Noncontributory pensions are funded entirely by employers or the government without requiring employee contributions, ensuring retirement benefits regardless of an individual's payment history. Contributory pensions, on the other hand, depend on regular contributions from employees, often matched by employers, creating a direct link between the amount contributed and the eventual retirement payout. Understanding the distinctions between these pension types helps individuals plan retirement income and assess the security offered by different pension schemes.

Table of Comparison

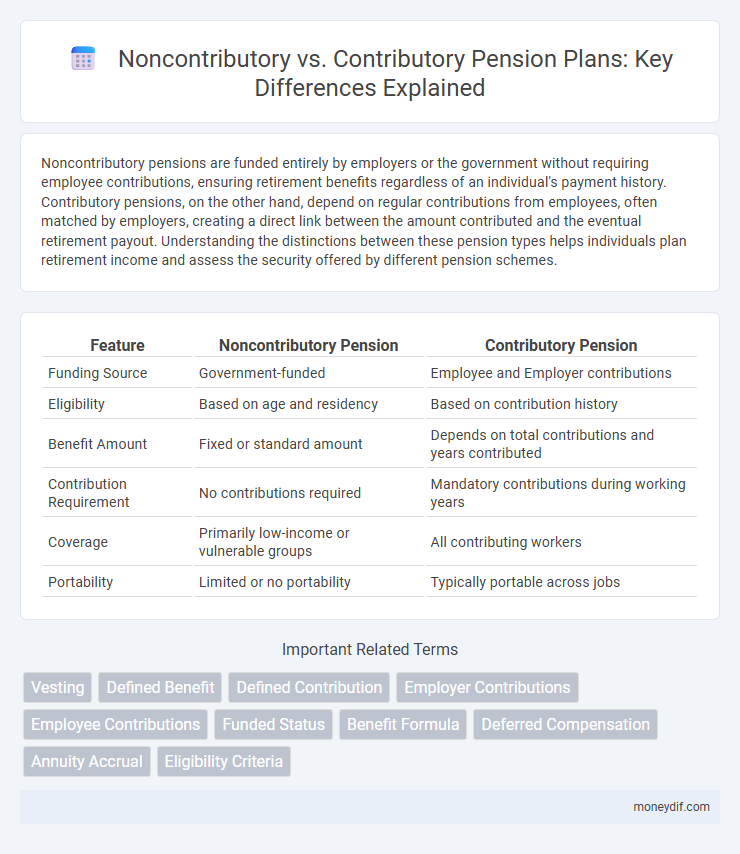

| Feature | Noncontributory Pension | Contributory Pension |

|---|---|---|

| Funding Source | Government-funded | Employee and Employer contributions |

| Eligibility | Based on age and residency | Based on contribution history |

| Benefit Amount | Fixed or standard amount | Depends on total contributions and years contributed |

| Contribution Requirement | No contributions required | Mandatory contributions during working years |

| Coverage | Primarily low-income or vulnerable groups | All contributing workers |

| Portability | Limited or no portability | Typically portable across jobs |

Understanding Noncontributory and Contributory Pensions

Noncontributory pensions are funded entirely by the government or employer without requiring employee contributions, providing retirees with financial security based on eligibility criteria such as age or disability. Contributory pensions require active contributions from employees, often matched by employers, accumulating funds that determine the eventual retirement benefit. Understanding the distinction helps beneficiaries evaluate eligibility, benefit calculations, and funding sources for sustainable pension planning.

Key Differences Between Noncontributory and Contributory Pension Schemes

Noncontributory pension schemes are fully funded by employers or the government, eliminating employee contributions, whereas contributory schemes require regular contributions from both employees and employers. Eligibility and benefit calculations differ significantly; noncontributory plans often provide universal or need-based benefits, while contributory plans link benefits directly to the amount and duration of contributions. Administrative complexity and funding sources also vary, impacting the sustainability and accessibility of each pension type.

Advantages of Noncontributory Pension Plans

Noncontributory pension plans offer the distinct advantage of financial security without requiring employees to allocate a portion of their salary, ensuring full employer-financed retirement benefits. These plans promote greater inclusivity by providing retirement coverage to all eligible workers regardless of their ability to contribute. This approach enhances employee satisfaction and retention while reducing administrative burdens associated with individual contributions.

Benefits of Contributory Pension Systems

Contributory pension systems provide individuals with a direct correlation between their contributions and eventual benefits, enhancing retirement income security. These systems encourage long-term savings behavior, resulting in higher accumulated funds and more sustainable pension financing. Furthermore, contributory schemes often offer greater financial equity and resilience, reducing the burden on public resources compared to noncontributory models.

Eligibility Criteria for Each Pension Type

Noncontributory pensions typically require recipients to meet strict eligibility criteria based on age, income level, or disability status without prior contributions to the pension system. Contributory pensions depend on an individual's employment history and mandatory or voluntary payments into the pension fund, with benefits calculated based on the amount and duration of these contributions. Eligibility for contributory pensions often includes a minimum number of contribution years and may require reaching a specific retirement age.

Funding Sources: Who Pays for Your Pension?

Noncontributory pensions are fully funded by employers or the government, meaning employees do not make direct contributions from their wages. Contributory pensions require employees to contribute a portion of their salary, often matched by employer payments, creating a joint funding structure. Understanding these funding sources is critical for assessing pension sustainability and individual retirement benefits.

Impact on Retirement Income Security

Contributory pension schemes require regular employee and employer contributions, enhancing retirement income security by building a substantial fund over time. Noncontributory pensions rely entirely on employer or government funding, potentially offering less sustainability and lower income levels due to funding limitations. Contributory plans generally provide greater financial stability and predictability for retirees, ensuring more reliable income streams in the long term.

Government Role in Noncontributory vs Contributory Pensions

Government plays a crucial role in noncontributory pensions by providing financial support directly to eligible beneficiaries without requiring prior contributions, ensuring a safety net for vulnerable populations such as the elderly and disabled. In contributory pension systems, the government acts as a regulator and administrator, overseeing the collection of mandatory employee and employer contributions, managing pension funds, and guaranteeing benefit distributions. These differing roles highlight the government's responsibility in promoting social security through both direct welfare provision and structured, contribution-based retirement schemes.

Employer and Employee Responsibilities

Noncontributory pension plans place the full funding responsibility on the employer, requiring no financial input from employees, which can increase employer costs but ensures predictable employee benefits. Contributory pension plans share funding responsibilities, with both employers and employees making regular contributions, typically resulting in lower initial employer expenses and fostering employee investment in their retirement savings. Employers must manage compliance and contribution accuracy in both plan types, while employees in contributory plans gain direct control over their pension growth through their contributions.

Choosing the Right Pension Scheme for Your Future

Noncontributory pension schemes provide retirement benefits funded entirely by employers or the government, ensuring financial security without employee contributions. Contributory schemes require regular payments from employees and employers, often resulting in higher benefits due to shared funding and investment returns. Selecting the right pension depends on factors like income stability, long-term savings goals, and eligibility for employer or state contributions.

Important Terms

Vesting

Vesting in pension plans determines the employee's ownership of benefits, with noncontributory plans typically vesting employer contributions faster than contributory plans where employees also invest.

Defined Benefit

Defined Benefit plans with noncontributory funding rely solely on employer contributions, whereas contributory plans require both employer and employee contributions to finance retirement benefits.

Defined Contribution

Defined Contribution plans allocate retirement benefits based on employee and employer contributions, with Contributory plans requiring employee input, while Noncontributory plans are fully funded by the employer. Contribution levels and investment returns directly determine the eventual retirement payout in both types.

Employer Contributions

Employer contributions in contributory plans require employee participation, whereas noncontributory plans are fully funded by the employer without employee contributions.

Employee Contributions

Employee contributions in contributory plans require workers to allocate a portion of their salary toward benefits, increasing their stake in the plan's success, while noncontributory plans are fully funded by employers with no employee financial input. Understanding the distinction impacts retirement savings strategies and influences overall compensation packages in corporate benefit structures.

Funded Status

Funded status measures the difference between plan assets and liabilities in pension plans, where noncontributory plans rely solely on employer funding while contributory plans incorporate both employer and employee contributions. A stronger funded status often reflects better financial health in contributory plans due to shared funding sources, reducing the risk of underfunding compared to noncontributory plans.

Benefit Formula

Benefit formulas in contributory plans are based on employee and employer contributions, directly influencing the final payout amount, while noncontributory plans rely solely on employer funding, often resulting in different benefit calculations and potential tax implications. Understanding the distinction affects retirement planning, as contributory plans may offer higher benefits due to accumulated contributions and investment earnings.

Deferred Compensation

Deferred compensation plans can be categorized into noncontributory and contributory types, where noncontributory plans are fully funded by the employer without employee contributions, while contributory plans require employees to contribute a portion of their salary. Understanding the tax implications and vesting schedules of each type is essential for optimizing retirement benefits and ensuring compliance with IRS regulations.

Annuity Accrual

Annuity accrual rates typically vary between noncontributory plans, where employers solely fund benefits, and contributory plans, which include employee contributions, directly affecting the total accumulated retirement benefits.

Eligibility Criteria

Eligibility criteria for noncontributory programs require no beneficiary payments, whereas contributory programs mandate individual or employer contributions for qualification.

Noncontributory vs Contributory Infographic

moneydif.com

moneydif.com