Commutation of pension involves converting a portion of the pension into a lump sum amount received at retirement, reducing the monthly pension payments thereafter. Uncommuted pension provides a continuous monthly income without any upfront lump sum, offering long-term financial stability. Choosing between commutation and uncommuted pension depends on immediate cash needs versus preference for steady pension income during retirement.

Table of Comparison

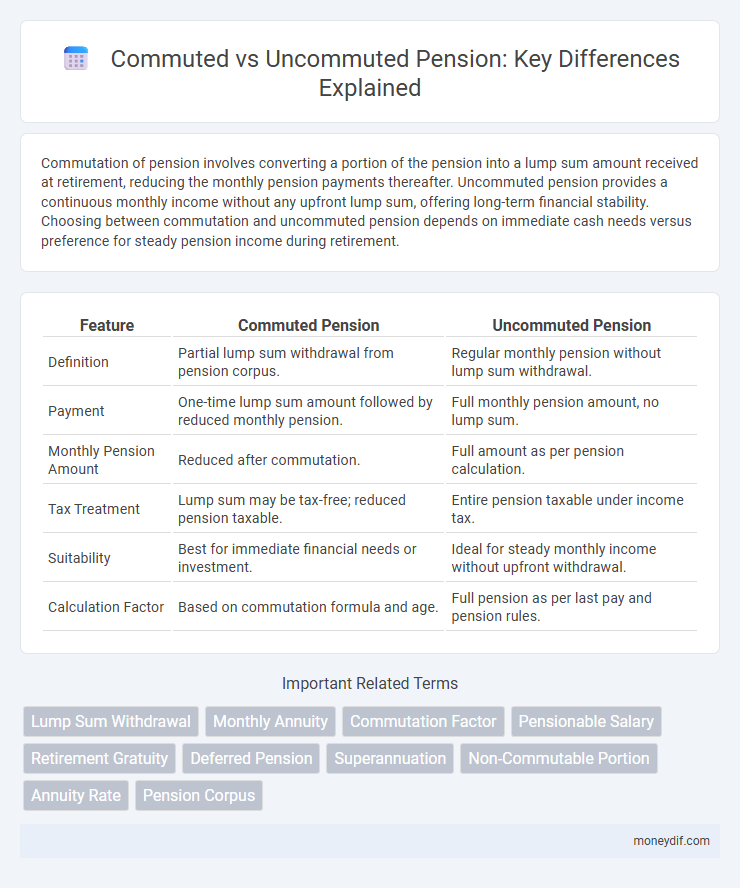

| Feature | Commuted Pension | Uncommuted Pension |

|---|---|---|

| Definition | Partial lump sum withdrawal from pension corpus. | Regular monthly pension without lump sum withdrawal. |

| Payment | One-time lump sum amount followed by reduced monthly pension. | Full monthly pension amount, no lump sum. |

| Monthly Pension Amount | Reduced after commutation. | Full amount as per pension calculation. |

| Tax Treatment | Lump sum may be tax-free; reduced pension taxable. | Entire pension taxable under income tax. |

| Suitability | Best for immediate financial needs or investment. | Ideal for steady monthly income without upfront withdrawal. |

| Calculation Factor | Based on commutation formula and age. | Full pension as per last pay and pension rules. |

Understanding Commuted and Uncommuted Pensions

Commuted pension refers to a portion of the monthly pension amount that is converted into a lump sum payment at the time of retirement, reducing the regular pension payments thereafter. Uncommuted pension is the reduced monthly pension received after the commutation amount has been paid out, providing a steady income stream throughout retirement. Understanding the difference helps retirees balance immediate financial needs with long-term income security.

Key Differences Between Commuted and Uncommuted Pensions

Commuted pension involves a lump-sum payment received upfront by surrendering a portion of the monthly pension, resulting in reduced regular pension payouts. Uncommuted pension provides full monthly pension benefits without any lump-sum withdrawal, ensuring steady income throughout retirement. The key difference lies in the trade-off between immediate lump-sum benefits and consistent long-term pension payments.

Eligibility Criteria for Pension Commutation

Pension commutation eligibility requires the pensioner to have attained a minimum specified age, typically 50 years, and to be in receipt of a monthly pension. The pension must be granted under a recognized scheme allowing partial withdrawal of the pension amount as a lump sum while reducing the regular pension. Documentation proving continuous service, pension sanction order, and identity proof is essential for processing the commutation request.

Calculation Method for Commuted Pension

The calculation method for a commuted pension involves determining the lump sum amount paid upfront in exchange for a reduced monthly pension, typically based on a commutation factor prescribed in pension rules. This factor depends on the retiree's age and life expectancy, and the lump sum is calculated by multiplying the commutation factor with the portion of the pension chosen for commutation. The remaining uncommuted pension is then paid monthly at a reduced rate, reflecting the amount commuted as a lump sum.

Benefits of Opting for Commuted Pension

Opting for a commuted pension allows pensioners to receive a lump sum payment upfront, providing immediate financial liquidity to meet large expenses or investments. This option reduces the monthly pension amount but offers greater flexibility in managing personal finances and estate planning. Commuted pensions can also be tax-efficient, as the lump sum may be partially or fully exempt from taxable income under prevailing government rules.

Drawbacks of Commuted Pension vs. Uncommuted Pension

Commuted pension provides a lump sum payment by sacrificing part of the monthly pension, but this results in reduced regular income during retirement, potentially impacting long-term financial stability. Uncommuted pension offers a consistent monthly income, ensuring steady cash flow and better inflation protection, though it lacks immediate liquidity. The trade-off involves balancing immediate funds with ongoing financial security, with commutation's drawbacks including lower sustained monthly benefits and potential depletion of retirement resources.

Tax Implications: Commuted vs. Uncommuted Pension

Commuted pension refers to the lump sum amount received in exchange for a reduced monthly pension, which is partially tax-exempt under Section 10(10A) of the Income Tax Act, subject to limits set by the government. Uncommuted pension consists of regular monthly payments fully taxable as income under the head "Salaries" or "Income from other sources," depending on the employer's status. Choosing commutation impacts taxable income, with the lump sum offering immediate tax benefits while uncommuted pension ensures a steady taxable income stream throughout retirement.

Payment Structure: Lump Sum or Regular Pension

Commutation of pension involves receiving a lump sum payment upfront by surrendering a portion of the regular pension amount, effectively reducing the monthly payout. Uncommuted pension provides a continuous monthly pension payment without any initial lump sum, ensuring steady income throughout retirement. Choosing commutation affects the overall pension payout structure, balancing immediate cash needs against long-term regular income stability.

Factors to Consider Before Choosing Pension Type

Choosing between commutation and uncommuted pension depends on factors such as immediate financial needs, long-term income security, and tax implications. Commutation offers a lump sum payment upfront, which is beneficial for urgent expenses or investment opportunities but reduces the monthly pension amount. Uncommuted pension ensures a steady, higher monthly income over the retirement period, providing financial stability without initial lump sum benefits.

Frequently Asked Questions on Pension Commutation

Pension commutation allows retirees to convert a portion of their monthly pension into a lump sum payment, providing immediate financial liquidity. Unlike uncommuted pension, where the retiree receives regular monthly payments for life, commutation reduces the monthly pension amount permanently. Common FAQs include eligibility criteria, tax implications, and the impact of commutation on survivor benefits and overall retirement income.

Important Terms

Lump Sum Withdrawal

Lump sum withdrawal allows partial commutation of pension benefits, reducing the uncommuted pension amount while providing a one-time payment based on a predetermined commutation factor.

Monthly Annuity

Monthly annuity offers a fixed regular payment calculated based on the commutation factor and the uncommuted pension amount, where higher commutation reduces the monthly pension but provides a lump sum upfront. The balance between commuted and uncommuted pension directly impacts the retiree's long-term income stability and immediate financial needs.

Commutation Factor

The commutation factor determines the lump-sum amount received by pensioners upon converting a portion of their pension into a one-time payment, directly influencing the balance between commuted and uncommuted pension benefits.

Pensionable Salary

Pensionable salary determines the calculation basis for commutation and uncommuted pension benefits, directly impacting the lump-sum amount surrendered versus the monthly pension received.

Retirement Gratuity

Retirement gratuity offers a lump-sum payment option, with commutation allowing partial conversion of pension into a one-time amount while uncommuted pension provides lifelong monthly payouts without any lump sum.

Deferred Pension

Deferred pension allows partial commutation of the lump sum while receiving a reduced uncommuted pension during retirement.

Superannuation

Commutation of superannuation allows partial lump-sum withdrawal by surrendering future pension rights, whereas an uncommuted pension provides a continuous monthly retirement income without any lump-sum withdrawal.

Non-Commutable Portion

The non-commutable portion of a pension is the part that must be paid as a regular income and cannot be converted into a lump sum payment, ensuring a steady retirement income stream. In contrast, the commutable portion allows pensionholders to exchange part of their future pension benefits for an immediate cash sum, providing flexibility in managing retirement finances.

Annuity Rate

Annuity rate determines the fixed periodic payment received by a retiree, where commutation allows a lump-sum withdrawal reducing the uncommuted pension, thereby impacting the overall pension payout structure.

Pension Corpus

Pension corpus refers to the total accumulated fund used to provide retirement income, which can be partially withdrawn as commutation, resulting in a lump sum payment, while the remaining pension is paid out regularly as an uncommuted pension. Commutation reduces the monthly pension amount, as a portion is taken upfront, whereas uncommuted pension provides consistent monthly payments without any lump sum withdrawal.

Commutation vs Uncommuted pension Infographic

moneydif.com

moneydif.com