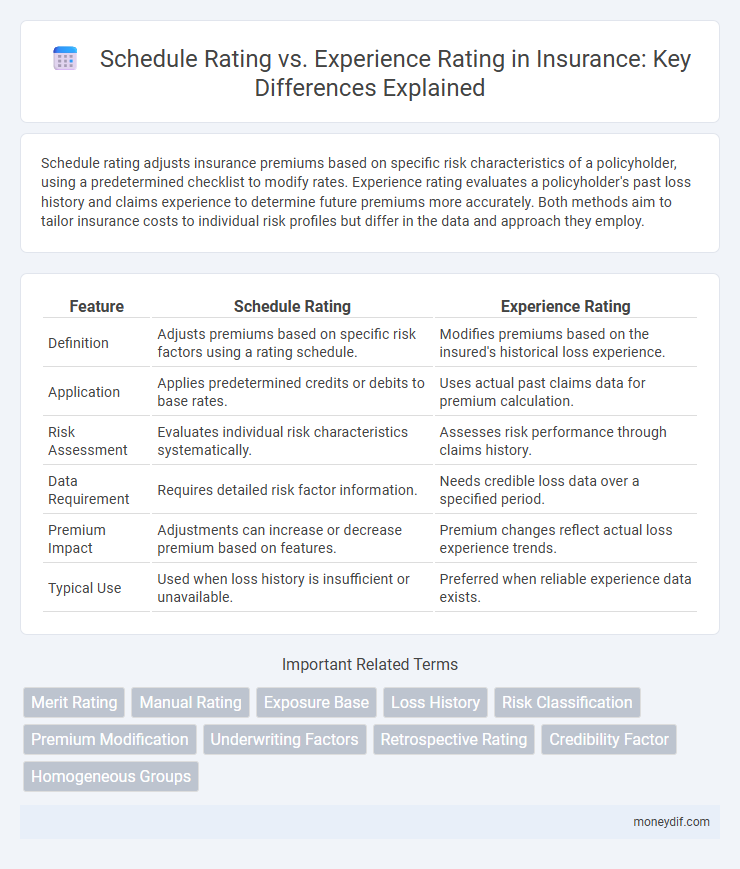

Schedule rating adjusts insurance premiums based on specific risk characteristics of a policyholder, using a predetermined checklist to modify rates. Experience rating evaluates a policyholder's past loss history and claims experience to determine future premiums more accurately. Both methods aim to tailor insurance costs to individual risk profiles but differ in the data and approach they employ.

Table of Comparison

| Feature | Schedule Rating | Experience Rating |

|---|---|---|

| Definition | Adjusts premiums based on specific risk factors using a rating schedule. | Modifies premiums based on the insured's historical loss experience. |

| Application | Applies predetermined credits or debits to base rates. | Uses actual past claims data for premium calculation. |

| Risk Assessment | Evaluates individual risk characteristics systematically. | Assesses risk performance through claims history. |

| Data Requirement | Requires detailed risk factor information. | Needs credible loss data over a specified period. |

| Premium Impact | Adjustments can increase or decrease premium based on features. | Premium changes reflect actual loss experience trends. |

| Typical Use | Used when loss history is insufficient or unavailable. | Preferred when reliable experience data exists. |

Understanding Schedule Rating and Experience Rating

Schedule rating adjusts insurance premiums based on specific risk factors identified in the policyholder's profile, such as equipment condition or safety measures, enabling a customized premium reflecting unique risk elements. Experience rating evaluates past loss experience of the insured, comparing it to the expected loss, which rewards companies with lower-than-average claims through reduced premiums or penalizes those with higher losses. Both methods aim to align premiums more closely with actual risk, but schedule rating uses predefined criteria while experience rating relies on historical claims data.

Key Definitions: Schedule Rating vs Experience Rating

Schedule rating evaluates risk by adjusting premiums based on specific risk factors and characteristics unique to a policy, allowing insurers to fine-tune rates beyond standard classifications. Experience rating adjusts premiums according to the insured's past loss history, reflecting actual claims data to incentivize better risk management and reward safer operations. Both methods serve to personalize insurance costs, with schedule rating focusing on qualitative risk attributes and experience rating relying on quantitative loss experience.

How Schedule Rating Works in Insurance

Schedule rating in insurance adjusts premiums by evaluating specific risk factors associated with a policyholder, such as building construction, fire protection measures, and occupancy type. Insurers apply percentage credits or debits to a base rate based on these detailed characteristics, reflecting the unique risk profile rather than relying on historical loss data. This method offers a more granular approach to premium calculation compared to experience rating, which primarily considers past claims history.

The Mechanisms Behind Experience Rating

Experience rating adjusts insurance premiums based on a policyholder's actual loss history, using past claims data to predict future risk more accurately. This mechanism contrasts with schedule rating, which relies on manual adjustments for specific risk characteristics rather than historical loss experience. Experience rating incentivizes better risk management by rewarding lower-than-expected losses with reduced premiums.

Comparative Advantages of Schedule and Experience Rating

Schedule rating offers customized premium adjustments based on specific risk factors and loss control measures, providing tailored incentives for improved safety practices. Experience rating calculates premiums primarily on an insured's actual past loss experience, promoting accountability and rewarding consistently low claims history. The choice between the two depends on whether a policyholder benefits more from detailed risk assessment or from their historical claims record in influencing premium costs.

Impact on Insurance Premium Calculation

Schedule rating adjusts insurance premiums based on specific risk factors related to the insured property or operation, allowing for more precise customization of rates. Experience rating evaluates an insured's historical loss data to modify premiums, rewarding lower claims frequency with reduced costs. Both methods improve premium accuracy by aligning rates closely with risk exposure and loss history.

Risk Assessment: Schedule vs Experience Rating

Schedule rating evaluates risk by adjusting premiums based on specific, individual risk factors such as building materials or fire protection systems, allowing tailored assessments for properties with unique characteristics. Experience rating bases premium adjustments on an insured's actual loss history and claims experience over a given period, reflecting the real-world frequency and severity of losses. Both methods enhance risk assessment accuracy by incorporating tangible data, with schedule rating focusing on physical risk attributes and experience rating emphasizing historical claim performance.

Industry Applications and Common Practices

Schedule rating involves adjusting premiums based on specific risk factors related to a particular industry, allowing insurers to tailor rates for unique hazards within sectors like construction or manufacturing. Experience rating calculates premiums by analyzing a company's past loss history, making it common in industries such as trucking and hospitality where claims data is readily available. Both methods are widely applied to create more accurate and fair insurance pricing, enhancing risk management for businesses through customized underwriting approaches.

Pros and Cons: Schedule Rating vs Experience Rating

Schedule rating offers insurers flexibility by adjusting premiums based on specific risk characteristics, allowing tailored rates for unique exposures, but it may involve subjective judgments and increased administrative complexity. Experience rating bases premiums on the insured's actual loss history, promoting fairness and rewarding risk management, yet it can penalize policyholders for isolated incidents and may not reflect emerging risks effectively. Both methods impact cost predictability and risk incentive differently, making the choice dependent on the insurer's portfolio and policyholder risk profile.

Choosing the Right Rating Method for Your Policy

Choosing the right rating method for your insurance policy depends on your business's risk profile and historical loss data. Schedule rating adjusts premiums based on specific risk factors unique to your operations, while experience rating evaluates your past claim history to determine future costs. Assessing which method aligns best with your risk management strategy and financial stability ensures more accurate and potentially cost-saving premium calculations.

Important Terms

Merit Rating

Merit rating evaluates insurance premiums by combining schedule rating, which adjusts rates based on specific risk characteristics of a policyholder's operations, with experience rating, which reflects the actual loss history over a set period. Schedule rating modifies the base rate through debits or credits for unique risk factors, while experience rating provides a retrospective adjustment linked to the insured's claims performance and loss frequency.

Manual Rating

Manual rating establishes premiums based on predetermined industry classifications and risk factors, offering a standardized approach to insurance pricing. Schedule rating modifies these base rates by factoring in individual risk characteristics, while experience rating adjusts premiums according to an insured's historical loss data, providing a more personalized risk assessment.

Exposure Base

Exposure base quantifies the measure of risk units, such as payroll or hours worked, used to apply schedule rating factors in insurance underwriting; it provides a standardized metric to adjust premiums based on specific risk characteristics. Experience rating, by contrast, incorporates actual past loss history relative to the exposure base to modify premiums, ensuring rates reflect the insured's unique claim experience rather than generic schedule adjustments.

Loss History

Loss history significantly influences both Schedule Rating and Experience Rating in insurance underwriting, where Schedule Rating adjusts premiums based on individual risk characteristics and specific loss factors, while Experience Rating calculates premiums primarily from an entity's aggregate loss experience over time. Analyzing detailed loss history enables insurers to accurately apply Schedule Ratings for unique risk modifications and refine Experience Ratings by reflecting consistent loss performance trends in premium adjustments.

Risk Classification

Risk classification in insurance distinguishes between Schedule Rating and Experience Rating by evaluating individual policy characteristics versus historical loss data. Schedule Rating adjusts premiums based on specific risk factors, while Experience Rating modifies rates according to an insured's past claims experience to predict future risk accurately.

Premium Modification

Premium modification adjusts workers' compensation insurance costs by comparing a business's actual loss experience (Experience Rating) against industry averages, incentivizing safer workplaces. Schedule Rating modifies premiums based on specific risk factors like safety programs or claim handling, resulting in tailored rates that reflect unique business practices beyond standard experience data.

Underwriting Factors

Underwriting factors in Schedule Rating emphasize individual risk characteristics such as specific hazards or safety features, allowing precise adjustments to premiums based on measurable risk traits. Experience Rating, however, adjusts premiums primarily according to the insured's historical loss experience, reflecting past claims frequency and severity to predict future risk.

Retrospective Rating

Retrospective Rating adjusts workers' compensation premiums based on actual loss experience during the policy period, differing from Schedule Rating which modifies rates through specific risk characteristics and Experience Rating that uses employer's historical loss data over several years. Retrospective Rating uniquely balances initial premium payments with final costs by reflecting the real-time claims experience, offering a more dynamic and potentially cost-saving alternative to fixed Schedule or Experience Ratings.

Credibility Factor

The Credibility Factor in workers' compensation insurance quantifies the reliability of Schedule Rating adjustments compared to Experience Rating outcomes, balancing historical claim data against customized risk modifications. It ensures premium accuracy by integrating both an employer's loss experience and risk characteristics reflected in schedule adjustments, optimizing the insurance pricing model for fair assessment.

Homogeneous Groups

Homogeneous groups in insurance are segments of policyholders with similar risk characteristics, enabling more accurate premium setting through schedule rating, which adjusts rates based on predefined risk factors. Experience rating, by contrast, tailors premiums based on the group's actual past loss experience, making it more dynamic but less uniform compared to the fixed adjustments in schedule rating.

Schedule Rating vs Experience Rating Infographic

moneydif.com

moneydif.com