Facultative reinsurance provides coverage for individual risks, allowing insurers to cede specific policies to reinsurers on a case-by-case basis. Treaty reinsurance involves a contractual agreement where the reinsurer automatically accepts a defined portfolio of risks, streamlining risk management and ensuring broader coverage. Understanding the distinct mechanisms and applications of facultative versus treaty reinsurance is crucial for optimizing risk transfer strategies and maintaining financial stability.

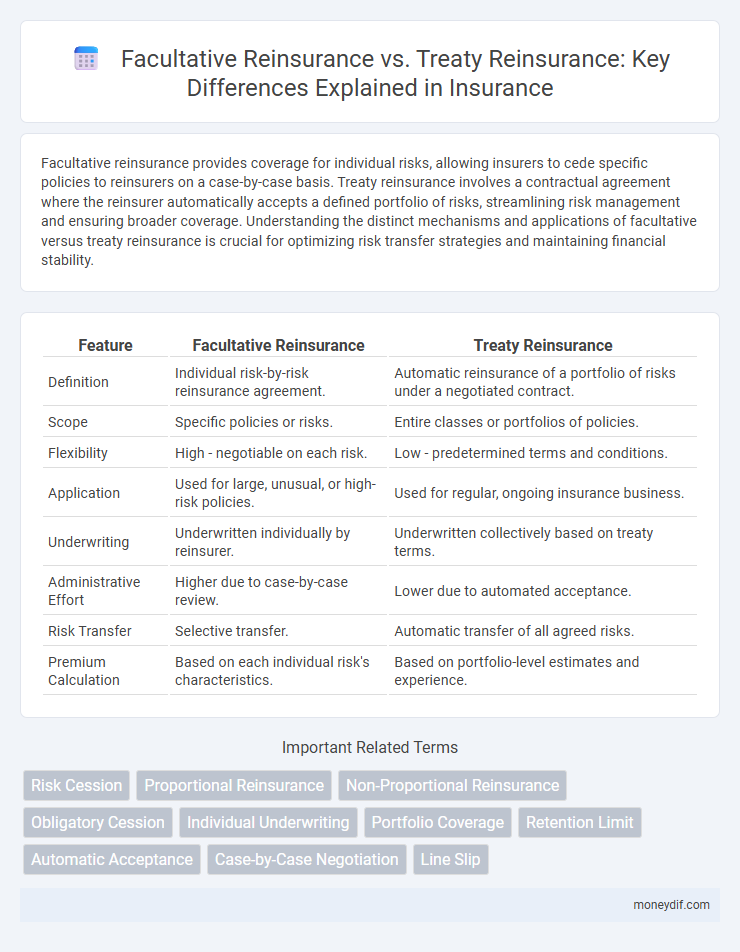

Table of Comparison

| Feature | Facultative Reinsurance | Treaty Reinsurance |

|---|---|---|

| Definition | Individual risk-by-risk reinsurance agreement. | Automatic reinsurance of a portfolio of risks under a negotiated contract. |

| Scope | Specific policies or risks. | Entire classes or portfolios of policies. |

| Flexibility | High - negotiable on each risk. | Low - predetermined terms and conditions. |

| Application | Used for large, unusual, or high-risk policies. | Used for regular, ongoing insurance business. |

| Underwriting | Underwritten individually by reinsurer. | Underwritten collectively based on treaty terms. |

| Administrative Effort | Higher due to case-by-case review. | Lower due to automated acceptance. |

| Risk Transfer | Selective transfer. | Automatic transfer of all agreed risks. |

| Premium Calculation | Based on each individual risk's characteristics. | Based on portfolio-level estimates and experience. |

Introduction to Facultative and Treaty Reinsurance

Facultative reinsurance involves the ceding insurer transferring risk on a case-by-case basis for individual policies, allowing tailored coverage and more precise risk management. Treaty reinsurance, by contrast, covers a portfolio of policies under a standing agreement, providing continuous risk transfer and simplifying the administration process. Both methods enable insurers to increase underwriting capacity and stabilize loss experience but differ in flexibility and scope of risk coverage.

Key Differences Between Facultative and Treaty Reinsurance

Facultative reinsurance involves the ceding insurer transferring risk on an individual policy basis, allowing selective acceptance or rejection by the reinsurer, whereas treaty reinsurance covers a portfolio of policies under a pre-agreed contract, providing automatic coverage. Facultative reinsurance offers flexibility and detailed risk assessment but requires more administrative effort, while treaty reinsurance ensures broad, continuous protection and simplifies the underwriting process. The choice between facultative and treaty reinsurance depends on risk size, portfolio diversification, and the insurer's appetite for risk sharing and operational complexity.

How Facultative Reinsurance Works

Facultative reinsurance works by allowing the primary insurer to cede risk on an individual policy or risk basis, with each risk evaluated and negotiated separately between the insurer and reinsurer. This type of reinsurance provides tailored coverage for specific risks that fall outside the scope of treaty agreements, offering flexibility and risk management for unique or high-value policies. The reinsurer has the right to accept or reject each risk, ensuring selective underwriting and customized risk sharing.

How Treaty Reinsurance Works

Treaty reinsurance involves a contract where the insurer automatically cedes a defined portion of risks to the reinsurer, covering an entire portfolio or class of policies without individual underwriting. This method ensures continuous risk-sharing and financial stability by spreading potential claims across broader entities, often based on proportional or non-proportional arrangements. The reinsurer assumes liability for losses as stipulated, facilitating efficient risk management and capital optimization within the primary insurance company.

Advantages of Facultative Reinsurance

Facultative reinsurance offers precise risk selection, allowing insurers to cede specific individual risks that fall outside the scope of treaty agreements. This flexibility enhances risk management by providing tailored coverage for unique or high-value policies, improving portfolio quality. Insurers benefit from increased underwriting control and the ability to negotiate terms directly with reinsurers, optimizing financial stability.

Advantages of Treaty Reinsurance

Treaty reinsurance offers insurers broad risk coverage by automatically ceding a portfolio of policies, enhancing risk management efficiency and financial stability. It provides consistent loss protection, reducing underwriting volatility and administrative costs compared to facultative reinsurance, which requires individual approval for each risk. Insurers benefit from strengthened capital reserves and improved solvency through the predictable capacity that treaty reinsurance agreements guarantee.

Disadvantages of Facultative Reinsurance

Facultative reinsurance involves case-by-case underwriting, leading to higher administrative costs and slower coverage decisions compared to treaty reinsurance. Its selective nature can result in coverage gaps and inconsistent risk sharing, increasing exposure for the ceding insurer. The lack of automatic acceptance may also cause delays during high-volume periods, limiting efficiency and responsiveness.

Disadvantages of Treaty Reinsurance

Treaty reinsurance limits flexibility by binding the ceding insurer to predetermined terms and coverage, often leading to less tailored risk management compared to facultative reinsurance. It may result in overpayment for coverage on low-risk policies while underinsuring high-risk exposures, reducing overall cost-efficiency. The automatic nature of treaty agreements can hinder the insurer's ability to decline specific risks, potentially increasing exposure to unfavorable claims.

Choosing Between Facultative and Treaty Reinsurance

Choosing between facultative reinsurance and treaty reinsurance depends on the insurer's risk exposure and portfolio size. Facultative reinsurance is suitable for high-value or unusual risks requiring individual assessment, while treaty reinsurance covers a block of policies automatically under agreed terms. Optimal selection balances cost, coverage flexibility, and risk management efficiency.

Impact on Risk Management and Underwriting

Facultative reinsurance offers tailored risk management by allowing insurers to cede individual risks selectively, enhancing underwriting precision and control over exposure. Treaty reinsurance provides automatic coverage for a portfolio of policies, streamlining risk distribution and supporting consistent underwriting practices across large blocks of business. Effective utilization of facultative and treaty reinsurance balances risk retention and transfer, optimizing the insurer's capital efficiency and underwriting profitability.

Important Terms

Risk Cession

Risk cession varies between facultative reinsurance, which covers individual risks case-by-case, and treaty reinsurance, which automatically covers a portfolio of risks under a pre-agreed contract.

Proportional Reinsurance

Proportional Reinsurance involves sharing premiums and losses between insurer and reinsurer based on agreed percentages, with Facultative Reinsurance covering individual risks selectively and Treaty Reinsurance providing automatic coverage for a portfolio of policies.

Non-Proportional Reinsurance

Non-Proportional Reinsurance involves coverage where the reinsurer pays losses exceeding a specified retention, commonly used in Facultative Reinsurance for individual risks while Treaty Reinsurance applies it to a portfolio of risks under a pre-agreed contract.

Obligatory Cession

Obligatory cession requires the cedent to automatically cede specified risks to the reinsurer under treaty reinsurance, whereas facultative reinsurance allows the cedent to selectively cede individual risks without obligation.

Individual Underwriting

Individual underwriting in facultative reinsurance involves case-by-case risk assessment and acceptance, contrasting with treaty reinsurance where bulk risks are automatically covered based on pre-agreed terms without individual evaluation.

Portfolio Coverage

Portfolio coverage in Facultative Reinsurance targets individual risks selectively, whereas Treaty Reinsurance automatically covers entire portfolios of policies within agreed terms.

Retention Limit

Retention limit in facultative reinsurance defines the maximum risk a ceding insurer retains per individual policy, whereas in treaty reinsurance, it applies to aggregated risk limits under a predefined agreement covering multiple policies.

Automatic Acceptance

Automatic acceptance in treaty reinsurance ensures continuous coverage for predefined risks without individual approvals, contrasting with facultative reinsurance where each risk requires separate underwriting consent.

Case-by-Case Negotiation

Case-by-case negotiation in facultative reinsurance allows customized risk assessment for individual policies, contrasting with treaty reinsurance's pre-agreed terms covering a portfolio of risks.

Line Slip

Line slip streamlines facultative reinsurance by allowing underwriters to automatically accept risks within predefined limits under a broader treaty reinsurance agreement.

Facultative Reinsurance vs Treaty Reinsurance Infographic

moneydif.com

moneydif.com