The annuity factor determines the present value of a stream of future pension payments, enabling retirees to understand the worth of lifelong income. Lump sum commutation allows pension holders to exchange a portion of their future pension for an immediate one-time payment. Evaluating annuity factors versus lump sum commutation is crucial for maximizing retirement benefits and aligning with individual financial goals.

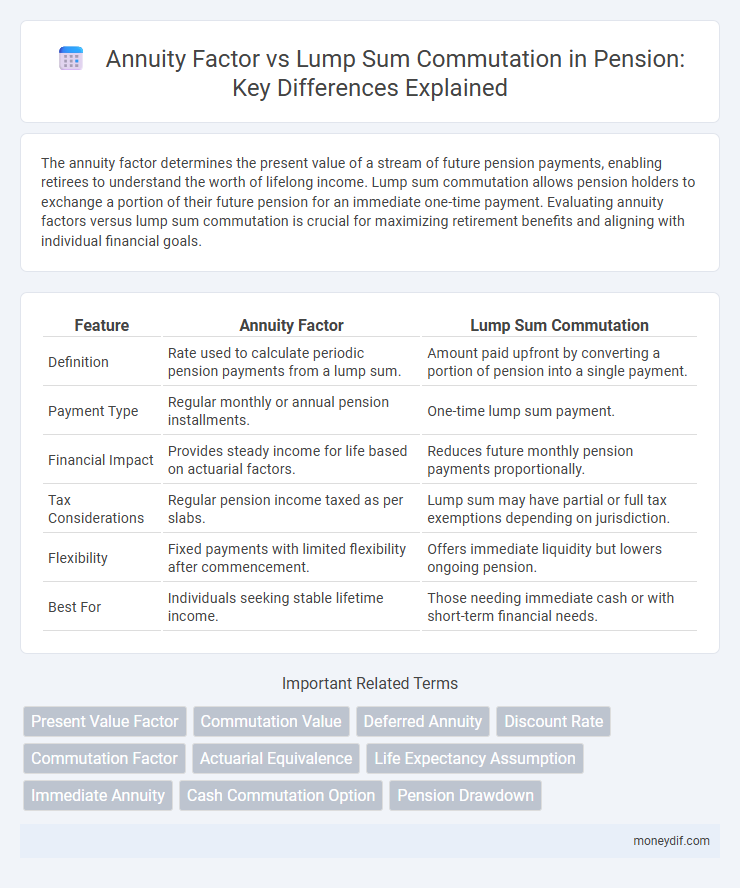

Table of Comparison

| Feature | Annuity Factor | Lump Sum Commutation |

|---|---|---|

| Definition | Rate used to calculate periodic pension payments from a lump sum. | Amount paid upfront by converting a portion of pension into a single payment. |

| Payment Type | Regular monthly or annual pension installments. | One-time lump sum payment. |

| Financial Impact | Provides steady income for life based on actuarial factors. | Reduces future monthly pension payments proportionally. |

| Tax Considerations | Regular pension income taxed as per slabs. | Lump sum may have partial or full tax exemptions depending on jurisdiction. |

| Flexibility | Fixed payments with limited flexibility after commencement. | Offers immediate liquidity but lowers ongoing pension. |

| Best For | Individuals seeking stable lifetime income. | Those needing immediate cash or with short-term financial needs. |

Understanding Pension Options: Annuity Factor and Lump Sum Commutation

Annuity factor determines the annual pension payable based on life expectancy and interest rates, essential for calculating steady retirement income. Lump sum commutation allows a portion of the pension to be converted into a one-time payment, reducing the ongoing pension but providing immediate liquidity. Understanding the balance between annuity factors and lump sum commutation helps retirees optimize income security and financial flexibility during retirement.

What Is Annuity Factor in Pension Calculations?

Annuity factor in pension calculations represents the present value of future pension payments, used to determine the lump sum equivalent of a periodic annuity. It is calculated based on interest rates, life expectancy, and payment frequency, reflecting the cost to provide a pension over the retiree's expected lifespan. This factor is crucial in comparing annuity vs lump sum commutation options, ensuring accurate financial decision-making for pension benefits.

Lump Sum Commutation: Meaning and Process Explained

Lump Sum Commutation refers to the process of converting a portion of a pension annuity into a one-time cash payment, allowing retirees immediate access to funds. The commutation amount is calculated using a commutation factor, which considers life expectancy and prevailing interest rates to determine the lump sum value. This option provides flexibility in retirement planning by enabling partial withdrawal while reducing future annuity payments.

Key Differences Between Annuity Factor and Lump Sum Commutation

The annuity factor represents the present value of future pension payments and is used to calculate periodic retirement income, while lump sum commutation converts a portion of the pension into a one-time payment, reducing future monthly benefits. Annuity factor depends on variables such as age, interest rates, and life expectancy, whereas lump sum commutation involves a predetermined commutation rate set by the pension scheme. Choosing between annuity factor and lump sum commutation affects the beneficiary's cash flow, tax implications, and long-term retirement security.

Pros and Cons of Taking Lump Sum vs Annuity in Pension

Choosing a lump sum commutation offers immediate access to a large amount of money, providing flexibility for investments or urgent expenses, but it risks outliving your savings without guaranteed lifelong income. Opting for an annuity factor ensures a steady and predictable monthly pension payment for life, protecting against longevity risk but limiting liquidity and potential growth. Evaluating personal financial goals, health status, and market conditions is crucial when deciding between lump sum and annuity options in pension planning.

Factors Influencing the Choice: Annuity Factor or Lump Sum

Factors influencing the choice between annuity factor and lump sum commutation include interest rates, life expectancy, and personal financial goals. Higher interest rates increase the annuity factor, making regular payments more valuable, while longer life expectancy favors annuities for sustained income. Tax implications and liquidity needs also play critical roles in deciding between a guaranteed annuity stream or a one-time lump sum payout.

Tax Implications: Annuity Payments vs Lump Sum Withdrawals

Annuity payments are typically taxed as regular income, spreading the tax liability over many years, which can result in a lower overall tax rate. Lump sum withdrawals often trigger immediate tax charges on the entire amount, potentially pushing individuals into higher tax brackets for that year. Understanding the differences in tax treatment between annuity factor calculations and lump sum commutation is crucial for optimizing retirement income and minimizing tax burdens.

How to Calculate Annuity Factor and Lump Sum Commutation Value

The annuity factor is calculated by summing the present value of future pension payments, using the formula PV = PMT x [(1 - (1 + r)^-n) / r], where PMT is the pension payment, r is the discount rate, and n is the number of payment periods. Lump sum commutation value is determined by multiplying the annual pension amount by a commutation factor, which reflects the pension scheme's specific rate for converting pension income into a one-time payment. Actuarial tables and mortality rates are essential inputs in deriving accurate annuity and commutation factors for pension calculations.

Risk Assessment: Security of Annuity vs Flexibility of Lump Sum

The annuity factor provides a guaranteed income stream, minimizing longevity and market risks by ensuring financial security throughout retirement. In contrast, lump sum commutation offers flexibility to manage and invest funds independently but exposes individuals to investment volatility and potential depletion risk. Assessing risk tolerance and financial goals is crucial when choosing between the guaranteed predictability of annuities and the adaptable but uncertain nature of lump sum payments.

Making the Right Choice: Assessing Your Pension Withdrawal Strategy

Evaluating the annuity factor versus lump sum commutation requires analyzing life expectancy, interest rates, and tax implications to maximize pension income. Annuity factors provide a steady, guaranteed stream of payments based on actuarial calculations, whereas lump sum commutation offers immediate access to a large payment but reduces future income security. Prioritizing long-term financial stability and personal retirement goals ensures the optimal pension withdrawal strategy tailored to individual needs.

Important Terms

Present Value Factor

Present Value Factor quantifies the current worth of future cash flows, contrasting the Annuity Factor's calculation of equal periodic payments with the Lump Sum Commutation's single payment valuation.

Commutation Value

Commutation Value calculates the lump sum payment by multiplying the annuity factor with the pension amount, converting future annuity payments into a present lump sum equivalent.

Deferred Annuity

Deferred annuity calculations often utilize the annuity factor to determine the present value of future payments, facilitating comparisons with lump sum commutations. The annuity factor represents the discounted sum of future cash flows, enabling actuaries to estimate the lump sum needed today to replace a series of deferred payments.

Discount Rate

The discount rate is crucial in calculating both annuity factors and lump sum commutation values, as it determines the present value of future payments by reflecting the time value of money and risk. Higher discount rates reduce annuity factors and lump sum commutation values, impacting pension valuations and financial planning decisions.

Commutation Factor

The commutation factor, integral to actuarial calculations, quantifies the present value of future payments, enabling the comparison between lump sum commutation and annuity factor for precise pension settlement decisions.

Actuarial Equivalence

Actuarial equivalence ensures the present value of an annuity factor matches the lump sum commutation value by applying consistent mortality rates and interest assumptions.

Life Expectancy Assumption

Life expectancy assumption critically influences the calculation of annuity factors by determining the expected payment period, directly affecting the lump sum commutation value used for pension and insurance settlements.

Immediate Annuity

Immediate annuities use the annuity factor to convert a lump sum into a stream of periodic payments, reflecting time value of money and mortality assumptions.

Cash Commutation Option

Cash commutation option allows pensioners to exchange a portion of their annuity for a lump sum payment by applying a commutation factor to the annuity factor, optimizing retirement income flexibility.

Pension Drawdown

Pension drawdown strategies balance annuity factor calculations and lump sum commutation options to optimize retirement income and tax efficiency.

Annuity Factor vs Lump Sum Commutation Infographic

moneydif.com

moneydif.com