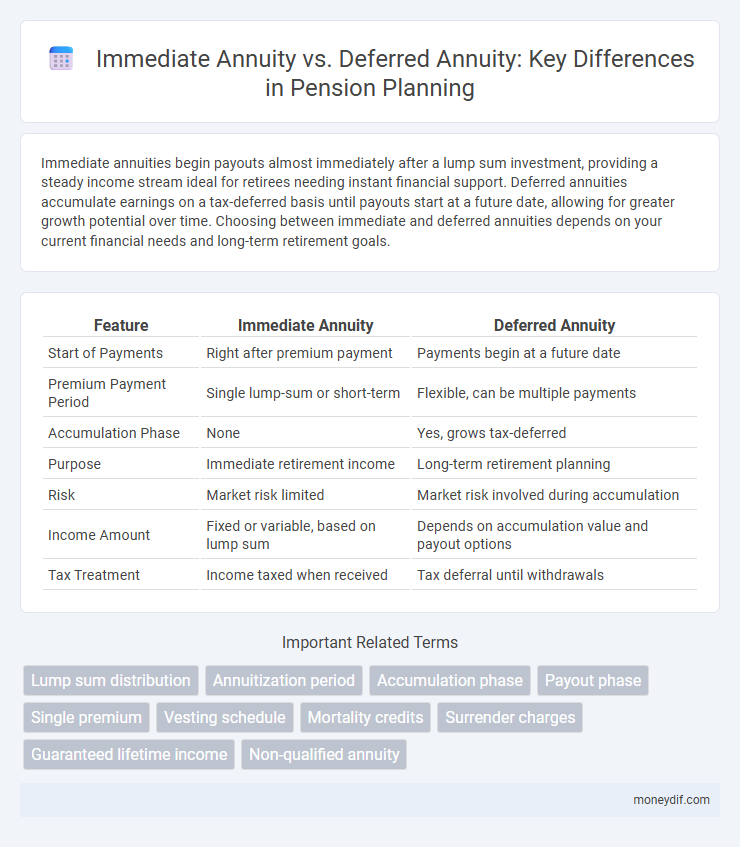

Immediate annuities begin payouts almost immediately after a lump sum investment, providing a steady income stream ideal for retirees needing instant financial support. Deferred annuities accumulate earnings on a tax-deferred basis until payouts start at a future date, allowing for greater growth potential over time. Choosing between immediate and deferred annuities depends on your current financial needs and long-term retirement goals.

Table of Comparison

| Feature | Immediate Annuity | Deferred Annuity |

|---|---|---|

| Start of Payments | Right after premium payment | Payments begin at a future date |

| Premium Payment Period | Single lump-sum or short-term | Flexible, can be multiple payments |

| Accumulation Phase | None | Yes, grows tax-deferred |

| Purpose | Immediate retirement income | Long-term retirement planning |

| Risk | Market risk limited | Market risk involved during accumulation |

| Income Amount | Fixed or variable, based on lump sum | Depends on accumulation value and payout options |

| Tax Treatment | Income taxed when received | Tax deferral until withdrawals |

Understanding Immediate and Deferred Annuities

Immediate annuities begin payments almost immediately after a lump sum investment, providing a steady income stream ideal for retirees seeking instant financial stability. Deferred annuities accumulate funds tax-deferred over time, with distributions starting at a future date, allowing for potential growth before retirement. Choosing between immediate and deferred annuities depends on one's financial goals, retirement timeline, and need for income predictability.

Key Differences Between Immediate and Deferred Annuities

Immediate annuities begin payments almost immediately after a lump-sum investment, providing a guaranteed income stream ideal for retirees seeking instant cash flow. Deferred annuities accumulate funds tax-deferred over a period, allowing the investor to grow their savings before converting to income, which is optimal for long-term retirement planning. Key differences include the timing of income payments, tax treatment during accumulation, and flexibility in managing payout options.

How Immediate Annuities Work

Immediate annuities begin paying income almost immediately after a lump-sum premium is paid, typically within one month. This type of annuity converts the principal into a guaranteed stream of income for a specified period or for life, providing predictable cash flow. Immediate annuities are ideal for retirees seeking stable, regular payments without the waiting period associated with deferred annuities.

How Deferred Annuities Work

Deferred annuities accumulate funds tax-deferred during the accumulation phase, allowing the invested capital to grow until the payout phase begins, typically at retirement. Contributions are invested in various financial vehicles, such as bonds, stocks, or mutual funds, depending on the annuity contract's terms and risk preferences. Upon reaching the annuity start date, the deferred annuity converts the accumulated value into a stream of periodic payments, providing a steady income for a specified period or for the annuitant's lifetime.

Pros and Cons of Immediate Annuities

Immediate annuities provide guaranteed income starting almost immediately after a lump sum payment, making them ideal for retirees seeking stable cash flow. They eliminate investment risk by offering predictable payments but lack liquidity and may have limited inflation protection. Compared to deferred annuities, immediate annuities sacrifice potential growth for certainty, making them less suitable for those with longer retirement horizons.

Pros and Cons of Deferred Annuities

Deferred annuities offer the advantage of tax-deferred growth, allowing investments to compound over time without immediate tax liabilities. However, they may involve surrender charges if funds are withdrawn early and often have higher fees compared to other retirement vehicles. These contracts provide flexibility for long-term retirement planning but require careful consideration of investment options and time horizons to maximize benefits.

Choosing Between Immediate and Deferred Annuities

Choosing between immediate and deferred annuities depends on your retirement timeline and income needs. Immediate annuities provide instant income payments right after a lump sum investment, ideal for those who have already retired or need steady cash flow soon. Deferred annuities allow your investment to grow tax-deferred until you start withdrawals later, which benefits individuals planning long-term retirement savings or seeking to accumulate funds before retirement.

Tax Implications of Both Annuity Types

Immediate annuities are taxed on the portion of each payment that represents earnings, while the return of principal portion is tax-free, providing consistent taxable income starting soon after investment. Deferred annuities grow tax-deferred until withdrawals begin, allowing earnings to compound without current tax liability, but distributions are taxed as ordinary income upon withdrawal. Choosing between immediate and deferred annuities affects tax planning, as immediate annuities offer predictable taxable income, whereas deferred annuities provide tax deferral benefits until retirement when you may be in a lower tax bracket.

Suitability for Different Retirement Goals

Immediate annuities suit retirees seeking consistent income starting right after retirement, providing financial stability for essential expenses. Deferred annuities fit those aiming to grow their funds tax-deferred over time, making them ideal for long-term retirement goals and later income needs. Choosing between these annuities depends on the retiree's timeline, income requirements, and risk tolerance.

Frequently Asked Questions: Immediate vs Deferred Annuities

Immediate annuities begin payments shortly after a lump sum is invested, making them ideal for retirees seeking steady income right away. Deferred annuities accumulate funds over time, allowing the investment to grow tax-deferred before payouts begin, often benefiting younger investors planning for long-term retirement goals. Common questions include differences in payout timing, tax treatment, and flexibility in investment options between immediate and deferred annuities.

Important Terms

Lump sum distribution

Lump sum distribution offers immediate access to funds, making it suitable for those choosing immediate annuities, whereas deferred annuities allow for tax-deferred growth by postponing income payments.

Annuitization period

The annuitization period for an immediate annuity begins shortly after purchase, providing quick income, whereas a deferred annuity's annuitization period starts after a specified accumulation phase, delaying payouts.

Accumulation phase

The accumulation phase in a deferred annuity allows tax-deferred growth of investments before payouts begin, whereas an immediate annuity bypasses accumulation by starting income payments almost instantly after a lump-sum deposit.

Payout phase

The payout phase in an immediate annuity begins right after a lump sum payment, providing guaranteed income streams typically starting within one month, whereas in a deferred annuity, the payout phase is postponed until a future date, allowing the invested funds to grow tax-deferred. Immediate annuities suit individuals seeking instant, predictable retirement income, while deferred annuities offer flexibility and potential for higher accumulation before distributions commence.

Single premium

Single premium immediate annuities require a lump-sum payment upfront, providing guaranteed income payments that start almost immediately, typically within one year. Single premium deferred annuities involve an initial lump sum that grows tax-deferred over time, with income payments beginning at a specified future date, allowing for potential accumulation of interest before withdrawal.

Vesting schedule

A vesting schedule determines the timeline for ownership rights, impacting Immediate annuity by providing payments starting immediately, while Deferred annuity benefits from a delayed payout phase after the vesting period.

Mortality credits

Mortality credits enhance the returns of immediate annuities by pooling longevity risk and redistributing funds from early deaths to survivors, whereas deferred annuities accumulate funds without immediate payouts and rely on investment growth plus mortality credits during the payout phase. Immediate annuities offer systematic mortality credit benefits starting at payout, while deferred annuities delay these benefits until annuitization, impacting long-term income stability and lifetime income potential.

Surrender charges

Immediate annuities typically do not have surrender charges because payments begin right away, whereas deferred annuities often impose surrender charges if funds are withdrawn before the end of the surrender period.

Guaranteed lifetime income

Guaranteed lifetime income from an immediate annuity begins payments shortly after purchase, while a deferred annuity accumulates funds over time before distributing income.

Non-qualified annuity

A non-qualified immediate annuity begins payments soon after a lump-sum investment with after-tax dollars, whereas a non-qualified deferred annuity allows tax-deferred growth of after-tax contributions before initiating income payments at a later date.

Immediate annuity vs Deferred annuity Infographic

moneydif.com

moneydif.com