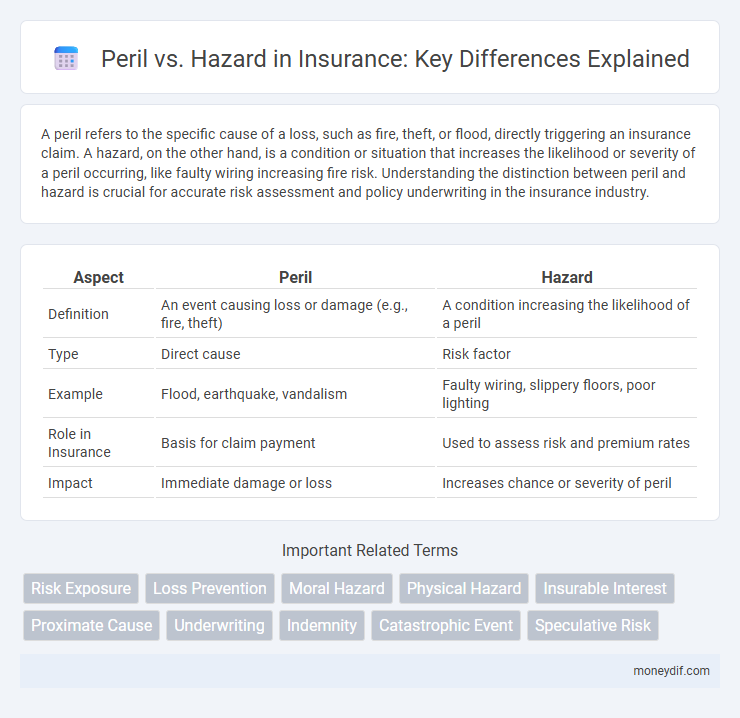

A peril refers to the specific cause of a loss, such as fire, theft, or flood, directly triggering an insurance claim. A hazard, on the other hand, is a condition or situation that increases the likelihood or severity of a peril occurring, like faulty wiring increasing fire risk. Understanding the distinction between peril and hazard is crucial for accurate risk assessment and policy underwriting in the insurance industry.

Table of Comparison

| Aspect | Peril | Hazard |

|---|---|---|

| Definition | An event causing loss or damage (e.g., fire, theft) | A condition increasing the likelihood of a peril |

| Type | Direct cause | Risk factor |

| Example | Flood, earthquake, vandalism | Faulty wiring, slippery floors, poor lighting |

| Role in Insurance | Basis for claim payment | Used to assess risk and premium rates |

| Impact | Immediate damage or loss | Increases chance or severity of peril |

Understanding Peril and Hazard in Insurance

Perils in insurance refer to specific risks or causes of loss, such as fire, theft, or natural disasters, that directly result in damage to insured property. Hazards are conditions or situations that increase the likelihood or severity of a peril occurring, including factors like faulty wiring or poor building maintenance. Differentiating between peril and hazard helps insurers assess risk accurately and determine appropriate coverage and premiums.

Defining Peril: What It Means in Insurance Terms

A peril in insurance refers to a specific event or risk that causes loss or damage to insured property, such as fire, theft, or natural disasters. It represents the actual cause of a loss, distinguishable from hazards which increase the likelihood of a peril occurring but are not direct causes themselves. Understanding perils is fundamental for policyholders to ensure their coverage aligns with the types of risks most relevant to their property or assets.

Types of Perils: Named vs. Open Perils

Named perils insurance policies specifically list covered risks such as fire, theft, or windstorm, providing clear boundaries for claim eligibility. Open perils policies, also known as all-risk policies, cover all causes of loss except those explicitly excluded, offering broader protection against unforeseen events. Understanding the distinction between named and open perils is critical for selecting appropriate coverage tailored to individual risk exposure in property insurance.

What Is a Hazard? Key Insurance Definitions

A hazard in insurance is any condition or situation that increases the likelihood or severity of a loss, distinguishing it from a peril, which is the actual cause of loss such as fire or theft. Hazards are typically categorized into physical, moral, or morale hazards, each affecting risk assessment differently. Understanding hazards helps insurers accurately evaluate potential risks and determine appropriate policy terms and premiums.

Types of Hazards: Physical, Moral, and Morale

Physical hazards refer to tangible conditions that increase the likelihood of a loss, such as faulty wiring or icy roads. Moral hazards involve intentional actions by individuals to cause or exaggerate a loss, including fraud or arson. Morale hazards arise from carelessness or indifference to loss due to a lack of incentive to prevent damage, often seen when insured parties neglect proper maintenance or safety measures.

Key Differences Between Peril and Hazard

Perils refer to specific causes of loss, such as fire, theft, or flooding, that directly result in damage to insured property. Hazards are conditions or situations, like faulty wiring or icy sidewalks, that increase the likelihood or severity of a peril occurring. Understanding the distinction between peril and hazard is crucial for accurate risk assessment and effective insurance policy formulation.

The Role of Peril and Hazard in Risk Assessment

Perils represent the actual causes of loss, such as fire, theft, or natural disasters, directly impacting the insured property or individual. Hazards are conditions or situations that increase the likelihood or severity of these perils, including factors like poor maintenance, faulty wiring, or high-crime areas. Accurately distinguishing between peril and hazard is crucial in risk assessment for insurance underwriting, as it informs premium calculations and coverage decisions by evaluating both the immediate threats and contributing vulnerabilities.

Real-World Examples of Perils and Hazards

Perils in insurance refer to specific events such as fire, theft, or flood that cause direct loss or damage to property, while hazards are conditions that increase the likelihood or severity of such perils, like faulty wiring or storing flammable materials improperly. For example, a lightning strike (peril) can cause a house fire, whereas dry weather and dense vegetation (hazards) increase the risk of wildfire spreading. Recognizing the distinction between perils and hazards enables insurers to assess risk accurately and set appropriate premiums.

How Perils and Hazards Affect Insurance Premiums

Perils directly trigger insurance claims by causing losses such as fire or theft, leading insurers to adjust premiums based on the likelihood and severity of these events. Hazards increase the probability or impact of perils occurring, so risky conditions like faulty wiring or poor building maintenance raise insurance premiums to offset higher potential claims. Understanding the distinction between perils and hazards enables insurers to more accurately assess risk and determine appropriate premium rates.

Why Distinguishing Peril from Hazard Matters in Policy Coverage

Distinguishing peril from hazard is crucial in insurance policy coverage because perils refer to the direct causes of loss, such as fire or theft, while hazards are conditions that increase the likelihood or severity of these perils. Accurate identification allows insurers to assess risk more precisely, set appropriate premiums, and determine coverage limits effectively. Misclassifying hazards as perils or vice versa can lead to coverage disputes and unexpected claim denials, impacting policyholder protection.

Important Terms

Risk Exposure

Risk exposure increases when peril triggers hazard conditions that amplify potential damage.

Loss Prevention

Loss prevention strategies focus on identifying hazards--conditions or situations with the potential to cause harm--rather than perils, which are actual events or causes of loss, in order to mitigate risks effectively.

Moral Hazard

Moral hazard arises when individuals take greater risks because they are protected from the consequences, distinguishing it from peril, which is the cause of loss, and hazard, which increases the likelihood or severity of that loss.

Physical Hazard

Physical hazards refer to tangible dangers such as fire, explosion, or natural disasters that pose risks, while peril is the specific event causing loss and hazard is the underlying condition increasing the likelihood of that peril.

Insurable Interest

Insurable interest is a fundamental requirement in insurance contracts ensuring the policyholder suffers a financial loss from the insured peril, which is a specific risk or event causing damage or loss, whereas a hazard refers to conditions or situations that increase the likelihood or severity of the peril. Distinguishing between peril and hazard enhances risk assessment accuracy, supporting underwriting decisions and claim evaluations based on genuine financial stake.

Proximate Cause

Proximate cause in insurance law is the primary peril or hazard that directly triggers a loss, establishing liability by linking the event to the resulting damage without the need to consider remote or indirect factors.

Underwriting

Underwriting assesses risks by distinguishing perils, which are specific causes of loss such as fire or theft, from hazards, conditions that increase the likelihood or severity of those losses, like faulty wiring or poor security. Effective risk evaluation requires identifying both perils and hazards to determine accurate insurance premiums and coverage limits.

Indemnity

Indemnity in insurance ensures compensation for losses caused by perils, which are direct causes of damage, whereas hazards increase the likelihood or severity of those perils without directly causing loss.

Catastrophic Event

A catastrophic event results from a peril, which is an immediate cause of damage, whereas a hazard represents the underlying condition or situation that increases the vulnerability to such peril.

Speculative Risk

Speculative risk involves potential outcomes with both loss and gain, whereas peril refers to the actual cause of loss and hazard denotes conditions increasing the likelihood or severity of that loss.

Peril vs Hazard Infographic

moneydif.com

moneydif.com