The Scheme Actuary specializes in assessing the financial health and long-term viability of a pension plan by evaluating liabilities, mortality rates, and funding requirements. The Fund Manager, on the other hand, is responsible for investing the pension fund's assets to achieve growth and meet return targets while managing investment risks. Both roles are critical for ensuring the sustainability and performance of a pension scheme, with the actuary focusing on funding strategy and the manager driving asset allocation and investment decisions.

Table of Comparison

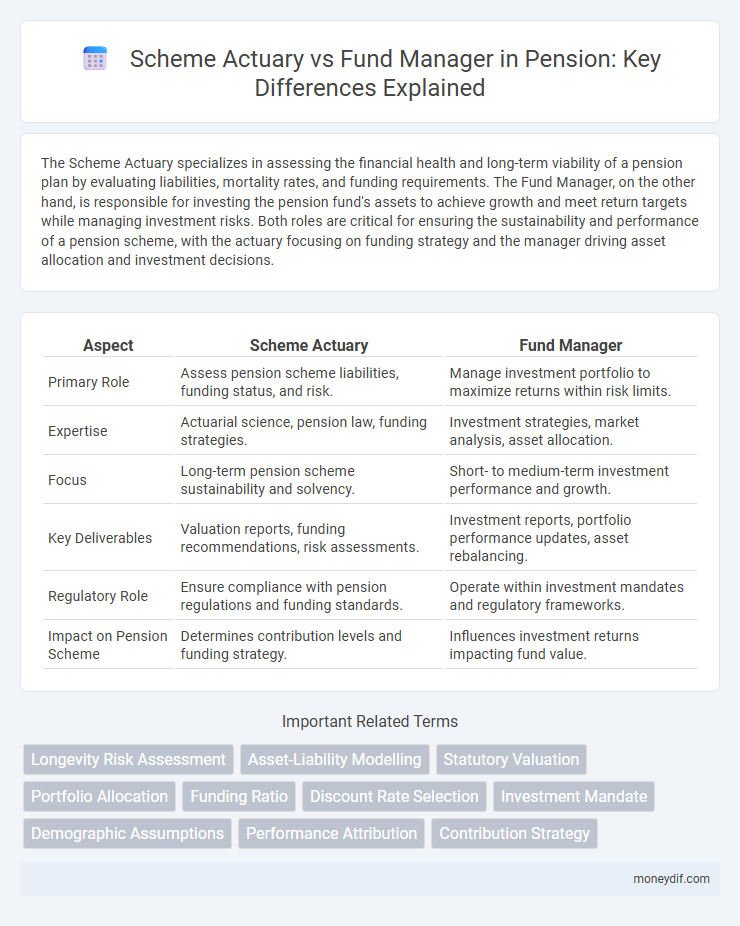

| Aspect | Scheme Actuary | Fund Manager |

|---|---|---|

| Primary Role | Assess pension scheme liabilities, funding status, and risk. | Manage investment portfolio to maximize returns within risk limits. |

| Expertise | Actuarial science, pension law, funding strategies. | Investment strategies, market analysis, asset allocation. |

| Focus | Long-term pension scheme sustainability and solvency. | Short- to medium-term investment performance and growth. |

| Key Deliverables | Valuation reports, funding recommendations, risk assessments. | Investment reports, portfolio performance updates, asset rebalancing. |

| Regulatory Role | Ensure compliance with pension regulations and funding standards. | Operate within investment mandates and regulatory frameworks. |

| Impact on Pension Scheme | Determines contribution levels and funding strategy. | Influences investment returns impacting fund value. |

Understanding the Roles: Scheme Actuary vs Fund Manager

Scheme actuaries focus on evaluating pension plan liabilities, performing actuarial valuations, and ensuring the fund's financial health to meet long-term obligations. Fund managers specialize in investment decisions, asset allocation, and portfolio management to maximize returns within the pension scheme's risk tolerance. Both roles are critical, with actuaries guiding funding strategies while fund managers drive investment performance.

Key Responsibilities of a Scheme Actuary

A Scheme Actuary is responsible for assessing the financial health of a pension scheme by analyzing actuarial assumptions, calculating funding valuations, and ensuring long-term solvency to meet future pension obligations. They provide expert advice on contribution rates and benefit changes, monitor risks, and prepare detailed reports for trustees and regulators to maintain compliance. Unlike fund managers who focus on investment strategy and portfolio growth, scheme actuaries concentrate on balancing liabilities with assets to secure pension promises.

Core Functions of a Fund Manager in Pensions

The core functions of a fund manager in pensions encompass investment decision-making, portfolio management, and risk assessment, aiming to maximize returns within the scheme's risk appetite. Fund managers actively monitor market conditions and adjust asset allocations to meet long-term pension liabilities and ensure steady growth. Their expertise in selecting diverse asset classes directly impacts the financial health and sustainability of pension funds.

Impact on Pension Scheme Performance

Scheme actuaries evaluate pension scheme liabilities and funding levels to ensure long-term solvency, directly influencing contribution rates and benefit sustainability. Fund managers focus on investment decisions, asset allocation, and portfolio performance to maximize returns within risk parameters. The collaboration between actuaries and fund managers significantly impacts pension scheme performance by balancing financial stability with growth potential.

Regulatory and Compliance Duties

Scheme actuaries ensure pension plans comply with regulatory requirements by conducting valuation reports, assessing funding levels, and advising on risk management to meet statutory standards. Fund managers focus on regulatory adherence by managing investment strategies within prescribed guidelines, maintaining asset-liability matching, and reporting to regulatory bodies to safeguard beneficiaries' assets. Both roles require thorough knowledge of pension laws, but scheme actuaries emphasize actuarial compliance while fund managers prioritize investment regulation compliance.

Decision-Making: Valuation vs Investment Strategy

Scheme actuaries focus on accurate valuation of pension liabilities, assessing funding status and long-term risks to ensure sufficient resources for future payouts. Fund managers concentrate on developing and executing investment strategies aimed at maximizing returns while managing market risks within the pension fund's risk appetite. The actuary informs decision-making by providing financial health insights, while the fund manager applies these insights to optimize the asset allocation and portfolio performance.

Risk Management Approaches

Scheme actuaries utilize quantitative risk assessment models to evaluate pension liabilities and ensure sufficient funding levels, focusing on long-term solvency and demographic uncertainties. Fund managers employ investment risk management strategies, including asset diversification and market trend analysis, to optimize returns and mitigate financial volatility. Both roles collaborate to balance actuarial assumptions with market conditions, aligning pension scheme sustainability with fiduciary responsibilities.

Collaboration and Communication in Pension Schemes

Scheme actuaries and fund managers collaborate closely to ensure pension schemes are financially sustainable and aligned with investment strategies. Effective communication between actuaries, who assess liabilities and risks, and fund managers, who oversee asset growth, enables responsive adjustments to funding policies and investment decisions. Regular information exchange supports transparency, enhances risk management, and optimizes the balance between pension benefits and fund performance.

Qualifications and Professional Standards

Scheme actuaries must hold qualifications from recognized actuarial bodies such as the Institute and Faculty of Actuaries or the Society of Actuaries, ensuring expertise in assessing pension liabilities and funding requirements. Fund managers, typically certified through financial certifications like the CFA charter, specialize in investment strategies and portfolio management to maximize fund growth. Both roles adhere to strict professional standards, with scheme actuaries governed by actuarial codes of practice and fund managers regulated by financial authorities and industry best practices.

Choosing Between a Scheme Actuary and a Fund Manager

Choosing between a scheme actuary and a fund manager hinges on their distinct roles: a scheme actuary specializes in assessing pension liabilities, funding levels, and ensuring long-term sustainability through actuarial valuations. In contrast, a fund manager focuses on investing pension assets, optimizing returns, and managing investment risk to meet fund objectives. Effective pension management requires balancing the actuarial insights from scheme actuaries with the strategic asset allocation and investment expertise of fund managers.

Important Terms

Longevity Risk Assessment

The Longevity Risk Assessment conducted by the Scheme Actuary provides critical actuarial projections essential for the Fund Manager's strategic allocation and risk mitigation decisions in pension fund management.

Asset-Liability Modelling

Scheme actuaries optimize Asset-Liability Modelling by forecasting pension obligations and designing funding strategies, while fund managers implement these strategies through asset allocation and investment decisions to meet future liabilities.

Statutory Valuation

Statutory valuation requires the Scheme Actuary to provide an independent assessment of a pension fund's liabilities and financial health, while the Fund Manager focuses on asset management and investment performance to meet those liabilities.

Portfolio Allocation

Portfolio allocation involves strategic distribution of assets to optimize risk-return balance, where a Scheme Actuary focuses on long-term liabilities and ensures the sustainability of pension funds, while a Fund Manager prioritizes short- to medium-term market opportunities to maximize investment returns. The Scheme Actuary's role is crucial in aligning asset allocation with actuarial valuations and funding status, whereas the Fund Manager dynamically adjusts holdings based on market conditions and performance targets.

Funding Ratio

The Funding Ratio, a critical metric comparing a pension scheme's assets to its liabilities, is closely analyzed by Scheme Actuaries who assess long-term financial health and by Fund Managers who focus on asset growth strategies to meet funding targets.

Discount Rate Selection

Scheme actuaries prioritize discount rate selection based on long-term liabilities and regulatory compliance while fund managers focus on market-driven returns and asset performance optimization.

Investment Mandate

The investment mandate defines strategic asset allocation and risk parameters that the Scheme Actuary evaluates for actuarial soundness while the Fund Manager operationalizes these guidelines to optimize portfolio returns within regulatory and fiduciary constraints.

Demographic Assumptions

Demographic assumptions, including mortality rates, retirement ages, and member turnover, critically influence Scheme Actuary valuations by determining pension liabilities, while Fund Managers focus on these factors less directly, prioritizing investment returns and asset allocation strategies.

Performance Attribution

Performance attribution differentiates Scheme Actuary's risk-adjusted return analysis from Fund Manager's portfolio-specific return sources to optimize investment strategy and accountability.

Contribution Strategy

The Contribution Strategy involves determining optimal payment levels based on actuarial assessments to ensure long-term pension fund solvency and risk management by a scheme actuary. Fund managers implement investment decisions aligned with these contribution targets to balance growth objectives and liability matching, enhancing overall fund performance.

Scheme Actuary vs Fund Manager Infographic

moneydif.com

moneydif.com