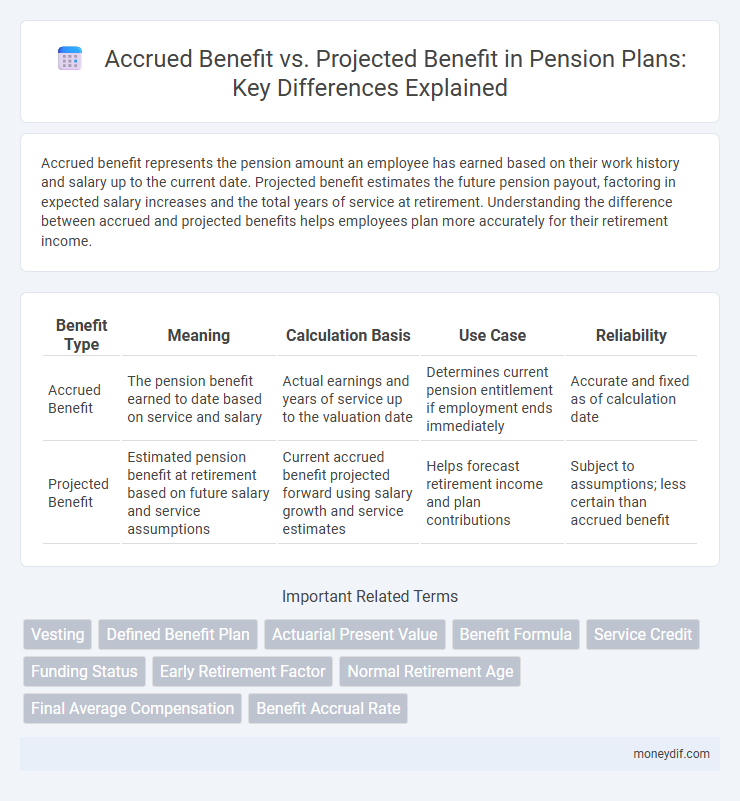

Accrued benefit represents the pension amount an employee has earned based on their work history and salary up to the current date. Projected benefit estimates the future pension payout, factoring in expected salary increases and the total years of service at retirement. Understanding the difference between accrued and projected benefits helps employees plan more accurately for their retirement income.

Table of Comparison

| Benefit Type | Meaning | Calculation Basis | Use Case | Reliability |

|---|---|---|---|---|

| Accrued Benefit | The pension benefit earned to date based on service and salary | Actual earnings and years of service up to the valuation date | Determines current pension entitlement if employment ends immediately | Accurate and fixed as of calculation date |

| Projected Benefit | Estimated pension benefit at retirement based on future salary and service assumptions | Current accrued benefit projected forward using salary growth and service estimates | Helps forecast retirement income and plan contributions | Subject to assumptions; less certain than accrued benefit |

Definition of Accrued Benefit

Accrued benefit refers to the portion of a pension benefit that an employee has earned based on their service up to a specific point in time, reflecting the value of contributions and years worked. This benefit represents the guaranteed amount payable upon retirement, excluding future salary increases or additional service years. It contrasts with the projected benefit, which estimates the total pension based on expected future earnings and continued employment.

Understanding Projected Benefit

Understanding projected benefit involves estimating the future pension amount based on expected salary increases and years of service, unlike accrued benefit which reflects the pension earned up to the current date. This forward-looking calculation helps participants anticipate their retirement income more accurately by incorporating assumptions such as salary growth rates and retirement age. Projected benefits provide a comprehensive view of potential retirement benefits, aiding in better financial planning and decision-making for pension holders.

Key Differences Between Accrued and Projected Benefits

Accrued benefits represent the pension amount earned based on an employee's service and salary up to the present date, reflecting a vested entitlement. Projected benefits estimate the future pension amount at retirement, factoring in expected salary increases and additional years of service. The key difference lies in the accrued benefit being a guaranteed value, while the projected benefit is a forecast subject to change.

How Accrued Benefits Are Calculated

Accrued benefits in a pension plan are calculated based on the employee's service years and salary history up to the calculation date, reflecting the value of benefits earned to that point. The formula typically involves multiplying the employee's credited service by a benefit multiplier and average salary, ensuring an accurate representation of vested pension rights. This contrasts with projected benefits, which estimate future pension values assuming continued service and salary increases.

Methods for Projecting Pension Benefits

Methods for projecting pension benefits include the accrued benefit method and the projected benefit method, with the latter estimating future pension entitlements based on factors such as anticipated salary increases, service years, and retirement age. The projected benefit method calculates benefits by multiplying future expected final salaries by years of credited service, providing a more comprehensive estimate of retirement income. Actuaries use demographic assumptions and economic variables to ensure the accuracy of projected benefits, crucial for pension plan funding and financial planning.

Importance of Accrued Benefits in Pension Planning

Accrued benefits represent the pension amount earned based on an employee's actual service up to a specific date, providing a concrete and guaranteed value for retirement planning. These benefits are crucial as they offer a reliable financial foundation, unlike projected benefits that estimate future entitlements subject to variables like salary increases and tenure. Emphasizing accrued benefits ensures pension plan participants have a clear understanding of their secured retirement income, enhancing informed decision-making and risk management.

Role of Projected Benefits in Retirement Forecasting

Projected benefits play a crucial role in retirement forecasting by estimating the future pension payments based on expected salary increases and years of service, providing a forward-looking view compared to accrued benefits, which reflect the value earned up to the present. This forward estimation helps individuals and financial planners assess potential retirement income and make informed decisions about additional contributions or adjustments to savings strategies. Utilizing projected benefits enhances the accuracy of retirement planning by incorporating variables like career growth and inflation, ensuring a comprehensive forecast.

Accrued vs. Projected Benefits in Defined Benefit Plans

Accrued benefits represent the pension amount earned by an employee based on their service and salary up to the current date, reflecting the vested entitlement in a defined benefit plan. Projected benefits estimate the future pension value considering expected salary increases and service until retirement, often resulting in a higher amount than accrued benefits. Understanding the distinction between accrued and projected benefits is crucial for accurate retirement planning and assessing pension liabilities.

Impact of Employment Changes on Both Benefits

Accrued benefit represents the pension amount earned based on an employee's service up to a specific date, remaining fixed despite changes in employment status. Projected benefit estimates the future pension value by incorporating assumptions like salary increases and continued service, which can significantly fluctuate with employment changes such as promotions, job switches, or layoffs. Employment changes impact projected benefits more directly than accrued benefits, influencing the potential retirement income through variations in future earnings and tenure assumptions.

Accrued and Projected Benefits: Implications for Pension Fund Management

Accrued benefits represent the pension amount an employee has earned based on their service and salary to date, serving as a concrete liability for pension fund managers. Projected benefits estimate future pension payments by factoring in anticipated salary increases and years of service, essential for forecasting long-term fund obligations. Effective pension fund management requires balancing accrued and projected benefits to ensure solvency and optimize investment strategies against evolving demographic and economic variables.

Important Terms

Vesting

Vesting determines the non-forfeitable portion of an accrued benefit, which reflects benefits earned to date, while projected benefits estimate future entitlements based on expected service and salary growth.

Defined Benefit Plan

The accrued benefit in a Defined Benefit Plan represents the pension earned based on service to date, while the projected benefit estimates the future pension at retirement assuming continued service and salary increases.

Actuarial Present Value

Actuarial Present Value calculates the present value of projected benefits, which typically exceed accrued benefits by incorporating assumptions about future salary increases and service.

Benefit Formula

The Benefit Formula calculates retirement benefits by comparing the Accrued Benefit, based on service earned to date, with the Projected Benefit, which estimates future benefits assuming continued service and salary growth.

Service Credit

Service credit directly impacts accrued benefits by reflecting earned pension rights, whereas projected benefits estimate future pension values based on anticipated service and salary growth.

Funding Status

Funding status evaluates the difference between accrued benefits, representing earned pension obligations, and projected benefits, which estimate future pension liabilities based on anticipated earnings and service.

Early Retirement Factor

The Early Retirement Factor adjusts the Accrued Benefit downward to estimate the reduced Projected Benefit if retirement occurs before the normal retirement age.

Normal Retirement Age

Normal Retirement Age determines when accrued benefits convert to projected benefits, impacting the calculation and timing of the full pension payout.

Final Average Compensation

Final Average Compensation directly influences the calculation of accrued benefits, while projected benefits estimate the anticipated retirement payout based on future salary growth.

Benefit Accrual Rate

The Benefit Accrual Rate measures the rate at which an employee's accrued benefit grows relative to their projected benefit over time in a pension plan.

Accrued benefit vs Projected benefit Infographic

moneydif.com

moneydif.com