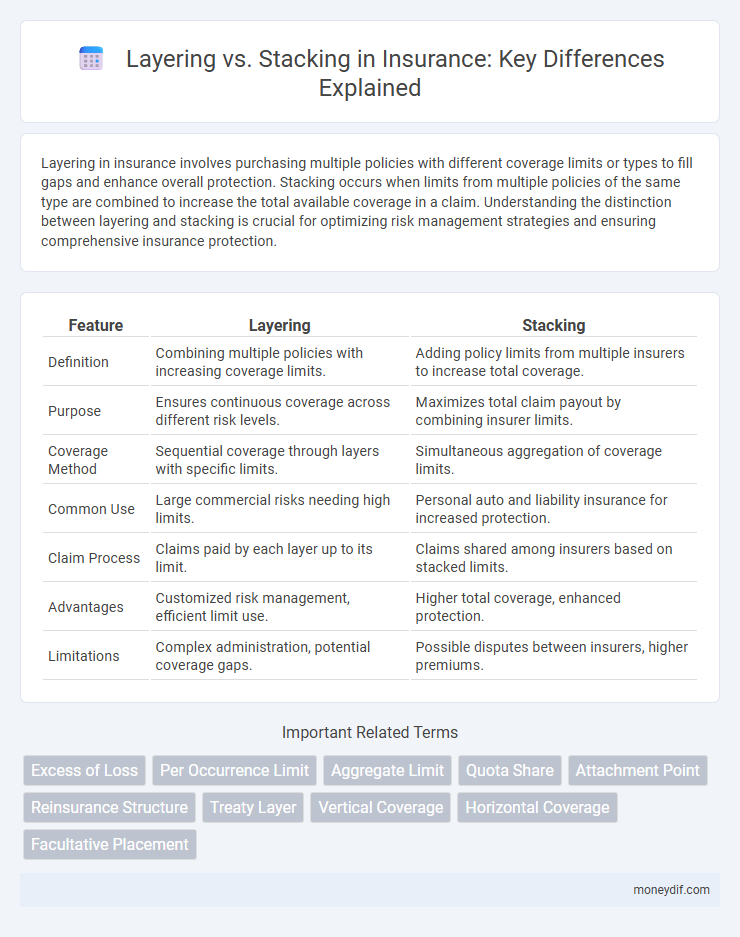

Layering in insurance involves purchasing multiple policies with different coverage limits or types to fill gaps and enhance overall protection. Stacking occurs when limits from multiple policies of the same type are combined to increase the total available coverage in a claim. Understanding the distinction between layering and stacking is crucial for optimizing risk management strategies and ensuring comprehensive insurance protection.

Table of Comparison

| Feature | Layering | Stacking |

|---|---|---|

| Definition | Combining multiple policies with increasing coverage limits. | Adding policy limits from multiple insurers to increase total coverage. |

| Purpose | Ensures continuous coverage across different risk levels. | Maximizes total claim payout by combining insurer limits. |

| Coverage Method | Sequential coverage through layers with specific limits. | Simultaneous aggregation of coverage limits. |

| Common Use | Large commercial risks needing high limits. | Personal auto and liability insurance for increased protection. |

| Claim Process | Claims paid by each layer up to its limit. | Claims shared among insurers based on stacked limits. |

| Advantages | Customized risk management, efficient limit use. | Higher total coverage, enhanced protection. |

| Limitations | Complex administration, potential coverage gaps. | Possible disputes between insurers, higher premiums. |

Understanding Layering in Insurance

Layering in insurance refers to structuring multiple policies to provide different coverage amounts at varying levels of risk, often used to manage large or complex exposures efficiently. This technique allows insurers and policyholders to distribute risk across primary and excess layers, minimizing premium costs while maximizing protection. Understanding layering helps businesses design customized insurance programs that match specific loss tolerance and financial goals.

Defining Stacking in Insurance Policies

Stacking in insurance policies refers to the ability to combine coverage limits from multiple vehicles or policies to increase the total payout for a single claim. This often applies to uninsured or underinsured motorist coverage, where insured individuals can "stack" limits from several vehicles insured under one policy or multiple policies they hold. Stacking increases potential compensation but is subject to state regulations and policy terms, making it essential to review specific policy language thoroughly.

Key Differences Between Layering and Stacking

Layering in insurance refers to purchasing multiple policies with different coverage limits to create a cumulative protection amount, while stacking involves combining coverage limits from multiple policies that apply to the same risk. Layering typically spreads risk across several insurers and increases overall coverage without overlapping, whereas stacking allows a policyholder to claim full benefits from each policy, potentially leading to higher total payouts. Understanding these differences is crucial for optimizing insurance protection and managing premium costs effectively.

Benefits of Layering Insurance Coverage

Layering insurance coverage enables policyholders to tailor protection by combining multiple policies with varying limits to address specific risks comprehensively. This strategy maximizes coverage efficiency and reduces gaps, ensuring higher total indemnity during claims. Layering also provides flexibility in managing premiums and risk exposure, optimizing financial outcomes for both individuals and businesses.

Advantages of Stacking Insurance Limits

Stacking insurance limits allows policyholders to combine coverage amounts from multiple policies or vehicles, significantly increasing the total available protection in the event of a claim. This approach enhances financial security by providing higher payout limits, which can be crucial for covering extensive damages or medical expenses. Stacking also maximizes the value of premiums paid, offering broader coverage without purchasing a single, higher-limit policy.

Common Scenarios for Layering vs Stacking

Layering in insurance occurs when multiple policies provide coverage for different portions of a risk, such as combining primary and excess liability policies to increase protection limits. Stacking arises when coverage limits from multiple policies, often belonging to the same insured or vehicle under auto insurance, are combined to enhance the total amount available for a claim. Common layering scenarios include commercial general liability with umbrella policies, while stacking typically appears in personal auto insurance where insured parties have multiple vehicles or policies.

Layering vs Stacking: Cost Implications

Layering insurance involves purchasing multiple policies with distinct coverage limits, often resulting in higher premiums due to overlapping protections and administrative fees. Stacking combines coverage limits from multiple policies or endorsements for the same risk, which can lead to increased payout amounts but also escalates overall costs through cumulative premium charges. Understanding the cost implications of layering versus stacking is essential for optimizing insurance spending and avoiding unnecessary financial burdens.

Risk Management Strategies: Layering and Stacking

Layering and stacking are crucial risk management strategies in insurance that involve organizing coverage limits across multiple policies. Layering distributes risk by purchasing insurance in layers, each providing a specific coverage amount that collectively builds up the total limit, effectively managing large exposures without overpaying for high limits on a single policy. Stacking combines coverage limits from multiple policies or insured entities, increasing the available protection in claim scenarios, often used in auto or liability insurance to maximize claim payouts.

Legal Considerations in Layering and Stacking

Legal considerations in layering versus stacking within insurance involve understanding state-specific regulations on policy limits and claim aggregation. Layering refers to purchasing insurance policies consecutively with different coverage limits, while stacking involves combining multiple policy limits to increase total coverage available for a claim. Courts often scrutinize stacking legality based on jurisdiction, policy language, and whether the insured's multiple vehicles or policies qualify for aggregated benefits under state law.

Choosing the Right Approach: Layering or Stacking

Choosing the right approach between layering and stacking in insurance depends on policy limits and claim scenarios. Layering involves spreading coverage across multiple policies with different limits to minimize risk exposure, while stacking aggregates limits from multiple policies to increase total coverage available for a claim. Evaluating the extent of coverage needed, state laws, and potential claim amounts helps determine whether layering or stacking best optimizes insurance protection.

Important Terms

Excess of Loss

Excess of Loss reinsurance involves indemnifying losses exceeding a specified retention limit, with layering referring to multiple reinsurance contracts applied sequentially over increasing layers of risk attachment points. Stacking combines coverage limits from multiple policies or layers to provide aggregate protection, enhancing overall risk mitigation by cumulatively absorbing losses across layers.

Per Occurrence Limit

Per Occurrence Limit defines the maximum payable amount for each individual claim in an insurance policy, crucial in evaluating risk exposure in Layering vs Stacking strategies. Layering spreads coverage across multiple policies with separate limits per occurrence, while Stacking combines limits from multiple policies to increase overall coverage for a single claim.

Aggregate Limit

Aggregate limit defines the maximum total coverage available under an insurance policy during a specific period, impacting how layered and stacked policies function. Layering involves purchasing multiple policies with distinct limits to cover higher exposures, while stacking combines coverage limits from policies of similar type or from multiple insured sources, both strategies relying on understanding aggregate limits to avoid coverage gaps or overlaps.

Quota Share

Quota Share reinsurance involves ceding a fixed percentage of premiums and losses to a reinsurer, optimizing risk distribution across a portfolio. Layering refers to segmenting coverage by loss severity within the same layer, while stacking involves multiple quota share agreements applied sequentially, enhancing risk diversification through both horizontal and vertical distribution.

Attachment Point

The attachment point in layering refers to the specific location where each clothing piece connects, ensuring a seamless and comfortable fit, while stacking focuses on the visible accumulation of fabric folds or layers at areas like sleeves or pant legs to create a textured aesthetic. Effective layering optimizes thermal regulation and mobility by strategically aligning attachment points, whereas stacking emphasizes visual depth and dimension through fabric overlap.

Reinsurance Structure

Layering in reinsurance involves dividing coverage into distinct layers, each absorbing losses up to a specified limit, optimizing risk transfer and capital efficiency. Stacking refers to combining multiple reinsurance contracts on top of each other, increasing aggregate coverage but potentially complicating loss allocation and claims management.

Treaty Layer

The Treaty Layer model in blockchain architecture emphasizes modular design where distinct protocol layers handle specific functions, improving scalability and security compared to traditional layering approaches. Unlike simple stacking, which vertically integrates components, Treaty Layer enables adaptive interoperability and protocol composability across diverse blockchain networks.

Vertical Coverage

Vertical coverage in networking refers to the extent of signal transmission across different elevation layers, where layering involves organizing network functions into discrete protocol layers to enhance modularity and functionality, while stacking combines multiple network devices or components vertically to increase capacity and redundancy within the same operational layer. Optimizing vertical coverage by balancing layering and stacking improves network scalability, performance, and reliability in complex communication environments.

Horizontal Coverage

Horizontal coverage in wireless networks is enhanced by layering techniques that create multiple coverage zones, while stacking focuses on integrating different frequency bands vertically to improve signal penetration and capacity. Effective use of layering increases service area by overlaying cells, whereas stacking optimizes spectrum utilization by combining diverse technologies within the same geographic layer.

Facultative Placement

Facultative placement in reinsurance involves selecting specific risks to cede, which contrasts with layering that divides risk into horizontal slices by retention levels, while stacking aggregates multiple layers vertically across different policies. This strategic approach optimizes risk distribution by balancing the depth (stacking) and breadth (layering) of coverage to enhance reinsurance capacity and limit exposure.

Layering vs Stacking Infographic

moneydif.com

moneydif.com