Facultative reinsurance involves the ceding insurer transferring risk for individual policies to the reinsurer, offering tailored coverage on a case-by-case basis. Treaty reinsurance covers a portfolio of policies under a pre-agreed contract, providing automatic risk-sharing and streamlined administration. Choosing between facultative and treaty reinsurance depends on the insurer's need for flexibility versus the efficiency of handling bulk risk exposures.

Table of Comparison

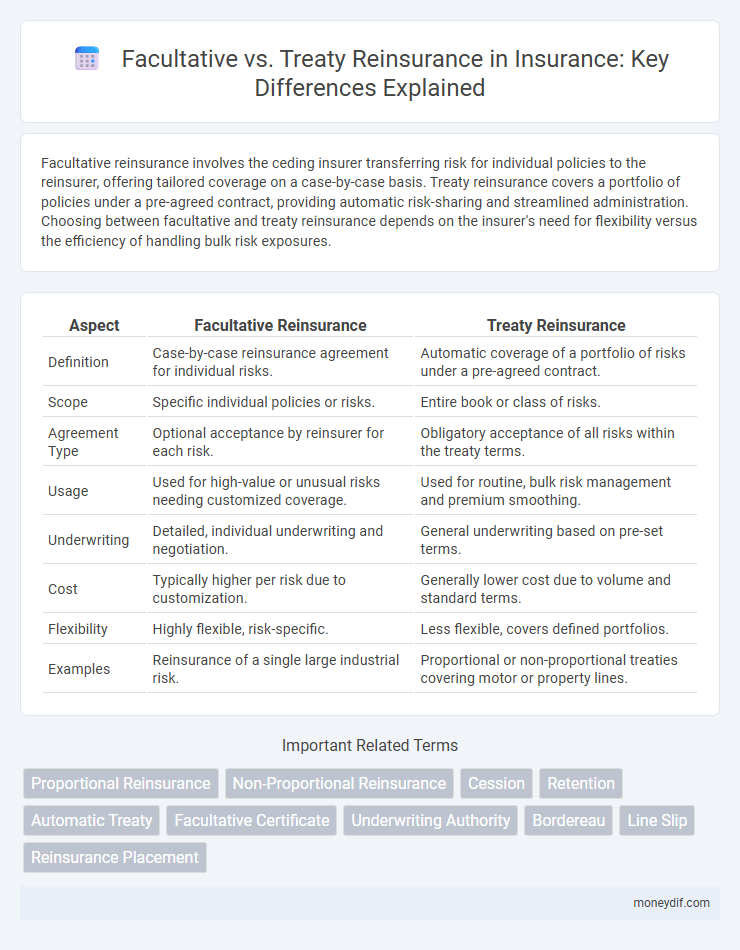

| Aspect | Facultative Reinsurance | Treaty Reinsurance |

|---|---|---|

| Definition | Case-by-case reinsurance agreement for individual risks. | Automatic coverage of a portfolio of risks under a pre-agreed contract. |

| Scope | Specific individual policies or risks. | Entire book or class of risks. |

| Agreement Type | Optional acceptance by reinsurer for each risk. | Obligatory acceptance of all risks within the treaty terms. |

| Usage | Used for high-value or unusual risks needing customized coverage. | Used for routine, bulk risk management and premium smoothing. |

| Underwriting | Detailed, individual underwriting and negotiation. | General underwriting based on pre-set terms. |

| Cost | Typically higher per risk due to customization. | Generally lower cost due to volume and standard terms. |

| Flexibility | Highly flexible, risk-specific. | Less flexible, covers defined portfolios. |

| Examples | Reinsurance of a single large industrial risk. | Proportional or non-proportional treaties covering motor or property lines. |

Introduction to Facultative and Treaty Reinsurance

Facultative reinsurance involves the ceding insurer transferring individual risks to the reinsurer on a case-by-case basis, providing tailored coverage for specific policies. Treaty reinsurance covers a portfolio of risks under a pre-agreed contract, automatically reinsuring policies that meet the defined criteria. Both methods enhance risk management, but facultative reinsurance offers selective risk sharing, while treaty reinsurance ensures continuous protection across grouped exposures.

Defining Facultative Reinsurance

Facultative reinsurance involves the ceding insurer transferring individual risks to the reinsurer on a case-by-case basis, allowing tailored coverage for specific policies. This type of reinsurance provides flexibility by enabling detailed underwriting and risk assessment for unique or high-value exposures. Unlike treaty reinsurance, facultative agreements require separate negotiations for each risk, enhancing precision in risk management and pricing.

Understanding Treaty Reinsurance

Treaty reinsurance is a form of agreement where the reinsurer automatically accepts a predetermined portion or type of risks from the ceding insurer, streamlining risk management and underwriting processes. This type of reinsurance enhances the ceding company's capacity by providing continuous risk coverage without needing individual risk approval, crucial for large portfolios. Key benefits include improved capital efficiency, consistent loss protection, and the ability to underwrite larger or more diverse risks with shared financial exposure.

Key Differences Between Facultative and Treaty Reinsurance

Facultative reinsurance covers individual risks on a case-by-case basis, allowing insurers to select specific policies for coverage, while treaty reinsurance involves a pre-agreed portfolio of risks transferred automatically between the insurer and reinsurer. Facultative reinsurance offers more flexibility and underwriting control, whereas treaty reinsurance provides continual, broad risk protection and administrative efficiency. The choice between facultative and treaty reinsurance impacts risk management strategies, premium ceding, and claims handling in the insurance industry.

Advantages of Facultative Reinsurance

Facultative reinsurance offers precise risk selection by allowing insurers to cede specific individual risks, enhancing portfolio management and underwriting accuracy. It provides flexibility in coverage terms tailored to unique or high-value risks that may not fit within treaty agreements. This approach reduces exposure to large losses and supports effective capital allocation in complex insurance programs.

Advantages of Treaty Reinsurance

Treaty reinsurance offers insurers consistent risk transfer by covering an entire portfolio of policies, enhancing underwriting capacity and stabilizing loss experience. It reduces administrative expenses due to automatic coverage without the need for individual policy negotiations, accelerating claims settlement and improving cash flow management. Furthermore, treaty reinsurance fosters long-term partnerships between ceding companies and reinsurers, facilitating better risk assessment and financial planning.

Limitations of Facultative Reinsurance

Facultative reinsurance has limitations in that it requires individual underwriting approval for each risk, leading to slower processing times compared to treaty reinsurance. This type of reinsurance also lacks the efficiency of automatic coverage, making it less suitable for portfolios with high volumes of homogeneous risks. Insurers may face increased administrative costs and potential gaps in coverage due to selective acceptance under facultative reinsurance agreements.

Limitations of Treaty Reinsurance

Treaty reinsurance imposes limitations such as fixed coverage terms that may not fully address unusual or high-risk exposures, restricting flexibility for ceding insurers. It covers a predefined portfolio of risks, which can lead to systemic vulnerability if the entire portfolio experiences correlated losses. These constraints often necessitate facultative reinsurance to manage specific, exceptional risks beyond treaty scope.

Choosing Between Facultative and Treaty Reinsurance

Choosing between facultative and treaty reinsurance depends on risk specificity and portfolio strategy. Facultative reinsurance offers tailored coverage for individual, high-risk policies, allowing underwriters to evaluate and price each risk separately. Treaty reinsurance provides automatic coverage for a defined portfolio, promoting consistency and efficiency in risk management across multiple policies.

Impact of Reinsurance Type on Risk Management

Facultative reinsurance allows insurers to cede individual risks selectively, enhancing risk management by providing customized coverage for high-value or unusual exposures. Treaty reinsurance involves automatic coverage of a portfolio of risks, enabling consistent risk transfer and stabilization of loss experience across multiple policies. The choice between facultative and treaty reinsurance directly impacts an insurer's capital allocation, underwriting flexibility, and overall financial stability.

Important Terms

Proportional Reinsurance

Proportional reinsurance involves sharing premiums and losses between the primary insurer and reinsurer based on an agreed percentage, distinguishing it from facultative reinsurance, which is negotiated separately for individual risks. Treaty reinsurance, in contrast, covers a portfolio of risks automatically under a contract, streamlining coverage and providing broader risk management compared to facultative arrangements.

Non-Proportional Reinsurance

Non-proportional reinsurance provides coverage for losses exceeding a specified amount, primarily used in treaty reinsurance to protect against high-severity claims across a portfolio, whereas facultative reinsurance addresses individual risks on a case-by-case basis. This arrangement allows insurers to limit exposure to catastrophic losses while customizing coverage for unique or large risks through facultative contracts.

Cession

Cession in facultative reinsurance involves individually negotiated risk transfers, while treaty reinsurance cession covers predefined portfolios under automatic agreements. Facultative cessions offer tailored risk selection, whereas treaty cessions provide broader, continuous protection with standardized terms.

Retention

Retention in facultative reinsurance refers to the portion of risk the ceding insurer retains before passing excess liability to the reinsurer, typically negotiated on a policy-by-policy basis. In treaty reinsurance, retention is a predetermined amount or percentage of risk retained by the ceding company under an agreement covering a portfolio of policies, ensuring consistent risk sharing between the insurer and reinsurer.

Automatic Treaty

Automatic treaty reinsurance involves a predefined agreement where the ceding insurer automatically transfers a specified portion of risks to the reinsurer, ensuring comprehensive coverage without individual underwriting. Unlike facultative reinsurance, which is negotiated on a case-by-case basis for specific risks, automatic treaty streamlines risk management by encompassing a portfolio of policies under a consistent reinsurance contract.

Facultative Certificate

A Facultative Certificate documents the acceptance of individual risks by an insurer under facultative reinsurance, where each risk is negotiated separately. Unlike treaty reinsurance, which covers a portfolio of risks automatically, facultative reinsurance allows tailored coverage and specific risk assessment for unique or high-value exposures.

Underwriting Authority

Underwriting authority delineates the extent to which reinsurers can approve risks, with facultative reinsurance granting reinsurers case-by-case approval for individual risks, while treaty reinsurance provides automatic acceptance of a portfolio of risks under a pre-agreed contract. Facultative underwriting authority requires detailed risk assessment for each submission, whereas treaty authority streamlines risk transfer by binding reinsurers to predefined terms and limits without individual approval.

Bordereau

A Bordereau is a detailed report submitted by a cedant to a reinsurer, listing individual risks, premiums, and claims relevant to Facultative or Treaty Reinsurance agreements. In Facultative Reinsurance, Bordereaux focus on specific, singular risks, whereas in Treaty Reinsurance, they cover a portfolio of risks under a pre-agreed contract.

Line Slip

Line slip serves as a flexible facultative reinsurance mechanism allowing multiple reinsurers to share risk on a pre-agreed basis without underwriting each policy individually, enhancing efficiency compared to traditional treaty reinsurance. This arrangement streamlines coverage for complex or large risks by combining features of facultative discretion with treaty reinsurance's collective risk-sharing structure.

Reinsurance Placement

Reinsurance placement involves allocating risk between primary insurers and reinsurers through two main types: facultative reinsurance, which covers individual risks requiring separate negotiation, and treaty reinsurance, which automatically covers a portfolio of risks under a pre-agreed contract. Effective placement strategies optimize risk transfer, enhance capacity, and stabilize loss experience by balancing the detailed customization of facultative reinsurance with the broad coverage of treaty reinsurance.

Facultative vs Treaty Reinsurance Infographic

moneydif.com

moneydif.com