A primary beneficiary is the individual or entity first in line to receive the insurance proceeds upon the policyholder's death, while a contingent beneficiary serves as a backup, inheriting benefits only if the primary beneficiary is deceased or unable to claim the policy. Understanding the roles and distinctions between contingent and primary beneficiaries helps ensure that insurance benefits are distributed according to the policyholder's wishes without legal complications. Properly naming both beneficiary types prevents delays in claims processing and offers financial security to intended recipients.

Table of Comparison

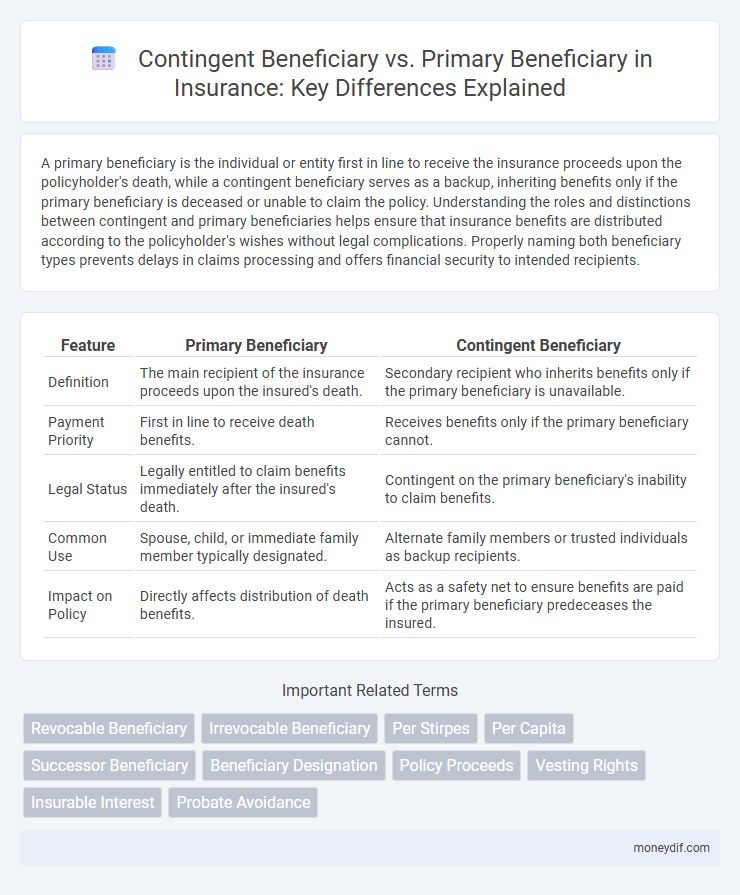

| Feature | Primary Beneficiary | Contingent Beneficiary |

|---|---|---|

| Definition | The main recipient of the insurance proceeds upon the insured's death. | Secondary recipient who inherits benefits only if the primary beneficiary is unavailable. |

| Payment Priority | First in line to receive death benefits. | Receives benefits only if the primary beneficiary cannot. |

| Legal Status | Legally entitled to claim benefits immediately after the insured's death. | Contingent on the primary beneficiary's inability to claim benefits. |

| Common Use | Spouse, child, or immediate family member typically designated. | Alternate family members or trusted individuals as backup recipients. |

| Impact on Policy | Directly affects distribution of death benefits. | Acts as a safety net to ensure benefits are paid if the primary beneficiary predeceases the insured. |

Understanding Primary Beneficiaries in Insurance

Primary beneficiaries in insurance policies are the individuals or entities designated to receive the policy benefits immediately upon the insured's death. They hold the first claim to the proceeds, ensuring prompt distribution without requiring verification of the contingent beneficiaries. Clearly specifying primary beneficiaries helps prevent delays and legal disputes, safeguarding the insured's intentions for benefit allocation.

What Is a Contingent Beneficiary?

A contingent beneficiary in insurance is the individual or entity designated to receive the policy benefits if the primary beneficiary is deceased or unable to claim the funds. This backup designation ensures that the payout is directed according to the policyholder's wishes, providing an additional layer of security for asset distribution. Understanding the role of a contingent beneficiary helps in effective estate planning and prevents disputes in the event the primary beneficiary cannot inherit the insurance proceeds.

Key Differences Between Primary and Contingent Beneficiaries

Primary beneficiaries receive the insurance payout directly upon the policyholder's death, holding the first right to the benefits. Contingent beneficiaries inherit the proceeds only if all primary beneficiaries are deceased or unable to claim the policy benefits. Understanding these key differences is crucial for effective estate planning and ensuring the intended distribution of insurance proceeds.

How to Designate Primary and Contingent Beneficiaries

Designate a primary beneficiary by clearly naming the person or entity who will receive the insurance proceeds first, using full legal names and contact information to avoid ambiguity. Assign a contingent beneficiary to specify who receives the benefits if the primary beneficiary is deceased or unable to claim, ensuring the policy's payout is distributed according to your wishes. Review and update beneficiary designations regularly to reflect life changes and maintain accuracy in your insurance policies.

Importance of Naming a Contingent Beneficiary

Naming a contingent beneficiary in an insurance policy ensures that benefits are distributed according to your wishes if the primary beneficiary cannot receive them, preventing potential legal disputes. This designation acts as a crucial backup, providing financial security to alternate recipients such as family members or dependents. Properly identifying both primary and contingent beneficiaries enhances clarity and avoids delays in claim processing during critical times.

Common Mistakes in Beneficiary Designations

Confusing contingent beneficiaries with primary beneficiaries often leads to unintended benefit distributions, as the primary beneficiary must predecease the insured for the contingent to receive payouts. Common mistakes include failing to update beneficiary designations after major life events such as marriage or divorce, resulting in outdated or invalid assignments. Overlooking the importance of clear, specific beneficiary information can cause claim delays or disputes, emphasizing the need for precise, current records in insurance policies.

Legal Implications for Primary and Contingent Beneficiaries

Primary beneficiaries hold the initial legal right to receive insurance proceeds upon the insured's death, creating an immediate claim to the policy benefits. Contingent beneficiaries gain legal entitlement only if all primary beneficiaries predecease the insured or disclaim their benefit, serving as a secondary layer of claimants. Understanding the legal hierarchy between primary and contingent beneficiaries helps prevent disputes and ensures smooth asset transfer according to the insured's intent.

Updating Your Beneficiary Designations

Updating your beneficiary designations ensures that your insurance policy reflects your current wishes, whether for a primary or contingent beneficiary. The primary beneficiary receives the policy proceeds first, while the contingent beneficiary inherits only if the primary beneficiary is unavailable. Regularly reviewing and updating these designations helps prevent disputes and ensures proper distribution of benefits.

Contingent vs Primary Beneficiary: Real Life Scenarios

Primary beneficiaries receive insurance payouts immediately upon a policyholder's death, ensuring direct transfer of benefits. Contingent beneficiaries act as backups, receiving funds only if the primary beneficiaries are deceased or legally unable to claim. In real life, naming a contingent beneficiary prevents delays and complications in the claim process, safeguarding beneficiaries' financial security.

Frequently Asked Questions About Beneficiary Roles

A primary beneficiary is the first person or entity designated to receive insurance proceeds upon the policyholder's death, while a contingent beneficiary receives the benefits only if the primary beneficiary is unable or unwilling to accept them. Policyholders often ask how to update beneficiary designations, what happens if no beneficiary is named, and whether beneficiaries can be changed without a policyholder's consent. Understanding these roles helps ensure that insurance payouts are directed according to the policyholder's wishes, avoiding legal complications or delays in claims settlement.

Important Terms

Revocable Beneficiary

A revocable beneficiary designation allows the policyholder to change or revoke the beneficiary at any time without their consent, which differs from the contingent beneficiary who receives the benefit only if the primary beneficiary is deceased or unable to claim it. The primary beneficiary is the first in line to receive the policy proceeds, while the contingent beneficiary serves as a backup to ensure the benefits are distributed if the primary beneficiary cannot.

Irrevocable Beneficiary

An irrevocable beneficiary holds a guaranteed interest in an insurance policy or trust that cannot be changed without their consent, contrasting with a primary beneficiary who is the initial recipient of benefits upon the insured event. A contingent beneficiary receives benefits only if the primary beneficiary is unable or unwilling to claim them, creating a secondary layer of payment priority.

Per Stirpes

Per Stirpes is a probate distribution method ensuring that a deceased beneficiary's share passes to their descendants, maintaining the original inheritance structure through generations. In the context of contingent versus primary beneficiaries, Per Stirpes guarantees that if a primary beneficiary predeceases the account holder, their share automatically transfers to their heirs rather than to the contingent beneficiaries.

Per Capita

Per capita distribution allocates assets equally among surviving contingent beneficiaries when a primary beneficiary predeceases the grantor, ensuring fair inheritance divisions at each generational level. This method contrasts with per stirpes distribution, which passes the deceased primary beneficiary's share directly to their descendants, emphasizing the importance of specifying beneficiary designations for estate planning accuracy.

Successor Beneficiary

A successor beneficiary inherits assets if both the primary and contingent beneficiaries predecease the account holder, ensuring the continuation of asset distribution. Primary beneficiaries receive assets first, while contingent beneficiaries act as backups, and the successor beneficiary provides a further layer of succession planning.

Beneficiary Designation

A primary beneficiary is the first individual or entity designated to receive assets upon the policyholder's death, while a contingent beneficiary inherits only if the primary beneficiary predeceases the policyholder or is otherwise unable to claim the benefits. Clarifying contingent beneficiary details ensures seamless asset transfer and prevents legal disputes if the primary beneficiary cannot accept the inheritance.

Policy Proceeds

Policy proceeds are paid to the primary beneficiary first, with contingent beneficiaries entitled to receive benefits only if the primary beneficiary predeceases the policyholder or declines the inheritance. Understanding the distinction between primary and contingent beneficiaries ensures clear estate planning and prevents disputes over insurance payouts.

Vesting Rights

Vesting rights determine when a beneficiary becomes entitled to the assets in a trust or retirement plan, with primary beneficiaries having immediate claim upon the grantor's death, while contingent beneficiaries receive rights only if the primary beneficiary predeceases or disclaims the inheritance. Clear differentiation between contingent and primary beneficiaries ensures proper asset distribution under vesting rules, minimizing probate delays and legal disputes.

Insurable Interest

Insurable interest legally requires the policyholder to have a financial or emotional stake in the insured, ensuring the validity of the life insurance policy, while contingent beneficiaries receive benefits only if the primary beneficiary is deceased or unable to claim. Distinguishing between primary and contingent beneficiaries impacts claim distribution, with the primary beneficiary having first rights to the policy proceeds and the contingent beneficiary acting as a backup recipient.

Probate Avoidance

Probate avoidance strategies often involve designating contingent beneficiaries to ensure assets bypass probate if the primary beneficiary predeceases the account holder, allowing a seamless transfer of property. Properly naming contingent beneficiaries on financial accounts or life insurance policies reduces the risk of court intervention and expedites inheritance distribution.

Contingent Beneficiary vs Primary Beneficiary Infographic

moneydif.com

moneydif.com