Schedule coverage provides protection for individually listed items with specified limits, ensuring precise valuation and claim settlements. Blanket coverage offers a single coverage amount for multiple items or properties under one policy, simplifying insurance but potentially leading to underinsurance or overinsurance of certain assets. Choosing between schedule and blanket coverage depends on the value, quantity, and risk associated with the insured items.

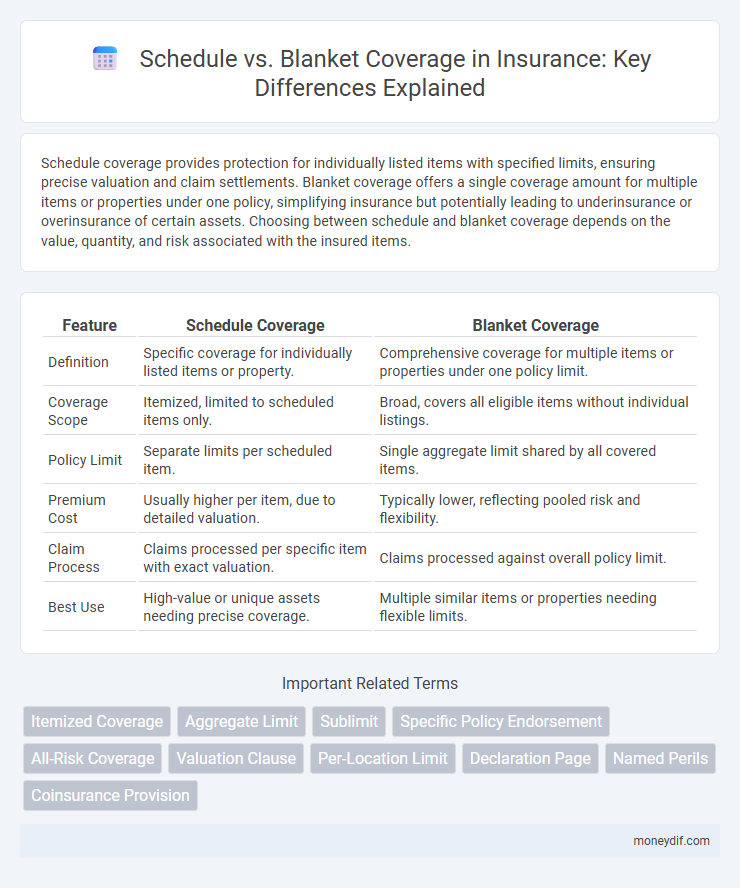

Table of Comparison

| Feature | Schedule Coverage | Blanket Coverage |

|---|---|---|

| Definition | Specific coverage for individually listed items or property. | Comprehensive coverage for multiple items or properties under one policy limit. |

| Coverage Scope | Itemized, limited to scheduled items only. | Broad, covers all eligible items without individual listings. |

| Policy Limit | Separate limits per scheduled item. | Single aggregate limit shared by all covered items. |

| Premium Cost | Usually higher per item, due to detailed valuation. | Typically lower, reflecting pooled risk and flexibility. |

| Claim Process | Claims processed per specific item with exact valuation. | Claims processed against overall policy limit. |

| Best Use | High-value or unique assets needing precise coverage. | Multiple similar items or properties needing flexible limits. |

Understanding Schedule Coverage in Insurance

Schedule coverage in insurance refers to a policy that itemizes and insures specific individual assets or property, providing precise coverage limits for each listed item. This approach allows policyholders to insure high-value items, such as jewelry or electronics, under a detailed schedule, ensuring accurate protection based on the item's appraised value. It contrasts with blanket coverage by offering targeted indemnity rather than a general overall limit, reducing the risk of underinsurance or coverage gaps.

What is Blanket Coverage?

Blanket coverage is an insurance policy that provides a single limit of protection covering multiple properties, locations, or items under one policy, rather than specifying each individually. This type of coverage simplifies claims and offers flexibility by automatically including new assets without the need for additional endorsements. It is particularly useful for businesses or individuals with numerous or frequently changing assets, ensuring comprehensive protection across all covered items.

Key Differences Between Schedule and Blanket Coverage

Schedule coverage insures specific items listed individually with defined limits, providing precise protection tailored to each asset. Blanket coverage offers a single total limit for multiple items or locations under one policy, enabling flexible use of coverage across all listed properties. Understanding these distinctions helps policyholders optimize protection strategies based on asset value concentration and risk distribution.

Pros and Cons of Schedule Coverage

Schedule coverage in insurance provides specific protection for individually listed items, ensuring precise valuation and tailored premiums that reflect the exact risk of each asset. This targeted approach offers clear benefits such as higher claim settlements for unique or high-value possessions and avoidance of underinsurance, but it requires detailed documentation and periodic updates, which can be time-consuming and potentially costly. While schedule coverage delivers enhanced accuracy and control, it may lack the convenience and broader protection offered by blanket coverage.

Advantages and Disadvantages of Blanket Coverage

Blanket coverage offers the advantage of insuring multiple assets under a single policy limit, providing flexibility and simplified management during property claims. However, its disadvantage lies in potential underinsurance for high-value items due to shared limits, which may not fully cover individual asset losses. This coverage is ideal for businesses with numerous similar-value assets but less effective for properties with diverse asset values requiring precise valuation.

Cost Comparison: Schedule vs Blanket Insurance

Schedule insurance often involves higher premiums due to individually listed items with specific values, leading to increased administrative costs and tailored coverage. Blanket coverage typically offers a more cost-effective solution by insuring multiple assets under a single limit, reducing premium expenses through consolidated risk assessment. Choosing between schedules and blanket policies depends on asset valuation accuracy, desired coverage precision, and overall budget constraints.

Which Businesses Benefit from Schedule Coverage?

Businesses with valuable, high-cost equipment or assets benefit most from schedule coverage because it itemizes and insures each specific item separately, ensuring accurate valuation and protection. Industries such as construction, photography, technology, and medical practices rely on scheduled coverage to safeguard expensive tools and specialized equipment against loss or damage. This tailored approach reduces gaps in protection often found in blanket policies, providing clarity and customized risk management.

Is Blanket Coverage Right for You?

Blanket coverage consolidates multiple insured items or locations under a single policy limit, offering flexibility and simplifying claims when assets frequently change or are located across various places. Schedule coverage lists specific items individually, providing tailored protection with predetermined coverage limits ideal for high-value or unique assets requiring precise valuation. Choosing blanket coverage is beneficial for businesses or homeowners with numerous or variable assets, ensuring broader protection without the need to update the policy constantly.

Common Claims: Schedule vs Blanket Policies

Schedule insurance policies list specific items covered individually, making claims straightforward for scheduled valuables like jewelry or electronics, ensuring higher reimbursement limits per item. Blanket coverage protects multiple items or properties under a single total coverage limit, often resulting in lower payouts for individual claims due to shared limits across all insured assets. Common claims under schedule policies often reflect detailed itemized losses, while blanket policies address broader damage claims that spread coverage across various belongings, impacting claim settlement amounts.

How to Choose Between Schedule and Blanket Coverage

Choosing between schedule and blanket coverage depends on the insured property's nature and value distribution. Schedule coverage itemizes and insures specific valuables at their appraised value, ideal for high-value or unique items requiring precise protection. Blanket coverage provides a single limit for multiple items or locations, offering flexibility but potentially less individual item protection, suitable for businesses or individuals with interchangeable assets.

Important Terms

Itemized Coverage

Itemized Coverage specifies individual assets or items insured under a policy, providing precise protection and tailored limits for each listed item, whereas Blanket Coverage offers a comprehensive protection amount for a group or class of items without the need for detailed listing. Businesses often choose Schedule Coverage for high-value assets requiring exact valuation, while Blanket Coverage suits cases where flexibility and broad protection for numerous lower-value items are necessary.

Aggregate Limit

Aggregate limit in insurance specifies the maximum total payout over a policy period, differing significantly between schedule and blanket coverage; schedule coverage sets individual limits per item or location, while blanket coverage pools a single aggregate limit across all covered items or locations, providing broader flexibility but requiring careful risk assessment to avoid limit exhaustion. Understanding these distinctions is crucial for optimizing policy design and ensuring adequate protection without overpaying for redundant coverage.

Sublimit

Sublimit in insurance defines the maximum amount payable under a specific coverage within a broader policy, often influencing the distinction between schedule and blanket coverage. Schedule coverage itemizes insured properties with individual limits, while blanket coverage provides a single aggregate limit for multiple properties, with sublimits potentially capping payouts on particular items or risks within that overall limit.

Specific Policy Endorsement

Specific Policy Endorsement provides targeted protection for individual items or risks, offering precise coverage terms distinct from the broader, all-encompassing nature of blanket coverage. Unlike blanket coverage that applies a single limit across multiple properties or risks, specific endorsements enable tailored limits and conditions for each insured item, enhancing clarity and risk management.

All-Risk Coverage

All-Risk Coverage provides comprehensive protection against a broad range of perils, with Schedule Coverage insuring specifically listed items individually, while Blanket Coverage extends protection to multiple properties or assets under a single limit. Schedule Coverage offers precise valuation and limits for high-value items, whereas Blanket Coverage provides flexible allocation of coverage among various assets without itemization.

Valuation Clause

A Valuation Clause specifies the method for determining the value of insured property in claims involving Schedule Coverage, which itemizes and assigns specific values to individual assets, versus Blanket Coverage, offering a total coverage limit for multiple properties without itemization. Understanding these distinctions ensures accurate claim settlements by clarifying whether assets are valued individually or as a collective aggregate under the insurance policy.

Per-Location Limit

Per-Location Limit defines the maximum coverage amount applicable to each individual site under an insurance policy, differentiating it from Blanket Coverage which aggregates limits across multiple locations. Schedules allocate specific limits to listed locations, ensuring targeted protection, whereas Blanket Coverage distributes a single limit across all locations collectively, impacting risk management and claims processing strategies.

Declaration Page

The Declaration Page outlines specific insured items and coverage limits, delineating schedule coverage that lists individual assets separately from blanket coverage, which provides a single aggregate limit for multiple items under one policy. Schedule coverage offers precise valuation and protection per item, while blanket coverage simplifies claims by pooling coverage amounts but may limit individual item reimbursement.

Named Perils

Named perils coverage specifies protections only for risks explicitly listed in the insurance policy, limiting claims to those particular events, whereas blanket coverage offers protection for all property and risks under a single limit without itemizing individual perils. Schedule coverage itemizes specific properties and insured perils separately, providing targeted protection, while blanket coverage combines multiple properties or locations under one total limit, offering flexible risk management for varied assets.

Coinsurance Provision

Coinsurance provisions in insurance policies define the insured's share of loss and can impact Schedule coverage, where specific items are individually listed and insured, and Blanket coverage, which provides a single limit for multiple properties or locations. While Schedule coverage applies coinsurance to each scheduled item separately, Blanket coverage uses a combined limit, often offering greater flexibility and reducing the risk of underinsurance across multiple insured assets.

Schedule vs Blanket Coverage Infographic

moneydif.com

moneydif.com