A policy lapse occurs when premium payments are not made by the due date, causing a temporary loss of coverage that may be reinstated by paying overdue premiums. Cancellation is the formal termination of an insurance policy by either the insurer or the insured, resulting in the policy becoming void and coverage ending immediately or after a specified period. Understanding the differences between lapse and cancellation is crucial for maintaining continuous protection and avoiding coverage gaps.

Table of Comparison

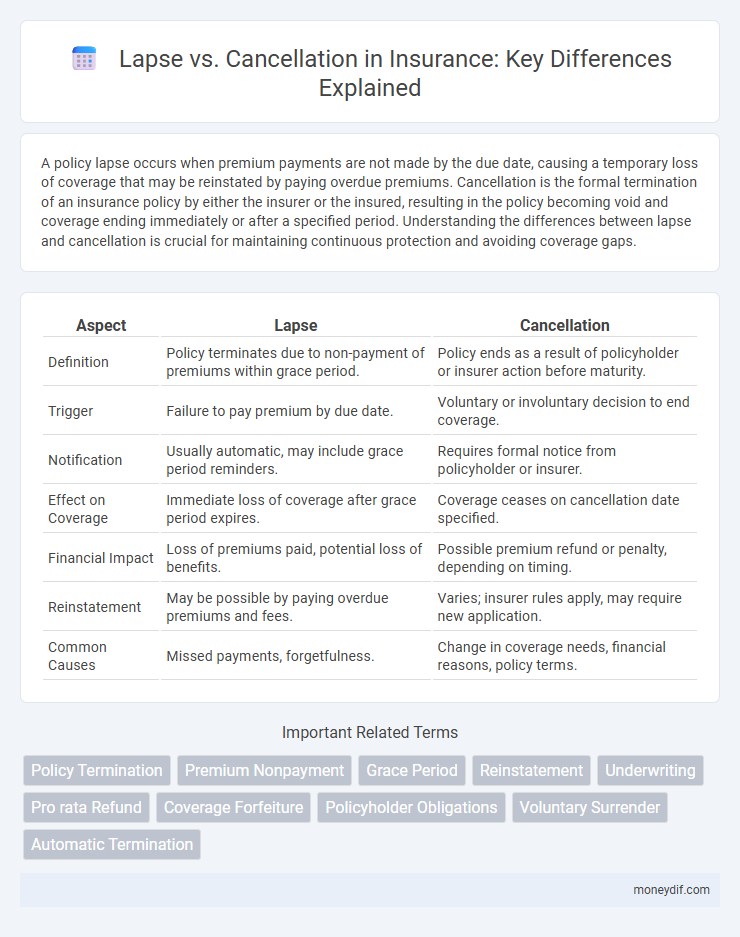

| Aspect | Lapse | Cancellation |

|---|---|---|

| Definition | Policy terminates due to non-payment of premiums within grace period. | Policy ends as a result of policyholder or insurer action before maturity. |

| Trigger | Failure to pay premium by due date. | Voluntary or involuntary decision to end coverage. |

| Notification | Usually automatic, may include grace period reminders. | Requires formal notice from policyholder or insurer. |

| Effect on Coverage | Immediate loss of coverage after grace period expires. | Coverage ceases on cancellation date specified. |

| Financial Impact | Loss of premiums paid, potential loss of benefits. | Possible premium refund or penalty, depending on timing. |

| Reinstatement | May be possible by paying overdue premiums and fees. | Varies; insurer rules apply, may require new application. |

| Common Causes | Missed payments, forgetfulness. | Change in coverage needs, financial reasons, policy terms. |

Understanding Policy Lapse and Cancellation

Policy lapse occurs when the insured fails to pay premiums within the grace period, resulting in the temporary or permanent termination of coverage without formal notice. Cancellation is an active process initiated by the insurer or policyholder to terminate the insurance contract before its expiration date, often accompanied by written notification. Understanding the differences between lapse and cancellation is crucial for maintaining continuous insurance protection and avoiding coverage gaps.

Key Differences Between Lapse and Cancellation

Lapse in insurance occurs when a policyholder fails to pay premiums within the grace period, resulting in the automatic termination of coverage, whereas cancellation is an active decision made by the insurer or policyholder to end the policy before its expiration date. Lapses typically happen due to non-payment, leading to potential loss of benefits and difficulties in reinstatement, while cancellations can be due to underwriting decisions, policy violations, or request by the insured. Understanding these distinct processes impacts coverage continuity, claims eligibility, and the possibility of policy reinstatement or renewal.

Common Reasons for Policy Lapse

Policy lapse commonly occurs due to missed premium payments, policyholder neglect, or financial hardship affecting the ability to pay premiums on time. Other reasons include failure to update contact information, misunderstanding policy terms, and lapses triggered by non-receipt of renewal notices. Insufficient funds in premium payment accounts or prioritizing other financial obligations over insurance premiums also significantly contribute to policy lapses.

Typical Causes of Policy Cancellation

Policy cancellation commonly occurs due to non-payment of premiums, providing false or misleading information during application, or failing to meet underwriting requirements. Lapses happen when policyholders neglect to pay premiums on time, but cancellations involve formal termination by the insurer for reasons such as fraud, misrepresentation, or significant risk changes. Understanding these causes helps policyholders maintain continuous coverage and avoid unexpected loss of insurance protection.

Impact on Coverage and Claims

A lapse in insurance occurs when premium payments are missed, causing the policy to become inactive without formal termination, which results in loss of coverage and denial of claims during the lapse period. Cancellation is a formal termination initiated by the insurer or policyholder that immediately ends coverage, eliminating any claim rights from the cancellation date onward. Both lapse and cancellation severely impact policyholder protection, but cancellation often leads to immediate and irreversible coverage loss.

Financial Consequences of Lapse vs Cancellation

Lapse in insurance coverage typically occurs when premium payments are missed, leading to the loss of policy benefits and potential difficulty in reinstating coverage, often with higher future premiums due to increased risk. Cancellation, initiated by the insurer or policyholder before the policy term ends, can result in prorated refunds or fees but may allow for smoother transitions to new policies without significant financial penalties. Both lapse and cancellation impact credit scores and financial planning, but lapses generally incur greater long-term costs due to loss of continuous coverage and potential underwriting complications.

How to Prevent Insurance Lapse

To prevent insurance lapse, ensure timely premium payments by setting up automatic bank drafts or calendar reminders. Regularly review policy documents and communicate with your insurer to address any coverage issues or billing discrepancies promptly. Maintaining accurate contact information with your insurer helps receive critical notices and avoid unintentional policy termination.

Steps to Take After Policy Cancellation

After a policy cancellation, promptly contact your insurer to understand the reasons and request detailed documentation to avoid future issues. Review your financial situation and explore options for reinstatement or obtaining a new policy to maintain coverage continuity. Document all communications and update your information to prevent lapses that could impact claims or premiums.

Reinstating a Lapsed Insurance Policy

Reinstating a lapsed insurance policy involves restoring coverage after the policy has ended due to non-payment of premiums within the grace period, distinguishing it from outright cancellation initiated by the insurer or policyholder. This process typically requires the payment of all overdue premiums, interest, and possibly proof of insurability, ensuring the policyholder regains continuous protection without starting a new policy. Understanding the reinstatement terms and conditions is crucial to avoid gaps in coverage and retain the original policy benefits.

Choosing the Right Action: Lapse or Cancel?

Choosing between lapse and cancellation in insurance depends on the policyholder's goals and financial situation. A lapse occurs when premium payments are missed, causing the policy to terminate automatically, often resulting in loss of coverage and potential eligibility for future policies at higher rates. Cancellation, initiated by the policyholder or insurer, formally ends the contract, allowing for planned termination or switching policies without risking unintended coverage gaps.

Important Terms

Policy Termination

Policy termination occurs when an insurance contract ends either by lapse, due to non-payment of premiums within the grace period, or by cancellation, initiated voluntarily by the policyholder or insurer before the policy's maturity. Lapse results in automatic expiration without coverage, whereas cancellation may involve partial refund and immediate cessation of benefits.

Premium Nonpayment

Premium nonpayment often leads to policy lapse, which occurs when the policyholder fails to pay premiums by the end of the grace period, resulting in temporary loss of coverage. Cancellation, on the other hand, is a formal termination of the insurance contract by the insurer, typically following an extended lapse or persistent nonpayment.

Grace Period

A grace period is a designated timeframe after the premium due date during which policyholders can make payments without policy lapse, preventing automatic cancellation. If the premium remains unpaid beyond this period, the policy lapses, losing coverage until reinstated or officially canceled.

Reinstatement

Reinstatement refers to the process of restoring a lapsed insurance policy, which occurs when the policyholder fails to pay premiums within the grace period, whereas cancellation signifies the complete termination of the policy by either the insurer or policyholder before its expiration. Understanding the distinction between lapse and cancellation is crucial, as reinstatement typically involves paying overdue premiums along with interest, while a canceled policy requires a new application and underwriting for coverage renewal.

Underwriting

Underwriting assesses risk factors influencing policy lapses, where lapses occur when premiums are unpaid and coverage ceases without formal termination; cancellations involve policy termination initiated by the insurer or policyholder, often triggered by underwriting decisions based on risk evaluation. Effective underwriting minimizes lapse rates by ensuring policyholders meet risk criteria, thereby reducing the financial impact of cancellations on the insurer.

Pro rata Refund

Pro rata refund calculates the reimbursement based on the exact unused portion of an insurance policy, typically applied during cancellation scenarios where coverage is terminated early. In contrast, lapse occurs when a policy expires due to non-payment, often resulting in no refund since the coverage period has ended unintentionally.

Coverage Forfeiture

Coverage forfeiture occurs when an insurance policy lapses due to non-payment of premiums, resulting in automatic termination of coverage without the policyholder receiving any refund. Cancellation, however, is an active termination initiated by either the insurer or insured, often allowing for prorated refunds and the possibility of reinstatement under certain conditions.

Policyholder Obligations

Policyholder obligations include timely premium payments to prevent lapse, which occurs when coverage ends due to nonpayment, whereas cancellation refers to the insurer terminating the policy under specified conditions. Maintaining premium schedules and notifying the insurer of changes ensures continuous coverage and avoids unintentional policy cancellation.

Voluntary Surrender

Voluntary surrender allows a policyholder to proactively terminate an insurance contract, differentiating it from lapse, which occurs due to non-payment, and cancellation, which is initiated by the insurer for policy violations or risk reassessment. This process often involves surrender charges and impacts the policy's cash value, whereas lapses and cancellations primarily affect coverage continuity and claim eligibility.

Automatic Termination

Automatic termination occurs when a policy or contract ends without the need for explicit cancellation, typically due to non-payment or expiration of the term, leading to a lapse that signifies the policy is no longer in force. Unlike cancellation, which is a voluntary or insured-initiated action to end coverage, lapse results from a failure to meet policy requirements, often causing the loss of benefits and potential reinstatement complications.

Lapse vs Cancellation Infographic

moneydif.com

moneydif.com