Overlay management enhances pension portfolio returns by actively adjusting exposure through derivatives while maintaining the core bond portfolio for risk control. Immunization focuses on matching asset duration to liability duration to minimize interest rate risks and ensure funding stability. Combining overlay management with immunization strategies allows pension funds to optimize returns without compromising liability-driven investment objectives.

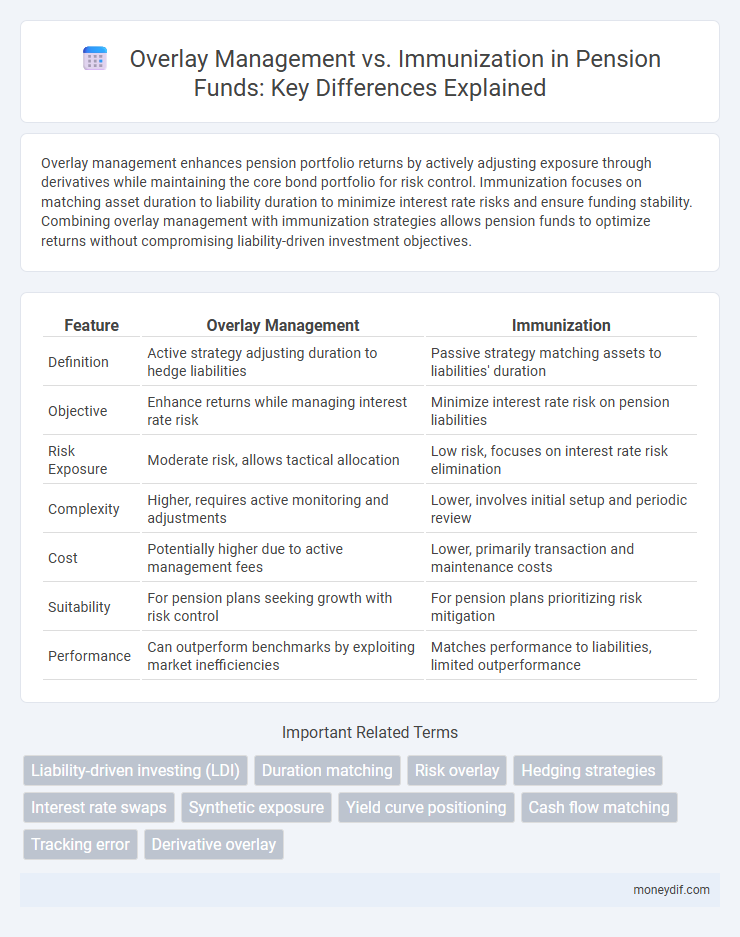

Table of Comparison

| Feature | Overlay Management | Immunization |

|---|---|---|

| Definition | Active strategy adjusting duration to hedge liabilities | Passive strategy matching assets to liabilities' duration |

| Objective | Enhance returns while managing interest rate risk | Minimize interest rate risk on pension liabilities |

| Risk Exposure | Moderate risk, allows tactical allocation | Low risk, focuses on interest rate risk elimination |

| Complexity | Higher, requires active monitoring and adjustments | Lower, involves initial setup and periodic review |

| Cost | Potentially higher due to active management fees | Lower, primarily transaction and maintenance costs |

| Suitability | For pension plans seeking growth with risk control | For pension plans prioritizing risk mitigation |

| Performance | Can outperform benchmarks by exploiting market inefficiencies | Matches performance to liabilities, limited outperformance |

Overview of Overlay Management and Immunization in Pension Funds

Overlay management enhances pension fund portfolios by dynamically adjusting asset allocations to manage risk and improve returns without altering the underlying investments. Immunization strategies aim to match the duration of assets and liabilities, ensuring that changes in interest rates do not affect the fund's ability to meet future pension payments. Both approaches are critical in maintaining pension fund stability, with overlay management offering flexibility and immunization providing a more rigid, risk-averse framework.

Key Differences Between Overlay Management and Immunization Strategies

Overlay management in pension portfolios involves actively adjusting asset allocations to enhance returns or control risk without altering the core investments, whereas immunization strategies focus on matching assets and liabilities to minimize interest rate risk and ensure future pension payments. Overlay management offers flexibility and can respond dynamically to market changes, contrasted with immunization's static, duration-matching approach designed for long-term liability protection. The key difference lies in overlay management's opportunistic adjustments versus immunization's liability-driven, risk-averse framework.

Objectives and Benefits of Overlay Management for Pension Plans

Overlay management in pension plans aims to enhance portfolio efficiency by dynamically adjusting asset exposures without altering the underlying investment structure, allowing precise risk control and cost-effective implementation of strategic objectives. Unlike immunization, which focuses on matching liabilities to fixed income assets to safeguard against interest rate changes, overlay management actively seeks incremental returns and risk reduction through derivatives and tactical asset allocation. This approach provides pension plans increased flexibility, improved risk-adjusted performance, and the ability to respond swiftly to market conditions while maintaining the integrity of the core investment strategy.

Immunization Strategies: Definition, Types, and Applications in Pensions

Immunization strategies in pensions involve structuring a fixed-income portfolio to shield the fund from interest rate fluctuations by matching asset durations with liability durations. Types include classical duration matching, key rate duration immunization, and contingent immunization, each tailored to different risk profiles and market conditions. Applications in pension funds ensure predictable cash flows to meet future liabilities, thereby minimizing the risk of underfunding due to interest rate changes.

Risk Management in Pension Funds: Overlay vs. Immunization Approaches

Overlay management in pension funds involves dynamic adjustments using derivatives and other instruments to manage interest rate and inflation risks without altering the underlying asset portfolio. Immunization strategies focus on matching asset durations with liability durations to ensure that pension obligations are met regardless of interest rate movements. Combining overlay management with immunization can enhance risk mitigation by providing flexibility and precision in managing interest rate exposure and cash flow matching.

Impact on Portfolio Performance: Overlay Management vs. Immunization

Overlay management enhances portfolio performance by dynamically adjusting exposures to market risks through derivatives, enabling tactical asset allocation and cost-efficient risk control. Immunization focuses on locking in returns by matching asset durations with liabilities, reducing interest rate risk but limiting upside potential from market fluctuations. Compared to immunization, overlay management offers greater flexibility and opportunity for alpha generation, though it requires more active monitoring and expertise to manage hedge effectiveness and transaction costs.

Matching Pension Liabilities: Which Method Works Best?

Overlay management enhances pension liability matching by dynamically adjusting asset allocations through derivatives, providing flexibility against interest rate fluctuations. Immunization focuses on constructing a fixed portfolio duration to meet future liabilities, ensuring predictable funding but with less adaptability to market changes. For pension plans seeking a balance between risk control and responsiveness, overlay management often delivers superior precision in matching evolving liabilities.

Implementation Challenges: Overlay Management Compared to Immunization

Overlay management faces implementation challenges including increased complexity in monitoring and adjusting multiple active strategies simultaneously, which requires advanced technology and skilled personnel. Immunization tends to be more straightforward due to its focus on matching asset durations to liabilities, reducing the frequency of rebalancing and easing operational demands. The dynamic nature of overlay management also introduces higher transaction costs and risks of model misspecification compared to the relatively stable immunization approach.

Cost Considerations for Pension Funds: Overlay vs. Immunization

Overlay management offers pension funds a flexible and cost-efficient approach by dynamically adjusting asset exposures without the need for large-scale portfolio reallocations. Immunization strategies, while providing predictable liability matching, often incur higher transaction costs and require frequent rebalancing to maintain duration alignment. Evaluating cost implications, overlay management can optimize risk control with lower operational expenses compared to the fixed, often more rigid immunization framework.

Future Trends in Pension Portfolio Management Strategies

Overlay management in pension portfolios leverages derivatives to dynamically adjust risk exposures without altering underlying asset holdings, offering enhanced flexibility compared to traditional immunization techniques that aim to match asset durations with liabilities. Future trends indicate a growing adoption of overlay strategies to optimize cost efficiency and respond swiftly to market fluctuations, driven by advances in quantitative modeling and real-time data analytics. Increasing integration of machine learning algorithms promises to further refine risk control and return enhancement in pension portfolio management.

Important Terms

Liability-driven investing (LDI)

Liability-driven investing (LDI) focuses on matching assets to future liabilities using overlay management techniques to dynamically adjust portfolios, while immunization aims to statically minimize interest rate risk by aligning asset durations with those of liabilities.

Duration matching

Duration matching in overlay management optimizes portfolio risk exposure by aligning asset and liability durations, whereas immunization focuses on securing a portfolio's value against interest rate changes by ensuring assets sufficiently cover liabilities at a specific time.

Risk overlay

Risk overlay enhances portfolio protection by dynamically adjusting overlay management strategies to complement immunization techniques that stabilize asset-liability durations.

Hedging strategies

Hedging strategies in overlay management focus on dynamically adjusting portfolio exposures to capture market opportunities and mitigate risks, whereas immunization aims to structure fixed-income portfolios to shield against interest rate fluctuations by matching the duration of assets and liabilities. Overlay management typically employs derivatives to tactically manage risk and enhance returns, while immunization relies on precise asset-liability matching to ensure portfolio value remains stable over time.

Interest rate swaps

Interest rate swaps are financial derivatives used in overlay management strategies to dynamically adjust portfolio exposure, whereas immunization focuses on matching assets and liabilities to hedge interest rate risk statically.

Synthetic exposure

Synthetic exposure in overlay management optimizes portfolio risk by replicating asset cash flows, whereas immunization strategically minimizes interest rate risk through duration matching.

Yield curve positioning

Yield curve positioning in overlay management involves strategically adjusting bond portfolios to exploit interest rate movements across different maturities, enhancing returns beyond traditional benchmarks. Immunization focuses on minimizing interest rate risk by matching asset durations to liabilities, preserving portfolio value against rate fluctuations.

Cash flow matching

Cash flow matching involves structuring bond portfolios so that incoming cash flows align precisely with future liabilities, optimizing liability-driven investment strategies. Overlay management differs by dynamically adjusting asset positions to hedge risks without altering the underlying portfolio, whereas immunization ensures the portfolio's duration matches liability duration to minimize interest rate risk impact.

Tracking error

Tracking error quantifies the performance deviation between overlay management strategies and immunization approaches in fixed income portfolios, highlighting differences in risk and return alignment.

Derivative overlay

Derivative overlay strategies enhance overlay management by strategically adjusting portfolio exposures to achieve immunization against interest rate risk.

Overlay management vs Immunization Infographic

moneydif.com

moneydif.com