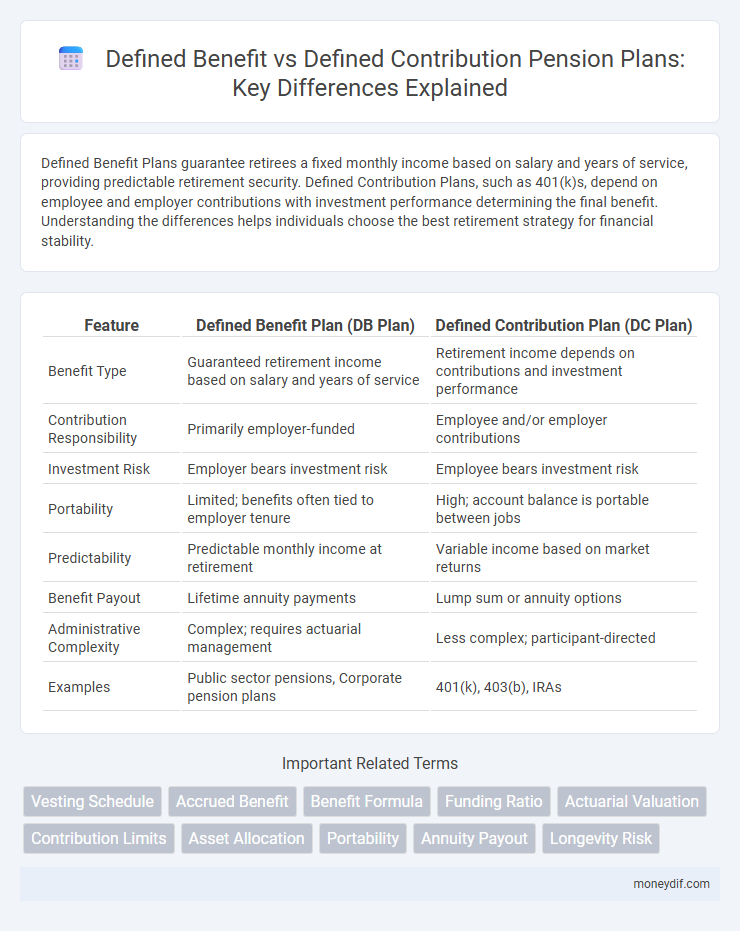

Defined Benefit Plans guarantee retirees a fixed monthly income based on salary and years of service, providing predictable retirement security. Defined Contribution Plans, such as 401(k)s, depend on employee and employer contributions with investment performance determining the final benefit. Understanding the differences helps individuals choose the best retirement strategy for financial stability.

Table of Comparison

| Feature | Defined Benefit Plan (DB Plan) | Defined Contribution Plan (DC Plan) |

|---|---|---|

| Benefit Type | Guaranteed retirement income based on salary and years of service | Retirement income depends on contributions and investment performance |

| Contribution Responsibility | Primarily employer-funded | Employee and/or employer contributions |

| Investment Risk | Employer bears investment risk | Employee bears investment risk |

| Portability | Limited; benefits often tied to employer tenure | High; account balance is portable between jobs |

| Predictability | Predictable monthly income at retirement | Variable income based on market returns |

| Benefit Payout | Lifetime annuity payments | Lump sum or annuity options |

| Administrative Complexity | Complex; requires actuarial management | Less complex; participant-directed |

| Examples | Public sector pensions, Corporate pension plans | 401(k), 403(b), IRAs |

Overview of Defined Benefit and Defined Contribution Plans

Defined Benefit Plans guarantee a specific retirement benefit based on salary and years of service, providing predictable income with the employer bearing investment risk. Defined Contribution Plans, such as 401(k)s, rely on employee and employer contributions invested in individual accounts, with retirement income dependent on investment performance. The key distinction lies in risk allocation: employers manage investment risk in Defined Benefit Plans, whereas employees assume investment risk in Defined Contribution Plans.

Key Features and Structure of Defined Benefit Plans

Defined Benefit Plans guarantee a specified monthly benefit at retirement, determined by factors such as salary history and years of service, offering predictable and stable income for retirees. These plans are typically employer-funded, with investment risk and funding responsibility resting primarily on the employer. The structure includes a pension formula, vesting schedules, and often provides lifelong benefits, making it a traditional and secure retirement option compared to Defined Contribution Plans.

Key Features and Structure of Defined Contribution Plans

Defined Contribution Plans establish individual accounts for participants, where contributions are fixed, but the retirement benefit depends on investment performance and account balance growth. Employers, employees, or both contribute regularly, and the accumulated funds are used to provide retirement income, often through withdrawals or annuities. Investment risk and potential rewards are borne by the participant, contrasting with Defined Benefit Plans where benefits are predetermined and employer-funded.

Funding and Employer Responsibilities

Defined Benefit Plans guarantee a specified retirement benefit amount, requiring employers to assume full funding responsibility and investment risk, with contributions based on actuarial valuations to ensure plan solvency. Defined Contribution Plans require employers to contribute fixed amounts or percentages to individual employee accounts, shifting investment risk and funding responsibility primarily to employees. Employer obligations in Defined Contribution Plans are limited to making agreed contributions, without guarantees on retirement outcomes.

Employee Benefits and Retirement Security

Defined Benefit Plans guarantee a fixed retirement benefit based on salary and years of service, providing employees with predictable income and enhanced retirement security. Defined Contribution Plans, such as 401(k)s, rely on individual contributions and investment performance, offering potential growth but exposing employees to market risks. Employees benefit from guaranteed lifetime income in Defined Benefit Plans, while Defined Contribution Plans promote personal control over retirement savings but with variable outcomes.

Investment Risk: Employer vs Employee

Defined Benefit Plans allocate investment risk to the employer, guaranteeing a fixed retirement benefit regardless of market performance, which requires the employer to manage assets prudently to meet future liabilities. Defined Contribution Plans shift investment risk to the employee, as retirement benefits depend on contributions made and investment returns, exposing employees to market fluctuations and potential shortfalls. This fundamental difference impacts retirement security, with employers bearing responsibility in defined benefit plans while employees assume control and risk in defined contribution arrangements.

Portability and Flexibility Comparison

Defined Benefit Plans offer limited portability as benefits are typically tied to tenure and employer sponsorship, making transfer to a new employer difficult. Defined Contribution Plans provide greater flexibility and portability since account balances are individually owned and can be rolled over to other retirement accounts or new employers' plans. This portability advantage supports workforce mobility and personal control over retirement savings.

Impact on Retirement Income Predictability

Defined Benefit Plans offer stable and predictable retirement income by guaranteeing a fixed payout based on salary and years of service, providing retirees with financial security. Defined Contribution Plans depend on investment performance and contributions, leading to more variable retirement income that can fluctuate with market conditions. The predictability of retirement income is higher in Defined Benefit Plans, while Defined Contribution Plans require individuals to manage investment risks and savings adequacy.

Regulatory and Compliance Considerations

Defined Benefit Plans require strict adherence to funding standards and actuarial assumptions set by regulatory bodies such as the Pension Benefit Guaranty Corporation (PBGC) and the Employee Retirement Income Security Act (ERISA) to ensure long-term solvency and participant protections. Defined Contribution Plans must comply with contribution limits, fiduciary responsibilities, and reporting requirements under ERISA and the Internal Revenue Code, emphasizing transparency and participant control over investment choices. Regulatory frameworks mandate rigorous compliance audits and disclosures for both plans to mitigate risks and protect beneficiaries' retirement assets.

Choosing the Right Pension Plan for Your Needs

Defined Benefit Plans guarantee a fixed retirement income based on salary and years of service, offering financial stability and predictable benefits. Defined Contribution Plans depend on individual contributions and investment performance, providing flexibility but variable outcomes. Selecting the right pension plan involves assessing your risk tolerance, retirement goals, and the need for income certainty versus growth potential.

Important Terms

Vesting Schedule

A vesting schedule in a Defined Benefit Plan typically determines the employee's right to pension benefits after a specified period, whereas in a Defined Contribution Plan, it dictates the employee's ownership of employer-contributed funds over time.

Accrued Benefit

Accrued benefits in defined benefit plans guarantee a predetermined retirement payout based on salary and service years, whereas defined contribution plans depend on individual contributions and investment performance with no assured benefits.

Benefit Formula

The Benefit Formula in a Defined Benefit Plan guarantees a predetermined retirement benefit based on salary and years of service, whereas a Defined Contribution Plan depends on individual contributions and investment returns without a fixed payout.

Funding Ratio

Funding ratio measures the financial health of a Defined Benefit Plan by comparing its assets to liabilities, unlike Defined Contribution Plans where funding depends solely on individual contributions.

Actuarial Valuation

Actuarial valuation assesses the present value of future liabilities in Defined Benefit Plans by analyzing demographic and financial assumptions, ensuring sufficient funding for promised retirement benefits. In contrast, Defined Contribution Plans rely on actual contributions and investment performance, transferring investment risk to participants without requiring actuarial valuation of future obligations.

Contribution Limits

Defined Benefit Plan contribution limits are determined by actuarial calculations to guarantee a specific retirement benefit, whereas Defined Contribution Plan limits are set by annual IRS contribution caps, such as $22,500 for 401(k) plans in 2024.

Asset Allocation

Asset allocation in defined benefit plans focuses on generating stable returns to meet future pension liabilities, often favoring fixed income and long-term investments, whereas defined contribution plans emphasize growth-oriented assets like equities to maximize individual account balances over time. The differing risk exposure and investment horizons between these plans require tailored asset strategies to balance security and growth objectives effectively.

Portability

Portability in Defined Contribution Plans allows participants to easily transfer accumulated assets between employers, while Defined Benefit Plans generally have limited portability due to employer-specific pension promises.

Annuity Payout

Annuity payout in a Defined Benefit Plan guarantees retirees a fixed income based on salary and years of service, ensuring financial stability over retirement. In contrast, a Defined Contribution Plan's annuity payout depends on investment performance and contributions, leading to variable retirement income without guaranteed fixed payments.

Longevity Risk

Longevity risk in Defined Benefit Plans arises from the obligation to provide lifetime pension payments, creating uncertainty in funding due to increasing life expectancies. Defined Contribution Plans transfer this risk to employees, as benefits depend on investment performance and accumulated savings, with no guaranteed payout duration.

Defined Benefit Plan vs Defined Contribution Plan Infographic

moneydif.com

moneydif.com