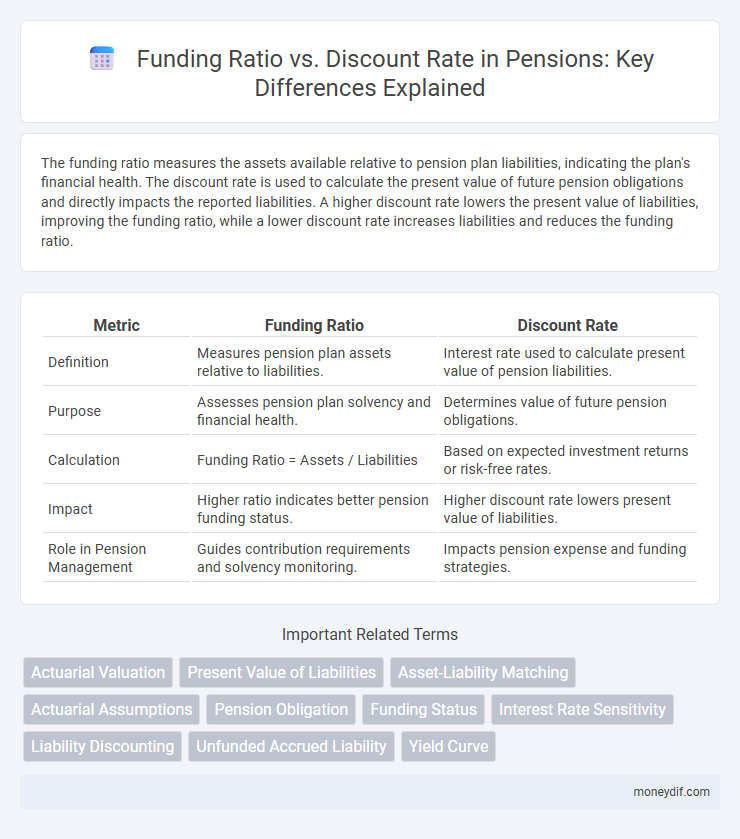

The funding ratio measures the assets available relative to pension plan liabilities, indicating the plan's financial health. The discount rate is used to calculate the present value of future pension obligations and directly impacts the reported liabilities. A higher discount rate lowers the present value of liabilities, improving the funding ratio, while a lower discount rate increases liabilities and reduces the funding ratio.

Table of Comparison

| Metric | Funding Ratio | Discount Rate |

|---|---|---|

| Definition | Measures pension plan assets relative to liabilities. | Interest rate used to calculate present value of pension liabilities. |

| Purpose | Assesses pension plan solvency and financial health. | Determines value of future pension obligations. |

| Calculation | Funding Ratio = Assets / Liabilities | Based on expected investment returns or risk-free rates. |

| Impact | Higher ratio indicates better pension funding status. | Higher discount rate lowers present value of liabilities. |

| Role in Pension Management | Guides contribution requirements and solvency monitoring. | Impacts pension expense and funding strategies. |

Understanding Pension Funding Ratios

Pension funding ratios measure the financial health of a pension plan by comparing its assets to its liabilities, indicating whether the plan has sufficient funds to meet future obligations. The discount rate, used to calculate the present value of pension liabilities, significantly impacts the funding ratio; higher discount rates reduce liability estimates and improve funding ratios, while lower rates inflate liabilities and worsen them. Accurately understanding the relationship between funding ratios and discount rates is crucial for pension plan sponsors to manage risk and ensure long-term sustainability.

Defining Discount Rate in Pension Plans

The discount rate in pension plans represents the interest rate used to calculate the present value of future pension liabilities, reflecting the time value of money and risk associated with the plan's obligations. It directly influences the funding ratio by determining the value assigned to pension obligations compared to plan assets. A higher discount rate reduces the present value of liabilities, often resulting in a higher funding ratio, while a lower rate increases liabilities, decreasing the funding ratio.

The Role of Discount Rate in Calculating Liabilities

The discount rate plays a critical role in determining pension liabilities by reflecting the present value of future obligations, directly impacting the funding ratio. A higher discount rate reduces the present value of liabilities, increasing the funding ratio and indicating a healthier pension plan status. Conversely, a lower discount rate raises liabilities' present value, decreasing the funding ratio and signaling potential underfunding risks.

Impact of Discount Rate Changes on Funding Ratio

Changes in the discount rate directly affect the pension plan's funding ratio by altering the present value of future liabilities; a higher discount rate lowers liabilities and improves the funding ratio, while a lower discount rate increases liabilities and reduces the funding ratio. Pension funds with significant fixed-income assets are particularly sensitive to discount rate fluctuations, impacting the perceived solvency and required contributions. Accurate discount rate selection is critical for realistic funding status and long-term pension sustainability.

Comparing Funding Ratio and Discount Rate: Key Differences

The funding ratio measures a pension plan's assets relative to its liabilities, indicating its financial health and ability to meet future obligations. The discount rate is used to calculate the present value of those liabilities, directly affecting the funding ratio by determining how liabilities are valued. A higher discount rate reduces the present value of liabilities, improving the funding ratio, while a lower discount rate increases liabilities and can signal underfunding risks.

Regulatory Requirements for Pension Discount Rates

Regulatory requirements for pension discount rates often mandate the use of conservative assumptions to ensure sufficient funding ratios and reduce the risk of underfunding. Regulatory bodies may require discount rates based on high-quality corporate bond yields or risk-free rates, directly influencing the reported funding ratio by impacting the present value of liabilities. Accurate adherence to these prescribed discount rates ensures pension plans meet solvency standards and maintain financial stability for beneficiaries.

How Economic Assumptions Affect Funding Ratios

Economic assumptions, particularly the discount rate, critically influence pension funding ratios by determining the present value of future liabilities. Higher discount rates reduce the present value of obligations, resulting in improved funding ratios, while lower rates increase liabilities and signal underfunding. Changes in inflation expectations, wage growth, and investment returns also alter funding ratios by affecting both asset valuations and the calculated pension liabilities.

Managing Pension Risk: Funding Ratio vs Discount Rate Decisions

Managing pension risk requires careful alignment between the funding ratio and discount rate, as the funding ratio indicates a pension plan's financial health while the discount rate reflects assumptions about future liabilities. A higher discount rate reduces the present value of pension liabilities, potentially improving the funding ratio but increasing the risk if actual returns fall short. Effective pension risk management balances realistic discount rate selection with maintaining a funding ratio that supports long-term sustainability and minimizes underfunding risks.

Best Practices for Setting Pension Discount Rates

Setting pension discount rates requires balancing realistic assumptions with financial prudence to maintain a healthy funding ratio. Best practices emphasize using discount rates that reflect the plan's expected investment returns while considering market conditions and liabilities duration to avoid underestimating obligations. Employing a combination of risk-free rates and equity risk premiums supports sustainable funding ratios and long-term pension solvency.

Improving Funding Ratios: Strategies and Considerations

Improving funding ratios requires careful management of discount rates to accurately reflect pension liabilities and investment risks. Adopting more conservative discount rates can enhance the reliability of funding assessments while incentivizing prudent asset allocation and contribution strategies. Monitoring market conditions and regulatory guidelines ensures alignment of discount rates with long-term liabilities, supporting sustainable pension funding.

Important Terms

Actuarial Valuation

The actuarial valuation reveals that a higher discount rate typically lowers the funding ratio by reducing the present value of liabilities, affecting pension plan solvency assessments.

Present Value of Liabilities

The Present Value of Liabilities (PVL) decreases as the Discount Rate increases, directly impacting the Funding Ratio by improving it when liabilities are discounted at higher rates. A lower Discount Rate raises the PVL, thus reducing the Funding Ratio and indicating potential underfunding in pension or insurance plans.

Asset-Liability Matching

Asset-liability matching optimizes funding ratio management by aligning asset returns with discount rates to minimize funding shortfalls and ensure pension plan solvency.

Actuarial Assumptions

The funding ratio, a key measure of pension plan health, is directly influenced by the discount rate assumptions used in actuarial valuations, where higher discount rates typically increase the funding ratio by reducing the present value of liabilities.

Pension Obligation

Pension obligation valuation depends heavily on the discount rate, where a lower discount rate increases the present value of liabilities, thereby decreasing the funding ratio. Accurate discount rate assumptions aligned with market conditions are essential for effective pension fund management and ensuring sustainable funding ratios.

Funding Status

A funding ratio exceeding the discount rate indicates a pension plan's assets sufficiently cover its liabilities, signaling strong financial health. Conversely, a funding ratio below the discount rate suggests underfunding, increasing the risk of future contribution shortfalls to meet obligations.

Interest Rate Sensitivity

Interest rate sensitivity critically influences the funding ratio as fluctuations in discount rates directly impact the present value of pension liabilities, causing funding status to vary. A lower discount rate increases the present value of liabilities, reducing the funding ratio, while a higher discount rate decreases liabilities and improves the funding ratio, highlighting the importance of accurately assessing interest rate risk in pension fund management.

Liability Discounting

Liability discounting directly impacts the funding ratio by adjusting the discount rate to reflect the present value of future liabilities, thereby influencing the assessment of pension scheme solvency.

Unfunded Accrued Liability

Unfunded accrued liability increases as the funding ratio decreases and the discount rate used to value pension obligations declines.

Yield Curve

The yield curve influences the funding ratio by affecting discount rates used to value pension liabilities, where a steeper curve typically lowers discount rates and decreases the funding ratio.

Funding Ratio vs Discount Rate Infographic

moneydif.com

moneydif.com