Adverse selection occurs when individuals with higher risk are more likely to purchase insurance, leading to a disproportionate number of high-risk policyholders. Moral hazard arises after obtaining insurance, causing insured parties to engage in riskier behavior due to the protection provided by the policy. Both concepts affect insurance pricing, underwriting strategies, and risk management practices to maintain profitability and sustainability.

Table of Comparison

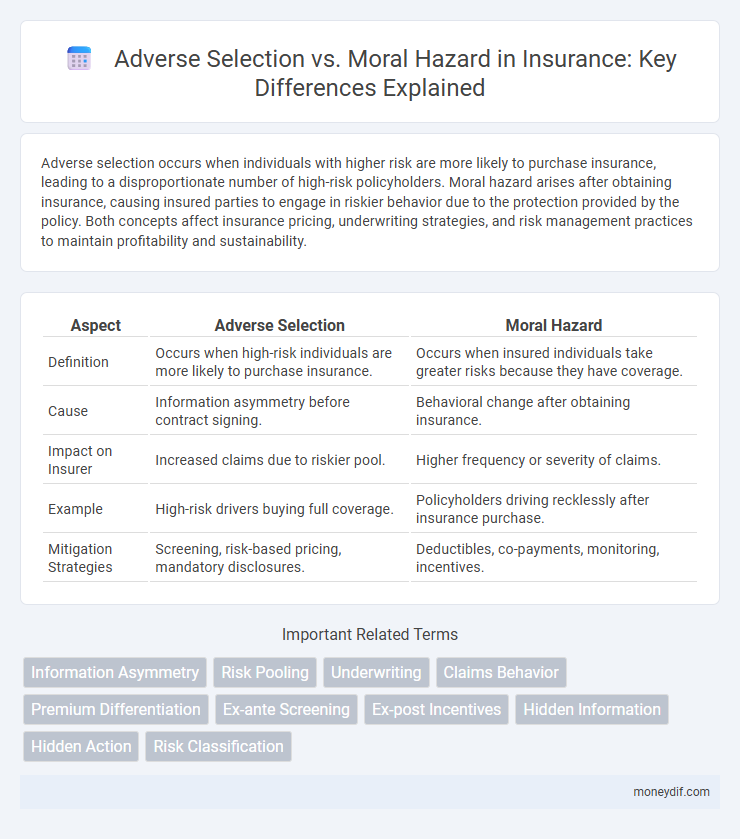

| Aspect | Adverse Selection | Moral Hazard |

|---|---|---|

| Definition | Occurs when high-risk individuals are more likely to purchase insurance. | Occurs when insured individuals take greater risks because they have coverage. |

| Cause | Information asymmetry before contract signing. | Behavioral change after obtaining insurance. |

| Impact on Insurer | Increased claims due to riskier pool. | Higher frequency or severity of claims. |

| Example | High-risk drivers buying full coverage. | Policyholders driving recklessly after insurance purchase. |

| Mitigation Strategies | Screening, risk-based pricing, mandatory disclosures. | Deductibles, co-payments, monitoring, incentives. |

Understanding Adverse Selection in Insurance

Adverse selection in insurance occurs when individuals with higher risk are more likely to purchase coverage, leading to an imbalance in the risk pool. Insurers face challenges in accurately pricing policies because those seeking coverage often have more information about their risk levels than the insurer. Effective underwriting and risk assessment techniques are essential to mitigate adverse selection and maintain policy sustainability.

Defining Moral Hazard in Insurance Context

Moral hazard in insurance refers to the increased risk of loss due to the insured party's behavior changes after obtaining coverage, such as taking less care to prevent damage or filing exaggerated claims. It arises because the protection from financial consequences reduces the incentive to avoid risky actions. Insurers manage moral hazard through measures like deductibles, co-payments, and policy limits to align the insured's interests with risk reduction.

Key Differences Between Adverse Selection and Moral Hazard

Adverse selection occurs before an insurance contract is signed, where individuals with higher risk are more likely to purchase insurance, leading to a disproportionate pool of high-risk policyholders. Moral hazard arises after the policy is in place, where the insured may engage in riskier behavior or reduce preventive efforts because they are protected by insurance coverage. The key difference lies in timing and behavior: adverse selection affects the insurer's risk pool at the point of underwriting, while moral hazard influences insured behavior post-contract.

Causes of Adverse Selection in Insurance Markets

Adverse selection in insurance markets arises primarily when buyers possess more information about their risk levels than insurers, leading high-risk individuals to disproportionately purchase coverage. This information asymmetry causes insurers to set higher premiums, discouraging low-risk individuals from buying policies and exacerbating the risk pool imbalance. Factors such as lack of transparency in risk disclosure and inadequate risk assessment tools significantly contribute to the persistence of adverse selection.

How Moral Hazard Affects Insurance Claims

Moral hazard affects insurance claims by increasing the likelihood of insured individuals engaging in riskier behavior or exaggerating claims because they are protected from the financial consequences. This behavior leads to higher claim frequencies and severities, which in turn drive up insurance premiums and reduce overall profitability for insurers. Insurers employ various strategies such as deductibles, co-payments, and policy limits to mitigate moral hazard and align the interests of insured parties with risk management objectives.

Real-World Examples of Adverse Selection

Adverse selection occurs when high-risk individuals are more likely to purchase insurance, leading to imbalanced risk pools and increased premiums. For example, in the health insurance market, individuals with pre-existing conditions often seek more comprehensive coverage, causing insurers to raise prices or restrict benefits to offset potential losses. This phenomenon challenges insurers to develop precise underwriting criteria and employ data analytics to better assess applicant risk profiles and reduce adverse selection impacts.

Identifying Moral Hazard Scenarios in Insurance

Moral hazard in insurance arises when policyholders alter their behavior after obtaining coverage, leading to increased risk or claims. Common scenarios include insured individuals driving less cautiously, homeowners neglecting property maintenance, or businesses taking fewer safety precautions due to the security of insurance. Identifying these behaviors requires monitoring claim patterns, policyholder actions, and implementing measures such as deductibles and co-payments to mitigate risk.

Strategies to Mitigate Adverse Selection

Implementing rigorous underwriting processes helps insurance companies accurately assess applicant risk, reducing adverse selection by discouraging high-risk individuals from applying without facing higher premiums. Offering differentiated policy options with varying degrees of coverage and deductibles enables better risk segmentation, ensuring premiums align closely with individual risk profiles. Utilizing advanced data analytics and continuous monitoring further enhances risk assessment accuracy, allowing insurers to adjust terms and pricing proactively to mitigate adverse selection effectively.

Methods to Control Moral Hazard in Insurance Policies

Insurance companies implement deductibles, co-payments, and policy limits to align policyholder behavior with risk management objectives and mitigate moral hazard. Regular audits, claim investigations, and the use of data analytics help detect fraudulent activities and discourage exaggerated claims. Incorporating experience rating and offering discounts for risk-reducing actions further incentivize responsible conduct among insured individuals.

The Impact of Adverse Selection and Moral Hazard on Premiums

Adverse selection increases insurance premiums by attracting higher-risk individuals who are more likely to file claims, leading insurers to raise prices to cover anticipated losses. Moral hazard drives premiums upward as insured parties may engage in riskier behavior or overutilize benefits, increasing the frequency and cost of claims. Both phenomena compel insurers to implement stricter underwriting criteria and adjust pricing models to maintain profitability and risk balance.

Important Terms

Information Asymmetry

Information asymmetry causes adverse selection by causing hidden characteristics before a transaction and leads to moral hazard by creating hidden actions after a transaction.

Risk Pooling

Risk pooling mitigates adverse selection by aggregating diverse risk profiles while managing moral hazard through monitoring and incentive alignment.

Underwriting

Underwriting mitigates adverse selection by accurately assessing risk before policy issuance and reduces moral hazard by implementing policy terms that discourage reckless behavior after coverage begins.

Claims Behavior

Claims behavior in insurance often reflects the dynamics between adverse selection and moral hazard, where adverse selection arises from high-risk individuals disproportionately seeking coverage, increasing the likelihood of claims. Moral hazard occurs post-policy issuance when insured parties may engage in riskier behavior or inflate claims, elevating the frequency and severity of reported losses.

Premium Differentiation

Premium differentiation mitigates adverse selection by aligning insurance costs with individual risk profiles, while moral hazard requires monitoring mechanisms to prevent excessive risk-taking after coverage.

Ex-ante Screening

Ex-ante screening mitigates adverse selection by assessing risk before contract formation, reducing information asymmetry and preventing high-risk individuals from selecting into contracts, thereby limiting moral hazard post-agreement.

Ex-post Incentives

Ex-post incentives mitigate moral hazard by aligning agent behavior after contract signing, while ex-ante measures primarily address adverse selection by screening agent types before agreements.

Hidden Information

Hidden information in adverse selection occurs before a transaction when one party has private knowledge about risk, while in moral hazard it emerges after a transaction when a party changes behavior due to asymmetric information.

Hidden Action

Hidden action in economics refers to situations where one party's unobservable actions lead to moral hazard, differing from adverse selection, which arises from asymmetric information about characteristics before a transaction.

Risk Classification

Risk classification mitigates adverse selection by accurately grouping insureds based on risk factors, reducing the likelihood of high-risk individuals disproportionately purchasing coverage and minimizing moral hazard by aligning premiums with risk exposure to discourage careless behavior.

Adverse Selection vs Moral Hazard Infographic

moneydif.com

moneydif.com