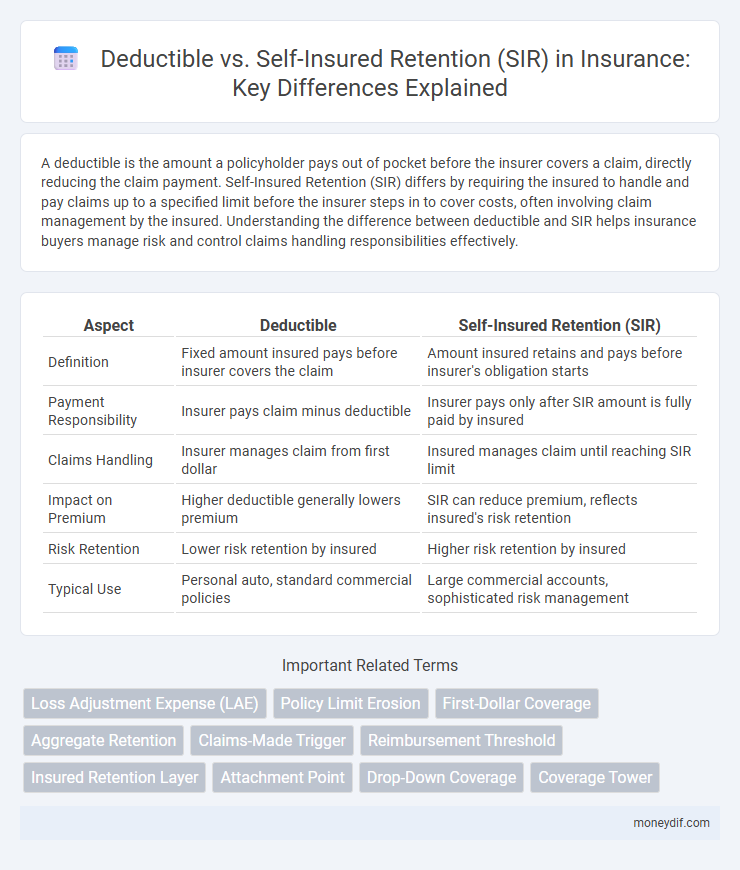

A deductible is the amount a policyholder pays out of pocket before the insurer covers a claim, directly reducing the claim payment. Self-Insured Retention (SIR) differs by requiring the insured to handle and pay claims up to a specified limit before the insurer steps in to cover costs, often involving claim management by the insured. Understanding the difference between deductible and SIR helps insurance buyers manage risk and control claims handling responsibilities effectively.

Table of Comparison

| Aspect | Deductible | Self-Insured Retention (SIR) |

|---|---|---|

| Definition | Fixed amount insured pays before insurer covers the claim | Amount insured retains and pays before insurer's obligation starts |

| Payment Responsibility | Insurer pays claim minus deductible | Insurer pays only after SIR amount is fully paid by insured |

| Claims Handling | Insurer manages claim from first dollar | Insured manages claim until reaching SIR limit |

| Impact on Premium | Higher deductible generally lowers premium | SIR can reduce premium, reflects insured's risk retention |

| Risk Retention | Lower risk retention by insured | Higher risk retention by insured |

| Typical Use | Personal auto, standard commercial policies | Large commercial accounts, sophisticated risk management |

Understanding Deductibles in Insurance Policies

Deductibles in insurance policies represent the fixed amount a policyholder must pay out-of-pocket before the insurer covers any expenses, directly impacting premium costs and claim settlements. Unlike Self-Insured Retention (SIR), which requires the policyholder to assume a larger initial loss and manage claims until the retention limit is met, deductibles are typically deducted from each individual claim payment. Understanding deductibles helps policyholders evaluate their financial exposure and optimize their insurance coverage for cost-effectiveness.

What is Self-Insured Retention (SIR)?

Self-Insured Retention (SIR) is the amount a policyholder must pay out-of-pocket before the insurance coverage begins to pay for a claim. Unlike a deductible, which is paid by the insurer on behalf of the insured, the insured is responsible for managing and paying claims within the retention limit. SIR is commonly used in commercial insurance policies to encourage risk management and reduce premium costs.

Key Differences Between Deductible and SIR

Deductible and Self-Insured Retention (SIR) differ primarily in the payment process; deductibles are amounts subtracted from a claim payment by the insurer, while SIR must be paid by the insured before the insurer's coverage begins. In deductible scenarios, the insurer handles the entire claim and then deducts the agreed amount, whereas with SIR, the insured manages and pays claims up to the retention limit. The key impact on risk management is that SIR policies require greater client involvement in claims administration, influencing cash flow and control over claim settlements.

How Deductibles Work in Claims Settlement

Deductibles in insurance policies require policyholders to pay a specified amount out-of-pocket before the insurer covers the remaining claim costs, effectively reducing small claims and controlling premium costs. Unlike self-insured retention (SIR), which must be paid entirely by the insured before any insurer payment, deductibles often involve the insurer covering losses immediately and then recovering the deductible amount from the insured. This mechanism streamlines claims settlement by allowing the insurer to manage and settle claims promptly while encouraging policyholders to avoid minor claims to minimize expenses.

How Self-Insured Retention (SIR) Functions

Self-Insured Retention (SIR) functions as an initial threshold amount a policyholder must pay out-of-pocket before the insurer's coverage begins, typically involving claim management handled by the insured. Unlike a deductible, where the insurer manages and pays the entire claim upfront then seeks reimbursement, SIR requires the insured to control and finance losses up to the retention limit directly. This mechanism incentivizes proactive risk management and can reduce premium costs by transferring early risk responsibility to the policyholder.

Financial Implications: Deductible vs. SIR

A deductible requires the insured to pay a fixed amount before insurance coverage begins, directly reducing the insurer's payout and often lowering premium costs. Self-Insured Retention (SIR) demands the insured to cover all losses up to a specified limit, resulting in higher upfront expense but increased control over claim management and cash flow. Financially, deductibles shift partial risk to the policyholder with predictable costs, while SIR exposes the insured to larger losses initially, impacting liquidity and requiring stronger risk management strategies.

Risk Management Considerations for Businesses

Deductibles and Self-Insured Retentions (SIR) are critical components in managing insurance costs and risk exposure for businesses, with deductibles requiring the insurer to pay from the first dollar while SIRs require the insured to handle losses up to the retention limit before insurer involvement. Risk management strategies must assess cash flow, claims frequency, and potential loss severity to determine optimal deductible or SIR levels, balancing premium savings against the financial impact of out-of-pocket expenses. Businesses benefit from analyzing historical loss data and leveraging risk transfer techniques to align deductible or SIR choices with overall risk tolerance and operational resilience.

Choosing Between Deductible and SIR: Factors to Evaluate

Choosing between a deductible and a self-insured retention (SIR) requires evaluating factors such as the insured's risk tolerance, cash flow capacity, and claims management capabilities. Deductibles are typically paid by the insured at the time of a claim, reducing premium costs upfront, while SIRs require the insured to pay losses up to the retention amount before insurer involvement, often necessitating more active claims handling. Analyzing the frequency and severity of potential claims alongside financial resources and administrative capabilities helps determine the most cost-effective and manageable option.

Claims Handling: Deductible vs. SIR Procedures

In claims handling, a deductible requires the insured to pay a specified amount before the insurer covers the remaining loss, with the insurer managing the entire claims process from the start. Self-Insured Retention (SIR) involves the insured retaining responsibility for claims up to a set amount, including initial claim investigation and defense costs, only involving the insurer once the retention threshold is exceeded. This distinction impacts claim reporting, legal defense control, and administrative processes, affecting overall risk management strategies.

Real-World Examples: Deductible and SIR in Action

In insurance claims, a deductible requires the insured to pay a fixed amount before the insurer covers the remaining costs, as seen in auto insurance where a $1,000 deductible means the policyholder pays the first $1,000 of repair expenses. Self-Insured Retention (SIR) applies primarily in commercial liability policies, such as a business facing a $50,000 SIR where it covers all costs up to that amount before the insurer intervenes. Real-world examples include a small business using an SIR to manage minor claims internally, reducing premiums, while an individual homeowner's policy uses a deductible to share risk and control premium costs.

Important Terms

Loss Adjustment Expense (LAE)

Loss Adjustment Expense (LAE) directly influences the cost structure of both Deductible and Self-Insured Retention (SIR) programs by covering the expenses related to investigating and settling claims. While deductibles typically transfer a fixed upfront cost to the insured, SIRs often entail more extensive administrative handling and higher LAE as the insured manages claims up to the retention limit before insurer involvement.

Policy Limit Erosion

Policy limit erosion occurs when defense costs and indemnity payments reduce the total available coverage under an insurance policy, often influenced by the interplay between the deductible and self-insured retention (SIR). Unlike deductibles where the insurer generally controls defense costs from the first dollar, SIR requires the insured to manage claims expenses until the retention is exhausted, impacting how quickly and to what extent the policy limits erode.

First-Dollar Coverage

First-Dollar Coverage eliminates the deductible, providing immediate insurance payment from the first dollar of loss, contrasting with Self-Insured Retention (SIR), which requires the insured to cover losses up to a specified amount before coverage begins. Businesses with high-risk profiles often choose SIR to control claims costs, while First-Dollar Coverage is preferred for predictable expenses and smoother cash flow management.

Aggregate Retention

Aggregate retention refers to the total amount a policyholder must pay for all claims during a policy period before the insurer begins to cover losses, distinct from a deductible which applies per claim. Self-Insured Retention (SIR) differs by requiring the insured to handle all claims administration and payment until the retention is met, whereas deductibles typically involve insurer-managed claims with the insured reimbursing the deductible portion.

Claims-Made Trigger

Claims-made trigger policies activate coverage when a claim is reported during the policy period, impacting how deductibles or Self-Insured Retentions (SIR) apply; deductibles require insured payment per claim while SIR involves retention of a higher amount before insurance coverage begins, often influencing liability limits and out-of-pocket expenses. Understanding the interaction between claims-made triggers and deductible versus SIR structures is essential for optimizing risk management and minimizing financial exposure in liability insurance contracts.

Reimbursement Threshold

The reimbursement threshold defines the amount an insured must pay before the insurer reimburses expenses, differing from the deductible which is paid out-of-pocket by the insured, whereas self-insured retention (SIR) requires the insured to cover losses up to a set limit before the insurer's obligation begins. Unlike deductibles, SIRs often involve the insured managing and paying claims directly until the retention is exhausted, affecting the timing and process of reimbursement.

Insured Retention Layer

The Insured Retention Layer represents the portion of risk that a policyholder retains before the insurance coverage applies, distinct from a deductible which is the fixed amount subtracted from a claim payment. Unlike deductibles, Self-Insured Retention (SIR) requires the insured to handle all claims expenses within this layer, often including claim handling costs, before the insurer's liability commences.

Attachment Point

The attachment point marks the threshold at which insurance coverage begins to apply, distinguishing the boundary between insured losses and policyholder responsibility. In policies with a deductible, the insurer pays losses exceeding the attachment point after the deductible is met, whereas in Self-Insured Retention (SIR), the policyholder retains responsibility for losses up to the attachment point before the insurer's coverage activates.

Drop-Down Coverage

Drop-down coverage activates when the self-insured retention (SIR) or deductible exceeds the underlying insurance limits, providing primary coverage that "drops down" to fill the gap. This coverage is crucial for mitigating exposure during large claims, ensuring insurers pay losses without shifting financial responsibility to policyholders until the SIR or deductible is exhausted.

Coverage Tower

Coverage Tower structures define layers of insurance protection where the Deductible represents the insured's initial out-of-pocket expense before coverage applies, whereas Self-Insured Retention (SIR) requires the insured to manage and pay claims within the retention limit before the insurer's obligation begins. Understanding the distinction between Deductible and SIR is crucial for optimizing risk management strategies and ensuring clear financial responsibility within an insurance program.

Deductible vs Self-Insured Retention (SIR) Infographic

moneydif.com

moneydif.com