Deferred pensions allow individuals to postpone receiving benefits until a later date, resulting in higher monthly payments due to extended accumulation and reduced payout periods. Immediate pensions begin payments shortly after retirement, providing instant income but typically at a lower monthly amount compared to deferred options. Choosing between deferred and immediate pensions depends on financial needs, longevity expectations, and retirement planning goals.

Table of Comparison

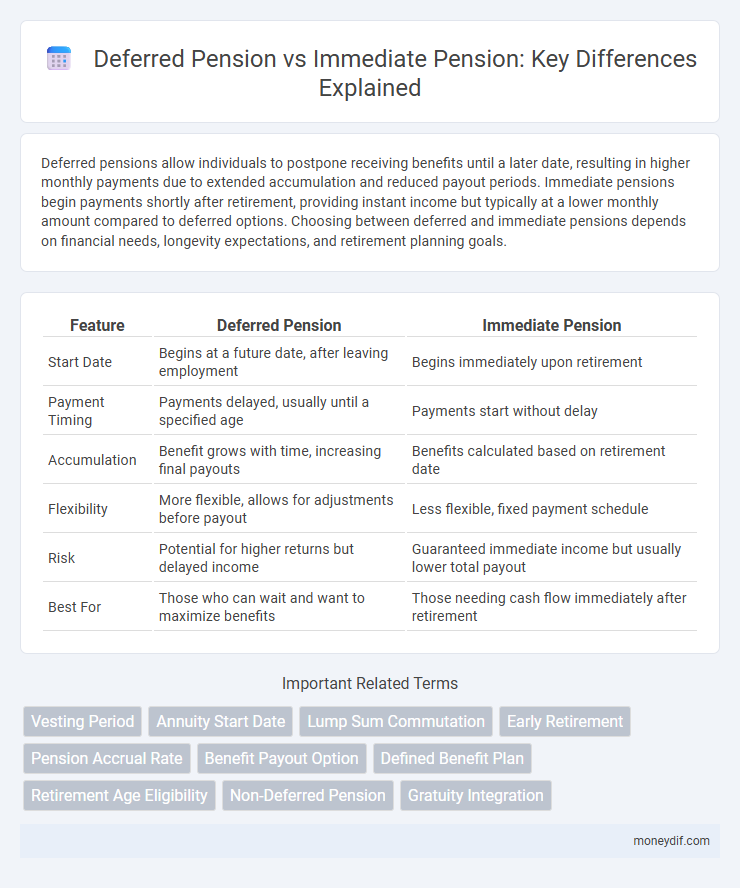

| Feature | Deferred Pension | Immediate Pension |

|---|---|---|

| Start Date | Begins at a future date, after leaving employment | Begins immediately upon retirement |

| Payment Timing | Payments delayed, usually until a specified age | Payments start without delay |

| Accumulation | Benefit grows with time, increasing final payouts | Benefits calculated based on retirement date |

| Flexibility | More flexible, allows for adjustments before payout | Less flexible, fixed payment schedule |

| Risk | Potential for higher returns but delayed income | Guaranteed immediate income but usually lower total payout |

| Best For | Those who can wait and want to maximize benefits | Those needing cash flow immediately after retirement |

Understanding Deferred Pension and Immediate Pension

Deferred pension allows individuals to postpone receiving retirement benefits until a later date, resulting in higher monthly payments due to extended contribution and interest accumulation. Immediate pension begins payments promptly after retirement, providing steady income without delay but generally lower monthly amounts than deferred plans. Understanding these options helps retirees align their income strategy with financial goals and life expectancy.

Key Differences Between Deferred and Immediate Pension

Deferred pension allows individuals to postpone receiving benefits until a later date, often resulting in higher monthly payments due to extended growth and compounding interest. Immediate pension begins payments shortly after retirement or plan eligibility, providing instant income but generally at a lower monthly rate compared to deferred options. Key differences include timing of payments, impact on benefit amounts, and flexibility in retirement income planning.

Eligibility Criteria for Deferred and Immediate Pensions

Deferred pension eligibility typically requires an individual to have reached the minimum age set by the pension scheme, often between 55 and 65 years, with a minimum number of service years or contributions paid into the plan. Immediate pension eligibility usually demands the claimant to have met the retirement age or ceased employment, triggering instant benefit access without further deferral conditions. Employers or pension providers may also stipulate specific accumulation periods or service thresholds critical for qualifying for either deferred or immediate pension disbursements.

Benefits of Choosing a Deferred Pension

Choosing a deferred pension allows the fund to grow through compounded returns, resulting in a higher payout upon retirement compared to immediate pensions. Deferred pensions often offer tax advantages during the accumulation phase, enhancing overall retirement savings. Delaying pension benefits can also provide increased financial security by adjusting payments based on inflation or longer life expectancy estimates.

Advantages of an Immediate Pension Option

An immediate pension option provides instant access to a steady income stream beginning at retirement, ensuring financial security without delay. It eliminates longevity risk by guaranteeing payments for life, which is especially beneficial for individuals seeking predictable cash flow. Immediate pensions also simplify retirement planning by converting accumulated pension savings into a reliable, regular income, reducing market exposure and administrative complexity.

Financial Implications: Deferred vs Immediate Pension

Deferred pensions allow individuals to accumulate higher future payouts by postponing benefit claims, resulting in increased monthly income due to longer contribution periods and potential investment growth. Immediate pensions begin payouts right after retirement, providing instant income but typically at a lower monthly rate compared to deferred options because of shorter accumulation and payout periods. The financial implications hinge on factors like life expectancy, tax considerations, and inflation, impacting the overall value and sustainability of the pension benefits.

Flexibility and Withdrawal Options Explained

Deferred pensions offer enhanced flexibility by allowing contributions to grow tax-deferred until withdrawal, providing the option to start receiving benefits at a chosen future date. Immediate pensions begin payments promptly after retirement, offering guaranteed income but limited access to lump sum withdrawals or changes once commenced. Understanding these distinctions helps optimize retirement income strategies based on liquidity needs and long-term financial goals.

Taxation Aspects of Deferred and Immediate Pensions

Deferred pensions allow tax deferral on contributions and investment growth until withdrawals begin, typically at retirement, potentially reducing taxable income during working years. Immediate pensions initiate payouts promptly after retirement, with periodic payments taxed as regular income, potentially resulting in higher annual tax liabilities. Understanding the timing of withdrawals and marginal tax rates is crucial for optimizing tax efficiency between deferred and immediate pension options.

Suitability: Which Pension Plan Fits Your Retirement Goals?

Deferred pensions allow individuals to accumulate higher benefits by postponing withdrawals, making them suitable for those with longer-term retirement plans and a stable income stream. Immediate pensions start disbursing funds shortly after retirement, fitting retirees who need a steady income sooner and prefer predictable cash flow. Choosing between deferred and immediate pensions depends on your retirement timeline, financial needs, and risk tolerance.

Factors to Consider Before Deciding: Deferred or Immediate Pension

Choosing between deferred and immediate pension requires evaluating factors such as current financial needs, life expectancy, and retirement goals. Deferred pensions offer the advantage of higher payouts due to continued accumulation but require the ability to delay income. Immediate pensions provide guaranteed income starting right after retirement, suited for those needing cash flow without delay or with shorter life expectancy.

Important Terms

Vesting Period

The vesting period in deferred pension plans determines the minimum time an employee must contribute before becoming eligible to receive benefits, contrasting immediate pension plans where payouts begin shortly after retirement without a waiting period. A longer vesting period typically encourages extended participation, impacting the accumulation of retirement funds compared to immediate pensions that focus on prompt income distribution.

Annuity Start Date

Annuity start date for deferred pensions begins after the deferral period ends, while for immediate pensions, it starts immediately upon retirement.

Lump Sum Commutation

Lump Sum Commutation allows pensioners to exchange a portion of their deferred or immediate pension for a one-time payment, optimizing retirement income based on individual financial needs and tax considerations.

Early Retirement

Choosing deferred pension over immediate pension can maximize long-term retirement income by allowing benefits to grow tax-deferred until a later, potentially higher payout age.

Pension Accrual Rate

The Pension Accrual Rate typically influences the growth of Deferred Pensions' benefits over time, contrasting with Immediate Pensions which begin payments based on the accrued rate at retirement without further accrual.

Benefit Payout Option

Choosing a deferred pension benefit payout option allows for larger eventual payouts by delaying income, while an immediate pension provides smaller, guaranteed payments starting right away.

Defined Benefit Plan

A Defined Benefit Plan offers retirees the choice between a Deferred Pension, which begins payout at a later date allowing benefits to grow, and an Immediate Pension, which starts disbursing benefits right after retirement.

Retirement Age Eligibility

Retirement age eligibility determines whether individuals qualify for deferred pension benefits, which accrue higher payouts by postponing withdrawals, or immediate pension payments that start promptly at retirement age.

Non-Deferred Pension

Non-deferred pension schemes provide beneficiaries with immediate payment benefits upon retirement, contrasting with deferred pensions that delay payouts until a future date. Immediate pensions begin disbursing income right after retirement, ensuring continuous cash flow, while non-deferred plans eliminate waiting periods for pension claims.

Gratuity Integration

Gratuity integration involves merging the gratuity amount with pension benefits, impacting the comparison between deferred pension and immediate pension by enhancing the total retirement corpus in deferred pension plans. This integration allows deferred pension holders to receive a lump sum gratuity combined with periodic pension payments, whereas immediate pension recipients generally forgo gratuity for earlier, consistent pension disbursements.

Deferred Pension vs Immediate Pension Infographic

moneydif.com

moneydif.com