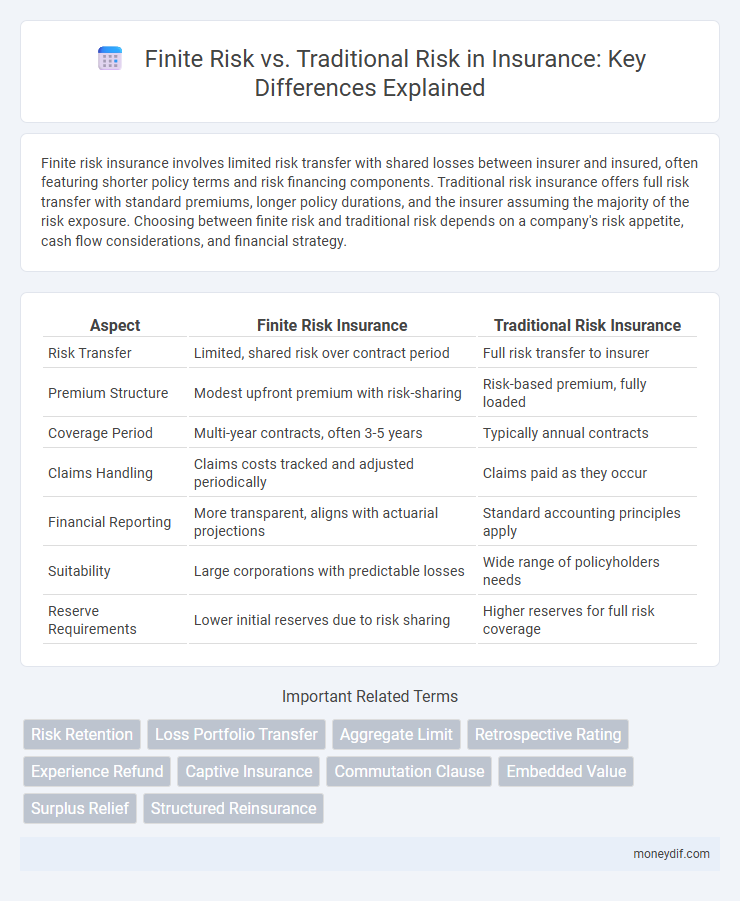

Finite risk insurance involves limited risk transfer with shared losses between insurer and insured, often featuring shorter policy terms and risk financing components. Traditional risk insurance offers full risk transfer with standard premiums, longer policy durations, and the insurer assuming the majority of the risk exposure. Choosing between finite risk and traditional risk depends on a company's risk appetite, cash flow considerations, and financial strategy.

Table of Comparison

| Aspect | Finite Risk Insurance | Traditional Risk Insurance |

|---|---|---|

| Risk Transfer | Limited, shared risk over contract period | Full risk transfer to insurer |

| Premium Structure | Modest upfront premium with risk-sharing | Risk-based premium, fully loaded |

| Coverage Period | Multi-year contracts, often 3-5 years | Typically annual contracts |

| Claims Handling | Claims costs tracked and adjusted periodically | Claims paid as they occur |

| Financial Reporting | More transparent, aligns with actuarial projections | Standard accounting principles apply |

| Suitability | Large corporations with predictable losses | Wide range of policyholders needs |

| Reserve Requirements | Lower initial reserves due to risk sharing | Higher reserves for full risk coverage |

Understanding Finite Risk and Traditional Risk Insurance

Understanding finite risk insurance involves spreading losses over a defined period with a capped insurer liability, balancing risk retention and transfer. Traditional risk insurance relies on transferring full risk exposure to the insurer, offering comprehensive coverage without loss-sharing mechanisms. Companies choosing finite risk benefit from predictable costs and risk modulation, whereas traditional insurance provides broader protection against unpredictable large claims.

Key Features of Finite Risk Insurance

Finite risk insurance combines risk transfer with risk financing, offering limited insurer exposure through multi-year policies and retrospective premium adjustments. It emphasizes capital efficiency, with the insured retaining part of the risk and potential for premium refunds based on loss experience. Key features include loss-sharing mechanisms, lower volatility in underwriting results, and enhanced control over claim management compared to traditional risk insurance models.

Core Elements of Traditional Risk Insurance

Traditional risk insurance involves full risk transfer where the insurer assumes all potential losses in exchange for premium payments. Key elements include risk pooling, premium calculation based on actuarial data, and policy limits designed to cover defined exposures. This model emphasizes indemnification, regulatory oversight, and claims management to maintain financial stability and predictability.

Risk Transfer Mechanisms Compared

Finite risk insurance involves limited risk transfer with shared losses between insurer and insured through structured mechanisms like loss corridors and experience accounts, emphasizing financial predictability. Traditional risk insurance transfers full risk exposure to the insurer, relying on premium payments and indemnity to cover potential losses without sharing or capping risks. These contrasting risk transfer mechanisms affect capital allocation, risk retention, and claim settlement approaches within insurance portfolios.

Financial Structures and Premium Differences

Finite risk insurance involves limited risk transfer with significant risk retention and premium financing spread over time, resulting in lower initial premiums compared to traditional risk insurance. Traditional risk insurance transfers the full risk to the insurer, requiring higher upfront premiums that reflect the insurer's exposure and administrative costs. Financial structures in finite risk policies include investment components and retrospective adjustments, while traditional policies rely on fixed premiums without profit-sharing features.

Advantages of Finite Risk Insurance

Finite risk insurance offers enhanced financial predictability by capping potential losses and spreading risk over time, which improves cash flow management for policyholders. It reduces the insurer's exposure to volatile claims, enabling more stable premium pricing compared to traditional risk insurance. Additionally, finite risk arrangements often include profit-sharing features, aligning the interests of both insurer and insured to encourage loss prevention and efficient risk management.

Benefits of Traditional Risk Approaches

Traditional risk approaches in insurance provide stable and predictable coverage through well-established underwriting practices, reducing financial uncertainty for policyholders. These methods leverage extensive historical data to price risk accurately and ensure regulatory compliance, promoting long-term solvency. The comprehensive nature of traditional risk supports consistent claims management and enhances customer confidence by delivering clear policy terms and robust legal protections.

Limitations and Challenges of Each Model

Finite risk insurance faces limitations such as restricted risk transfer due to predetermined risk-sharing arrangements and potential regulatory complexities impacting its flexibility. Traditional risk insurance encounters challenges including higher premium volatility and less predictability in loss outcomes, which can strain both insurer reserves and policyholder budgeting. Both models demand careful evaluation of financial stability, risk appetite, and long-term coverage goals to optimize risk management strategies.

Ideal Use Cases for Finite Risk vs. Traditional Risk

Finite risk insurance suits companies seeking predictable, limited exposure with long-term premium stability, particularly in managing high-severity, low-frequency risks such as environmental liabilities or product warranties. Traditional risk insurance is ideal for businesses facing frequent, low-severity claims requiring immediate coverage and cash flow protection, commonly used in property, casualty, and liability lines. Organizations with stable risk profiles and capital reserves favor finite risk models, while those needing flexible, short-term risk transfer rely on traditional insurance solutions.

Choosing the Right Risk Solution for Your Business

Finite risk insurance offers businesses a controlled exposure to losses by blending risk transfer with risk retention, minimizing volatility in underwriting results. Traditional risk insurance provides comprehensive coverage with straightforward premiums but may come with higher costs and less flexibility. Evaluating your company's risk tolerance, cash flow stability, and long-term financial goals is essential to selecting the solution that balances protection and cost-efficiency effectively.

Important Terms

Risk Retention

Risk retention strategies differ significantly between finite risk and traditional risk models, with finite risk emphasizing limited loss exposure through predefined reinsurance layers and premium smoothing, whereas traditional risk relies on broad risk transfer and unpredictable loss variability. Finite risk arrangements leverage contractually capped liabilities and loss development periods to enhance capital efficiency and reserving accuracy, contrasting with traditional risk's broader underwriting risk and longer-tail exposure.

Loss Portfolio Transfer

Loss Portfolio Transfer (LPT) involves transferring a portfolio of existing insurance liabilities to a reinsurer, offering a finite risk approach that limits the cedent's exposure to losses through pre-agreed caps and time limits. Unlike traditional risk transfers, which expose the reinsurer to unlimited loss potential, finite risk LPTs blend risk and financing elements, providing predictable outcomes and capital relief.

Aggregate Limit

Aggregate limit defines the maximum total coverage amount an insurance policy will pay for all claims during the policy period, crucial in comparing finite risk and traditional risk structures. Finite risk insurance typically involves lower aggregate limits with emphasis on risk financing and loss control, whereas traditional risk policies generally feature higher aggregate limits reflecting greater insurer risk assumption and claim payment obligations.

Retrospective Rating

Retrospective rating adjusts workers' compensation premiums based on actual loss experience, offering customized financial outcomes compared to traditional risk models that use fixed premiums. Finite risk insurance blends elements of retrospective rating and traditional insurance, providing limited risk transfer with adjustable costs tied to the insured's loss history.

Experience Refund

Experience Refund modifies premium based on actual loss experience, providing financial incentives for insureds to reduce claims, contrasting with Traditional Risk where premiums remain fixed regardless of performance. In Finite Risk insurance, Experience Refund mechanisms align risk retention with loss outcomes, enhancing risk-sharing and cash flow predictability for both parties.

Captive Insurance

Finite risk insurance involves limited risk transfer with predefined risk caps and shared losses, offering controlled financial exposure and retained risk by the insured; traditional risk insurance transfers the majority of risk to the insurer with higher premiums and broader coverage. Captive insurance often utilizes finite risk structures to balance cost-effectiveness and risk control, contrasting with the fully transferred risk profile typical in traditional insurance policies.

Commutation Clause

The Commutation Clause enables the early settlement of finite risk insurance contracts by terminating ongoing liabilities in exchange for a lump sum, contrasting with traditional risk policies where losses are paid as they occur over time. This clause provides financial certainty and improves cash flow management by limiting the insurer's residual exposure inherent in finite risk arrangements.

Embedded Value

Embedded Value (EV) measures the economic worth of an insurance company by combining adjusted net asset value and the present value of future profits from in-force business. Finite Risk reinsurance, characterized by limited risk transfer and more focus on financing, contrasts with Traditional Risk reinsurance which involves full risk transfer, significantly impacting the calculation and stability of Embedded Value.

Surplus Relief

Surplus relief in finite risk arrangements enhances an insurer's surplus without transferring significant risk, contrasting with traditional risk insurance that requires substantial risk transfer to recognize surplus. Finite risk contracts use limited risk components and multi-year loss offsets, optimizing capital efficiency and solvency ratios compared to the higher volatility and capital charges of traditional risk policies.

Structured Reinsurance

Structured reinsurance integrates finite risk elements by capping losses and blending risk transfer with financing, contrasting with traditional risk reinsurance that focuses on full risk assumption and indemnification. This approach enables insurers to manage capital more efficiently and stabilize earnings through customized loss corridors and limited risk exposure.

Finite Risk vs Traditional Risk Infographic

moneydif.com

moneydif.com