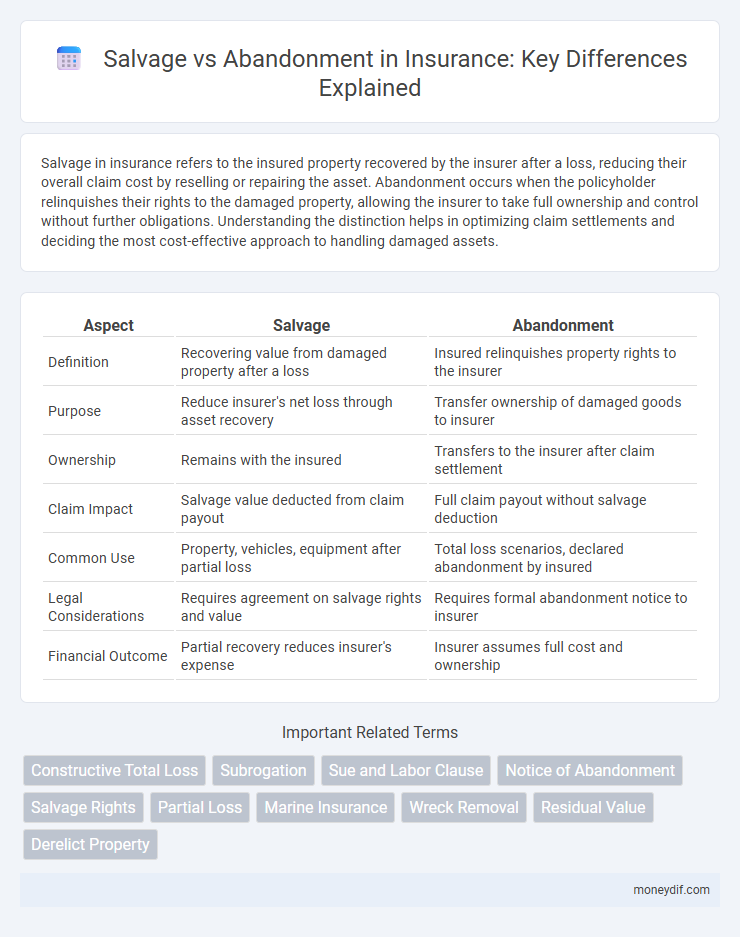

Salvage in insurance refers to the insured property recovered by the insurer after a loss, reducing their overall claim cost by reselling or repairing the asset. Abandonment occurs when the policyholder relinquishes their rights to the damaged property, allowing the insurer to take full ownership and control without further obligations. Understanding the distinction helps in optimizing claim settlements and deciding the most cost-effective approach to handling damaged assets.

Table of Comparison

| Aspect | Salvage | Abandonment |

|---|---|---|

| Definition | Recovering value from damaged property after a loss | Insured relinquishes property rights to the insurer |

| Purpose | Reduce insurer's net loss through asset recovery | Transfer ownership of damaged goods to insurer |

| Ownership | Remains with the insured | Transfers to the insurer after claim settlement |

| Claim Impact | Salvage value deducted from claim payout | Full claim payout without salvage deduction |

| Common Use | Property, vehicles, equipment after partial loss | Total loss scenarios, declared abandonment by insured |

| Legal Considerations | Requires agreement on salvage rights and value | Requires formal abandonment notice to insurer |

| Financial Outcome | Partial recovery reduces insurer's expense | Insurer assumes full cost and ownership |

Understanding Salvage and Abandonment in Insurance

Salvage in insurance refers to the recovery of damaged property by the insurer after compensation is paid to the policyholder, allowing the insurer to sell or reuse the damaged asset to offset the claim cost. Abandonment occurs when the policyholder relinquishes ownership of the damaged property to the insurer, transferring all rights and interests, often seen in total loss scenarios. Understanding the distinction between salvage and abandonment is crucial for determining liability, claim settlements, and the handling of damaged property in insurance contracts.

Key Differences Between Salvage and Abandonment

Salvage refers to the process of recovering usable parts or value from damaged insured property, often involving repair or resale by the insurer. Abandonment occurs when the policyholder relinquishes ownership of the damaged property to the insurer, typically in exchange for a total loss claim payout. Key differences include the transfer of ownership, with salvage allowing policyholders to retain property rights, while abandonment transfers full ownership to the insurer.

Legal Framework Governing Salvage and Abandonment

The legal framework governing salvage and abandonment in insurance is primarily established under maritime law, particularly the International Convention on Salvage (1989), which defines rights, obligations, and compensation mechanisms for salvors. Salvage operations involve the voluntary rescue of a vessel or cargo in peril with the intent to secure compensation, whereas abandonment occurs when the insured relinquishes all rights to the property, transferring ownership to the insurer who can then claim salvage rights. Jurisprudence and national statutes further delineate the conditions under which claims for salvage rewards or abandonment reimbursements are valid, affecting contractual obligations and liability in marine insurance policies.

Types of Insurance Policies Impacted by Salvage and Abandonment

Salvage and abandonment significantly impact property and casualty insurance policies, particularly auto and homeowner's insurance, where the insurer evaluates damaged assets for potential recovery. In auto insurance, salvage affects total loss settlements as insurers may retain the vehicle to recoup costs, while abandonment allows policyholders to relinquish ownership entirely. Commercial property insurance also deals with salvage through recovery of damaged business assets, influencing claim settlements and underwriting decisions.

Salvage Rights: When Insurers Take Over

Salvage rights arise when insurers take control of damaged property after a claim payout to recover value. Insurers assess the salvageable components or residual value, selling or repurposing them to offset claim costs. This process helps minimize overall losses and ensures efficient resource management within the insurance claims lifecycle.

Criteria for Claiming Abandonment in Insurance

Claiming abandonment in insurance requires the insured to demonstrate complete relinquishment of ownership and control over the damaged property, typically after it is deemed a total loss. The insured must notify the insurer of the intention to abandon within a specific timeframe and provide evidence that the salvage value does not justify repair or retention. Courts and policies often require clear communication and formal documentation to validate abandonment claims and transfer salvage rights to the insurer.

Financial Implications for Policyholders

Salvage allows policyholders to recover a portion of their vehicle's value by selling damaged property, reducing overall financial loss after a claim. Abandonment transfers ownership of damaged property to the insurer, potentially limiting reimbursement depending on the policy terms. Understanding these options helps policyholders assess potential out-of-pocket expenses and optimize claim settlements.

Salvage and Abandonment: Claims Process Explained

Salvage in insurance refers to the recovery of damaged property by the insurer after a claim payout, allowing the insurer to reduce the overall loss. Abandonment occurs when the policyholder relinquishes ownership of damaged property to the insurer, transferring rights for claim settlement. The claims process involves assessing the damage, determining salvage value, and deciding if abandonment is a viable option based on the extent of loss and policy terms.

Real-World Examples: Salvage vs Abandonment Scenarios

Salvage in insurance involves recovering value from damaged property, such as a totaled vehicle sold to a salvage yard, while abandonment occurs when the insured relinquishes all rights to the property, like leaving a severely flooded home to the insurer. In marine insurance, salvage might include towing a disabled ship to port to minimize loss, whereas abandonment would mean the owner hands over the vessel completely to the insurer for a total loss claim. Real-world examples demonstrate that salvage aims to reduce overall loss by reclaiming damaged assets, whereas abandonment transfers full ownership and risk to the insurer for full indemnification.

Best Practices for Handling Salvage and Abandonment Claims

Effective handling of salvage and abandonment claims requires prompt assessment of the damaged property's value and clear documentation to support recovery or disposal decisions. Insurers should establish transparent communication with policyholders and salvage purchasers, ensuring compliance with policy terms and regulatory requirements. Maintaining detailed records and collaborating with experienced adjusters helps optimize claim resolution and minimize losses.

Important Terms

Constructive Total Loss

Constructive Total Loss occurs when repair costs exceed the insured value of a vessel, prompting a decision between salvage and abandonment. Salvage involves recovering the ship or cargo to mitigate losses, while abandonment transfers ownership and claims to the insurer upon declaring the asset a loss.

Subrogation

Subrogation in insurance enables the insurer to recover losses by claiming rights against a third party after indemnifying the insured, often involving decisions between salvage and abandonment of damaged property. Salvage refers to retaining and repairing damaged goods to recover value, while abandonment occurs when the insured relinquishes rights to the insurer, allowing a total loss claim and transfer of property ownership for subrogation purposes.

Sue and Labor Clause

The Sue and Labor Clause in marine insurance mandates the insured to take reasonable actions to minimize loss or damage to the insured property after a maritime casualty, directly impacting claims related to salvage efforts versus abandonment of the vessel. Failure to comply with this clause can lead to denial of coverage for losses arising from abandonment, as insurers require demonstrable efforts to preserve the vessel or cargo through salvage operations.

Notice of Abandonment

A Notice of Abandonment formally declares a vessel owner's intent to relinquish salvage rights, transferring claims to salvage operators who recover the vessel. Salvage involves voluntary rescue operations aiming for reward, while abandonment legally releases ownership and responsibility, allowing salvors to claim rights under maritime law.

Salvage Rights

Salvage rights grant a salvor legal entitlement to compensation for recovering a vessel or cargo from peril without transferring ownership, distinguishing them from abandonment, where the owner relinquishes all property rights. Understanding the difference between salvage and abandonment is essential for maritime law, as salvage claims require voluntary efforts to save property, whereas abandonment allows finders to claim ownership after a certain period.

Partial Loss

Partial loss occurs when insured property sustains damage reducing its value without total destruction, prompting decisions between salvage or abandonment based on cost-efficiency. Salvage involves recovering remaining value and minimizing loss, whereas abandonment transfers ownership of damaged property to the insurer in exchange for full claim settlement.

Marine Insurance

Marine insurance covers losses from perils at sea, where salvage refers to efforts to recover a vessel or cargo from danger, aiming to minimize total loss. Abandonment occurs when the insured gives up rights to the ship or cargo due to severe damage, allowing the insurer to take possession and settle the claim.

Wreck Removal

Wreck removal involves the complex decision between salvage operations and abandonment, where salvage focuses on recovering the vessel or cargo to mitigate environmental risks and financial losses, while abandonment entails leaving the wreck due to factors like cost, safety hazards, or legal constraints. Effective wreck removal strategies depend on international regulations such as the Nairobi International Convention on the Removal of Wrecks 2007, emphasizing prompt action to prevent navigation hazards and protect marine ecosystems.

Residual Value

Residual value represents the estimated worth of an asset at the end of its useful life, often aligning with its salvage value, which accounts for recoverable materials or parts. In contrast, abandonment implies disposing of the asset with little to no residual or salvage value, frequently resulting in a total loss.

Derelict Property

Derelict property often raises legal distinctions between salvage rights and abandonment, where salvage involves the recovery of valuables from property still claimed by an owner, whereas abandonment implies relinquishing all ownership rights, allowing others to claim it legally. Understanding local laws is crucial, as salvage laws protect owners' interests, while abandonment can lead to title transfer or property forfeiture under statutes like adverse possession.

Salvage vs Abandonment Infographic

moneydif.com

moneydif.com