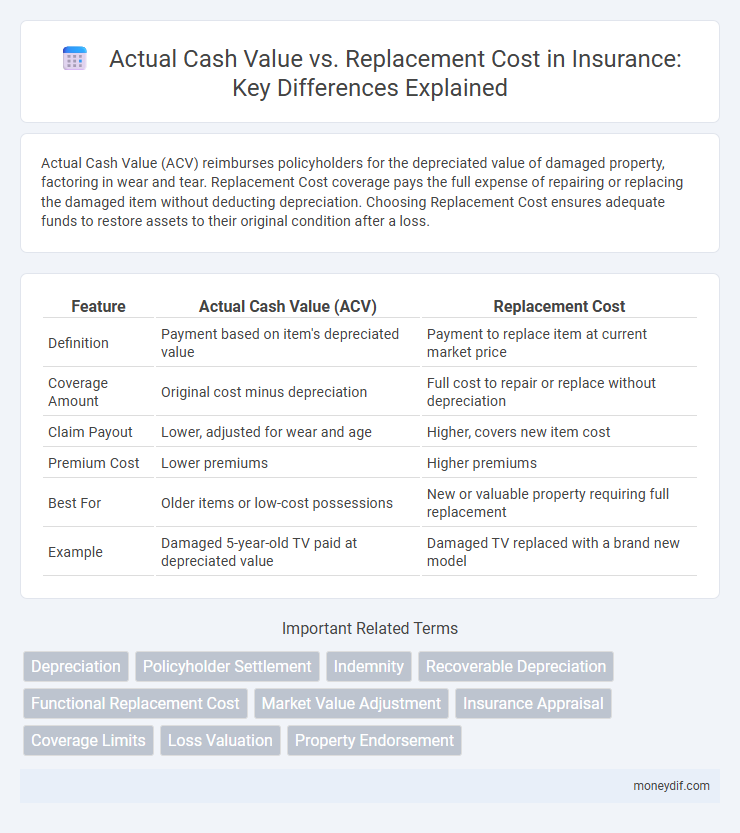

Actual Cash Value (ACV) reimburses policyholders for the depreciated value of damaged property, factoring in wear and tear. Replacement Cost coverage pays the full expense of repairing or replacing the damaged item without deducting depreciation. Choosing Replacement Cost ensures adequate funds to restore assets to their original condition after a loss.

Table of Comparison

| Feature | Actual Cash Value (ACV) | Replacement Cost |

|---|---|---|

| Definition | Payment based on item's depreciated value | Payment to replace item at current market price |

| Coverage Amount | Original cost minus depreciation | Full cost to repair or replace without depreciation |

| Claim Payout | Lower, adjusted for wear and age | Higher, covers new item cost |

| Premium Cost | Lower premiums | Higher premiums |

| Best For | Older items or low-cost possessions | New or valuable property requiring full replacement |

| Example | Damaged 5-year-old TV paid at depreciated value | Damaged TV replaced with a brand new model |

Understanding Actual Cash Value in Insurance

Actual Cash Value (ACV) in insurance refers to the amount paid to policyholders for a covered loss, calculated as the replacement cost of the damaged property minus depreciation. This valuation method considers factors such as the age, wear and tear, and obsolescence of the item at the time of loss. Understanding ACV helps policyholders grasp that reimbursement may be lower than the original purchase price, impacting claims for damaged or stolen assets.

What Is Replacement Cost Coverage?

Replacement cost coverage reimburses policyholders the amount needed to replace damaged or lost property with a new item of similar kind and quality, without deducting for depreciation. This type of coverage ensures that the insured can restore their property to its original state, reflecting current market prices. Unlike actual cash value, replacement cost provides fuller financial protection by covering the full cost of repairs or replacements.

Key Differences Between ACV and Replacement Cost

Actual Cash Value (ACV) insurance reimburses policyholders based on the item's current market value, accounting for depreciation and wear. Replacement Cost coverage pays the full amount needed to repair or replace the damaged property with a new equivalent, without deducting for depreciation. Key differences include the valuation method, with ACV reducing payouts over time due to depreciation while Replacement Cost offers higher, more comprehensive compensation.

How Insurers Calculate Actual Cash Value

Insurers calculate Actual Cash Value (ACV) by determining the replacement cost of the damaged property and then subtracting depreciation based on factors such as age, wear and tear, and obsolescence. This method reflects the current market value of the item rather than the price to replace it brand new. The ACV approach provides a fair assessment of compensation, aligning with the property's depreciated worth at the time of loss.

Pros and Cons of Replacement Cost Policies

Replacement cost policies cover the full expense to repair or replace damaged property without deducting for depreciation, ensuring policyholders can restore assets to their original condition. Pros include comprehensive protection and faster recovery after loss, while cons involve higher premiums and potential disputes over actual replacement costs. This coverage is ideal for individuals seeking maximum financial security against property damage or loss.

Scenarios Where ACV Might Benefit Policyholders

Actual Cash Value (ACV) benefits policyholders in scenarios involving older property where depreciation significantly reduces replacement expenses, minimizing out-of-pocket costs. In situations with limited budgets, ACV provides immediate, lower compensation reflective of the item's current worth rather than its full replacement cost. Policyholders facing frequent minor claims may prefer ACV to avoid increased premiums associated with higher replacement cost payouts.

Replacement Cost: When Is It Worth the Extra Premium?

Replacement cost coverage reimburses policyholders for the full cost of repairing or replacing damaged property without deducting depreciation, making it valuable for new or high-value items. It is worth the extra premium when the asset's market value is significantly lower than its replacement cost, such as in rapidly appreciating markets or when rebuilding expenses exceed original purchase price. Choosing replacement cost coverage ensures quicker recovery and financial protection against unforeseen increases in repair or reconstruction costs.

Claim Process: ACV vs Replacement Cost Explained

Actual Cash Value (ACV) claims reimburse policyholders based on the item's depreciated value at the time of loss, factoring in wear and tear. Replacement Cost claims cover the full cost of repairing or replacing the damaged property without deducting depreciation, ensuring out-of-pocket expenses are minimized. Understanding the distinction between ACV and replacement cost is crucial for managing expectations during the insurance claim process and maximizing settlement outcomes.

Common Misconceptions About Home Insurance Payouts

Many homeowners mistakenly believe insurance payouts cover the full replacement cost of their home, while policies often reimburse only the Actual Cash Value (ACV), which accounts for depreciation. Actual Cash Value reflects the item's current worth, subtracting wear and tear, leading to lower payouts than Replacement Cost coverage that pays to rebuild or repair without depreciation. Understanding the distinction between ACV and Replacement Cost prevents unexpected financial shortfalls during claims.

Choosing the Right Coverage: ACV or Replacement Cost?

Choosing between Actual Cash Value (ACV) and Replacement Cost coverage depends on how much you want to be reimbursed after a loss. ACV policies pay the depreciated value of your property, factoring in age and wear, resulting in lower premiums but potentially higher out-of-pocket costs. Replacement Cost coverage reimburses the full cost of repairing or replacing damaged property without depreciation, providing greater financial protection at a higher premium.

Important Terms

Depreciation

Depreciation reduces the actual cash value of an asset by accounting for wear and age, whereas replacement cost reflects the expense to replace the asset with a new one without depreciation.

Policyholder Settlement

Policyholder settlements based on Actual Cash Value reimburse the depreciated value of damaged property, while Replacement Cost settlements cover the full expense to repair or replace without deduction for depreciation.

Indemnity

Indemnity in insurance compensates the policyholder based on Actual Cash Value, which accounts for depreciation, rather than Replacement Cost, which covers the full expense to replace the damaged property without depreciation.

Recoverable Depreciation

Recoverable depreciation represents the portion of depreciation withheld from an insurance claim's Actual Cash Value payment and reimbursed when the Replacement Cost of damaged property is confirmed and repairs are completed.

Functional Replacement Cost

Functional Replacement Cost evaluates the cost to replace property with a functionally equivalent asset of similar utility, bridging the gap between Actual Cash Value, which accounts for depreciation, and full Replacement Cost, which covers the expense of new materials and labor.

Market Value Adjustment

Market Value Adjustment affects insurance payouts by modifying the Actual Cash Value based on Replacement Cost fluctuations, ensuring claim settlements reflect current market conditions.

Insurance Appraisal

Insurance appraisal often determines claim settlements by comparing Actual Cash Value, which accounts for depreciation, to Replacement Cost, reflecting the full expense to replace damaged property without depreciation.

Coverage Limits

Coverage limits determine the maximum amount an insurance policy will pay for a loss, directly impacting whether a claim is settled based on Actual Cash Value (ACV) or Replacement Cost. Policies offering Replacement Cost coverage reimburse the full cost to repair or replace damaged property without depreciation, while ACV coverage pays the property's depreciated value, often resulting in lower claim payments.

Loss Valuation

Loss valuation compares Actual Cash Value, which deducts depreciation, to Replacement Cost, reflecting the expense to restore or replace damaged property at current market prices.

Property Endorsement

Property endorsement determines whether insurance claims are settled based on actual cash value, reflecting depreciation, or replacement cost, covering the full expense to repair or replace the property without deduction for depreciation.

Actual Cash Value vs Replacement Cost Infographic

moneydif.com

moneydif.com