Cost-of-Living Adjustment (COLA) provides periodic increases in pension benefits based on changes in inflation, ensuring retirees maintain purchasing power over time. In contrast, indexation ties pension benefits to a specific economic indicator, often inflation or wage growth, applying systematic adjustments automatically. Both mechanisms aim to protect pensioners from eroding income, but COLA typically offers more flexible, discretionary increases while indexation ensures predictable, formula-driven benefit growth.

Table of Comparison

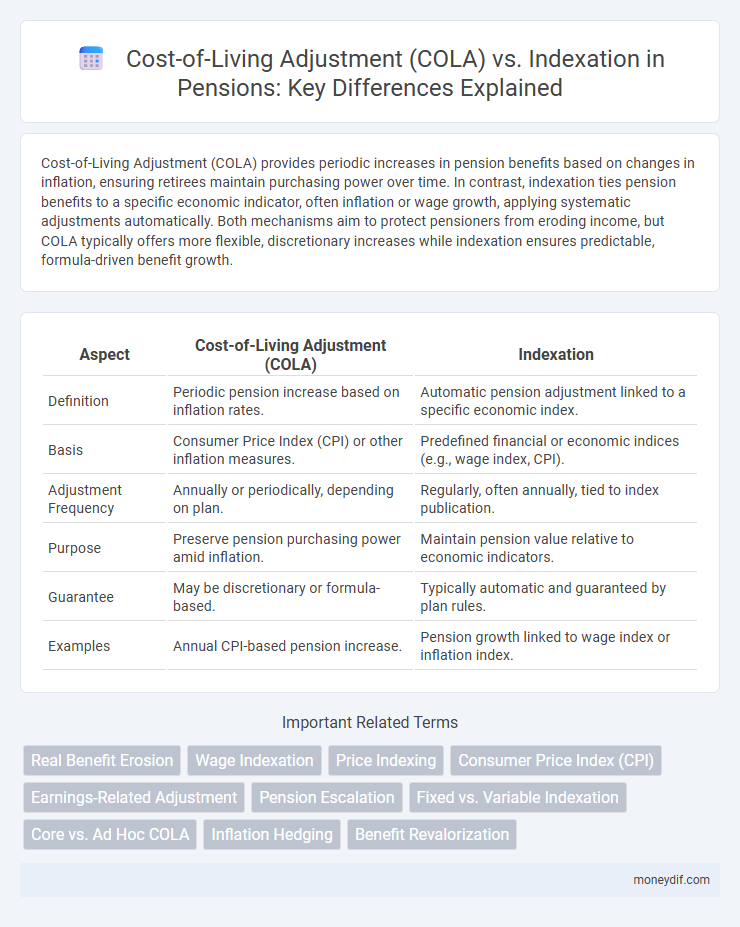

| Aspect | Cost-of-Living Adjustment (COLA) | Indexation |

|---|---|---|

| Definition | Periodic pension increase based on inflation rates. | Automatic pension adjustment linked to a specific economic index. |

| Basis | Consumer Price Index (CPI) or other inflation measures. | Predefined financial or economic indices (e.g., wage index, CPI). |

| Adjustment Frequency | Annually or periodically, depending on plan. | Regularly, often annually, tied to index publication. |

| Purpose | Preserve pension purchasing power amid inflation. | Maintain pension value relative to economic indicators. |

| Guarantee | May be discretionary or formula-based. | Typically automatic and guaranteed by plan rules. |

| Examples | Annual CPI-based pension increase. | Pension growth linked to wage index or inflation index. |

Understanding Cost-of-Living Adjustment (COLA)

Cost-of-Living Adjustment (COLA) is a periodic increase in pension benefits designed to maintain retirees' purchasing power amidst inflation by linking payments to inflation rates, typically measured by the Consumer Price Index (CPI). COLA ensures that pension income keeps pace with rising living costs, preventing erosion of real value over time. Unlike indexation, which may adjust based on wage growth or fixed formulas, COLA specifically targets inflation-driven cost increases for more accurate benefit preservation.

What is Pension Indexation?

Pension indexation refers to the systematic adjustment of pension benefits in line with inflation or wage growth to preserve the purchasing power of retirees. Unlike a fixed Cost-of-Living Adjustment (COLA), which may be set as a predetermined percentage, pension indexation typically follows an economic indicator such as the Consumer Price Index (CPI). This mechanism ensures pensions remain responsive to actual economic changes, safeguarding the income of pensioners against erosion by rising living costs.

Key Differences: COLA vs Indexation

Cost-of-Living Adjustment (COLA) increases pension benefits based on changes in inflation rates, typically tied to a specific consumer price index to preserve retirees' purchasing power. Indexation adjusts pension payments according to a predetermined formula linked to economic indicators such as wage growth or GDP, providing more stable but less frequent adjustments. The key difference lies in COLA's responsiveness to real-time inflation fluctuations, while indexation offers systematic, rule-based benefit increases independent of short-term inflation changes.

How COLA Impacts Retirement Income

Cost-of-Living Adjustment (COLA) directly increases retirement income by adjusting pension payments according to inflation rates, preserving retirees' purchasing power over time. Unlike fixed indexation, which may apply predetermined wage or price indexes, COLA ensures a more responsive and real-time alignment with cost increases in essential goods and services. This dynamic adjustment mechanism mitigates the erosion of retirement income caused by rising living costs, supporting financial stability for pensioners.

Indexation Methods in Pension Plans

Indexation in pension plans involves adjusting pension benefits to keep up with inflation, using methods such as fixed percentage increases, linking to consumer price indices, or wage growth benchmarks. Common indexation formulas include the Retail Price Index (RPI) or Consumer Price Index (CPI), which directly impact the purchasing power of retirees. Effective indexation methods ensure pension payouts maintain real value over time, protecting pensioners from inflation erosion.

Inflation Protection: COLA vs Indexation

Cost-of-Living Adjustment (COLA) provides pension increases based on a fixed formula or predetermined rate, which may not fully reflect real inflation changes, potentially leading to purchasing power erosion. Indexation ties pension benefits directly to inflation indicators like the Consumer Price Index (CPI), ensuring more precise protection against rising living costs. Comparing COLA versus indexation highlights the importance of inflation protection mechanisms in preserving retirees' financial stability over time.

Examples: COLA in Public vs Private Pensions

Public pensions often apply Cost-of-Living Adjustments (COLA) based on inflation indices such as the Consumer Price Index (CPI) to maintain retirees' purchasing power, exemplified by Social Security benefits in the United States. In contrast, private pensions may use indexation methods tied to wage growth or fixed percentage increases, as seen in some corporate defined benefit plans, which can result in less predictable adjustments compared to COLA. Differences in these approaches impact the real value of retirement income, with public pensions generally offering more reliable inflation protection.

Pros and Cons of COLA and Indexation

Cost-of-Living Adjustment (COLA) directly increases pension benefits based on inflation rates, providing timely protection against rising living costs but can strain pension fund sustainability during high inflation periods. Indexation adjusts pensions according to a fixed set of economic indicators, ensuring predictable increases and easier budgeting for pension schemes but may lag behind actual inflation, reducing purchasing power over time. Balancing COLA's responsiveness with indexation's stability is crucial for maintaining retirees' financial security while preserving fund solvency.

Global Practices: Pension Adjustments Worldwide

Cost-of-Living Adjustment (COLA) and indexation represent key mechanisms for pension increases globally, ensuring retirees maintain purchasing power amid inflation. COLA typically adjusts pension benefits based on inflation rates such as the Consumer Price Index (CPI), prevalent in the United States and Canada, while indexation often links pension benefits to wage growth or a hybrid of inflation and wages, as seen in countries like the Netherlands and Australia. Variations in pension adjustment policies reflect differing approaches to fiscal sustainability and social protection across pension systems worldwide.

Choosing the Right Adjustment for Pensioners

Choosing the right adjustment for pensioners involves understanding the distinctions between Cost-of-Living Adjustment (COLA) and indexation methods. COLA directly links pension increases to inflation rates, ensuring retirees maintain purchasing power amidst rising living costs, while indexation typically ties pension growth to wage increases or a fixed formula, offering more stable but potentially less responsive adjustments. Pension funds must evaluate economic conditions, inflation trends, and retirees' needs to determine whether COLA or indexation delivers optimal financial security and sustainability.

Important Terms

Real Benefit Erosion

Real benefit erosion occurs when Cost-of-Living Adjustments (COLA) fail to fully match inflation rates, causing indexation to lag behind actual increases in living expenses.

Wage Indexation

Wage indexation adjusts salaries based on inflation measures like the Cost-of-Living Adjustment (COLA) to maintain purchasing power, whereas indexation can also link wages to other economic indicators such as productivity or average wages.

Price Indexing

Price indexing adjusts wages or benefits based on inflation rates, with Cost-of-Living Adjustments (COLA) specifically tied to consumer price indices to preserve purchasing power, while indexation broadly links payments or contracts to various economic indicators.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures changes in the average prices of a basket of goods and services, serving as a key indicator for Cost-of-Living Adjustments (COLA) that increase wages or benefits to maintain purchasing power. Indexation uses the CPI to automatically adjust payments, such as pensions or tax brackets, ensuring they keep pace with inflation without manual intervention.

Earnings-Related Adjustment

Earnings-Related Adjustment increases retirement benefits based on wage growth, while Cost-of-Living Adjustment (COLA) and Indexation specifically adjust benefits for inflation to maintain purchasing power.

Pension Escalation

Pension escalation through Cost-of-Living Adjustment (COLA) annually adjusts benefits based on inflation rates, while indexation links pension increases to a specific economic index, ensuring long-term value preservation.

Fixed vs. Variable Indexation

Fixed indexation provides a predetermined, constant adjustment rate for benefits or wages, ensuring predictable increases that may not always reflect actual cost-of-living changes. Variable indexation, often linked to COLA, adjusts payments based on inflation indices or consumer price changes, offering more accurate compensation aligned with real economic conditions.

Core vs. Ad Hoc COLA

Core COLA focuses on predetermined, consistent cost-of-living adjustments based on essential inflation metrics, while Ad Hoc COLA involves discretionary indexation adjustments triggered by specific economic conditions or exceptional inflation rates.

Inflation Hedging

Cost-of-Living Adjustment (COLA) directly counters inflation by increasing wages or benefits based on consumer price indexes, while indexation broadly ties financial instruments or contracts to inflation metrics to preserve purchasing power.

Benefit Revalorization

Benefit revalorization ensures pension payments maintain purchasing power by applying Cost-of-Living Adjustments (COLA) based on inflation rates, contrasting with indexation methods that link increases to wage growth or economic indicators.

Cost-of-Living Adjustment (COLA) vs Indexation Infographic

moneydif.com

moneydif.com