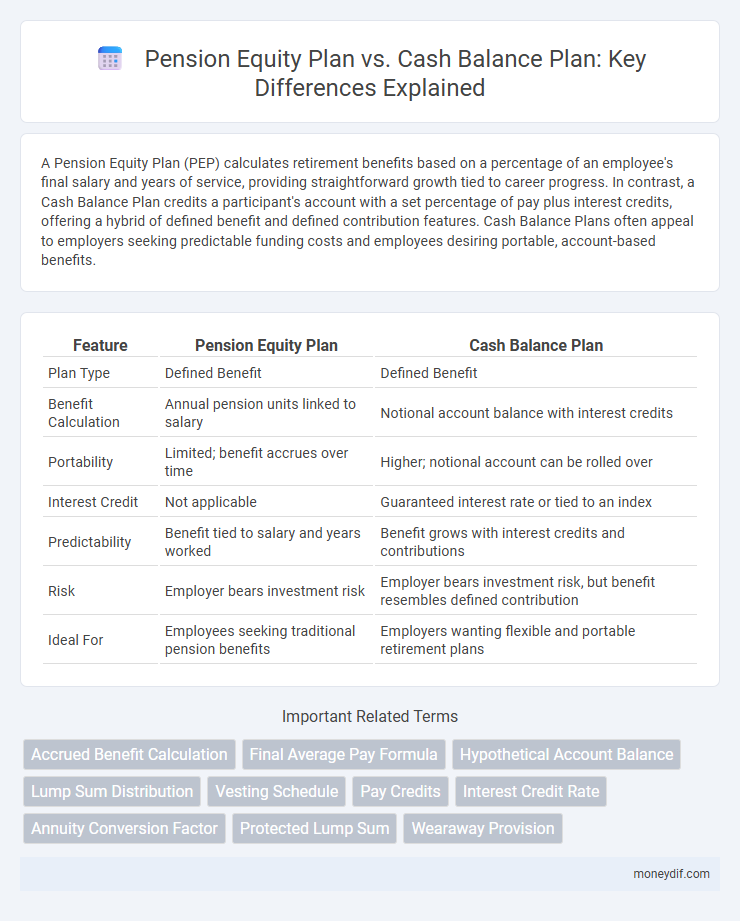

A Pension Equity Plan (PEP) calculates retirement benefits based on a percentage of an employee's final salary and years of service, providing straightforward growth tied to career progress. In contrast, a Cash Balance Plan credits a participant's account with a set percentage of pay plus interest credits, offering a hybrid of defined benefit and defined contribution features. Cash Balance Plans often appeal to employers seeking predictable funding costs and employees desiring portable, account-based benefits.

Table of Comparison

| Feature | Pension Equity Plan | Cash Balance Plan |

|---|---|---|

| Plan Type | Defined Benefit | Defined Benefit |

| Benefit Calculation | Annual pension units linked to salary | Notional account balance with interest credits |

| Portability | Limited; benefit accrues over time | Higher; notional account can be rolled over |

| Interest Credit | Not applicable | Guaranteed interest rate or tied to an index |

| Predictability | Benefit tied to salary and years worked | Benefit grows with interest credits and contributions |

| Risk | Employer bears investment risk | Employer bears investment risk, but benefit resembles defined contribution |

| Ideal For | Employees seeking traditional pension benefits | Employers wanting flexible and portable retirement plans |

Overview of Pension Equity Plans

Pension Equity Plans (PEPs) calculate retirement benefits based on an employee's annual compensation multiplied by a predetermined percentage, creating a clear, account-like target benefit. Unlike Cash Balance Plans, which accumulate a hypothetical account balance with interest credits, PEPs focus on equity accruals tied directly to salary growth. This structure often appeals to businesses seeking predictable retirement costs with benefits closely aligned to earnings.

Understanding Cash Balance Plans

Cash Balance Plans combine features of defined benefit and defined contribution plans, offering participants a guaranteed benefit expressed as a hypothetical account balance that grows annually with pay credits and interest credits. Unlike Pension Equity Plans, which calculate benefits based on a percentage of final salary multiplied by years of service, Cash Balance Plans provide a clearer and more portable account value that is easier to understand. This structure allows employers to manage pension funding more predictably while giving employees a tangible benefit accumulation.

Key Differences Between Pension Equity and Cash Balance Plans

Pension Equity Plans calculate retirement benefits based on a percentage of a participant's annual compensation, which accumulates to form the final benefit amount. Cash Balance Plans maintain a hypothetical account that grows annually with employer contributions and interest credits, resembling a defined contribution plan structure. Key differences include the benefit calculation method, with Pension Equity Plans emphasizing career earnings, while Cash Balance Plans provide a more predictable, account-based growth model.

Eligibility and Participation Criteria

Pension Equity Plans typically require employees to meet specific age and service requirements, often including a minimum number of years worked, before becoming eligible for participation. Cash Balance Plans generally allow broader eligibility with automatic enrollment for most employees upon meeting a minimum service period, such as one year, without stringent age restrictions. The participation criteria in Pension Equity Plans are often more restrictive compared to the inclusive nature of Cash Balance Plans, which aim to provide retirement benefits to a wider employee base.

Benefit Calculation Methods

Pension Equity Plans calculate benefits based on a percentage of an employee's annual salary multiplied by years of service, often resulting in defined lump sum amounts at retirement. Cash Balance Plans credit a participant's account with a stated percentage of their annual pay plus interest, mimicking a defined contribution plan but maintaining guaranteed benefits. The key distinction lies in the Pension Equity Plan's focus on accrued salary-based equity, whereas the Cash Balance Plan emphasizes a hypothetically growing account balance with interest credits.

Vesting Schedules and Portability

Pension Equity Plans typically offer faster vesting schedules, often allowing employees to become fully vested within three to five years, enhancing the security of their retirement benefits. Cash Balance Plans feature a portable account balance that employees can transfer or roll over upon leaving the company, promoting greater flexibility in managing retirement savings. Both plans aim to balance benefit accumulation with employee mobility, but Cash Balance Plans are generally more advantageous for employees prioritizing portability.

Employer and Employee Contributions

Pension Equity Plans typically base employer contributions on a fixed percentage of an employee's salary, often providing predictable growth tied to compensation, while employee contributions are usually optional and can vary by plan design. Cash Balance Plans require employer contributions determined by a predetermined formula, commonly a percentage of salary plus interest credits, and generally do not mandate employee contributions, making them attractive for employers focusing on stable funding. Both plans offer defined benefit features but differ in how contributions impact the employee's individual account balance.

Risk Management and Investment Options

Pension Equity Plans (PEPs) and Cash Balance Plans differ significantly in risk management and investment options. PEPs expose employees to market risk as benefits fluctuate with company stock performance, while Cash Balance Plans offer more stable, defined returns with employer-guaranteed interest credits, reducing employee risk. Investment options in Cash Balance Plans are typically managed by the employer or plan sponsor, contrasting with PEPs, where employees bear direct investment risk tied to equity ownership.

Tax Implications of Each Plan

Pension Equity Plans (PEPs) typically provide benefits based on a portion of final salary and accrued service, resulting in defined pension amounts that are taxed as ordinary income upon distribution. Cash Balance Plans function as defined benefit plans but express benefits as hypothetical account balances, with tax deferral on employer contributions and investment gains until retirement withdrawals. Both plans offer tax-deferred growth, but Cash Balance Plans often have more predictable benefit accruals and flexible payout options, which can influence individual tax planning strategies.

Choosing the Right Plan for Your Retirement Goals

Choosing the right retirement plan involves understanding the distinct features of Pension Equity Plans and Cash Balance Plans. Pension Equity Plans offer retirement benefits based on a fixed percentage of an employee's final salary multiplied by years of service, providing predictable lifetime income. Cash Balance Plans function like defined benefit plans with an individual account balance that grows annually through employer contributions and interest credits, offering more portability and clearer benefit statements for retirement planning.

Important Terms

Accrued Benefit Calculation

Accrued Benefit Calculation in Pension Equity Plans is based on the accumulated notional account reflecting individual pension units, whereas Cash Balance Plans calculate accrued benefits as a hypothetical account balance with guaranteed interest credits.

Final Average Pay Formula

The Final Average Pay Formula in Pension Equity Plans calculates retirement benefits based on an average of the employee's highest earnings, contrasting with Cash Balance Plans that use hypothetical account balances and interest credits to determine benefits.

Hypothetical Account Balance

Hypothetical Account Balance in a Pension Equity Plan represents a virtual account reflecting an employee's accrued benefits based on pay credits and interest credits similar to defined contribution plans, while in a Cash Balance Plan, it denotes a guaranteed balance updated annually with specified pay and interest credits ensuring predictable retirement benefits. Both plans use these notional accounts to calculate pension benefits, but the Pension Equity Plan ties growth more closely to the employee's earnings history, whereas the Cash Balance Plan provides a more stable, formula-driven accumulation.

Lump Sum Distribution

Lump sum distributions from a Pension Equity Plan are typically calculated based on a participant's pension equity units and final average salary, while distributions from a Cash Balance Plan reflect the participant's hypothetical account balance, including employer credits and interest.

Vesting Schedule

Pension Equity Plans provide a defined benefit with a vesting schedule based on a percentage of pension equity accrued annually, while Cash Balance Plans feature a vesting schedule tied to employer contributions credited to individual hypothetical accounts.

Pay Credits

Pay credits in Pension Equity Plans are typically expressed as percentage of salary credits increasing the pension account, while Cash Balance Plans allocate pay credits as fixed dollar amounts to employee accounts, influencing retirement benefits differently.

Interest Credit Rate

The Interest Credit Rate in a Pension Equity Plan typically mirrors market performance, whereas in a Cash Balance Plan it is a fixed or variable rate set by the employer, affecting the growth of retirement benefits.

Annuity Conversion Factor

Annuity Conversion Factor determines the monthly pension benefit from a lump sum in Pension Equity Plans and Cash Balance Plans by converting accumulated account balances into lifetime annuities.

Protected Lump Sum

A Protected Lump Sum in Pension Equity Plans guarantees a minimum payout based on accrued pension equity, contrasting with Cash Balance Plans where benefits are typically expressed as account balances matched by employer contributions and interest credits.

Wearaway Provision

The Wearaway Provision in Pension Equity Plans delays benefit accrual recognition, causing participants to temporarily forfeit pension gains earned under previous formulas compared to the continuous benefit accrual in Cash Balance Plans.

Pension Equity Plan vs Cash Balance Plan Infographic

moneydif.com

moneydif.com