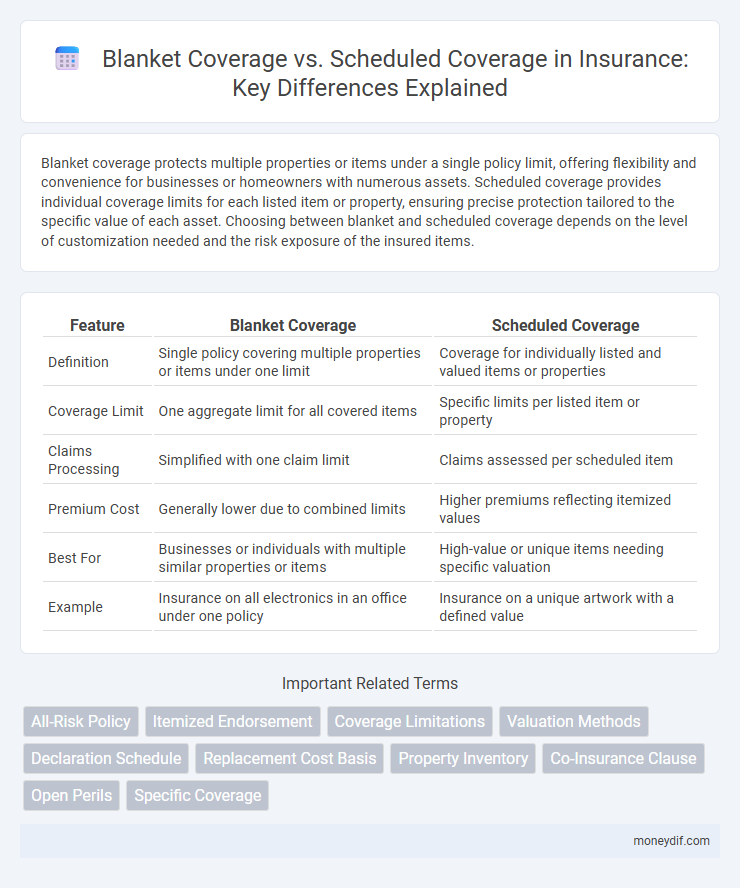

Blanket coverage protects multiple properties or items under a single policy limit, offering flexibility and convenience for businesses or homeowners with numerous assets. Scheduled coverage provides individual coverage limits for each listed item or property, ensuring precise protection tailored to the specific value of each asset. Choosing between blanket and scheduled coverage depends on the level of customization needed and the risk exposure of the insured items.

Table of Comparison

| Feature | Blanket Coverage | Scheduled Coverage |

|---|---|---|

| Definition | Single policy covering multiple properties or items under one limit | Coverage for individually listed and valued items or properties |

| Coverage Limit | One aggregate limit for all covered items | Specific limits per listed item or property |

| Claims Processing | Simplified with one claim limit | Claims assessed per scheduled item |

| Premium Cost | Generally lower due to combined limits | Higher premiums reflecting itemized values |

| Best For | Businesses or individuals with multiple similar properties or items | High-value or unique items needing specific valuation |

| Example | Insurance on all electronics in an office under one policy | Insurance on a unique artwork with a defined value |

Understanding Blanket Coverage in Insurance

Blanket coverage in insurance provides a single limit of protection that applies to multiple properties or items under one policy, eliminating the need to list each asset separately. This type of coverage is ideal for businesses or homeowners with numerous assets, as it offers flexibility and simplifies claims when damage occurs to several items simultaneously. Blanket coverage enhances protection by covering all insured property up to the specified limit, regardless of individual item values or locations.

What is Scheduled Coverage?

Scheduled coverage provides insurance protection for specific high-value items listed individually on a policy, such as jewelry, artwork, or electronics. Each item is appraised and assigned a separate coverage limit, ensuring tailored compensation in case of loss, theft, or damage. This type of coverage is ideal for valuable assets that exceed standard policy limits under blanket coverage.

Key Differences Between Blanket and Scheduled Coverage

Blanket coverage insures multiple properties or items under a single policy limit, offering flexibility without specifying individual values, while scheduled coverage lists each insured item separately with its own coverage amount. Blanket coverage simplifies claims for property portfolios or businesses with frequently changing assets, whereas scheduled coverage provides precise protection and higher compensation for unique or high-value items. Choosing between the two depends on asset types, valuation accuracy, and the need for tailored risk management within insurance policies.

Pros and Cons of Blanket Coverage

Blanket coverage offers the advantage of protecting multiple properties or items under a single policy limit, simplifying claims and often reducing premium costs. However, it may lead to insufficient coverage for high-value assets since the total limit is shared across all items, increasing the risk of underinsurance. This type of coverage suits businesses with numerous lower-value assets but may not be ideal when detailed item valuation and protection are required.

Advantages and Disadvantages of Scheduled Coverage

Scheduled coverage offers precise protection by itemizing specific insured property with predetermined values, ensuring accurate claim settlements and comprehensive replacement cost coverage. This approach minimizes disputes over valuation and can provide higher coverage limits for valuable items compared to blanket coverage. However, scheduled coverage requires regular item appraisal and updating, leading to higher administrative effort and potential gaps if items are added without prompt scheduling.

When to Choose Blanket Coverage

Blanket coverage is ideal for businesses or individuals with multiple, frequently changing assets because it automatically covers all items under one policy limit without itemizing each. This type of insurance reduces the risk of coverage gaps when adding new items or experiencing shifting inventory values. Choosing blanket coverage is beneficial when simplicity, flexibility, and comprehensive protection for a diverse range of properties are priorities.

When is Scheduled Coverage the Better Option?

Scheduled coverage is the better option when insuring high-value or unique items such as jewelry, fine art, or collectibles, as it provides precise protection with specified limits for each item. It eliminates coverage gaps and allows for replacement cost reimbursement, ensuring full value recovery in case of loss or damage. This type of coverage is essential for policyholders needing tailored protection beyond the limits of blanket coverage.

Cost Comparison: Blanket vs Scheduled Coverage

Blanket coverage typically offers a single premium that insures multiple properties or items under one policy, often resulting in lower overall costs due to consolidated risk management. Scheduled coverage requires individual premiums for each insured item, which can lead to higher expenses but provides precise coverage limits tailored to each asset's value. Evaluating the cost-effectiveness depends on the number, value, and risk profile of insured items, with blanket policies favoring broader protection at a generally reduced price point.

Common Scenarios for Each Coverage Type

Blanket coverage is ideal for businesses with multiple properties or fluctuating inventory values, as it provides a single limit for all items, covering losses without itemizing each asset. Scheduled coverage suits entities with high-value items requiring specific valuations, such as fine art collectors or commercial tenants insuring expensive equipment individually. Common scenarios for blanket coverage include retail stores and restaurants, while scheduled coverage is typically used by contractors and specialized retailers.

How to Decide: Blanket Coverage or Scheduled Coverage?

Choosing between blanket coverage and scheduled coverage depends on the value and types of insured items; blanket coverage provides a single limit for multiple properties under one policy, ideal for businesses with many low-value items. Scheduled coverage assigns specific coverage limits for individually listed items, offering precise protection for high-value or unique assets. Evaluate the total asset value, risk exposure, and ease of claims management to determine the most cost-effective and comprehensive option.

Important Terms

All-Risk Policy

An All-Risk Policy provides comprehensive protection by covering all perils except those explicitly excluded, with Blanket Coverage insuring multiple properties or items under a single limit while Scheduled Coverage itemizes individual assets with specified limits for each.

Itemized Endorsement

Itemized Endorsements specify individual property coverage within a policy, contrasting with Blanket Coverage that provides a single limit for multiple items, while Scheduled Coverage lists and values each item separately for precise protection.

Coverage Limitations

Blanket coverage provides comprehensive protection for multiple items under a single limit, while scheduled coverage specifies individual coverage limits for each insured item, reducing gaps but potentially increasing premium costs.

Valuation Methods

Scheduled coverage provides itemized insured values for specific assets, offering precise valuation and tailored protection, whereas blanket coverage combines multiple assets under a single limit, simplifying coverage but potentially risking undervaluation or overextension.

Declaration Schedule

Declaration schedules clearly list covered items with scheduled coverage providing specific insured values for high-value assets, while blanket coverage offers a total coverage limit across multiple items without itemizing individual values.

Replacement Cost Basis

Replacement cost basis determines the reimbursement value for insured property under blanket coverage, which provides a single limit for multiple items, versus scheduled coverage, which allocates specific limits to individually listed items.

Property Inventory

Blanket coverage protects all property items under one total limit, while scheduled coverage assigns specific limits to individual items for more precise valuation and claims.

Co-Insurance Clause

The Co-Insurance Clause requires insured parties to maintain a specified percentage of coverage value, making Blanket Coverage preferable over Scheduled Coverage for comprehensive protection across multiple properties or assets.

Open Perils

Open Perils coverage offers blanket protection for multiple property types under a single policy, while scheduled coverage specifies individual items with separate coverage limits and terms.

Specific Coverage

Specific coverage insures individual items or properties listed in a schedule, providing protection for each item's unique value and risk, whereas blanket coverage offers a single limit that covers multiple items or properties collectively, simplifying claims but potentially limiting detailed valuation. In insurance policies, choosing between blanket coverage and scheduled coverage depends on the insured's need for flexibility, detailed protection, and coverage limits for valuable assets.

Blanket Coverage vs Scheduled Coverage Infographic

moneydif.com

moneydif.com