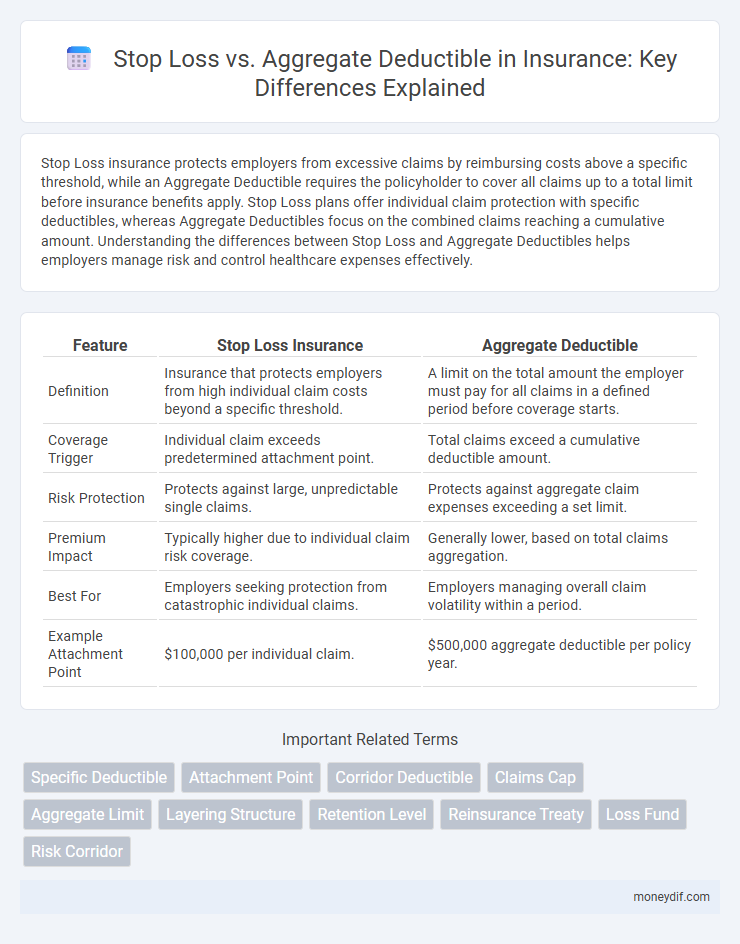

Stop Loss insurance protects employers from excessive claims by reimbursing costs above a specific threshold, while an Aggregate Deductible requires the policyholder to cover all claims up to a total limit before insurance benefits apply. Stop Loss plans offer individual claim protection with specific deductibles, whereas Aggregate Deductibles focus on the combined claims reaching a cumulative amount. Understanding the differences between Stop Loss and Aggregate Deductibles helps employers manage risk and control healthcare expenses effectively.

Table of Comparison

| Feature | Stop Loss Insurance | Aggregate Deductible |

|---|---|---|

| Definition | Insurance that protects employers from high individual claim costs beyond a specific threshold. | A limit on the total amount the employer must pay for all claims in a defined period before coverage starts. |

| Coverage Trigger | Individual claim exceeds predetermined attachment point. | Total claims exceed a cumulative deductible amount. |

| Risk Protection | Protects against large, unpredictable single claims. | Protects against aggregate claim expenses exceeding a set limit. |

| Premium Impact | Typically higher due to individual claim risk coverage. | Generally lower, based on total claims aggregation. |

| Best For | Employers seeking protection from catastrophic individual claims. | Employers managing overall claim volatility within a period. |

| Example Attachment Point | $100,000 per individual claim. | $500,000 aggregate deductible per policy year. |

Understanding Stop Loss and Aggregate Deductible

Stop Loss insurance protects employers from excessive claims by reimbursing costs once individual or aggregate claims exceed a predetermined threshold, minimizing financial risk. An Aggregate Deductible, often used in self-funded health plans, sets a total cost limit employers must pay before Stop Loss coverage applies, encompassing all claims within a policy period. Understanding the distinction between Stop Loss limits and Aggregate Deductibles is crucial for managing healthcare expenses and ensuring effective risk management in employee benefit plans.

Key Differences Between Stop Loss and Aggregate Deductible

Stop Loss insurance provides protection against individual claim limits, reimbursing costs once a specific threshold per claim is exceeded, while Aggregate Deductible covers the total claims amount, activating once cumulative claims reach a preset aggregate limit. Stop Loss is designed to limit exposure to high-cost individual claims, whereas Aggregate Deductible caps overall claims expense for a policy period. Understanding these distinctions is critical for insurers and employers in managing risk and controlling healthcare costs effectively.

How Stop Loss Insurance Works

Stop Loss insurance protects employers from unexpectedly high claims by reimbursing costs that exceed a predetermined deductible limit, either on an individual or aggregate basis. It activates once an employee's medical expenses surpass the specific deductible amount, limiting the employer's financial risk. This coverage ensures budget stability by capping potential losses from large or numerous claims within a policy period.

The Basics of Aggregate Deductible

An aggregate deductible represents the total amount a policyholder must pay out-of-pocket for all claims during a policy period before the insurer begins to cover expenses. Unlike the stop loss deductible, which applies individually to each claim, the aggregate deductible accumulates claim costs until it reaches a specified threshold. This feature helps manage overall risk by capping the policyholder's total deductible exposure within a given timeframe.

Advantages of Stop Loss Coverage

Stop Loss coverage offers protection beyond the aggregate deductible by capping an insurer's maximum loss on individual claims, ensuring financial stability even in cases of unexpectedly high-cost claims. It provides precise risk management by covering losses that exceed a predetermined threshold, limiting the insurer's exposure to catastrophic losses. This coverage is particularly advantageous for self-insured employers seeking to safeguard against significant spikes in claim costs while maintaining predictable budgeting.

Pros and Cons of Aggregate Deductible

Aggregate deductible insurance offers a cap on total out-of-pocket expenses for claims within a policy period, allowing businesses to manage cash flow more predictably. The key advantage is cost efficiency for organizations with frequent smaller claims, as payments accumulate toward the deductible limit before the insurer pays. However, the downside includes the risk of high cumulative expenses before coverage kicks in, which can strain finances during periods of multiple significant claims.

When to Choose Stop Loss Over Aggregate Deductible

Choose stop loss insurance over an aggregate deductible when protecting against high individual claimants or catastrophic claims is essential, as stop loss limits exposure to large claims by setting a per-claim threshold. Aggregate deductibles are preferable for managing the total claims cost within a policy period but may not offer sufficient protection against unpredictable, high-cost claims. Businesses facing volatile health or liability risks benefit from stop loss coverage to ensure financial stability and mitigate the impact of extreme claims.

Cost Implications: Stop Loss vs Aggregate Deductible

Stop Loss insurance limits an employer's exposure to high individual claim costs by reimbursing expenses that exceed a specified amount, often resulting in more predictable budgeting for catastrophic claims. Aggregate Deductible plans require the total claims to surpass a cumulative threshold before insurance kicks in, potentially leading to higher out-of-pocket expenses during multiple moderate claims. Employers must weigh the steadier financial protection of Stop Loss against the potentially lower premiums but higher overall risk of Aggregate Deductibles when managing healthcare plan costs.

Impact on Claims Management and Risk

Stop loss insurance limits financial exposure by capping individual claim payments, transferring high-cost risk from the insurer to the reinsurer. Aggregate deductibles require the insured to cover total claims up to a set amount within a policy period before the insurer reimburses, concentrating risk management on cumulative loss control. Effective claims management balances stop loss protection to prevent catastrophic losses while managing aggregate deductibles to optimize cash flow and risk retention.

Choosing the Right Option for Your Organization

Selecting between stop loss and aggregate deductible insurance requires analyzing your organization's risk tolerance, claim frequency, and financial capacity to absorb losses. Stop loss insurance provides protection against individual high-cost claims by capping liabilities per claim, while aggregate deductibles limit total claims expenses over a policy period. Evaluating historical claims data and cash flow helps determine which option balances cost control with effective risk management for your organization's unique insurance needs.

Important Terms

Specific Deductible

Specific Deductible refers to the amount an insured must pay out-of-pocket on an individual claim before stop loss insurance coverage begins, differing from Aggregate Deductible which applies to the total claims within a policy period. Stop loss insurance with a Specific Deductible protects against high-cost claims on individual risks, whereas an Aggregate Deductible limits insurer liability based on cumulative claims reaching a predetermined threshold.

Attachment Point

Attachment Point defines the loss threshold at which an insurer's stop loss coverage begins, effectively marking the insurer's financial responsibility limit before reinsurance or aggregate deductibles apply. Stop loss insurance caps the insurer's losses above the attachment point on individual claims, while the aggregate deductible accumulates losses over multiple claims, triggering coverage only after total claims exceed this cumulative threshold.

Corridor Deductible

A corridor deductible serves as a threshold where the insured absorbs losses between the specific deductible and the stop loss limit, differing from an aggregate deductible which applies after all claims cumulatively reach a set amount. In stop loss insurance, the corridor deductible limits the insurer's liability within a specific range before full coverage resumes, contrasting with aggregate deductibles that require total claims accumulation before activation.

Claims Cap

Claims Cap limits the maximum payout on a claim, directly affecting Stop Loss insurance by capping insurer liability per individual claim; in contrast, an Aggregate Deductible sets a total annual threshold that must be met before coverage applies, impacting overall risk exposure. Stop Loss focuses on individual high-cost claims protection, while Aggregate Deductible manages cumulative losses over a policy period, making both essential for tailored risk management strategies.

Aggregate Limit

Aggregate limit defines the maximum payout an insurer will provide for all claims within a policy period, while aggregate deductible is the total amount the insured must pay out-of-pocket before coverage applies. Stop loss functions as a threshold that limits the insured's total financial responsibility, activating coverage once the aggregate deductible is met, effectively capping losses beyond a specified aggregate limit.

Layering Structure

In insurance contracts, the layering structure divides risk coverage into separate layers, with the stop loss protecting against losses exceeding a specified amount, while the aggregate deductible requires the insured to cover total claims up to a set limit before the insurer pays. Proper alignment of stop loss and aggregate deductible ensures balanced risk retention and premium optimization for self-insured plans.

Retention Level

Retention level represents the specific amount of loss a policyholder absorbs before a stop loss or aggregate deductible coverage activates, serving as a critical threshold in risk management strategies. Stop loss insurance limits losses on individual claims exceeding the retention level, whereas aggregate deductibles apply when total losses across claims surpass the retention threshold, optimizing financial protection and cash flow for self-insured entities.

Reinsurance Treaty

A Reinsurance Treaty involving Stop Loss coverage limits the reinsurer's liability once losses exceed a predefined threshold, providing protection against catastrophic claims, whereas an Aggregate Deductible requires the ceding company to absorb losses up to a certain aggregate amount before reinsurance coverage applies, emphasizing cumulative loss control over a policy period. Understanding the distinct financial risk-sharing mechanisms of Stop Loss versus Aggregate Deductible is critical for structuring reinsurance agreements that optimize capital efficiency and loss mitigation.

Loss Fund

Loss Fund represents the reserve of claims funds set aside by an insurer or self-insured entity to cover losses before reaching the Stop Loss or Aggregate Deductible thresholds. Stop Loss limits the maximum loss per individual or claim, while Aggregate Deductible establishes a total threshold for all claims combined, protecting the fund from excessive aggregate losses.

Risk Corridor

Risk corridors balance financial exposure between insurers and payers by limiting losses through mechanisms like stop loss and aggregate deductibles, ensuring predictable risk management. Stop loss protects against high individual claims by capping per-claim losses, while aggregate deductibles set a threshold for total claim costs, triggering risk corridor payments once exceeded.

Stop Loss vs Aggregate Deductible Infographic

moneydif.com

moneydif.com