Morale hazard refers to the carelessness or indifference of an insured individual toward risk because they have insurance coverage, often leading to negligent behavior. Moral hazard involves intentional actions or fraud by the insured to exploit insurance benefits for personal gain, such as exaggerating claims or causing damage deliberately. Understanding the distinction between morale hazard and moral hazard helps insurers develop policies that minimize risk while ensuring fair claims processing.

Table of Comparison

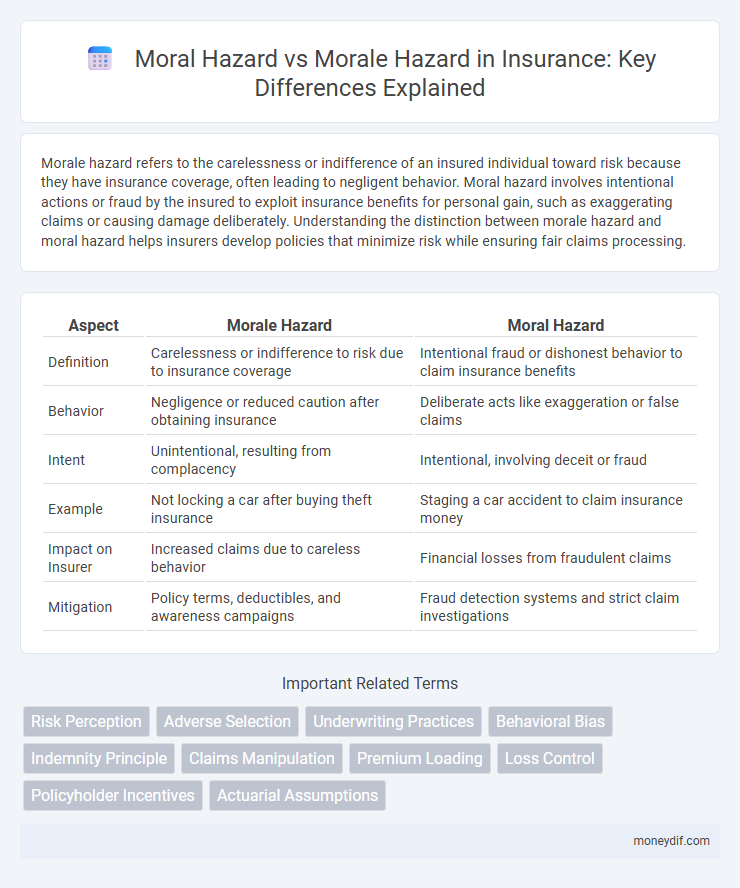

| Aspect | Morale Hazard | Moral Hazard |

|---|---|---|

| Definition | Carelessness or indifference to risk due to insurance coverage | Intentional fraud or dishonest behavior to claim insurance benefits |

| Behavior | Negligence or reduced caution after obtaining insurance | Deliberate acts like exaggeration or false claims |

| Intent | Unintentional, resulting from complacency | Intentional, involving deceit or fraud |

| Example | Not locking a car after buying theft insurance | Staging a car accident to claim insurance money |

| Impact on Insurer | Increased claims due to careless behavior | Financial losses from fraudulent claims |

| Mitigation | Policy terms, deductibles, and awareness campaigns | Fraud detection systems and strict claim investigations |

Understanding Morale Hazard and Moral Hazard

Morale hazard refers to the increased risk resulting from a policyholder's careless or irresponsible behavior because they have insurance coverage, while moral hazard involves intentional actions or fraud to exploit the insurance policy. Understanding morale hazard is crucial for insurers as it highlights the impact of negligence and inattentiveness on claim frequency and severity. Effective risk management strategies often emphasize minimizing both morale and moral hazards to maintain underwriting profitability and reduce fraudulent claims.

Key Differences Between Morale Hazard and Moral Hazard

Morale hazard involves carelessness or indifference to loss due to insurance coverage, while moral hazard refers to intentional fraudulent behavior or risk-taking to benefit from insurance. Morale hazard is unintentional and stems from an insured party's attitude, whereas moral hazard is deliberate and involves deceit or dishonesty. Understanding these distinctions helps insurers assess risk accurately and prevent both negligence and fraud effectively.

Real-Life Examples of Morale Hazard in Insurance

Morale hazard in insurance occurs when insured individuals exhibit carelessness or indifference toward risk, increasing the likelihood or severity of a loss. For example, a driver with car insurance might drive recklessly, knowing damages will be covered, or a homeowner may neglect property maintenance, leading to preventable claims. These behaviors differ from moral hazard, which involves intentional fraud or deceit, highlighting the significance of addressing attitude-driven risk in underwriting and claims management.

Real-Life Examples of Moral Hazard in Insurance

Moral hazard in insurance occurs when a policyholder takes greater risks because they are protected from the consequences, such as a driver texting while insured because they expect damages to be covered. Real-life examples include homeowners neglecting maintenance after securing property insurance or employees filing exaggerated workers' compensation claims knowing the costs are borne by insurers. These behaviors increase claim frequency and severity, leading insurers to implement policy measures like higher deductibles and monitoring to mitigate risk exposure.

Causes of Morale Hazard in Policyholders

Morale hazard in insurance arises primarily from the insured's carelessness or indifference due to the belief that the policy will cover any losses, leading to increased risk-taking behavior. Common causes include negligence, lack of effort to prevent losses, and a false sense of security that diminishes personal responsibility. This behavior contrasts with moral hazard, which involves intentional fraudulent acts by policyholders to benefit from insurance claims.

Causes of Moral Hazard in Policyholders

Moral hazard in policyholders primarily stems from asymmetric information, where insured individuals may take higher risks knowing their losses are covered by insurance. This behavior is caused by reduced incentives to prevent damage or loss due to the financial protection provided by the insurance policy. Factors such as lack of strict policy enforcement, inadequate monitoring mechanisms, and complex contract terms further exacerbate the tendency for insured parties to act irresponsibly.

Impact of Morale Hazard on Insurance Premiums

Morale hazard refers to the insured party's indifference or carelessness towards risk because they have insurance coverage, which often leads to higher claim frequency and severity. This behavioral risk increases the insurer's expected losses, prompting underwriters to raise insurance premiums to offset potential costs. Elevated premiums serve as a financial deterrent, encouraging policyholders to adopt more prudent behavior and reduce careless risk-taking.

Impact of Moral Hazard on Claim Frequency

Moral hazard significantly increases claim frequency by encouraging insured individuals to engage in riskier behavior, knowing their losses are covered by insurance. This effect distorts risk assessment models and leads insurers to raise premiums to offset higher claims. Understanding moral hazard is crucial for designing policies that incentivize responsible behavior and reduce fraudulent or excessive claims.

Strategies Insurers Use to Mitigate Hazards

Insurers deploy rigorous underwriting standards and continuous risk assessments to mitigate morale hazards by promoting responsible policyholder behavior and reducing carelessness or negligence. To address moral hazards, insurers implement policy exclusions, fraud detection systems, and strict claims investigations to prevent intentional dishonesty or fraudulent activities. Employing incentive-based programs such as no-claim bonuses and premium discounts encourages vigilance and honesty, effectively reducing both morale and moral hazards.

Morale Hazard vs Moral Hazard: Why Distinction Matters

Morale hazard and moral hazard both impact insurance risk but differ fundamentally; morale hazard arises from carelessness or negligence without intent to cause loss, while moral hazard involves deliberate fraudulent or dishonest behavior to claim benefits. Understanding the distinction matters because insurers assess risk management strategies differently, applying stricter underwriting or policy terms for moral hazard cases. Properly identifying morale versus moral hazards enables accurate premium setting, reduces fraud, and improves claims handling efficiency.

Important Terms

Risk Perception

Risk perception significantly influences the differentiation between morale hazard and moral hazard, where morale hazard involves careless behavior due to perceived safety nets, while moral hazard entails deliberate unethical actions to exploit insurance benefits. Understanding these nuances aids insurers in designing policies that mitigate opportunistic risks by aligning incentives and enhancing risk awareness.

Adverse Selection

Adverse selection occurs when asymmetric information leads to high-risk individuals being more likely to purchase insurance, exacerbating the problem of moral hazard, which arises from insured parties engaging in riskier behavior post-coverage due to reduced consequences. Unlike morale hazard, which involves an insured individual's attitude or carelessness increasing risk, moral hazard directly results from incentives created by insurance policies, impacting risk assessment and premium pricing.

Underwriting Practices

Underwriting practices carefully assess the distinction between morale hazard, which involves negligent behavior due to a lack of incentive to avoid risk, and moral hazard, where deliberate dishonesty or fraud increases the likelihood of a claim. Effective risk evaluation techniques include thorough background checks, detailed policy terms, and stringent monitoring to mitigate the impact of both morale and moral hazards on insurance losses.

Behavioral Bias

Behavioral bias in finance often leads to misjudgments involving moral hazard, where individuals take excessive risks because they do not bear the full consequences, whereas morale hazard refers to careless behavior stemming from a lack of ethical standards rather than intentional exploitation. Both biases impair risk assessment and decision-making but differ fundamentally in the motivation and nature of the risk-taking behavior.

Indemnity Principle

The Indemnity Principle in insurance ensures compensation restores the insured to their pre-loss financial position, discouraging moral hazard by preventing profit from loss, whereas morale hazard reflects careless behavior arising from the perception of coverage but is not directly addressed by indemnity. Distinguishing moral hazard as intentional risk-taking and morale hazard as unintentional negligence helps insurers design policies that minimize fraud and promote responsible conduct.

Claims Manipulation

Claims manipulation often arises from moral hazard, where individuals exploit insurance policies by intentionally causing or exaggerating losses, contrasting with morale hazard, which involves careless behavior due to a lack of incentive to avoid risk. Understanding the distinction between moral hazard--deliberate fraudulent actions--and morale hazard--negligent or reckless attitudes--helps insurers design policies that minimize abuse and align incentives for responsible behavior.

Premium Loading

Premium loading adjusts insurance costs to reflect increased risks linked to moral hazard, where insured individuals may engage in riskier behavior knowing they are covered; this contrasts with morale hazard, which involves unintentional carelessness rather than deliberate risk-taking. Insurers incorporate premium loadings to mitigate potential losses from moral hazard by aligning policy costs with the likelihood of claims influenced by behavioral changes post-coverage.

Loss Control

Loss control in insurance focuses on mitigating risks by identifying and managing potential hazards, distinguishing between morale hazard--careless behavior due to indifference--and moral hazard--intentional actions to cause loss or deceive the insurer. Effective loss control strategies target morale hazards by promoting safety awareness and responsible behavior, while addressing moral hazards requires thorough investigation and fraud prevention measures.

Policyholder Incentives

Policyholder incentives designed to reduce moral hazard encourage responsible behavior by aligning financial interests, such as premium discounts for safe driving or no-claims bonuses. These incentives mitigate morale hazard by reinforcing trust and discouraging intentional negligence or fraud, ultimately promoting risk-aware decision-making.

Actuarial Assumptions

Actuarial assumptions regarding morale hazard focus on policyholders' attitudes and behaviors influenced by perceived insurance coverage, potentially leading to careless actions without fraudulent intent, whereas moral hazard involves intentional dishonesty or fraud to exploit insurance benefits. Accurate differentiation between morale and moral hazard is critical for setting premiums and designing policies to mitigate risk and prevent loss exposure.

Morale Hazard vs Moral Hazard Infographic

moneydif.com

moneydif.com