Auto-enrolment in pensions automatically secures employees into a retirement savings plan, significantly increasing participation rates compared to opt-in schemes, where individuals must actively choose to join. This system improves long-term financial security by reducing the inertia that often prevents voluntary enrolment. Employers benefit from streamlined administration and enhanced compliance with pension regulations.

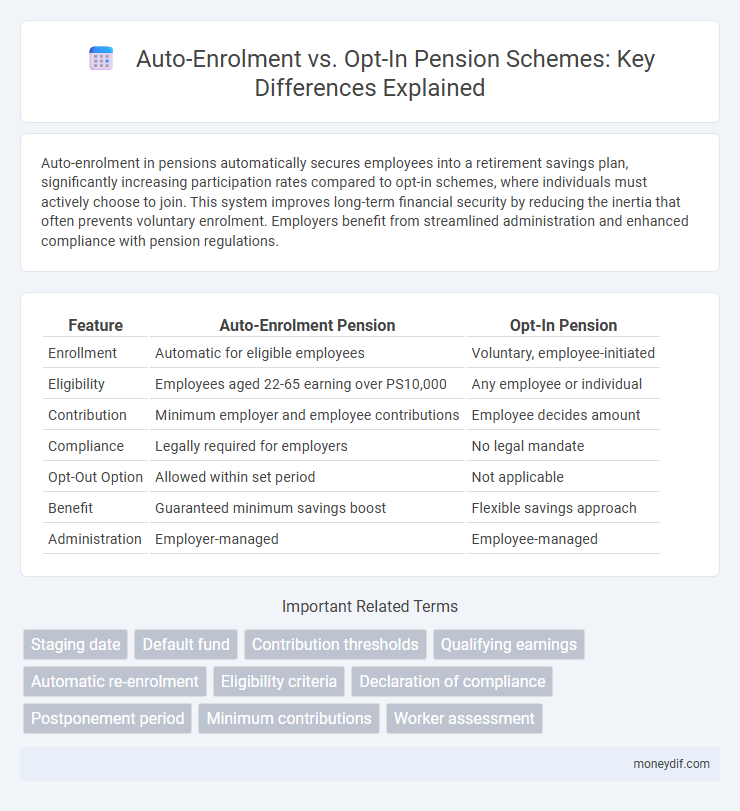

Table of Comparison

| Feature | Auto-Enrolment Pension | Opt-In Pension |

|---|---|---|

| Enrollment | Automatic for eligible employees | Voluntary, employee-initiated |

| Eligibility | Employees aged 22-65 earning over PS10,000 | Any employee or individual |

| Contribution | Minimum employer and employee contributions | Employee decides amount |

| Compliance | Legally required for employers | No legal mandate |

| Opt-Out Option | Allowed within set period | Not applicable |

| Benefit | Guaranteed minimum savings boost | Flexible savings approach |

| Administration | Employer-managed | Employee-managed |

Understanding Auto-Enrolment and Opt-In Pensions

Auto-enrolment pensions automatically enroll eligible employees into workplace pension schemes, ensuring consistent savings without requiring active decisions, thus increasing overall retirement fund participation. Conversely, opt-in pensions require employees to actively choose to join, which often leads to lower enrollment rates due to inertia or lack of awareness. Understanding these mechanisms is crucial for maximizing pension contributions and securing financial stability in retirement.

Key Differences Between Auto-Enrolment and Opt-In

Auto-enrolment mandates that eligible employees are automatically enrolled into a workplace pension scheme, ensuring higher participation rates and consistent retirement savings. Opt-in requires employees to actively choose to join their pension plan, often resulting in lower enrollment due to inertia and lack of awareness. Auto-enrolment shifts the administrative burden to employers and increases overall pension coverage, while opt-in places responsibility on employees to initiate savings themselves.

Eligibility Criteria for Each Scheme

Auto-enrolment pension schemes require employees aged 22 to State Pension age, earning above the lower earnings limit (currently PS10,000 per year), to be automatically enrolled by their employer. In contrast, opt-in schemes allow any employee, regardless of age or earnings, to voluntarily join and start contributing to a pension plan. Employers must assess eligibility based on these criteria to determine the appropriate pension scheme enrollment method.

Advantages of Auto-Enrolment for Employees

Auto-enrolment in pension schemes ensures employees are automatically registered, increasing participation rates and promoting long-term financial security. This system reduces the risk of employees missing out on retirement savings due to procrastination or lack of awareness. Employer contributions under auto-enrolment enhance the total pension pot, offering greater retirement benefits compared to opt-in schemes.

Challenges and Limitations of Opt-In Pensions

Opt-in pensions face significant challenges, including low participation rates due to lack of employee engagement and awareness. Many individuals delay or avoid enrolling, leading to inadequate retirement savings and financial insecurity. Employers also encounter administrative burdens and higher costs compared to auto-enrolment schemes that automatically include eligible workers.

Impact on Employer Responsibilities and Costs

Auto-enrolment significantly increases employer responsibilities by mandating automatic pension enrollment for eligible employees, requiring regular contributions and ongoing compliance monitoring. This system raises operational costs due to administrative tasks, pension provider fees, and potential penalties for non-compliance. Conversely, opt-in schemes reduce employer obligations and expenses, as contributions are made only for employees who actively choose to join, although this may result in lower overall employee pension participation.

Employee Participation Rates: Auto-Enrolment vs Opt-In

Auto-enrolment schemes significantly boost employee participation rates, reaching over 90% compared to opt-in plans, where participation often falls below 50%. The default enrollment feature in auto-enrolment removes barriers to saving by automatically including eligible employees, while opt-in relies on proactive employee action. Studies show that the simplicity and inertia in auto-enrolment lead to higher pension scheme engagement and long-term retirement savings accumulation.

Long-Term Retirement Savings Outcomes

Auto-enrolment schemes significantly increase pension participation rates, resulting in higher long-term retirement savings compared to opt-in systems where individuals must actively choose to join. Studies show auto-enrolment boosts accumulation by consistently capturing workers who might otherwise delay or forgo saving, leveraging behavioral inertia to enhance retirement security. Opt-in plans often lead to lower savings levels due to procrastination and lack of engagement, negatively impacting eventual retirement income stability.

Legal and Regulatory Considerations

Auto-enrolment pensions legally mandate employers to automatically enroll eligible employees, ensuring compliance with the UK's Pensions Act 2008 and subsequent regulations, while opt-in schemes rely on employees' voluntary participation, potentially leading to lower coverage rates. Regulatory frameworks impose strict duties on employers to assess eligibility, provide clear communication, and facilitate contributions via payroll for auto-enrolment, whereas opt-in plans place less legal burden on employers but risk non-compliance with minimum pension provisions. The Pensions Regulator enforces penalties for failure to comply with auto-enrolment duties, highlighting the importance of adherence to statutory obligations in contrast to the more flexible but less comprehensive opt-in approach.

Future Trends in Pension Enrolment Policies

Future trends in pension enrolment policies indicate a shift toward more automated systems, with auto-enrolment significantly increasing participation rates in workplace pension schemes compared to opt-in models. Governments and employers are adopting auto-enrolment to address pension shortfalls and enhance retirement savings sustainability across diverse demographics. Data shows that auto-enrolment boosts long-term pension fund growth, reducing the risk of inadequate retirement income and dependence on public welfare.

Important Terms

Staging date

The staging date determines when employers must automatically enroll eligible employees into workplace pensions, contrasting with opt-in schemes where employees voluntarily choose to join.

Default fund

Default funds in auto-enrolment schemes typically offer diversified, low-risk portfolios to maximize retirement savings, contrasting with opt-in plans where individuals often select higher-risk investments.

Contribution thresholds

Contribution thresholds for auto-enrolment are legally mandated minimums that ensure consistent pension savings, whereas opt-in schemes rely on individual decisions with no compulsory minimum contributions.

Qualifying earnings

Qualifying earnings, defined as the portion of an employee's pay between the lower and upper thresholds set by the government, determine the minimum earnings on which employers must calculate pension contributions under auto-enrolment, unlike opt-in schemes where contributions depend on voluntary employee enrollment regardless of earnings.

Automatic re-enrolment

Automatic re-enrolment ensures eligible employees are re-enrolled into workplace pension schemes, contrasting with opt-in where employees must actively choose to join.

Eligibility criteria

Auto-enrolment eligibility criteria require employees aged between 22 and State Pension age, earning over the minimum threshold (PS10,000 annually in the UK), to be automatically enrolled in a workplace pension scheme; employers must comply by assessing employee status and earnings. Opt-in schemes allow employees below the threshold or outside these categories to voluntarily join the pension plan, providing flexibility but requiring active participation for enrollment.

Declaration of compliance

The Declaration of Compliance for auto-enrolment mandates employers to automatically enroll eligible employees into a pension scheme, contrasting with opt-in systems that require employee initiation to participate.

Postponement period

The postponement period allows employers to delay automatic enrolment into a pension scheme for up to three months after an employee's eligibility date, contrasting with opt-in schemes where employees must proactively join without delay.

Minimum contributions

Auto-enrolment mandates minimum pension contributions typically set at 8% of qualifying earnings, whereas opt-in schemes often have variable minimum contributions determined by individual or employer preferences.

Worker assessment

Worker assessment determines eligibility for workplace pension schemes, distinguishing between auto-enrolment, which mandates enrolling eligible employees, and opt-in schemes, where workers must actively choose to participate. Auto-enrolment increases pension coverage by automatically including eligible workers unless they opt out, while opt-in processes typically result in lower participation rates due to reliance on employee initiative.

Auto-enrolment vs Opt-in Infographic

moneydif.com

moneydif.com