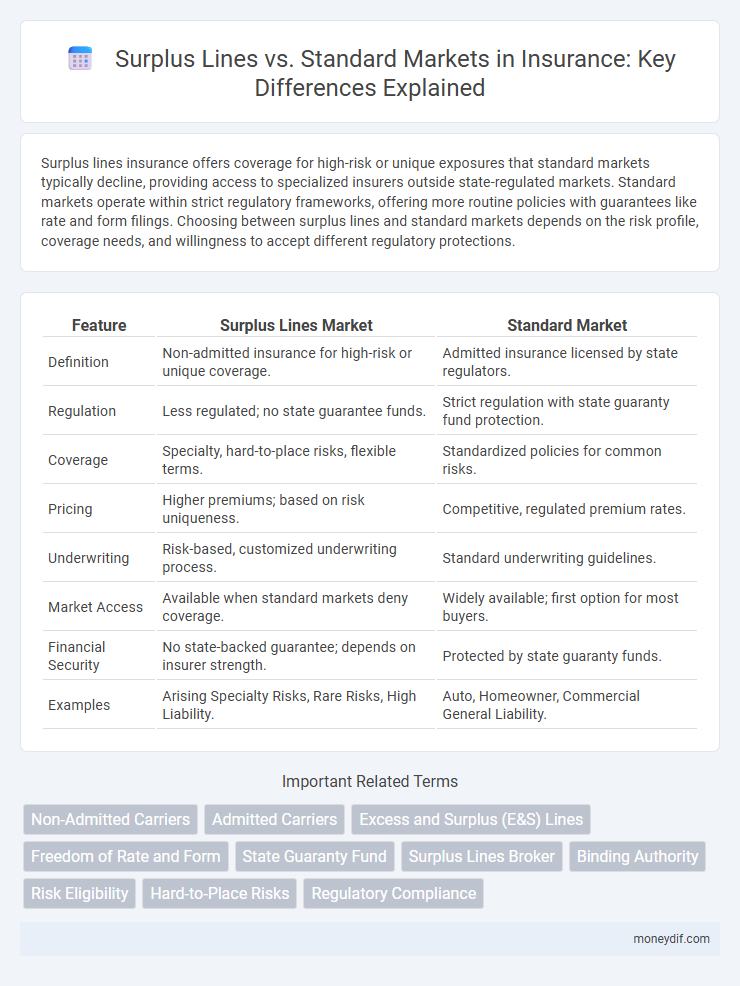

Surplus lines insurance offers coverage for high-risk or unique exposures that standard markets typically decline, providing access to specialized insurers outside state-regulated markets. Standard markets operate within strict regulatory frameworks, offering more routine policies with guarantees like rate and form filings. Choosing between surplus lines and standard markets depends on the risk profile, coverage needs, and willingness to accept different regulatory protections.

Table of Comparison

| Feature | Surplus Lines Market | Standard Market |

|---|---|---|

| Definition | Non-admitted insurance for high-risk or unique coverage. | Admitted insurance licensed by state regulators. |

| Regulation | Less regulated; no state guarantee funds. | Strict regulation with state guaranty fund protection. |

| Coverage | Specialty, hard-to-place risks, flexible terms. | Standardized policies for common risks. |

| Pricing | Higher premiums; based on risk uniqueness. | Competitive, regulated premium rates. |

| Underwriting | Risk-based, customized underwriting process. | Standard underwriting guidelines. |

| Market Access | Available when standard markets deny coverage. | Widely available; first option for most buyers. |

| Financial Security | No state-backed guarantee; depends on insurer strength. | Protected by state guaranty funds. |

| Examples | Arising Specialty Risks, Rare Risks, High Liability. | Auto, Homeowner, Commercial General Liability. |

Understanding Surplus Lines and Standard Markets

Surplus lines insurance covers risks that standard markets refuse due to high risk or unique circumstances, providing access to broader underwriting flexibility and specialized policies. Standard markets enforce stricter regulatory oversight with established rate guidelines, offering more regulated and standardized coverage options for typical risks. Understanding these differences helps brokers and insureds choose appropriate coverage based on risk profile, availability, and compliance requirements.

Key Differences Between Surplus Lines and Standard Markets

Surplus lines insurance provides coverage for high-risk or unique exposures that standard markets typically decline due to strict underwriting guidelines. Standard markets offer regulated, admitted policies with set rates and consumer protections, while surplus lines operate through non-admitted carriers without state rate restrictions. These differences affect policy availability, pricing flexibility, and claims handling, making surplus lines essential for specialized or hard-to-place risks.

Eligibility Criteria for Surplus Lines vs Standard Markets

Surplus lines insurance serves risks that do not meet the eligibility criteria of standard markets, typically covering high-risk or unusual exposures denied by admitted insurers. Standard markets require policies to adhere to regulatory guidelines and accept only applicants whose risks conform to set underwriting standards. Eligibility for surplus lines is predicated on the unavailability of coverage in the standard market, enabling access to broader, non-admitted insurers for specialized or higher-risk insurance needs.

Coverage Flexibility: Surplus Lines vs Standard Markets

Surplus lines insurance offers greater coverage flexibility by providing access to specialty and high-risk markets that standard markets often exclude. Unlike standard markets regulated by state mandates and restrictive underwriting guidelines, surplus lines insurers tailor policies to unique risks with customized terms and higher coverage limits. This adaptability makes surplus lines essential for businesses or individuals needing non-standard or hard-to-place insurance solutions.

Regulatory Oversight: How Surplus Lines Differ

Surplus lines insurance operates under a distinct regulatory framework that allows insurers to provide coverage for high-risk or unique exposures not typically accepted in standard markets. Unlike standard markets regulated directly by state insurance departments, surplus lines insurers rely on licensed surplus line brokers to ensure compliance and proper placement of risk. This regulatory oversight emphasizes transparency, market access, and consumer protection while accommodating the flexibility needed for specialized risks.

Pricing Structures and Premium Comparisons

Surplus lines insurance typically features higher pricing structures due to increased risk exposure and less regulatory oversight compared to standard markets. Premiums in surplus lines are generally higher, reflecting coverage for unique or hard-to-place risks that standard markets often exclude. Standard market insurance offers more stable pricing driven by regulatory frameworks and established risk pools, leading to more competitive premium rates for common risks.

Risk Appetite: What Surplus Lines Insurers Cover

Surplus lines insurers cover high-risk or unconventional risks that standard markets often decline due to stringent underwriting guidelines and limited risk appetite. These insurers provide coverage for unique, complex, or higher-risk exposures such as professional liability for emerging industries, environmental hazards, or specialty construction projects. Their flexible underwriting criteria allow them to assume risks beyond the scope of standard markets, addressing gaps in coverage for insureds with nonstandard risk profiles.

Claims Handling in Surplus Lines and Standard Markets

Claims handling in surplus lines involves managing higher-risk or unique insurance policies often not covered by standard markets, requiring specialized expertise and flexibility in policy terms. Standard markets provide more routine claims processing with established protocols, faster settlements, and regulatory oversight ensuring consumer protections. Surplus lines claims may face longer adjustment periods due to complex risk profiles, whereas standard markets benefit from streamlined claim adjudication and standardized coverage terms.

Advantages and Disadvantages of Surplus Lines Insurance

Surplus lines insurance offers coverage for high-risk or unique exposures that standard markets often decline, providing flexibility and access to specialized policies not available through admitted insurers. However, surplus lines lack the financial protections of state guaranty funds, exposing policyholders to greater risk if the insurer becomes insolvent. Despite higher premiums and less regulatory oversight, surplus lines remain essential for businesses requiring tailored solutions unavailable in standard markets.

Choosing Between Surplus Lines and Standard Markets

Choosing between surplus lines and standard markets depends on the risk profile and coverage needs of the insured. Surplus lines insurance offers access to specialized, non-admitted carriers that provide coverage for high-risk or unique exposures often declined by standard markets. Standard markets typically offer admitted carriers with regulated policies and more predictable pricing, suitable for common, lower-risk insurance needs.

Important Terms

Non-Admitted Carriers

Non-admitted carriers provide insurance through surplus lines markets, offering coverage for high-risk or unique exposures that standard markets typically decline. Surplus lines insurers operate without state licensing but must comply with regulatory requirements, enabling flexibility in underwriting compared to the highly regulated, admitted insurers of standard markets.

Admitted Carriers

Admitted carriers are insurance companies authorized and regulated by state insurance departments to operate within a state, offering standard markets with guaranteed consumer protections, while surplus lines carriers operate without state approval, providing coverage for high-risk or unique risks not available in the standard market. Surplus lines markets fill gaps by underwriting non-admitted risks, often with higher premiums and less regulatory oversight compared to admitted carriers.

Excess and Surplus (E&S) Lines

Excess and Surplus (E&S) Lines provide specialized insurance coverage for unique, high-risk, or hard-to-place risks that standard markets often decline due to strict underwriting guidelines or regulatory constraints. E&S markets offer greater flexibility in policy terms and pricing, enabling insurers to tailor solutions for complex or non-admissible risks not covered by standard insurers.

Freedom of Rate and Form

Freedom of Rate and Form allows surplus lines insurers to set their own rates and policy forms without prior state approval, contrasting with standard markets that require regulatory oversight and adherence to filed rates and standardized policies. This regulatory flexibility enables surplus lines markets to provide coverage for high-risk or unusual exposures that standard markets typically exclude.

State Guaranty Fund

The State Guaranty Fund safeguards policyholders by providing a safety net for claims when insurers become insolvent, primarily benefiting Standard Markets as surplus lines insurers are typically excluded from these protections. Surplus Lines carriers, operating outside state-guaranteed funds, offer coverage for high-risk or unique exposures but require insureds to accept increased risk due to the lack of guaranty fund backing.

Surplus Lines Broker

Surplus lines brokers specialize in accessing insurance markets not readily available through standard markets, often covering high-risk or unique risks that standard insurers decline. These brokers navigate non-admitted carriers, enabling clients to obtain customized coverage solutions beyond the scope of the standard market offerings.

Binding Authority

Binding authority enables surplus lines brokers to underwrite and bind coverage directly with non-admitted insurers, offering flexibility in accessing unique or high-risk markets that standard markets may not cover. Standard markets, regulated and admitted, provide more regulated policy forms and rates but lack the underwriting autonomy granted by binding authority in surplus lines transactions.

Risk Eligibility

Risk eligibility in surplus lines markets is designed for insureds with higher-risk profiles or unique exposures that standard markets typically decline or exclude. Surplus lines insurers offer broader underwriting flexibility and customized coverage, addressing risks standard markets cannot accommodate due to strict regulatory and underwriting guidelines.

Hard-to-Place Risks

Hard-to-place risks often require surplus lines insurance due to their unique, high-risk characteristics that standard markets typically avoid. Surplus lines carriers provide specialized coverage options with flexible underwriting criteria, accommodating risks that exceed the limitations of standard market policies.

Regulatory Compliance

Regulatory compliance in surplus lines involves adhering to specific state laws that govern non-admitted insurance carriers, which generally offer coverage unavailable in standard markets due to high risk or unique exposures. Unlike standard markets that follow comprehensive state-mandated solvency and rate filing requirements, surplus lines brokers must navigate surplus lines stamping offices, maintain diligent documentation, and ensure coverage availability without violating surplus lines eligibility criteria.

Surplus Lines vs Standard Markets Infographic

moneydif.com

moneydif.com