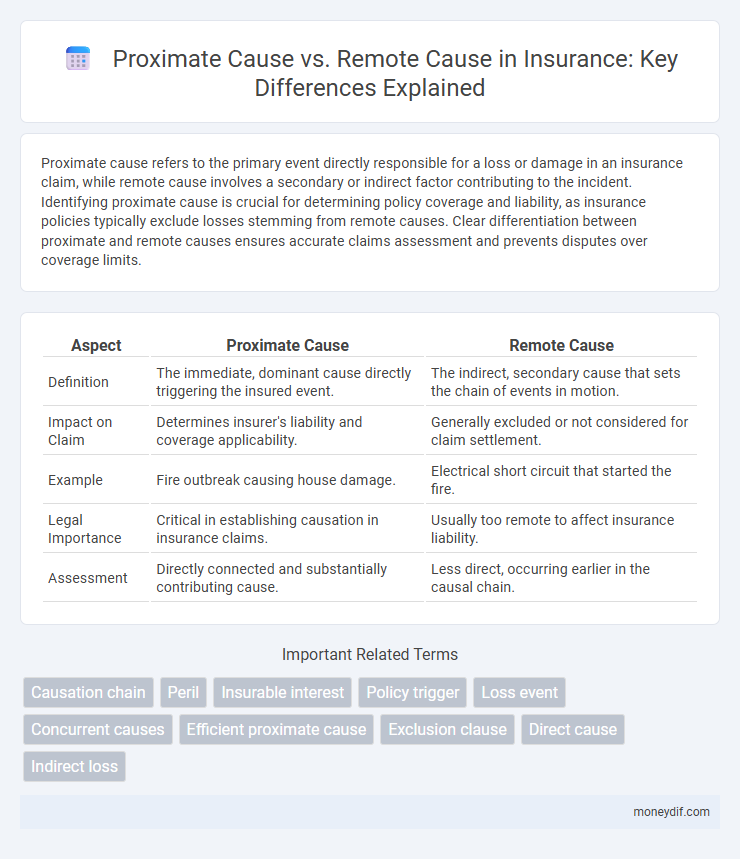

Proximate cause refers to the primary event directly responsible for a loss or damage in an insurance claim, while remote cause involves a secondary or indirect factor contributing to the incident. Identifying proximate cause is crucial for determining policy coverage and liability, as insurance policies typically exclude losses stemming from remote causes. Clear differentiation between proximate and remote causes ensures accurate claims assessment and prevents disputes over coverage limits.

Table of Comparison

| Aspect | Proximate Cause | Remote Cause |

|---|---|---|

| Definition | The immediate, dominant cause directly triggering the insured event. | The indirect, secondary cause that sets the chain of events in motion. |

| Impact on Claim | Determines insurer's liability and coverage applicability. | Generally excluded or not considered for claim settlement. |

| Example | Fire outbreak causing house damage. | Electrical short circuit that started the fire. |

| Legal Importance | Critical in establishing causation in insurance claims. | Usually too remote to affect insurance liability. |

| Assessment | Directly connected and substantially contributing cause. | Less direct, occurring earlier in the causal chain. |

Understanding Proximate Cause in Insurance

Proximate cause in insurance refers to the primary event responsible for causing a loss, directly linking the insured peril to the damage incurred. Insurers examine proximate cause to determine claim validity, ensuring coverage applies only when the loss stems from a covered risk rather than an indirect or remote cause. Accurately identifying proximate cause mitigates disputes regarding liability and helps streamline the claims process.

Defining Remote Cause in Insurance Policies

Remote cause in insurance refers to an indirect or secondary factor that eventually leads to a loss or damage but is not the immediate or direct cause covered by the policy. Insurance policies prioritize proximate cause, meaning only the nearest or most direct cause of the damage is typically considered for claims settlement. Understanding the distinction between proximate and remote causes is crucial for accurately interpreting policy coverage and claim eligibility.

Key Differences: Proximate Cause vs Remote Cause

Proximate cause in insurance refers to the primary event that directly leads to a loss or damage, establishing a clear causal link between the insured peril and the claim. Remote cause, on the other hand, involves an indirect or secondary factor that is too distant or unrelated to the loss to be considered the legal cause. Understanding the distinction between proximate and remote causes is crucial for claims adjudication and determining insurer liability.

Importance of Causation in Insurance Claims

Proximate cause is the direct, dominant cause of a loss or damage in insurance claims, determining the insurer's liability, while remote cause refers to indirect or incidental factors that are too far removed to trigger coverage. Establishing clear causation helps avoid disputes, ensuring accurate claim payouts and preventing fraudulent claims. Accurate identification of proximate cause is essential in underwriting policies and processing claims efficiently within insurance contracts.

Legal Principles Shaping Proximate Cause

Legal principles shaping proximate cause in insurance hinge on foreseeability and directness, determining whether an insured peril is closely connected to the loss. Courts analyze the sequence of events to identify the most immediate cause that sets the loss in motion, excluding remote causes that are too indirect or speculative. Establishing proximate cause affects claim validity by linking the insured peril directly to the damage sustained.

Typical Scenarios: Proximate and Remote Causes

Typical scenarios in insurance claims often involve distinguishing proximate causes, such as a direct fire damaging property, from remote causes like a preceding lightning strike that indirectly led to the fire. Proximate cause is the immediate event triggering loss, while remote cause relates to underlying factors that may contribute but are not the primary source of damage. Insurance policies prioritize proximate causes to determine liability and coverage eligibility, ensuring claims are settled based on the most direct cause of loss.

How Insurers Assess Causes in Claims

Insurers assess claims by identifying the proximate cause, which is the dominant event directly responsible for the loss, rather than remote causes that are indirect or incidental. The evaluation involves analyzing policy terms, loss chronology, and causation evidence to determine the primary trigger of damage covered under the insurance contract. Accurate differentiation between proximate and remote causes ensures appropriate claim settlements and risk management.

Case Law Examples: Proximate vs Remote Cause

Case law in insurance often distinguishes proximate cause as the direct, dominant cause of loss, whereas remote cause refers to a more indirect factor. In landmark cases like *Smith v. London Assurance* and *Chapelton v. Barry Urban District Council*, courts emphasized that proximate cause holds primary responsibility for triggering coverage, while remote causes typically fall outside policy protections. This distinction ensures that claims hinge on the most immediate event leading to damage, strengthening claim validity under policy terms.

Challenges in Determining the Operative Cause

Determining the operative cause in insurance claims involves distinguishing proximate cause, the dominant factor directly responsible for the loss, from remote causes, which are indirect or secondary contributors. Challenges arise due to complex event chains, overlapping causes, and legal interpretations that impact claim outcomes and liability assessments. Accurate identification requires thorough investigation and expert analysis to ensure appropriate risk allocation and policy enforcement.

Best Practices for Policyholders and Insurers

Proximate cause refers to the primary event or action directly leading to a loss, while remote cause denotes an indirect or secondary factor. Policyholders should clearly document incidents and understand policy terms to establish the proximate cause for claim approval. Insurers benefit from thorough investigations and clear communication to differentiate causes, ensuring accurate claims assessment and minimizing disputes.

Important Terms

Causation chain

The causation chain in legal and insurance contexts distinguishes between proximate cause, which is the direct and immediate cause of an event, and remote cause, which refers to an indirect or less immediate factor contributing to the outcome; proximate cause holds primary liability in establishing responsibility. Understanding the interplay between proximate and remote causes is crucial for accurately determining legal accountability and liability in complex cases involving multiple events or causes.

Peril

Peril defines the specific hazard causing loss, with proximate cause being the dominant, direct peril triggering the damage, while remote cause refers to indirect factors more distantly linked to the loss event.

Insurable interest

Insurable interest determines policy validity by ensuring the insured has a financial stake directly affected by the proximate cause rather than remote causes of loss.

Policy trigger

Policy trigger depends on establishing a proximate cause directly linked to the insured event rather than a remote cause that is too indirect to activate coverage.

Loss event

Loss events are primarily analyzed by distinguishing proximate causes, which directly trigger the damage, from remote causes that indirectly contribute to the loss.

Concurrent causes

Concurrent causes occur when multiple events simultaneously contribute to harm, distinguishing proximate cause as the primary direct factor and remote cause as an indirect or secondary factor in legal causation.

Efficient proximate cause

Efficient proximate cause refers to the immediate event directly responsible for an outcome, distinguishing it from remote causes that are indirect or underlying factors in legal and causal analysis.

Exclusion clause

An exclusion clause in a contract typically limits liability by specifying that losses caused by remote causes are excluded, while those resulting from proximate causes remain covered.

Direct cause

Direct cause serves as the immediate factor triggering an event, distinctly classified under proximate cause, unlike remote cause which involves indirect or distant factors.

Indirect loss

Indirect loss refers to damages that are not the immediate result of an incident but occur as a consequence of the proximate cause, which is the direct and immediate event leading to the loss. Remote cause involves events that are more distant or incidental, making the loss less foreseeable and often excluded from insurance coverage due to the indirect nature of the damage.

Proximate Cause vs Remote Cause Infographic

moneydif.com

moneydif.com