In an insurance soft market, premiums are generally lower, coverage is more accessible, and underwriting standards are relaxed, making it favorable for buyers. Conversely, a hard market features higher premiums, stricter underwriting, and reduced capacity, often resulting from increased claims or catastrophic losses. Understanding these market cycles allows businesses to strategically negotiate policies and manage risk effectively.

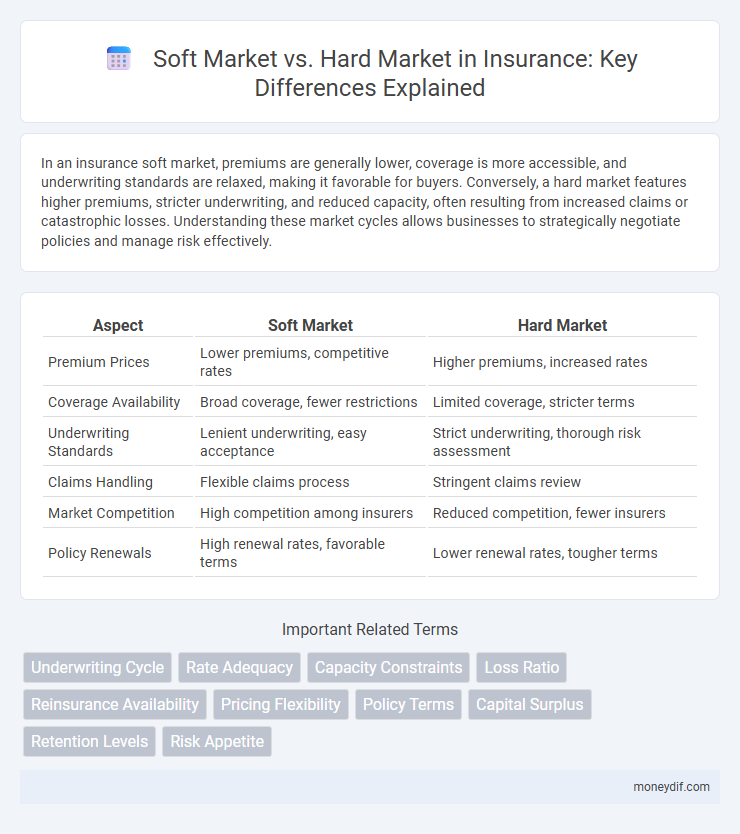

Table of Comparison

| Aspect | Soft Market | Hard Market |

|---|---|---|

| Premium Prices | Lower premiums, competitive rates | Higher premiums, increased rates |

| Coverage Availability | Broad coverage, fewer restrictions | Limited coverage, stricter terms |

| Underwriting Standards | Lenient underwriting, easy acceptance | Strict underwriting, thorough risk assessment |

| Claims Handling | Flexible claims process | Stringent claims review |

| Market Competition | High competition among insurers | Reduced competition, fewer insurers |

| Policy Renewals | High renewal rates, favorable terms | Lower renewal rates, tougher terms |

Understanding Soft and Hard Insurance Markets

A soft insurance market is characterized by high competition, lower premiums, broader coverage, and relaxed underwriting standards, making it favorable for buyers seeking cost-effective policies. Conversely, a hard insurance market features reduced capacity, higher premiums, strict underwriting criteria, and limited coverage options, often triggered by increased claims or catastrophic events. Understanding these market cycles helps businesses optimize risk management strategies and secure appropriate insurance solutions during fluctuating market conditions.

Key Differences Between Soft and Hard Markets

Soft markets in insurance are characterized by low premiums, high competition among insurers, and relaxed underwriting standards, resulting in greater coverage availability and policyholder bargaining power. Hard markets feature increased premiums, stricter underwriting criteria, reduced capacity, and limited policy offerings due to higher claims frequency or catastrophic losses. The cyclical nature of insurance markets means shifts between soft and hard conditions directly impact risk pricing, insurer profitability, and customer access to coverage.

Factors Influencing Insurance Market Cycles

Insurance market cycles are influenced by factors such as underwriting profitability, investment returns, and regulatory changes, which dictate shifts between soft and hard markets. In a soft market, high competition and ample capacity lead to lower premiums and relaxed underwriting standards, while a hard market features reduced capacity, higher premiums, and stricter terms driven by losses and increased claims. Catastrophic events, economic conditions, and changes in demand also play critical roles in transitioning between these market phases.

Impact of Soft Markets on Premiums and Coverage

Soft insurance markets drive premiums down due to high competition and abundant capital, resulting in more affordable coverage options for policyholders. This environment encourages broader coverage terms and increased capacity, allowing insurers to absorb greater risks and offer more flexible policy features. Reduced underwriting strictness in soft markets often leads to lower profitability margins but benefits consumers with lower costs and enhanced protection.

How Hard Markets Affect Policyholders

Hard markets in the insurance industry significantly increase premiums, reduce coverage options, and tighten underwriting standards for policyholders. During these periods, insurers become more selective, often declining higher-risk applications and imposing stricter policy terms. This environment can lead to increased out-of-pocket costs and limited access to comprehensive insurance protection for businesses and individuals.

Insurer Strategies in Soft vs Hard Markets

Insurers adopt flexible pricing models and increased underwriting leniency during soft markets to maintain market share amid high competition and low premium rates. In hard markets, they shift toward stricter underwriting criteria, higher premiums, and reduced capacity to manage increased claims frequency and severity. Strategic emphasis on risk selection and capital preservation becomes critical to sustain profitability in fluctuating market cycles.

Underwriting Standards: Soft vs Hard Market

Underwriting standards in a soft market tend to be more lenient, allowing insurers to accept higher risks with lower premiums to attract more business. In contrast, a hard market features stricter underwriting criteria, where insurers impose tighter risk assessments and higher premiums to maintain profitability amid increased claims or reduced capacity. These shifts directly impact policy availability, pricing, and coverage terms for insured clients.

Market Cycle Indicators for Insurers and Brokers

Market cycle indicators for insurers and brokers highlight shifts between soft and hard insurance markets, driven by factors such as premium pricing trends, underwriting capacity, and loss ratio fluctuations. In a soft market, low premiums and abundant capacity foster competition and broader coverage options, whereas a hard market is characterized by rising premiums, restricted capacity, and stricter underwriting standards. Tracking indicators like increased claims frequency, investment returns, and reserve adequacy enables market participants to anticipate transitions and adjust risk strategies effectively.

Navigating Renewals During Hard Market Conditions

During hard market conditions, insurance renewals often involve higher premiums, stricter underwriting criteria, and reduced coverage options due to limited carrier capacity. Policyholders must proactively engage with brokers to analyze risk profiles and explore alternative markets to secure optimal terms. Leveraging data-driven risk management strategies enhances negotiation power and mitigates the impact of hard market volatility on renewal outcomes.

Preparing for Shifts in the Insurance Market Cycle

Insurance professionals must closely monitor indicators such as premium rate trends, underwriting capacity, and claims frequency to anticipate shifts between soft and hard markets. Building flexible risk management strategies and maintaining strong insurer relationships enhance preparedness for fluctuating market conditions. Proactive adjustments in coverage terms and pricing models ensure resilience and competitiveness throughout the insurance market cycle.

Important Terms

Underwriting Cycle

The underwriting cycle oscillates between soft and hard markets, where soft markets feature low premiums, loose underwriting standards, and high competition, while hard markets are characterized by increased premiums, stringent underwriting criteria, and reduced capacity. This cycle directly impacts insurers' risk appetite, profitability, and market stability, influencing the overall insurance industry's financial health.

Rate Adequacy

Rate adequacy measures whether insurance premiums sufficiently cover expected losses, expenses, and provide a reasonable profit margin, which typically decreases during a soft market due to intense competition and reduced pricing power. In contrast, a hard market features higher rate adequacy as insurers increase premiums to offset rising claims, underwriting losses, and retain financial stability amidst reduced capacity.

Capacity Constraints

Capacity constraints in insurance markets significantly influence the transition between soft and hard market conditions, where limited underwriting capacity during a hard market drives higher premiums and stricter policy terms. In contrast, ample capacity in a soft market fosters competitive pricing and broader coverage availability.

Loss Ratio

Loss ratio directly impacts insurance pricing strategies, typically decreasing in a soft market due to intense competition and increased coverage availability, while rising in a hard market as insurers tighten underwriting standards and increase premiums to offset higher claim costs. Understanding these fluctuations helps insurers balance profitability and market share by adjusting reserves and risk appetite accordingly.

Reinsurance Availability

Reinsurance availability fluctuates significantly between soft and hard markets, with ample capacity and competitive pricing characterizing soft markets, while restricted supply and elevated premiums define hard markets. Insurers face challenges securing adequate coverage during hard markets, prompting stricter underwriting standards and increased emphasis on risk selection and management.

Pricing Flexibility

Pricing flexibility in a soft market often increases as insurers lower premiums to attract clients amid abundant capacity and intense competition. In contrast, a hard market restricts pricing flexibility due to reduced capacity, higher claim costs, and stricter underwriting standards, leading to elevated premiums and limited negotiation options.

Policy Terms

Policy terms in a soft market tend to be more flexible with lower premiums and broader coverage due to increased insurer competition, while in a hard market, terms become stricter with higher premiums and limited coverage as insurers tighten underwriting standards. These fluctuations directly impact risk appetite, renewal conditions, and overall contract negotiation in the insurance industry.

Capital Surplus

Capital surplus, reflecting excess funds raised by a company beyond its par value, influences underwriting capacity in insurance markets, with higher capital surpluses typically supporting a hard market characterized by higher premiums and tighter underwriting. In a soft market, abundant capital surplus leads to increased competition and lower premiums, as insurers strive to deploy surplus efficiently.

Retention Levels

Retention levels in a soft market tend to be lower due to increased competition and abundant underwriting capacity, allowing insureds to shift policies more easily. Conversely, in a hard market, retention levels rise as limited capacity and higher premiums encourage policyholders to maintain existing coverage to avoid cost increases and stricter underwriting standards.

Risk Appetite

Risk appetite defines the level of risk an organization is willing to accept, directly influencing strategies in soft market conditions where competition drives lower premiums and increased coverage capacity. In contrast, during hard markets marked by tight capacity and higher premiums, firms often reduce risk appetite to minimize exposure and maintain financial stability.

Soft Market vs Hard Market Infographic

moneydif.com

moneydif.com