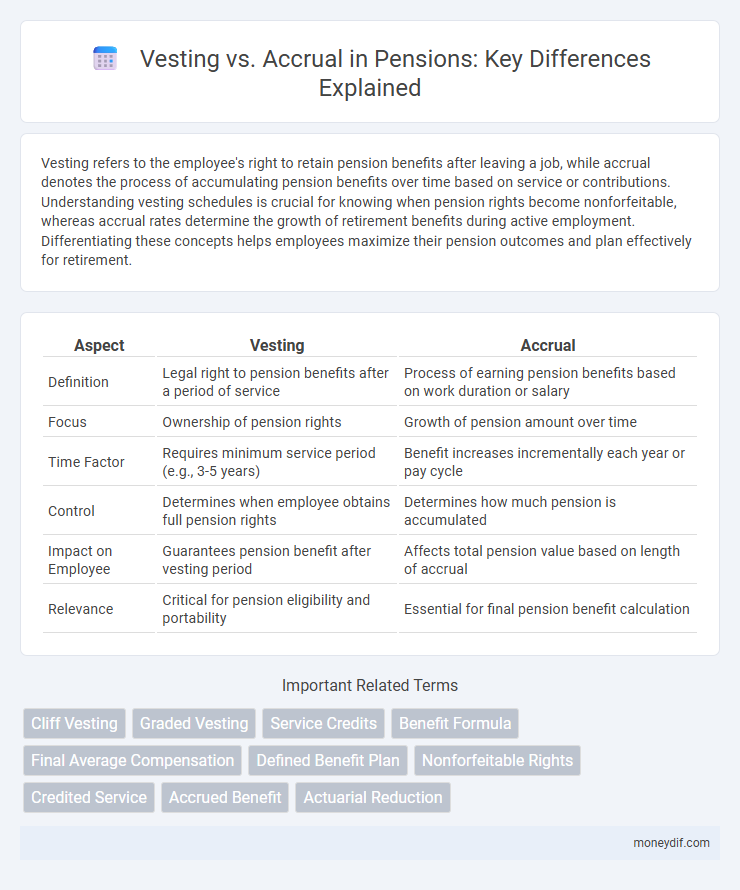

Vesting refers to the employee's right to retain pension benefits after leaving a job, while accrual denotes the process of accumulating pension benefits over time based on service or contributions. Understanding vesting schedules is crucial for knowing when pension rights become nonforfeitable, whereas accrual rates determine the growth of retirement benefits during active employment. Differentiating these concepts helps employees maximize their pension outcomes and plan effectively for retirement.

Table of Comparison

| Aspect | Vesting | Accrual |

|---|---|---|

| Definition | Legal right to pension benefits after a period of service | Process of earning pension benefits based on work duration or salary |

| Focus | Ownership of pension rights | Growth of pension amount over time |

| Time Factor | Requires minimum service period (e.g., 3-5 years) | Benefit increases incrementally each year or pay cycle |

| Control | Determines when employee obtains full pension rights | Determines how much pension is accumulated |

| Impact on Employee | Guarantees pension benefit after vesting period | Affects total pension value based on length of accrual |

| Relevance | Critical for pension eligibility and portability | Essential for final pension benefit calculation |

Understanding Vesting in Pension Plans

Vesting in pension plans determines the employee's right to the benefits contributed by the employer, ensuring eligibility to receive the pension after a specific period of service. Unlike accrual, which refers to the gradual accumulation of pension benefits based on earnings and years worked, vesting sets the legal ownership of those benefits. Understanding vesting schedules, such as cliff or graded vesting, is crucial for maximizing pension entitlements and retirement security.

What is Accrual in Pension Schemes?

Accrual in pension schemes refers to the process by which pension benefits are earned and accumulate over time based on an employee's service and salary. It determines the portion of the pension an employee is entitled to receive upon retirement, typically calculated as a fraction of annual earnings multiplied by years of service. Understanding accrual rates is crucial for evaluating the growth of pension benefits and estimating future retirement income.

Key Differences Between Vesting and Accrual

Vesting refers to the process by which an employee gains ownership of employer-contributed pension benefits, ensuring the right to those benefits even after leaving the company. Accrual describes the gradual buildup of pension benefits based on the employee's years of service and salary, determining the amount payable at retirement. The key difference is that vesting secures the right to benefits, while accrual calculates the benefit amount earned over time.

How Vesting Schedules Affect Retirement Benefits

Vesting schedules determine the timeline over which employees gain ownership of their pension benefits, directly impacting the amount of retirement income they can claim. A faster vesting schedule allows for earlier access to pension funds, increasing financial security upon retirement, while slower schedules may reduce benefits if employment ends prematurely. Understanding the nuances of vesting versus accrual helps employees optimize their retirement planning by aligning tenure with pension eligibility and growth.

Accrual Rates: Calculating Pension Growth

Accrual rates determine how much pension benefit an employee earns for each year of service, directly influencing pension growth calculations. Pension accrual is typically expressed as a percentage of the employee's final salary or average earnings, multiplied by years of service to calculate the total pension entitlement. Understanding the specific accrual rate is essential for accurately projecting future pension income and comparing pension plan benefits.

Vesting Periods: What Employees Need to Know

Vesting periods define the time employees must work before gaining full ownership of employer-contributed pension benefits, ensuring job retention incentives and financial security. Understanding vesting schedules--cliff or graded--is crucial for employees to maximize their retirement savings and plan career moves effectively. Awareness of state and federal regulations affecting vesting timelines helps employees avoid forfeiting benefits when changing jobs or retiring.

Impact of Job Changes on Vesting and Accrual

Job changes can significantly affect both vesting and accrual in pension plans, as vesting schedules determine the portion of pension benefits employees retain upon leaving a job. Accrual refers to the rate at which pension benefits accumulate based on service time, and switching employers may reset or halt accrual in defined benefit plans lacking portability. Understanding company-specific vesting rules and the type of pension plan is crucial for maintaining pension value during career transitions.

Legal and Regulatory Considerations for Vesting

Legal and regulatory considerations for vesting in pension plans ensure employees' entitlement to pension benefits after meeting specific service requirements, protecting them from forfeiture. Vesting schedules are mandated by laws such as the Employee Retirement Income Security Act (ERISA) in the U.S., which sets minimum standards for both cliff and graded vesting timelines. Non-compliance with these regulations can lead to legal penalties and undermine employees' retirement security, making adherence critical for plan sponsors.

Strategies to Maximize Your Pension Accrual

To maximize your pension accrual, focus on understanding the vesting schedule and increasing your years of service, as longer tenure directly boosts your pension benefits. Prioritize contributing the maximum allowable amount to defined contribution plans and carefully select investment options that align with your risk tolerance and retirement timeline. Regularly review your pension statements and seek financial advice to optimize both vesting status and accrual rates for a secure retirement.

Vesting vs Accrual: Choosing the Right Pension Plan

Vesting determines when an employee gains non-forfeitable rights to pension benefits, while accrual refers to the gradual accumulation of pension benefits over time based on salary and service years. Choosing the right pension plan requires understanding how vesting schedules affect benefit security versus how accrual rates influence final payout amounts. Employers and employees must evaluate both factors to maximize retirement income and ensure long-term financial stability.

Important Terms

Cliff Vesting

Cliff vesting refers to a vesting schedule where employees gain full ownership of their employer-provided benefits, such as retirement contributions, only after completing a specified continuous service period, often three or five years. In contrast, accrual-based vesting grants employees incremental ownership over benefits gradually, typically on a monthly or yearly basis, providing partial rights before full vesting is achieved.

Graded Vesting

Graded vesting gradually increases employee ownership in benefits over a specified period, contrasting with accrual which refers to the continuous accumulation of benefits independent of vesting schedules.

Service Credits

Service credits represent the amount of time an employee has worked towards pension or retirement benefits, with vesting referring to the portion of those credits an employee owns unconditionally after a certain period. Accrual pertains to the gradual accumulation of service credits over time, which directly impacts the employee's eligibility and benefit level upon vesting.

Benefit Formula

Benefit Formula determines retirement payouts by comparing Vesting, which secures participant eligibility over time, against Accrual, which calculates benefits earned based on service length and salary.

Final Average Compensation

Final Average Compensation determines pension benefits by calculating the average salary over a specified period, directly impacting vesting and accrual rates in retirement plans.

Defined Benefit Plan

Defined Benefit Plans typically feature a vesting schedule that determines when employees gain ownership of pension benefits, while accrual refers to the rate at which pension benefits accumulate based on years of service and salary.

Nonforfeitable Rights

Nonforfeitable rights ensure employees retain vested benefits, distinguishing them from accrued benefits that accumulate but may be forfeited if vesting conditions are unmet.

Credited Service

Credited service determines vesting eligibility by counting total service time, while accrual refers to the rate at which pension benefits accumulate during that service.

Accrued Benefit

Accrued benefits increase with each vesting period, reflecting the employee's earned entitlement, while accrual refers to the gradual accumulation of pension rights over time.

Actuarial Reduction

Actuarial reduction adjusts pension benefits by decreasing accrued amounts based on early vesting dates and the timing of benefit accruals.

Vesting vs Accrual Infographic

moneydif.com

moneydif.com