemnitor (responsible party) and indemnitee (compensated party). |

| Application | Insurance claims after loss payment. | Contracts, liability agreements, insurance policies. |

| Legal Basis | Equitable right under insurance law. | Contract law or statutory obligation. |

| Financial Impact | Limits insurer's net loss by recovery. | Ensures indemnified party bears no net loss. |

Understanding Subrogation in Insurance

Subrogation in insurance allows an insurer to pursue a third party responsible for a loss after compensating the insured, recovering the costs paid out in a claim. This process helps insurers mitigate claim expenses and keeps premiums lower by transferring the financial burden to the liable party. Understanding subrogation is crucial for policyholders, as it affects the claim settlement process and potential recoveries from responsible third parties.

Key Principles of Indemnification

Indemnification in insurance involves a contractual obligation where one party agrees to compensate another for losses or damages incurred, ensuring financial protection and risk transfer. Key principles include restoring the insured to their pre-loss position without profit, adhering to the principle of loss allocation, and maintaining proper documentation to validate claims. This mechanism contrasts with subrogation, which allows insurers to recover costs from a third party responsible for the loss.

Subrogation vs Indemnification: Core Differences

Subrogation involves an insurer stepping into the shoes of the insured to recover costs from a third party responsible for a loss, ensuring the insurer recoups paid claims. Indemnification refers to the contractual obligation to compensate a party for harm or loss, restoring them to their pre-loss financial state without pursuing third-party reimbursement. The core difference lies in subrogation's recovery process from liable third parties, whereas indemnification centers on direct compensation between parties under an agreement.

Legal Framework Governing Subrogation

The legal framework governing subrogation is primarily based on equitable principles that allow an insurer to step into the shoes of the insured after compensation, ensuring recovery from the responsible third party. Subrogation rights are typically outlined in insurance policies and supported by statutes and case law that balance the interests of insurers and insureds while preventing unjust enrichment. Courts enforce these rights to maintain fairness in loss distribution and uphold contractual obligations within the broader insurance indemnification process.

Types of Indemnity in Insurance

Indemnification in insurance primarily includes types such as actual cash value, replacement cost, and agreed value policies, each offering different methods to compensate policyholders for losses. Actual cash value covers the depreciated value of damaged property, while replacement cost indemnifies the full cost to replace the item without depreciation. Agreed value policies establish a predetermined amount for coverage, providing certainty in claims settlements and preventing disputes over valuation.

How Subrogation Impacts Policyholders

Subrogation allows insurers to recover costs from third parties responsible for a loss, which can prevent increased premiums for policyholders by offsetting the insurer's expenses. This process helps maintain affordable coverage by ensuring policyholders do not bear the financial burden of another party's negligence. However, subrogation may require policyholders to cooperate with the insurer in legal proceedings to facilitate cost recovery.

Real-World Examples of Subrogation and Indemnification

Subrogation often occurs when an insurance company seeks reimbursement from a third party responsible for causing the insured's loss, such as a car insurer suing a negligent driver after paying a claim. Indemnification is exemplified in commercial contracts where one party agrees to compensate another for damages or losses, like a contractor indemnifying a property owner against construction defects. These real-world applications illustrate subrogation's role in recovering costs and indemnification's function in risk allocation between parties.

Role of Waivers in Subrogation and Indemnification

Waivers play a critical role in subrogation and indemnification by limiting or releasing a party's right to recover losses from another party after a claim is paid. In subrogation, a waiver can prevent the insurer from pursuing recovery against the party responsible for the loss, while in indemnification, waivers delineate the extent of liability and financial responsibility between contracting parties. Clear waiver clauses help reduce litigation risks and clarify obligations in insurance contracts, enhancing risk management and claim settlement certainty.

Common Challenges in Subrogation and Indemnification Claims

Common challenges in subrogation and indemnification claims include establishing clear liability and proving the extent of damages, which often require detailed documentation and expert analysis. Delays in claim processing can arise from disputes over policy coverage and coordination between multiple insurers or parties involved. Effective communication and thorough investigation are essential to mitigate these issues and ensure timely resolution of claims.

Best Practices for Managing Subrogation and Indemnification Risks

Effective management of subrogation and indemnification risks requires clear contractual language that defines the scope of each party's responsibilities and limits liability exposure. Implementing thorough documentation and prompt claim investigation enhances recovery potential while minimizing disputes. Regular risk assessments and training programs ensure compliance with evolving legal standards and improve collaboration between insurers and insured parties.

Important Terms

Loss Transfer

Loss transfer involves shifting financial responsibility from one party to another, commonly explored through subrogation and indemnification mechanisms. Subrogation allows an insurer to pursue recovery from a third party responsible for the loss, while indemnification requires one party to compensate another for damages without asserting third-party claims.

Risk Assumption

Risk assumption involves a party accepting potential losses without seeking recovery, contrasting with subrogation where the insurer pursues a third party to recover costs after indemnification compensates the insured. Understanding the distinction between subrogation and indemnification clarifies liability allocation and financial responsibility in insurance claims and contracts.

Right of Recovery

Right of Recovery empowers an insurer to reclaim costs from a third party responsible for a loss, closely linked with subrogation where the insurer steps into the insured's shoes to pursue reimbursement, while indemnification involves one party compensating another for losses without necessarily assuming legal standing. Understanding the distinction between subrogation, which allows direct recovery from a liable third party, and indemnification, a contractual obligation for loss compensation, is crucial in risk management and insurance claims.

Hold Harmless Agreement

A Hold Harmless Agreement protects one party from liability by transferring risk to another, often involving indemnification clauses that require compensation for losses from specified claims. In contrast, subrogation allows an insurer to step into the insured's shoes to recover costs from a third party responsible for causing the loss, highlighting distinct legal mechanisms for risk allocation and financial responsibility.

Waiver of Subrogation

Waiver of Subrogation prevents an insurer from pursuing recovery from a third party after paying a claim, distinguishing it from indemnification clauses which require one party to compensate another for losses. While subrogation transfers the insurer's rights to seek reimbursement, indemnification directly shifts financial responsibility between contractual parties.

Contribution Clause

The Contribution Clause allocates liability among multiple parties to prevent overcompensation in claims, playing a critical role in distinguishing Subrogation, where an insurer seeks reimbursement from a third party responsible for a loss, from Indemnification, which involves one party compensating another as outlined in a contract. Understanding the interplay between Contribution Clause, Subrogation rights, and Indemnification obligations ensures precise risk allocation and minimizes legal disputes in insurance and contractual agreements.

Third-Party Liability

Third-party liability involves a party's legal responsibility to compensate another for damages caused, where subrogation allows an insurer to pursue recovery from the liable party after indemnifying the insured, while indemnification is the contractual obligation to compensate for losses regardless of fault. Understanding the distinctions between subrogation and indemnification is crucial for accurately managing claims, risk allocation, and legal responsibilities in insurance and liability cases.

Salvage Rights

Salvage rights grant a party the legal ability to recover compensation for saving property from loss, often entailing subrogation where the insurer assumes the insured's rights to pursue recovery from a third party. Indemnification differs as it involves direct compensation to the insured for covered losses without transferring legal claims against responsible parties.

Equitable Remedy

Equitable remedy in subrogation allows a party who has paid a debt or claim on behalf of another to step into the shoes of the creditor and recover the amount from the responsible third party, ensuring fairness in financial responsibility. Indemnification, on the other hand, is a contractual obligation where one party agrees to compensate another for losses or damages, emphasizing reimbursement rather than the right to pursue recovery from a third party.

Double Recovery

Double recovery occurs when a claimant receives compensation twice for the same loss, often arising in disputes involving subrogation and indemnification claims. Subrogation allows an insurer to recover costs from a third party responsible for the loss, while indemnification requires one party to reimburse another for expenses incurred, making careful coordination essential to prevent overlapping recoveries and legal conflicts.

Subrogation vs Indemnification Infographic

moneydif.com

moneydif.com