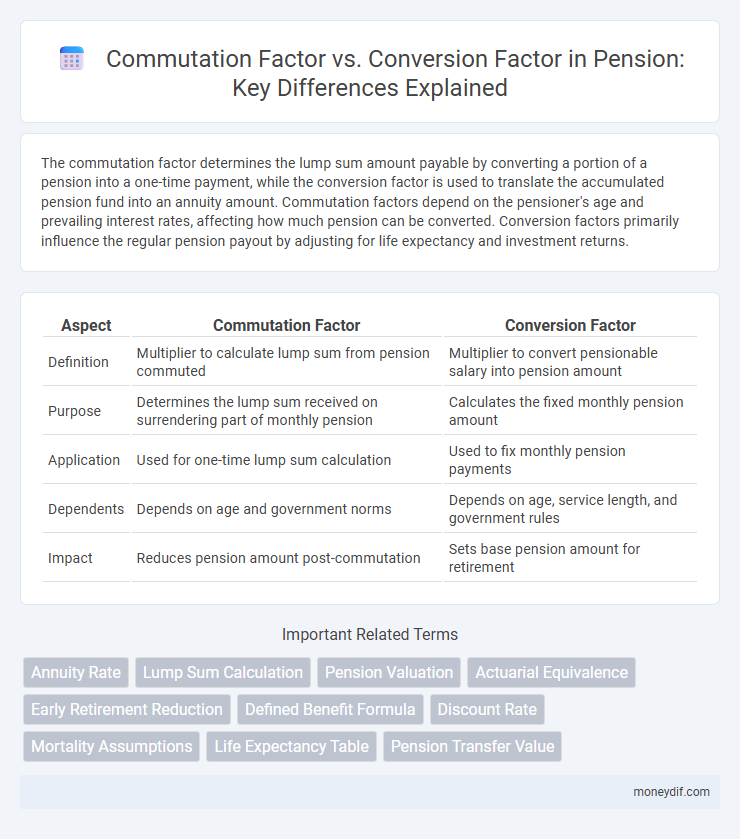

The commutation factor determines the lump sum amount payable by converting a portion of a pension into a one-time payment, while the conversion factor is used to translate the accumulated pension fund into an annuity amount. Commutation factors depend on the pensioner's age and prevailing interest rates, affecting how much pension can be converted. Conversion factors primarily influence the regular pension payout by adjusting for life expectancy and investment returns.

Table of Comparison

| Aspect | Commutation Factor | Conversion Factor |

|---|---|---|

| Definition | Multiplier to calculate lump sum from pension commuted | Multiplier to convert pensionable salary into pension amount |

| Purpose | Determines the lump sum received on surrendering part of monthly pension | Calculates the fixed monthly pension amount |

| Application | Used for one-time lump sum calculation | Used to fix monthly pension payments |

| Dependents | Depends on age and government norms | Depends on age, service length, and government rules |

| Impact | Reduces pension amount post-commutation | Sets base pension amount for retirement |

Introduction to Pension Commutation and Conversion Factors

Pension commutation refers to the process of exchanging a portion of a retiree's future pension payments for a lump-sum amount at retirement, calculated using the commutation factor. The commutation factor is a predetermined value that reflects the present value of pension benefits forgone, influenced by interest rates and life expectancy. Conversely, the conversion factor is used to determine the annual pension amount from a lump sum, helping employees understand the trade-off between immediate cash and long-term pension income.

Defining Commutation Factor in Pensions

The commutation factor in pensions determines the lump sum amount payable when a portion of the pension is converted into a one-time payment at retirement. It depends on factors like age, interest rates, and mortality tables, reflecting the present value of future pension payments foregone. Unlike the conversion factor, which is used to calculate the pension amount from the accumulated fund, the commutation factor specifically applies to converting part of the pension into cash upfront.

Understanding the Conversion Factor in Pension Schemes

The conversion factor in pension schemes determines the lump sum amount an individual can receive by converting a portion of their pension benefits into a one-time payment, reflecting the actuarial assumptions and interest rates used by the scheme. It differs from the commutation factor, which specifically calculates the value of pension foregone in exchange for the lump sum, often based on age and pension regulations. Understanding the conversion factor is crucial for accurately estimating retirement benefits and making informed decisions about lump sum withdrawals versus regular pension income.

Key Differences Between Commutation and Conversion Factors

Commutation factor determines the lump sum amount payable in exchange for pension by converting a portion of the pension into a present value lump sum, whereas conversion factor is used to calculate the monthly pension amount from the accumulated pension fund. The commutation factor considers factors like age and interest rates to quantify the monetary equivalent of the pension portion commuted; conversion factor primarily depends on actuarial tables reflecting life expectancy and interest rates for pension calculation. Understanding these distinctions is crucial for pension planning, affecting the trade-off between immediate lump sum benefits and long-term monthly pension income.

How Commutation Factor Affects Lump Sum Withdrawals

The commutation factor directly determines the lump sum amount a pensioner can withdraw at retirement by converting a portion of the monthly pension into a one-time payment. Unlike the conversion factor, which is used to calculate the monthly pension from a lump sum, the commutation factor reduces the pension size in exchange for a larger immediate payout. A higher commutation factor increases the lump sum amount but proportionally decreases the future monthly pension payments.

Impact of Conversion Factor on Monthly Pension Income

The conversion factor directly influences the monthly pension income by determining the lump sum amount exchanged for reduced future pension payments, impacting retirees' financial planning. A higher conversion factor decreases the monthly pension but increases the lump sum received upfront, while a lower factor increases the ongoing monthly pension but reduces the immediate cash benefit. Pensioners must carefully evaluate conversion factors relative to commutation factors to optimize their long-term retirement income stability.

Calculation Methods: Commutation Factor vs Conversion Factor

The commutation factor is calculated using actuarial tables that consider the retiree's age, life expectancy, and interest rate to determine the lump sum equivalent of a pension annuity. The conversion factor, on the other hand, is derived from standardized mortality rates and discount rates to convert a pension fund's lump sum into a monthly pension amount. While the commutation factor focuses on converting a portion of pension into a lump sum, the conversion factor converts the total pension fund into a periodic pension payment based on survival probabilities and interest assumptions.

Tax Implications of Commutation and Conversion Factors

The commutation factor determines the lump sum amount received when converting a portion of the pension into a one-time payment, which is subject to specific tax exemptions under Section 10(10A) of the Income Tax Act. The conversion factor is used to calculate the monthly pension amount post-commutation, influencing the taxable pension income, as any remaining pension is fully taxable as per regular income tax slabs. Understanding these factors is crucial for optimizing tax benefits, as the lump sum commuted amount can be partially or fully tax-free, whereas the converted pension amount forms part of the taxable pension income.

Choosing Between Commutation and Conversion Options

Choosing between commutation and conversion options depends on the retiree's preference for lump-sum benefits versus monthly pension income. The commutation factor determines the present value of the pension surrendered for a lump sum, whereas the conversion factor calculates the monthly pension amount converted from the commuted lump sum. Evaluating the factors based on longevity, financial needs, and tax implications helps optimize retirement income strategy.

Frequently Asked Questions on Pension Commutation and Conversion Factors

Pension commutation factor determines the lump sum amount an employee receives in exchange for reducing their monthly pension, calculated based on age and interest rates at retirement. The conversion factor is used to convert the pensionable amount into an equivalent monthly pension, reflecting actuarial assumptions and life expectancy. Understanding these factors clarifies how pensions are structured, helping retirees make informed decisions about lump sum withdrawals versus ongoing monthly benefits.

Important Terms

Annuity Rate

The annuity rate depends on the commutation factor, which calculates present value of future payments, while the conversion factor determines the lump sum needed to purchase the annuity.

Lump Sum Calculation

Lump Sum Calculation in pension plans depends on the Commutation Factor, which converts a portion of the pension into a one-time cash payment, while the Conversion Factor is used to determine the monthly pension amount from the lump sum.

Pension Valuation

Pension valuation involves calculating the present value of future pension liabilities, where the commutation factor determines the lump sum payable on surrender of part of the pension, and the conversion factor translates the accumulated pension fund into an annual pension amount. Accurate assessment of both factors is critical for actuarial valuations, ensuring fair benefit calculations and compliance with regulatory standards.

Actuarial Equivalence

Actuarial equivalence ensures that the commutation factor and conversion factor yield equivalent present values when converting future cash flows or pension benefits into lump-sum amounts.

Early Retirement Reduction

The Early Retirement Reduction significantly impacts pension calculations by applying a commutation factor to convert future benefits into lump sums, whereas the conversion factor determines the annual pension value from the commuted sum.

Defined Benefit Formula

The Defined Benefit Formula calculates pension benefits by multiplying the pensionable salary and service years, using the Commutation Factor to determine lump-sum conversions and the Conversion Factor to translate pension amounts into equivalent annuities.

Discount Rate

The discount rate directly influences the commutation factor and conversion factor by determining the present value of future payments used in actuarial calculations for annuities and pensions.

Mortality Assumptions

Mortality assumptions directly impact the calculation of commutation factors and conversion factors by influencing the expected present value of future life-contingent cash flows in actuarial models.

Life Expectancy Table

The Life Expectancy Table provides critical data for accurately calculating Commutation Factors and Conversion Factors used in actuarial present value assessments and pension plan valuations.

Pension Transfer Value

Pension Transfer Value calculations depend heavily on the Commutation Factor, which determines the lump sum payable for relinquishing future pension income, while the Conversion Factor translates annual pension entitlements into a capital value. Accurate comparison of these factors is crucial for members evaluating the financial benefits of commuting part of their pension versus transferring their pension pot.

Commutation Factor vs Conversion Factor Infographic

moneydif.com

moneydif.com