Indemnity in insurance involves compensating the insured for their loss to restore them to their financial position before the damage occurred. Subrogation allows the insurer to pursue recovery from a third party responsible for causing the insured's loss after indemnifying the insured. Understanding the distinction between indemnity, which ensures loss coverage, and subrogation, which enables claim recovery, is crucial for effective claims management.

Table of Comparison

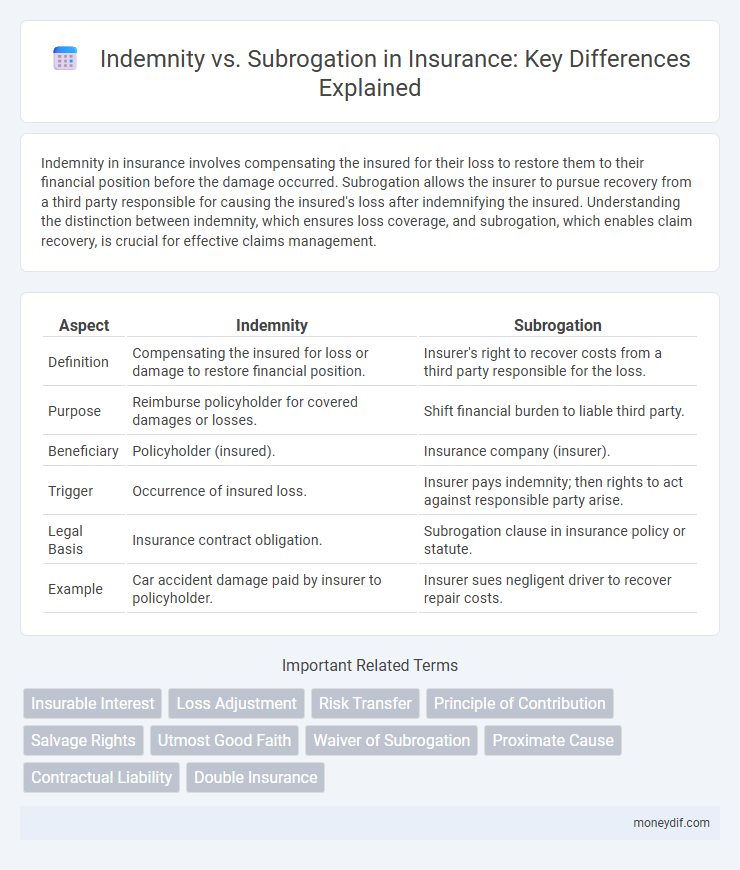

| Aspect | Indemnity | Subrogation |

|---|---|---|

| Definition | Compensating the insured for loss or damage to restore financial position. | Insurer's right to recover costs from a third party responsible for the loss. |

| Purpose | Reimburse policyholder for covered damages or losses. | Shift financial burden to liable third party. |

| Beneficiary | Policyholder (insured). | Insurance company (insurer). |

| Trigger | Occurrence of insured loss. | Insurer pays indemnity; then rights to act against responsible party arise. |

| Legal Basis | Insurance contract obligation. | Subrogation clause in insurance policy or statute. |

| Example | Car accident damage paid by insurer to policyholder. | Insurer sues negligent driver to recover repair costs. |

Understanding Indemnity in Insurance

Indemnity in insurance ensures that policyholders are restored to their financial position prior to a covered loss, preventing profit from claims. This principle limits compensation to the actual amount of damage or loss, safeguarding against over-insurance. Understanding indemnity is crucial for accurately assessing claim settlements and maintaining fairness between insurers and insured parties.

What Is Subrogation in Insurance?

Subrogation in insurance is the process by which an insurer seeks reimbursement from a third party responsible for causing a loss after compensating the policyholder. This legal right allows the insurer to recover payments made for claims, reducing overall costs and preventing the insured from receiving double compensation. Subrogation ensures that liability is appropriately assigned and helps maintain fair premium levels by shifting financial responsibility to the at-fault party.

Key Differences Between Indemnity and Subrogation

Indemnity involves compensating the insured party for a loss to restore them to their original financial position, while subrogation allows the insurer to pursue recovery from a third party responsible for the loss. Indemnity is a direct payment mechanism between insurer and insured, whereas subrogation transfers the insured's right to claim damages against the third party to the insurer. The key difference lies in indemnity addressing the insured's loss, and subrogation enabling the insurer to mitigate its own liability by seeking reimbursement.

How Indemnity Works in Insurance Claims

Indemnity in insurance claims ensures that the insured is restored to their financial position before the loss occurred, covering damages up to the policy limit without allowing profit. The insurer compensates the policyholder for verified losses, often requiring proof of loss and adherence to claim procedures. This principle prevents unjust enrichment by aligning payouts strictly with the actual value of the loss sustained.

The Role of Subrogation in Recovering Losses

Subrogation plays a crucial role in recovering losses by allowing an insurer to step into the shoes of the insured after a claim payment, pursuing reimbursement from the responsible third party. This mechanism helps insurance companies mitigate financial losses and stabilize premium rates by shifting liability costs away from the insurer. Effective subrogation processes enhance overall risk management and preserve the principle of indemnity by ensuring that claim payments are not duplicated.

Legal Foundations of Indemnity and Subrogation

Indemnity is grounded in the principle that an insured party should be restored to the financial position they occupied prior to a loss, preventing unjust enrichment. Subrogation allows insurers to assume the insured's legal rights to recover losses from third parties responsible for the damage, reinforcing equitable distribution of liability. Both doctrines rely on contract law and equitable principles to balance interests between insurers, insureds, and third parties.

Real-World Examples: Indemnity vs Subrogation

In insurance, indemnity ensures the policyholder is financially restored to their pre-loss position, such as an auto insurer paying for vehicle repairs after an accident. Subrogation allows the insurer to seek reimbursement from the at-fault third party, exemplified when a homeowner's insurer pursues payment from a negligent contractor responsible for fire damage. Real-world scenarios highlight indemnity's role in direct loss coverage and subrogation's function in cost recovery and preventing insured parties from collecting twice.

Benefits of Indemnity for Policyholders

Indemnity ensures policyholders receive fair compensation for their actual losses, restoring them to their financial position before the damage occurred. It minimizes out-of-pocket expenses by covering repair or replacement costs directly related to insured risks. This protection provides peace of mind and financial stability during unforeseen events.

The Impact of Subrogation on Insurance Premiums

Subrogation allows insurers to recover costs from third parties responsible for a loss, directly influencing insurance premiums by mitigating overall claim expenses. Successful subrogation efforts reduce the insurer's financial burden, helping to stabilize or potentially lower policyholder premiums over time. The efficiency of subrogation processes is a critical factor in underwriting practices and premium calculation models within the insurance industry.

Choosing the Right Coverage: Indemnity or Subrogation?

Choosing the right coverage between indemnity and subrogation depends on your specific insurance needs and risk management strategy. Indemnity ensures direct compensation for losses up to policy limits, protecting the insured from financial harm, while subrogation allows the insurer to recover costs by pursuing third-party claims after paying a loss. Evaluating policy terms, potential liabilities, and the likelihood of third-party fault helps determine whether indemnity or subrogation offers the most effective financial protection.

Important Terms

Insurable Interest

Insurable interest ensures that indemnity compensates a policyholder for actual loss, while subrogation allows the insurer to pursue recovery from third parties responsible for the damage.

Loss Adjustment

Loss adjustment involves determining indemnity payments to restore policyholders while subrogation enables insurers to recover costs from responsible third parties.

Risk Transfer

Risk transfer strategies involve indemnity agreements that shift loss responsibility to another party, while subrogation allows the indemnifying party to pursue recovery from the responsible third party.

Principle of Contribution

The Principle of Contribution ensures multiple insurers share the compensation proportionally in indemnity claims, while Subrogation allows an insurer to recover costs from a third party responsible for the loss.

Salvage Rights

Salvage rights grant the rescuer compensation for saving property from loss, typically under maritime law, while indemnity involves one party compensating another for a loss incurred, ensuring full reimbursement without benefiting from the claim. Subrogation allows the indemnitor to assume the indemnified party's legal rights to pursue recovery from third parties, optimizing asset recovery and preventing double compensation.

Utmost Good Faith

Utmost Good Faith requires full disclosure by the insured, ensuring that indemnity compensates the insured for loss without profit, while subrogation allows the insurer to recover costs from third parties responsible for the damage.

Waiver of Subrogation

Waiver of subrogation prevents an insurer from seeking reimbursement from a responsible third party, distinguishing it from indemnity clauses that transfer direct financial responsibility between parties.

Proximate Cause

Proximate cause determines the primary event responsible for loss, critically influencing indemnity payments by ensuring the insurer covers only damages directly linked to that cause; in subrogation, identifying proximate cause enables the insurer to seek recovery from the party legally liable for the loss, aligning financial responsibility appropriately. Indemnity restores the insured to their pre-loss position without profit, while subrogation transfers the insurer's right to pursue reimbursement, both reliant on clear proximate cause to enforce contractual and legal obligations effectively.

Contractual Liability

Contractual liability defines the scope of indemnity agreements while limiting or enabling subrogation rights to recover losses from third parties under insurance contracts.

Double Insurance

Double insurance involves multiple policies covering the same risk, requiring indemnity principles to prevent overcompensation and invoking subrogation rights to recover payments from other insurers.

Indemnity vs Subrogation Infographic

moneydif.com

moneydif.com