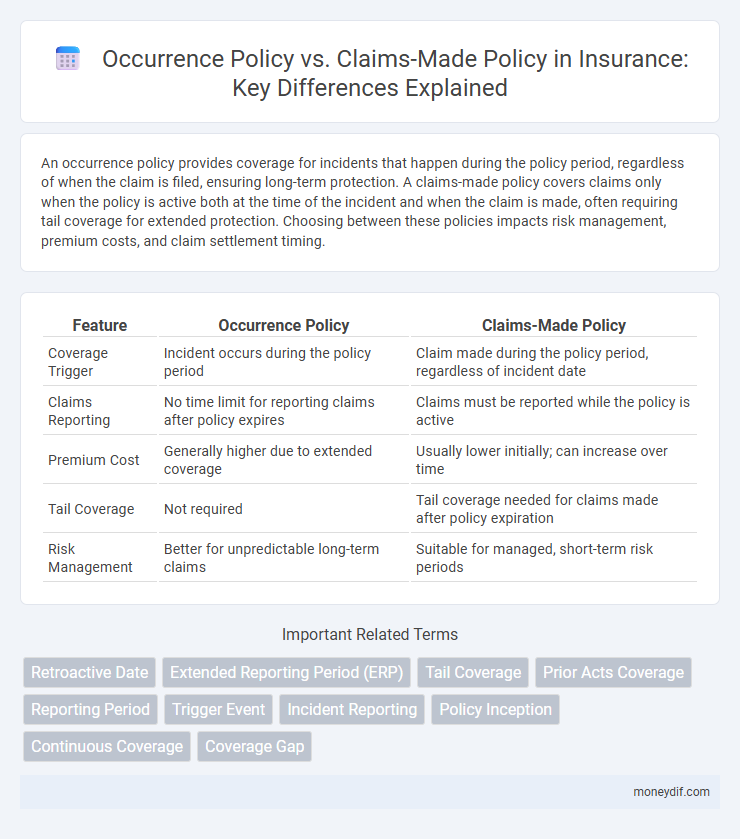

An occurrence policy provides coverage for incidents that happen during the policy period, regardless of when the claim is filed, ensuring long-term protection. A claims-made policy covers claims only when the policy is active both at the time of the incident and when the claim is made, often requiring tail coverage for extended protection. Choosing between these policies impacts risk management, premium costs, and claim settlement timing.

Table of Comparison

| Feature | Occurrence Policy | Claims-Made Policy |

|---|---|---|

| Coverage Trigger | Incident occurs during the policy period | Claim made during the policy period, regardless of incident date |

| Claims Reporting | No time limit for reporting claims after policy expires | Claims must be reported while the policy is active |

| Premium Cost | Generally higher due to extended coverage | Usually lower initially; can increase over time |

| Tail Coverage | Not required | Tail coverage needed for claims made after policy expiration |

| Risk Management | Better for unpredictable long-term claims | Suitable for managed, short-term risk periods |

Introduction to Occurrence and Claims-Made Policies

Occurrence policies provide coverage for incidents that occur during the policy period, regardless of when the claim is filed, ensuring protection even if the claim arises years later. Claims-made policies cover claims only if both the incident and the claim occur while the policy is active, requiring continuous renewal for ongoing protection. Understanding these core differences helps businesses select appropriate liability coverage based on risk exposure and reporting timelines.

Key Differences Between Occurrence and Claims-Made Coverage

Occurrence policies provide coverage for incidents that happen during the policy period, regardless of when the claim is reported, ensuring long-term protection. Claims-made policies cover claims only if both the incident and claim reporting occur within the active policy period, making tail coverage or prior acts coverage essential. The choice between occurrence and claims-made policies impacts risk management strategies, premium costs, and the scope of coverage for insured events.

How Occurrence Policies Work

Occurrence policies provide coverage for incidents that happen during the policy period, regardless of when the claim is filed. They protect insured parties against claims arising from events that occurred while the policy was active, even if the claim is reported years later. This type of policy offers long-term protection, eliminating gaps in coverage related to late-reported claims.

How Claims-Made Policies Work

Claims-made policies provide coverage for claims reported during the policy period, regardless of when the incident occurred, emphasizing the importance of timely claim reporting. These policies often require an extended reporting period or tail coverage to protect against claims filed after the policy expires. Insurers typically set premiums based on the insured's claim history and risk profile during the policy term, making it critical to maintain continuous coverage to avoid gaps in protection.

Advantages of Occurrence Policies

Occurrence policies offer comprehensive coverage by protecting insured parties against claims arising from incidents that occur during the policy period, regardless of when the claim is filed. They provide long-term security and reduce the risk of coverage gaps compared to claims-made policies, especially for professionals facing latent liability exposure. This type of policy simplifies risk management by eliminating the need for extended reporting periods or tail coverage extensions.

Advantages of Claims-Made Policies

Claims-made policies offer precise coverage for incidents reported during the policy period, ensuring protection aligns with current risks and reduces uncertainties related to past exposures. These policies often provide lower initial premiums compared to occurrence policies, making them cost-effective for businesses managing cash flow. Furthermore, claims-made coverage allows for tailored extended reporting periods, granting policyholders flexibility to report claims after the policy expires.

Costs and Premium Comparison

Occurrence policies generally have higher initial premiums because they cover incidents that occur during the policy period regardless of when the claim is filed, providing long-term protection but potentially increasing upfront costs. Claims-made policies typically offer lower initial premiums since coverage applies only to claims made during the active policy, but they can become more expensive over time due to tail coverage or extended reporting periods needed after policy termination. Businesses must analyze budget constraints and future risk exposure when comparing the total cost of occurrence versus claims-made insurance policies.

Tail Coverage Explained

Tail coverage in claims-made policies extends protection for claims reported after the policy period ends, covering incidents that occurred during the active policy term. Occurrence policies inherently cover claims arising from events during the policy period, regardless of when the claim is filed, eliminating the need for tail coverage. Understanding tail coverage is crucial for claims-made policyholders to avoid coverage gaps when switching insurers or after policy cancellation.

Choosing the Right Policy for Your Needs

Choosing between an occurrence policy and a claims-made policy hinges on your risk tolerance and coverage timeline, as occurrence policies cover incidents happening during the policy period regardless of when claims are filed, while claims-made policies require claims to be reported within the policy period. Businesses with stable, long-term risk exposure often benefit from occurrence policies due to their broader protection against future claims. In contrast, startups or entities with changing risk profiles may prefer claims-made policies for their lower initial premiums and coverage focus on current risk exposures.

Frequently Asked Questions About Policy Types

Occurrence policies cover claims arising from incidents that happen during the policy period, regardless of when the claim is filed, offering long-term protection for insured events. Claims-made policies require both the incident and the claim to occur while the policy is active, necessitating continuous coverage or extended reporting periods to maintain protection. Policyholders often ask about the cost differences, retroactive dates, and coverage continuity between these two policy types to make informed decisions based on their risk exposure and financial goals.

Important Terms

Retroactive Date

The retroactive date in a claims-made policy determines the earliest date an incident must occur for coverage, unlike occurrence policies that cover any incident happening during the policy period regardless of the claim date.

Extended Reporting Period (ERP)

Extended Reporting Period (ERP) allows claims-made policies to cover claims reported after policy expiration, unlike occurrence policies that cover incidents during the active policy period regardless of reporting time.

Tail Coverage

Tail coverage extends protection for claims reported after the expiration of a claims-made policy, whereas occurrence policies provide coverage for incidents occurring during the policy period regardless of when the claim is filed.

Prior Acts Coverage

Prior Acts Coverage extends protection for claims arising from incidents that occurred before the inception date of a Claims-Made policy, ensuring continuity when a policyholder switches between Claims-Made and Occurrence policies. Unlike Occurrence policies, which cover incidents occurring during the policy period regardless of when the claim is filed, Claims-Made policies require Prior Acts Coverage to secure defense and indemnity for events predating the policy start date.

Reporting Period

Reporting periods define the timeframe in Occurrence Policies during which incidents triggering coverage must happen, whereas Claims-Made Policies require claims to be reported within a specified reporting period regardless of when the incident occurred.

Trigger Event

A trigger event determines whether coverage applies based on the timing of an incident in occurrence policies, whereas claims-made policies require the claim to be reported during the active policy period.

Incident Reporting

Incident reporting under an occurrence policy covers claims arising from incidents during the policy period regardless of when reported, while claims-made policy requires incidents and claims to be reported within the policy period to be covered.

Policy Inception

Policy inception marks the effective start date of an insurance contract, distinguishing Occurrence Policies that cover incidents occurring during the policy period regardless of claim timing from Claims-Made Policies that cover claims reported within the policy period regardless of when the incident happened.

Continuous Coverage

Continuous coverage in claims-made policies requires maintaining uninterrupted insurance from the policy's retroactive date to avoid coverage gaps, whereas occurrence policies provide coverage for incidents occurring during the policy period regardless of when the claim is filed.

Coverage Gap

The Coverage Gap refers to the risk period between the end of an occurrence policy and the start of a claims-made policy, during which claims may not be covered unless extended reporting endorsements are purchased.

Occurrence Policy vs Claims-Made Policy Infographic

moneydif.com

moneydif.com