Accrued Benefit Obligation (ABO) represents the pension benefits earned by employees based on their service to date, calculated using current salary levels. Projected Benefit Obligation (PBO) estimates the pension benefits payable that considers future salary increases, providing a more comprehensive view of the pension liability. Understanding the difference between ABO and PBO is crucial for accurate pension fund valuation and financial reporting.

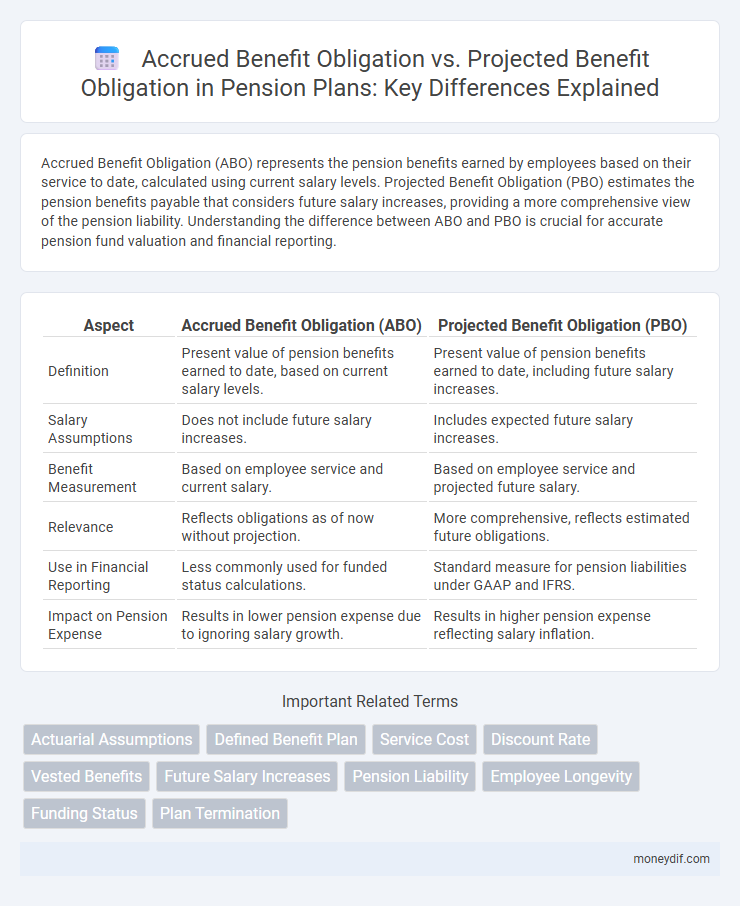

Table of Comparison

| Aspect | Accrued Benefit Obligation (ABO) | Projected Benefit Obligation (PBO) |

|---|---|---|

| Definition | Present value of pension benefits earned to date, based on current salary levels. | Present value of pension benefits earned to date, including future salary increases. |

| Salary Assumptions | Does not include future salary increases. | Includes expected future salary increases. |

| Benefit Measurement | Based on employee service and current salary. | Based on employee service and projected future salary. |

| Relevance | Reflects obligations as of now without projection. | More comprehensive, reflects estimated future obligations. |

| Use in Financial Reporting | Less commonly used for funded status calculations. | Standard measure for pension liabilities under GAAP and IFRS. |

| Impact on Pension Expense | Results in lower pension expense due to ignoring salary growth. | Results in higher pension expense reflecting salary inflation. |

Definition of Accrued Benefit Obligation (ABO)

Accrued Benefit Obligation (ABO) represents the present value of pension benefits earned by employees up to the measurement date, based on current and past service without considering future salary increases. ABO is a key component in pension accounting and reflects the obligation a company has for vested and non-vested benefits as of the valuation date. It contrasts with Projected Benefit Obligation (PBO), which factors in expected future salary growth affecting benefit amounts.

Definition of Projected Benefit Obligation (PBO)

The Projected Benefit Obligation (PBO) represents the actuarial present value of all pension benefits earned to date, including future salary increases, assuming the employee remains with the company until retirement. It differs from the Accrued Benefit Obligation (ABO), which only accounts for vested benefits based on current salaries without projecting future earnings. The PBO provides a more comprehensive estimate of the pension liability as it incorporates expected salary growth and service periods.

Key Differences Between ABO and PBO

Accrued Benefit Obligation (ABO) represents the present value of pension benefits earned by employees up to the valuation date, based on current salaries and service. Projected Benefit Obligation (PBO) includes future salary increases in calculating the pension liabilities, reflecting the estimated benefit at retirement considering expected compensation growth. The key difference lies in ABO using current salary levels, while PBO projects future salary levels, providing a more comprehensive measure of pension obligations.

Calculation Methods for ABO

The Accrued Benefit Obligation (ABO) calculation method uses employees' service and compensation history up to the measurement date, assuming no future salary increases. Actuarial assumptions consider factors such as employee turnover, mortality rates, and discount rates to estimate the present value of pension benefits earned. This contrasts with the Projected Benefit Obligation (PBO), which incorporates expected future salary growth in the benefit calculation.

Calculation Methods for PBO

Projected Benefit Obligation (PBO) calculation incorporates future salary increases, reflecting the expected benefits payable at retirement based on projected compensation levels. This method uses actuarial assumptions, such as employee turnover rates, mortality rates, and discount rates, to estimate the present value of pension liabilities. PBO provides a more comprehensive measure of pension obligations compared to Accrued Benefit Obligation, which considers benefits earned only up to the current date without anticipating future salary growth.

Impact on Pension Plan Funding

Accrued Benefit Obligation (ABO) represents the pension liabilities based on employees' earned service to date, calculated using current salary levels, leading to a more conservative estimate of pension plan funding needs. Projected Benefit Obligation (PBO) incorporates future salary increases, resulting in a higher liability figure that often requires companies to allocate more funds to ensure sufficient pension plan assets. The choice between ABO and PBO significantly impacts pension plan funding strategies, influencing contribution levels, funding adequacy assessments, and balancing long-term financial commitments.

Relevance to Financial Statements

The Accrued Benefit Obligation (ABO) represents the present value of pension benefits earned by employees up to the measurement date, using current salary levels, making it a conservative estimate for financial statements. The Projected Benefit Obligation (PBO), in contrast, includes expected future salary increases, providing a more comprehensive liability measure that reflects potential cost growth. Both ABO and PBO impact the pension liability reported on the balance sheet, but the PBO often leads to higher reported obligations, affecting expense recognition and corporate financial ratios.

Role in Actuarial Valuations

Accrued Benefit Obligation (ABO) represents the present value of pension benefits earned by employees up to the valuation date, based on current salary levels, serving as a conservative estimate in actuarial valuations. Projected Benefit Obligation (PBO) incorporates expected future salary increases, reflecting the anticipated pension liability more comprehensively over time. Actuaries rely on PBO to capture the impact of salary growth assumptions, while ABO provides a snapshot of vested benefits, both crucial for accurate pension fund assessments.

ABO vs. PBO in Risk Management

Accrued Benefit Obligation (ABO) reflects the present value of pension benefits earned by employees up to the measurement date using current salary levels, providing a conservative estimate valuable in risk management to assess matured liabilities. Projected Benefit Obligation (PBO) incorporates future salary increases, offering a more comprehensive liability measure that helps identify potential funding shortfalls and supports strategic pension risk mitigation. Understanding the distinction between ABO and PBO enables pension fund managers to balance precision and prudence in liability assessment, optimizing asset allocation and hedging strategies.

Regulatory and Reporting Requirements

Accrued Benefit Obligation (ABO) represents the present value of pension benefits earned by employees up to the measurement date based on current compensation levels, complying with conservative regulatory standards for financial reporting. Projected Benefit Obligation (PBO) incorporates expected future salary increases, providing a more comprehensive estimate aligned with regulatory frameworks such as GAAP and IFRS for pension liability disclosure. Accurate distinction between ABO and PBO is critical for regulatory compliance, ensuring transparent pension plan financial statements and adherence to pension accounting standards.

Important Terms

Actuarial Assumptions

Accrued Benefit Obligation (ABO) uses actuarial assumptions based on current salaries, while Projected Benefit Obligation (PBO) incorporates future salary increases to estimate pension liabilities.

Defined Benefit Plan

The Accrued Benefit Obligation (ABO) measures the present value of pension benefits earned by employees up to a specific date, based on salary history and service, while the Projected Benefit Obligation (PBO) includes future salary increases in its calculation, providing a more comprehensive estimate of the employer's pension liability under a defined benefit plan. Understanding the distinction between ABO and PBO is crucial for accurate pension accounting and financial reporting, as PBO typically results in a higher liability reflecting anticipated salary growth.

Service Cost

Service cost represents the present value of benefits earned by employees during a period, directly increasing the Accrued Benefit Obligation but calculated based on projections reflected in the Projected Benefit Obligation.

Discount Rate

The discount rate directly impacts the valuation of both Accrued Benefit Obligation (ABO) and Projected Benefit Obligation (PBO), with a higher discount rate reducing the present value of future pension liabilities. While ABO is calculated using current salary levels discounted to present value, PBO incorporates expected future salary increases, making it generally larger and more sensitive to variations in the discount rate.

Vested Benefits

Vested benefits represent the portion of accumulated pension rights secured under the Accrued Benefit Obligation, distinguishing it from the Projected Benefit Obligation which includes future salary projections.

Future Salary Increases

Future salary increases significantly impact the Projected Benefit Obligation by incorporating expected wage growth, whereas the Accrued Benefit Obligation reflects retirement benefits based solely on current salary levels.

Pension Liability

Pension liability is determined by comparing the Accrued Benefit Obligation, which reflects pension benefits earned to date based on current salary levels, with the Projected Benefit Obligation, which estimates future pension benefits considering expected salary increases.

Employee Longevity

Employee longevity increases the Projected Benefit Obligation compared to the Accrued Benefit Obligation due to the extended period of anticipated benefit payments.

Funding Status

Funding status measures the difference between plan assets and the Accrued Benefit Obligation (ABO), reflecting the present value of benefits earned by employees up to the measurement date. The Projected Benefit Obligation (PBO) represents the present value of all future benefits expected based on future salary increases, often exceeding the ABO due to the inclusion of projected wage growth.

Plan Termination

Plan termination requires measuring liabilities using the Accrued Benefit Obligation (ABO) to reflect vested benefits, which may differ from the typically higher Projected Benefit Obligation (PBO) that includes future salary increases.

Accrued Benefit Obligation vs Projected Benefit Obligation Infographic

moneydif.com

moneydif.com