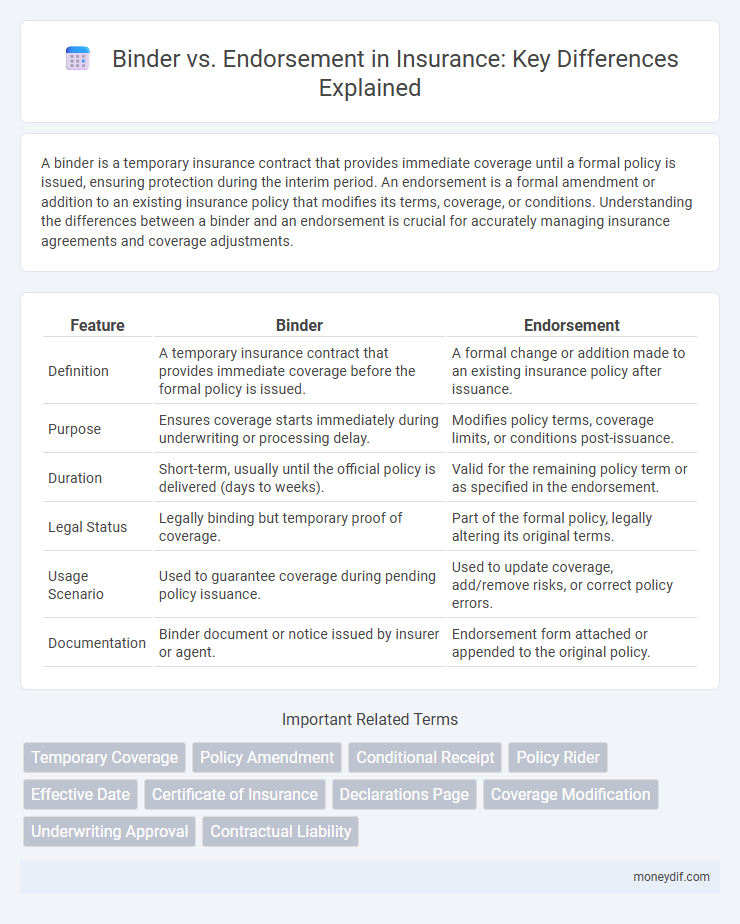

A binder is a temporary insurance contract that provides immediate coverage until a formal policy is issued, ensuring protection during the interim period. An endorsement is a formal amendment or addition to an existing insurance policy that modifies its terms, coverage, or conditions. Understanding the differences between a binder and an endorsement is crucial for accurately managing insurance agreements and coverage adjustments.

Table of Comparison

| Feature | Binder | Endorsement |

|---|---|---|

| Definition | A temporary insurance contract that provides immediate coverage before the formal policy is issued. | A formal change or addition made to an existing insurance policy after issuance. |

| Purpose | Ensures coverage starts immediately during underwriting or processing delay. | Modifies policy terms, coverage limits, or conditions post-issuance. |

| Duration | Short-term, usually until the official policy is delivered (days to weeks). | Valid for the remaining policy term or as specified in the endorsement. |

| Legal Status | Legally binding but temporary proof of coverage. | Part of the formal policy, legally altering its original terms. |

| Usage Scenario | Used to guarantee coverage during pending policy issuance. | Used to update coverage, add/remove risks, or correct policy errors. |

| Documentation | Binder document or notice issued by insurer or agent. | Endorsement form attached or appended to the original policy. |

Binder vs Endorsement: Key Differences Explained

A binder is a temporary insurance contract that provides immediate coverage before the formal policy is issued, while an endorsement is a modification or addition to an existing insurance policy that changes its terms, coverage, or conditions. Binders offer short-term protection typically lasting 30 to 90 days, enabling insureds to avoid any coverage gaps, whereas endorsements permanently alter the original policy and take effect once officially documented. Understanding these key differences is crucial for ensuring continuous coverage and accurately reflecting policy adjustments in insurance agreements.

What is an Insurance Binder?

An insurance binder is a temporary contract that provides proof of coverage until the formal insurance policy is issued, ensuring immediate protection for the insured. It specifies the key terms, coverage limits, and conditions agreed upon between the insurer and policyholder. Unlike endorsements, which modify existing policies, binders establish initial insurance coverage during the policy underwriting process.

Understanding Insurance Endorsements

Insurance endorsements modify the terms, coverage, or conditions of an existing insurance policy without creating a new contract, allowing tailored adjustments to suit specific needs. Unlike a binder, which is a temporary agreement providing proof of coverage before the formal policy is issued, endorsements become part of the permanent policy documentation. Common endorsements include adding or removing coverage, adjusting policy limits, or changing insured parties, enhancing policy flexibility and accuracy.

Purpose and Function of Binders in Insurance

Binders in insurance serve as temporary contracts providing immediate proof of coverage before a formal policy is issued, ensuring protection during the underwriting process. They specify key terms such as coverage limits, insured property, and duration, functioning as legally binding agreements to mitigate risk exposure. Unlike endorsements, which modify existing policies, binders establish initial coverage, facilitating timely risk management and client assurance.

How Endorsements Modify Insurance Policies

Endorsements modify insurance policies by altering coverage terms, limits, or conditions after the original policy is issued, providing tailored protection to meet changing insured needs. These amendments become integral parts of the policy, superseding or expanding existing provisions without issuing a new contract. Unlike binders, which offer temporary coverage before policy issuance, endorsements adjust the finalized policy's scope and details during its active period.

Temporary Coverage: The Role of a Binder

A binder provides temporary insurance coverage that activates immediately upon issuance, ensuring protection until the formal policy is finalized. Unlike an endorsement, which modifies an existing insurance policy, a binder serves as a standalone agreement that guarantees coverage in the interim. This temporary document is critical in risk management by bridging the gap between application approval and official policy issuance.

Types of Insurance Endorsements

Insurance endorsements modify the original policy by altering coverage terms, adding or excluding risks, or changing limits. Common types of insurance endorsements include endorsements for additional insured parties, coverage extensions such as flood or earthquake insurance, and policy limit increases. These endorsements ensure tailored protection by addressing specific client needs beyond the standard binder or initial agreement.

Legal Implications: Binder vs Endorsement

A binder serves as a temporary insurance contract providing immediate coverage before the official policy is issued, creating binding legal obligations for both insurer and insured. In contrast, an endorsement modifies or amends an existing insurance policy, altering terms, coverage limits, or conditions without initiating a new contract. Legal implications of binders involve enforceability of coverage during the interim period, while endorsements legally adjust the scope of coverage within the original policy framework.

When to Use a Binder vs an Endorsement

Use a binder when immediate proof of insurance coverage is required before the formal policy is issued, especially during policy negotiations or underwriting delays. An endorsement is applied after a policy is in effect to modify, add, or remove coverage terms, such as adjusting limits, adding insured parties, or covering new risks. Choosing between a binder and an endorsement depends on timing needs and whether temporary or permanent policy changes are necessary.

Binder and Endorsement in Claims Processing

A binder serves as a temporary insurance contract that provides immediate proof of coverage until a formal policy is issued, playing a crucial role in claims processing by ensuring claimants have verified protection during the interim. An endorsement modifies the terms, coverage, or conditions of an existing insurance policy, directly affecting claims handling by clarifying or altering the insurer's obligations after the policy has been issued. Understanding the distinctions between binders and endorsements is essential for accurately managing claim approvals, coverage limits, and policy adjustments.

Important Terms

Temporary Coverage

Temporary coverage provides immediate insurance protection before the formal policy is issued, often documented through a binder that outlines specific terms and duration. Unlike endorsements that modify or add provisions to an existing policy, binders act as standalone temporary contracts ensuring coverage until the official policy takes effect.

Policy Amendment

A policy amendment modifies specific terms or conditions of an existing insurance contract, whereas a binder serves as temporary proof of coverage until the formal policy is issued. Endorsements, unlike binders, are formal written documents that officially alter the original policy by adding, deleting, or changing coverage details.

Conditional Receipt

A Conditional Receipt provides temporary coverage starting from the date of application, contingent upon underwriting approval, distinguishing it from a Binder, which offers immediate but temporary insurance protection until a formal policy is issued. Unlike an Endorsement, which modifies the terms of an existing insurance policy, a Conditional Receipt governs the initial application phase and is effective only if specific conditions, such as medical exams or premium payment, are met.

Policy Rider

A policy rider is a specific add-on to an insurance policy that modifies its coverage by adding, excluding, or limiting benefits. Unlike a binder, which is a temporary agreement providing immediate coverage before the policy is finalized, an endorsement is a formal written amendment to an existing policy, making the rider a type of endorsement used to tailor the insurance contract to the insured's needs.

Effective Date

The effective date in a binder establishes immediate temporary coverage, protecting the insured until a formal policy endorsement is issued, which then provides permanent modifications or additions to the contract. Binders act as short-term proof of insurance, whereas endorsements officially amend the policy terms from the specified effective date forward.

Certificate of Insurance

A Certificate of Insurance provides proof of insurance coverage but does not alter policy terms; a binder is a temporary, binding agreement offering immediate coverage until a formal policy is issued, while an endorsement is a formal amendment to an existing insurance policy that modifies coverage or terms. Understanding the distinctions among these documents is essential for accurately managing risk and ensuring valid coverage in insurance transactions.

Declarations Page

The Declarations Page outlines critical insurance policy details such as coverage limits, insured parties, and premium amounts, serving as a foundational document for both binders and endorsements. While a binder acts as a temporary agreement providing immediate coverage before the formal policy is issued, an endorsement modifies specific terms or coverage within an existing policy and is documented through updates to the Declarations Page.

Coverage Modification

Coverage modification through an insurance binder provides temporary proof of coverage with specific terms effective immediately, while an endorsement permanently alters the terms, conditions, or coverage of an existing insurance policy. Binders grant provisional protection prior to policy issuance, whereas endorsements officially amend the policy documentation and coverage details after issuance.

Underwriting Approval

Underwriting approval ensures risk assessment aligns with insurer guidelines before issuing a binder, which provides temporary coverage pending policy issuance, while an endorsement modifies existing policy terms post-approval without altering initial risk acceptance. Distinguishing between binders and endorsements is critical for maintaining regulatory compliance and accurately managing coverage scope during policy lifecycle.

Contractual Liability

Contractual liability distinguishes between binders and endorsements in insurance agreements, where binders provide temporary coverage pending policy issuance, creating immediate contractual obligations, while endorsements modify or add specific terms to an existing policy, altering the contract's scope or conditions. Understanding this distinction is crucial for accurately managing risk exposure and ensuring compliance with contractual obligations in insurance practices.

Binder vs Endorsement Infographic

moneydif.com

moneydif.com