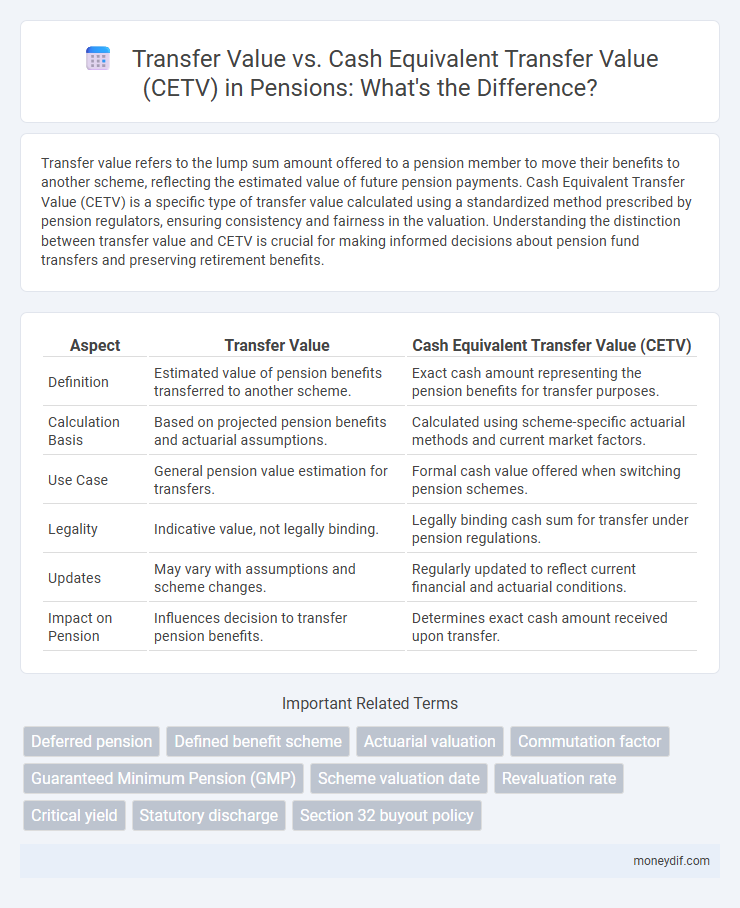

Transfer value refers to the lump sum amount offered to a pension member to move their benefits to another scheme, reflecting the estimated value of future pension payments. Cash Equivalent Transfer Value (CETV) is a specific type of transfer value calculated using a standardized method prescribed by pension regulators, ensuring consistency and fairness in the valuation. Understanding the distinction between transfer value and CETV is crucial for making informed decisions about pension fund transfers and preserving retirement benefits.

Table of Comparison

| Aspect | Transfer Value | Cash Equivalent Transfer Value (CETV) |

|---|---|---|

| Definition | Estimated value of pension benefits transferred to another scheme. | Exact cash amount representing the pension benefits for transfer purposes. |

| Calculation Basis | Based on projected pension benefits and actuarial assumptions. | Calculated using scheme-specific actuarial methods and current market factors. |

| Use Case | General pension value estimation for transfers. | Formal cash value offered when switching pension schemes. |

| Legality | Indicative value, not legally binding. | Legally binding cash sum for transfer under pension regulations. |

| Updates | May vary with assumptions and scheme changes. | Regularly updated to reflect current financial and actuarial conditions. |

| Impact on Pension | Influences decision to transfer pension benefits. | Determines exact cash amount received upon transfer. |

Understanding Pension Transfer Value

Pension transfer value represents the monetary amount offered when moving pension benefits to another scheme, reflecting the current value of the accrued pension rights. Cash Equivalent Transfer Value (CETV) specifically quantifies the lump sum amount an individual can transfer, calculated using actuarial factors such as interest rates and life expectancy. Understanding pension transfer values is crucial for making informed decisions about pension portability and retirement planning.

What is a Cash Equivalent Transfer Value (CETV)?

A Cash Equivalent Transfer Value (CETV) represents the lump sum amount a pension scheme member can transfer to another pension arrangement upon leaving the scheme. CETV is calculated based on the scheme's liabilities at retirement age, reflecting the present value of future pension benefits. This transfer value enables members to consolidate or move their pension benefits while maintaining their accrued rights.

Key Differences: Transfer Value vs CETV

The key differences between Transfer Value and Cash Equivalent Transfer Value (CETV) lie in their calculation methods and regulatory frameworks; Transfer Value is the amount offered by a pension scheme to transfer benefits, while CETV is a standardized figure used in UK pension transfers to reflect the cash value of accrued benefits. CETVs include factors such as projected pension increases and are regularly updated based on market conditions and actuarial assumptions, whereas Transfer Values might vary more significantly depending on scheme-specific rules. Understanding these distinctions helps members evaluate pension transfer options accurately and make informed financial decisions.

How is CETV Calculated?

The Cash Equivalent Transfer Value (CETV) is calculated by estimating the current capital cost of providing the pension benefits promised under a defined benefit scheme, considering factors such as the member's age, salary, pensionable service, and accrued benefits. Actuarial assumptions regarding interest rates, inflation, and life expectancy significantly influence the CETV amount. This transfer value represents the lump sum needed to provide the same pension benefits if transferred to another pension scheme.

Factors Influencing Pension Transfer Values

Pension transfer values and Cash Equivalent Transfer Values (CETVs) differ primarily in calculation methods and regulatory frameworks, with CETVs reflecting the estimated lump sum needed to secure equivalent pension benefits outside the original scheme. Factors influencing pension transfer values include changes in interest rates, inflation assumptions, life expectancy projections, and scheme-specific funding levels. Regulatory adjustments and market conditions also significantly impact CETV calculations, affecting the attractiveness and timing of pension transfers.

Advantages of Knowing Your CETV

Knowing your Cash Equivalent Transfer Value (CETV) provides a precise valuation of your pension benefits, enabling informed decisions about transferring or retaining your pension. CETV reflects the lump sum amount your pension scheme would pay if you transferred out, offering clarity on your retirement assets' worth. Understanding your CETV helps maximize financial planning opportunities and ensures optimal alignment with your long-term retirement goals.

Risks Involved with Pension Transfers

Transferring a pension using a Transfer Value or a Cash Equivalent Transfer Value (CETV) carries significant financial risks, including market volatility impacting the transferred amount and potential loss of guaranteed benefits offered by defined benefit schemes. Evaluating the long-term implications of losing secure income streams against the flexibility of invested funds is crucial, as poor investment choices post-transfer can erode retirement savings. Professional financial advice is essential to understand the complex tax consequences, exit penalties, and potential shortfall in retirement income associated with pension transfers.

When to Consider Requesting a CETV

Requesting a Cash Equivalent Transfer Value (CETV) is crucial when contemplating a pension transfer to another scheme or when seeking flexibility in retirement options. CETVs provide a precise valuation of your pension benefits in cash terms, helping to compare options such as defined benefit versus defined contribution schemes. It is advisable to request a CETV during significant life events, changes in employment, or when market conditions may influence transfer outcomes.

Regulatory Guidance on Pension Transfers

Transfer value represents the lump sum amount offered to a pension member to move their pension benefits to another scheme. Cash Equivalent Transfer Value (CETV) is a specific calculation method mandated by regulatory authorities such as The Pensions Regulator (TPR) in the UK, ensuring standardized and fair valuation based on current actuarial assumptions. Regulatory guidance requires transparency and accuracy in CETV calculations to protect members' interests during pension transfers, emphasizing compliance with prescribed rules to prevent financial loss.

Seeking Professional Advice on Transfer Values

Transfer values and Cash Equivalent Transfer Values (CETVs) represent different methods of valuing pension benefits for transfer purposes. Seeking professional advice ensures accurate assessment of pension scheme rules, tax implications, and long-term financial impact. Expert guidance helps optimize decision-making tailored to individual retirement goals and market conditions.

Important Terms

Deferred pension

Deferred pension transfer values are calculated as Cash Equivalent Transfer Values (CETVs), reflecting the lump sum amount payable to transfer pension benefits from one scheme to another.

Defined benefit scheme

The Cash Equivalent Transfer Value (CETV) represents the lump sum estimated by a defined benefit scheme to transfer pension rights, reflecting the actuarial value of future pension payments.

Actuarial valuation

Actuarial valuation determines the Transfer Value by assessing pension liabilities and projecting future benefits, while the Cash Equivalent Transfer Value (CETV) represents the discounted lump sum amount payable to transfer pension benefits between schemes.

Commutation factor

The commutation factor determines the proportion of a pension transfer value that can be converted into a lump sum payment, directly affecting the cash equivalent transfer value (CETV) calculation. Accurate application of the commutation factor ensures precise valuation between the transfer value and the CETV, reflecting the member's expected future pension benefits.

Guaranteed Minimum Pension (GMP)

Guaranteed Minimum Pension (GMP) affects the Transfer Value and Cash Equivalent Transfer Value (CETV) calculations by ensuring pension benefits meet statutory minimums, influencing the accuracy and fairness of CETV offered during pension scheme transfers.

Scheme valuation date

Scheme valuation date determines the reference point for calculating Transfer Value and Cash Equivalent Transfer Value (CETV), ensuring accurate pension benefit assessments.

Revaluation rate

Revaluation rate impacts the Transfer Value by adjusting pension benefits, while the Cash Equivalent Transfer Value (CETV) reflects the current monetary value of those benefits for scheme transfers.

Critical yield

Critical yield represents the minimum investment return required for a Transfer Value to match or exceed the Cash Equivalent Transfer Value (CETV) in pension scheme transfers.

Statutory discharge

The statutory discharge legally releases pension scheme trustees from future liabilities when paying a transfer value or a Cash Equivalent Transfer Value (CETV), ensuring the member's entitlement is formally settled upon transferring pension benefits.

Section 32 buyout policy

Section 32 buyout policies offer a tax-efficient way to transfer pension benefits by converting a pension fund into an investment-linked policy. The Transfer Value represents the cash amount offered for the policy transfer, while the Cash Equivalent Transfer Value (CETV) specifically denotes the actuarially calculated lump sum payable by pension schemes, reflecting the value of accrued pension rights upon transfer.

Transfer value vs Cash equivalent transfer value (CETV) Infographic

moneydif.com

moneydif.com