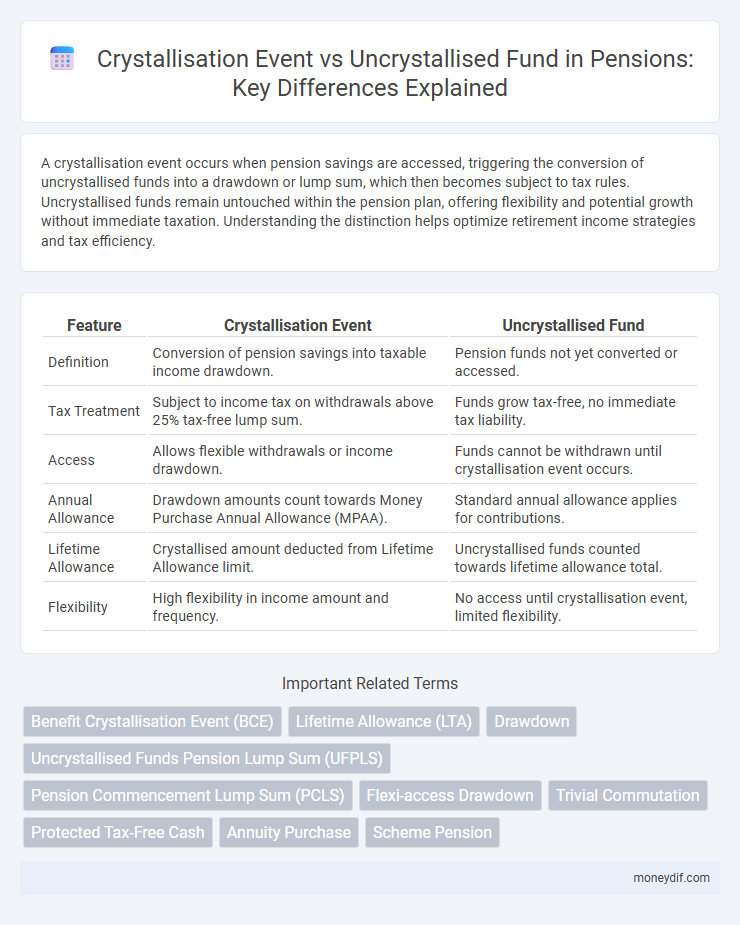

A crystallisation event occurs when pension savings are accessed, triggering the conversion of uncrystallised funds into a drawdown or lump sum, which then becomes subject to tax rules. Uncrystallised funds remain untouched within the pension plan, offering flexibility and potential growth without immediate taxation. Understanding the distinction helps optimize retirement income strategies and tax efficiency.

Table of Comparison

| Feature | Crystallisation Event | Uncrystallised Fund |

|---|---|---|

| Definition | Conversion of pension savings into taxable income drawdown. | Pension funds not yet converted or accessed. |

| Tax Treatment | Subject to income tax on withdrawals above 25% tax-free lump sum. | Funds grow tax-free, no immediate tax liability. |

| Access | Allows flexible withdrawals or income drawdown. | Funds cannot be withdrawn until crystallisation event occurs. |

| Annual Allowance | Drawdown amounts count towards Money Purchase Annual Allowance (MPAA). | Standard annual allowance applies for contributions. |

| Lifetime Allowance | Crystallised amount deducted from Lifetime Allowance limit. | Uncrystallised funds counted towards lifetime allowance total. |

| Flexibility | High flexibility in income amount and frequency. | No access until crystallisation event, limited flexibility. |

Understanding Pension Crystallisation: Key Concepts

Pension crystallisation refers to the process of converting uncrystallised pension funds into taxable income or benefits, typically occurring at retirement or upon taking a pension lump sum. Uncrystallised funds represent the portion of a pension pot that has not yet been accessed or subjected to tax charges, remaining fully invested and growing tax-free. Understanding the distinction between crystallised and uncrystallised funds is crucial for effective retirement planning and managing potential tax liabilities.

What is a Crystallisation Event?

A Crystallisation Event occurs when a pension holder accesses their pension benefits, converting an uncrystallised fund into a crystallised fund, triggering tax implications. The uncrystallised fund represents the portion of the pension yet to be accessed or taxed. Once crystallised, the fund value is used to determine tax-free lump sums and any subsequent taxable income withdrawals.

Uncrystallised Funds: Meaning and Features

Uncrystallised pension funds refer to savings within a pension plan that have not yet been accessed or converted into income, remaining invested and growing tax-free until withdrawal. These funds offer flexibility, allowing individuals to choose the timing and method of accessing their pension benefits, often without immediate tax consequences. Key features include the ability to leave the funds invested, potential for growth, and options for lump-sum withdrawals or phased retirement income once crystallisation occurs.

Crystallisation Triggers: When Does It Happen?

Crystallisation events in pensions occur when an individual accesses or draws benefits from their pension fund, converting uncrystallised funds into crystallised funds subject to tax implications. Key crystallisation triggers include reaching the minimum pension age, typically 55 (rising to 57 in 2028), taking a pension commencement lump sum, or starting regular withdrawals such as drawdown or annuity purchase. Understanding these triggers is essential for effective pension planning and managing tax liabilities associated with pension fund access.

Tax Implications: Crystallised vs Uncrystallised Funds

Crystallisation event triggers taxation on pension funds as the uncrystallised pension pot becomes accessible, leading to income tax on withdrawals exceeding the 25% tax-free lump sum. Uncrystallised funds remain tax-deferred until a crystallisation event occurs, preserving their tax-free status but limiting access and growth potential. Understanding the distinction between crystallised and uncrystallised funds is crucial for effective pension tax planning and minimizing unexpected tax liabilities.

Accessing Your Pension: Rules and Options

Accessing your pension involves a crystallisation event, which occurs when you convert part or all of your uncrystallised fund into income or lump sums, triggering potential tax liabilities. Uncrystallised funds remain invested without tax charges until you decide to crystallise and access them through options like drawdown, annuities, or lump sums. Understanding the rules governing crystallisation events is crucial for optimizing tax efficiency and ensuring compliance with pension withdrawal limits and age criteria.

Lump Sum Withdrawal and Crystallisation

A crystallisation event occurs when a pension fund is converted into a drawdown arrangement, allowing lump sum withdrawals up to 25% tax-free while the remaining balance remains invested. In contrast, an uncrystallised fund enables flexible lump sum withdrawals without prior conversion, but each payment may be taxed based on the individual's marginal rate. Understanding the tax implications and timing of crystallisation is crucial for optimizing pension income and managing tax liabilities effectively.

Lifetime Allowance and Crystallisation Events

A Crystallisation Event triggers assessment against the Lifetime Allowance, determining potential tax charges on the pension fund's value at the time of benefit withdrawal, transfer, or drawdown commencement. Uncrystallised Funds refer to pension savings yet to be accessed or turned into income, remaining outside Lifetime Allowance testing until a Crystallisation Event occurs. Understanding the timing and impact of Crystallisation Events is crucial for effective pension planning and minimizing Lifetime Allowance tax liabilities.

Planning Strategies: Managing Fund Crystallisation

Effective pension planning involves carefully managing the crystallisation event to maximize tax efficiency and retirement income. Delaying crystallisation can allow the uncrystallised fund to grow tax-free, but it risks reduced investment time and potential market volatility. Strategic timing of fund crystallisation balances the need for income with minimizing tax liabilities and preserving capital for beneficiaries.

Common Questions on Crystallisation and Uncrystallised Funds

A crystallisation event in a pension triggers the conversion of uncrystallised funds into a drawdown or annuity arrangement, enabling access to retirement benefits while locking in the fund's value for tax purposes. Common questions include how much tax-free cash can be taken during crystallisation, the timing and flexibility of accessing benefits, and the impact on remaining uncrystallised funds. Understanding the difference between crystallised and uncrystallised funds helps clarify pension income options and tax implications when planning retirement withdrawals.

Important Terms

Benefit Crystallisation Event (BCE)

A Benefit Crystallisation Event (BCE) triggers the calculation of pension benefits for tax purposes, transforming uncrystallised funds into crystallised funds subject to annual allowances and tax rules.

Lifetime Allowance (LTA)

Lifetime Allowance (LTA) limits the amount of pension savings that can be crystallised during crystallisation events without incurring additional tax charges, while uncrystallised funds remain within the pension scheme and are not yet subject to LTA tax assessments.

Drawdown

Drawdown in pension schemes refers to the process of withdrawing funds from an uncrystallised pension pot, triggering a crystallisation event that converts the uncrystallised fund into a crystallised fund subject to taxation and regulatory rules. The crystallisation event determines the new value for benefit calculations and pension growth, distinguishing between remaining uncrystallised portions and the allocated drawdown amounts accessible for income withdrawal.

Uncrystallised Funds Pension Lump Sum (UFPLS)

The Uncrystallised Funds Pension Lump Sum (UFPLS) allows a pension holder to withdraw a lump sum from their uncrystallised fund without requiring a full crystallisation event, enabling partial access to pension savings before the entire fund is crystallised.

Pension Commencement Lump Sum (PCLS)

The Pension Commencement Lump Sum (PCLS) is a tax-free cash payment available at the Crystallisation Event, where funds transition from an Uncrystallised Fund to a crystallised pension pot.

Flexi-access Drawdown

Flexi-access Drawdown allows pensioners to withdraw varying amounts from their crystallised funds following a Crystallisation Event, while uncrystallised funds remain invested without withdrawals or tax implications until designated for future crystallisation.

Trivial Commutation

Trivial Commutation simplifies partial withdrawal calculations by allowing small sums to be paid out without affecting the overall Crystallisation Event status of an Uncrystallised Fund.

Protected Tax-Free Cash

A Protected Tax-Free Cash amount is secured during a Crystallisation Event by locking in tax-free withdrawals from the previously Uncrystallised Fund balance.

Annuity Purchase

Annuity purchase involves converting an uncrystallised pension fund into a series of guaranteed payments following a crystallisation event such as retirement or reaching the minimum pension age. The transition from uncrystallised funds to crystallised funds triggers tax liabilities while securing a stable income stream through annuity payments.

Scheme Pension

Scheme Pension crystallisation event converts uncrystallised pension funds into income-drawing assets, triggering tax liabilities and enabling regulated drawdown options.

Crystallisation Event vs Uncrystallised Fund Infographic

moneydif.com

moneydif.com