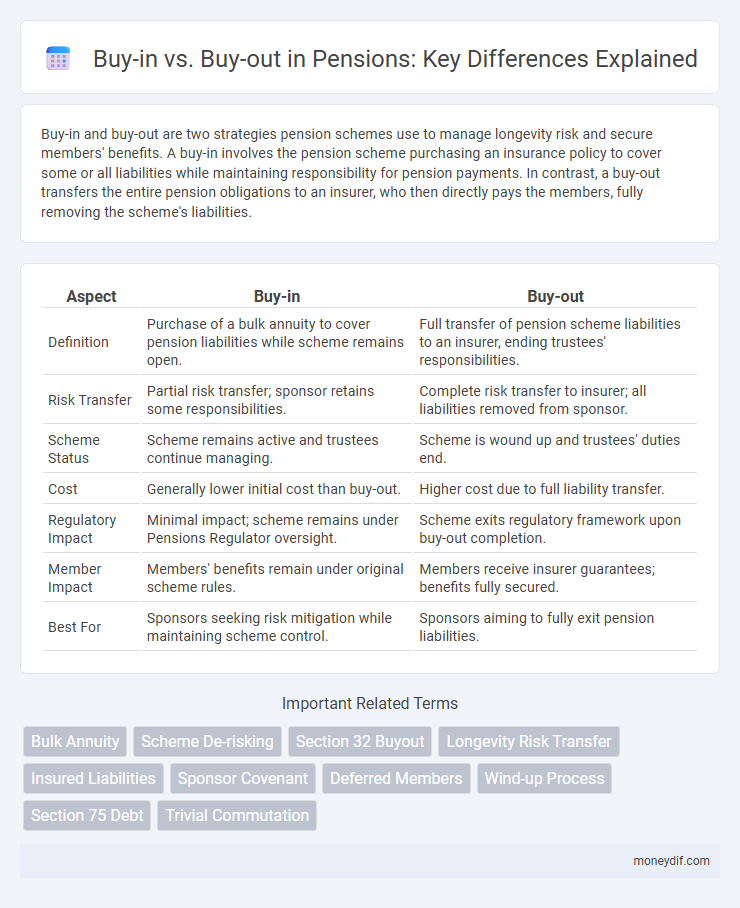

Buy-in and buy-out are two strategies pension schemes use to manage longevity risk and secure members' benefits. A buy-in involves the pension scheme purchasing an insurance policy to cover some or all liabilities while maintaining responsibility for pension payments. In contrast, a buy-out transfers the entire pension obligations to an insurer, who then directly pays the members, fully removing the scheme's liabilities.

Table of Comparison

| Aspect | Buy-in | Buy-out |

|---|---|---|

| Definition | Purchase of a bulk annuity to cover pension liabilities while scheme remains open. | Full transfer of pension scheme liabilities to an insurer, ending trustees' responsibilities. |

| Risk Transfer | Partial risk transfer; sponsor retains some responsibilities. | Complete risk transfer to insurer; all liabilities removed from sponsor. |

| Scheme Status | Scheme remains active and trustees continue managing. | Scheme is wound up and trustees' duties end. |

| Cost | Generally lower initial cost than buy-out. | Higher cost due to full liability transfer. |

| Regulatory Impact | Minimal impact; scheme remains under Pensions Regulator oversight. | Scheme exits regulatory framework upon buy-out completion. |

| Member Impact | Members' benefits remain under original scheme rules. | Members receive insurer guarantees; benefits fully secured. |

| Best For | Sponsors seeking risk mitigation while maintaining scheme control. | Sponsors aiming to fully exit pension liabilities. |

Understanding Pension Buy-in and Buy-out

Pension buy-in involves an insurer providing a bulk annuity policy to a pension scheme, securing the scheme's liabilities while the scheme retains responsibility for payments to members. Pension buy-out occurs when the insurer takes on full responsibility by purchasing the scheme's liabilities and paying members directly, effectively removing the liabilities from the sponsoring employer's balance sheet. Both strategies aim to reduce risk and provide financial security, with buy-in serving as a step toward a full buy-out.

Key Differences Between Buy-in and Buy-out

Buy-in involves an insurance policy purchased by the pension scheme to cover liabilities while the scheme retains responsibility for payments. Buy-out transfers the pension liabilities and payment obligations entirely to an insurer, removing the scheme's responsibility. The key difference lies in risk transfer: buy-in manages risk within the scheme, whereas buy-out fully transfers risk and administration to the insurer.

How Pension Buy-ins Work

Pension buy-ins involve an insurance company providing a bulk annuity policy that matches the pension scheme's liabilities, securing a stable income stream to cover member benefits. This strategy transfers investment and longevity risks from the pension scheme to the insurer, ensuring predictable cash flow without immediate changes to member entitlements. Buy-ins serve as a crucial step in pension scheme de-risking by partially insulating the plan from market volatility and demographic uncertainties.

How Pension Buy-outs Work

Pension buy-outs transfer the responsibility of managing and paying pension liabilities from the sponsoring company to an insurance provider through a bulk annuity contract, securing members' benefits. The insurer assumes investment, longevity, and administration risks, ensuring retirees receive guaranteed payments regardless of future market conditions. This mechanism effectively removes pension obligations from the company's balance sheet, providing financial certainty and reducing long-term risk exposure.

Advantages of Pension Buy-in Solutions

Pension buy-in solutions provide insurers with a cost-effective way to transfer portions of pension liabilities off the sponsor's balance sheet while maintaining some control over the plan's management. These arrangements improve funding stability by matching pension assets to liabilities, reducing the risk of funding shortfalls and providing greater financial predictability. Buy-ins also facilitate smoother transitions toward full buy-outs, enhancing risk management without immediate derecognition of pension obligations.

Benefits of Pension Buy-out Arrangements

Pension buy-out arrangements transfer the pension liabilities and associated investment risks from the sponsor to a third-party insurer, providing financial security and reducing the sponsor's balance sheet volatility. These arrangements ensure guaranteed benefits payouts to pension scheme members, enhancing member confidence and protection against underfunding. By removing pension obligations, companies can focus on core business activities while achieving regulatory compliance and improved credit ratings.

Risks Associated with Buy-in and Buy-out

Buy-in and buy-out transactions both mitigate pension scheme risks, but each carries distinct exposures. Buy-in risks include asset-liability mismatch, insurer insolvency, and potential adverse impact on funding ratios, while buy-out risks extend to scheme wind-up complexities, member communication challenges, and reliance on insurer claims-paying ability. Evaluating insurer financial strength, contract terms, and ongoing governance is essential to managing these risks effectively in pension risk transfer strategies.

When Should Pension Schemes Consider Buy-in vs Buy-out?

Pension schemes should consider a buy-in when seeking a secure method to match liabilities while retaining scheme control and flexibility, especially during the accumulation phase. A buy-out becomes appropriate when the scheme aims to fully transfer all liabilities and risks to an insurer, typically as part of winding up or when the sponsor wants complete risk removal. Factors such as scheme size, funding level, member demographics, and long-term risk appetite critically influence the decision between buy-in and buy-out strategies.

Impact on Members: Buy-in vs Buy-out

Buy-in arrangements provide security to pension members by transferring investment and longevity risks to an insurer while keeping the pension scheme intact, ensuring members' benefits are paid as promised. Buy-out involves transferring all liabilities and responsibilities entirely to an insurer, resulting in members becoming policyholders and removing future scheme management risks. The impact on members differs in terms of risk exposure, with buy-outs offering greater certainty but less flexibility compared to buy-ins.

Factors to Consider for Pension Trustees

Pension trustees must evaluate funding status, risk tolerance, and long-term liabilities when considering buy-in or buy-out strategies. Buy-in contracts provide asset-backed policies that hedge longevity risk while maintaining sponsor covenant exposure. Buy-out transactions fully transfer pension obligations to insurers, eliminating ongoing admin responsibilities but requiring robust due diligence on insurer creditworthiness and cost implications.

Important Terms

Bulk Annuity

Bulk annuity buy-in secures pension scheme assets by purchasing insurer liabilities while buy-out fully transfers pension scheme members' risks and obligations to the insurer.

Scheme De-risking

Scheme de-risking involves choosing buy-in or buy-out strategies to transfer pension liabilities and mitigate financial risks for defined benefit schemes.

Section 32 Buyout

Section 32 Buyout legally facilitates transferring ownership interests, distinguishing buy-out as acquiring full control from existing owners, while buy-in involves an external party purchasing a stake to join ownership.

Longevity Risk Transfer

Longevity risk transfer through buy-in schemes involves an employer purchasing an insurance policy to cover pension liabilities while retaining plan sponsorship, whereas buy-out fully transfers pension obligations and assets to an insurer, relieving the employer of all future risks.

Insured Liabilities

Buy-in transfers insured liabilities to an insurer through bulk annuity purchases maintaining sponsor involvement, while buy-out completely removes liabilities from the sponsor by transferring all obligations to the insurer.

Sponsor Covenant

Sponsor Covenant in private equity outlines the commitments and obligations a sponsor must uphold during Buy-in and Buy-out transactions, ensuring alignment of interests with investors. It typically includes guarantees on financial contributions, governance rights, and exit strategies to mitigate risks and enhance deal value.

Deferred Members

Deferred members opting for buy-in strategies contribute assets to pension funds, while buy-out approaches transfer pension liabilities to insurers, securing guaranteed income payments.

Wind-up Process

The wind-up process involves the systematic liquidation of assets and settling of liabilities to finalize a company's closure, highlighting critical distinctions between buy-in transactions, where new investors acquire equity to participate in the business operations, and buy-out transactions, where existing stakeholders purchase shares to gain full ownership control.

Section 75 Debt

Section 75 debt protection applies when you use a credit card for buy-in purchases, offering consumer rights for goods or services costing over PS100, whereas buy-out agreements typically do not qualify under Section 75, limiting consumer protections.

Trivial Commutation

Trivial commutation occurs when the price difference between buy-in and buy-out transactions is minimal, ensuring smooth settlement in securities trading without significant arbitrage opportunities. This concept helps maintain market efficiency by reducing settlement fails and promoting fair pricing during corporate actions and stock borrow/lend operations.

Buy-in vs Buy-out Infographic

moneydif.com

moneydif.com