Choosing between a lump sum and an annuity for your pension depends on your financial goals and risk tolerance. A lump sum offers immediate access to your funds, providing flexibility in investments and large purchases, while an annuity guarantees a steady income stream for life, reducing the risk of outliving your savings. Evaluating factors like tax implications, longevity, and spending needs is essential to making the best decision for retirement security.

Table of Comparison

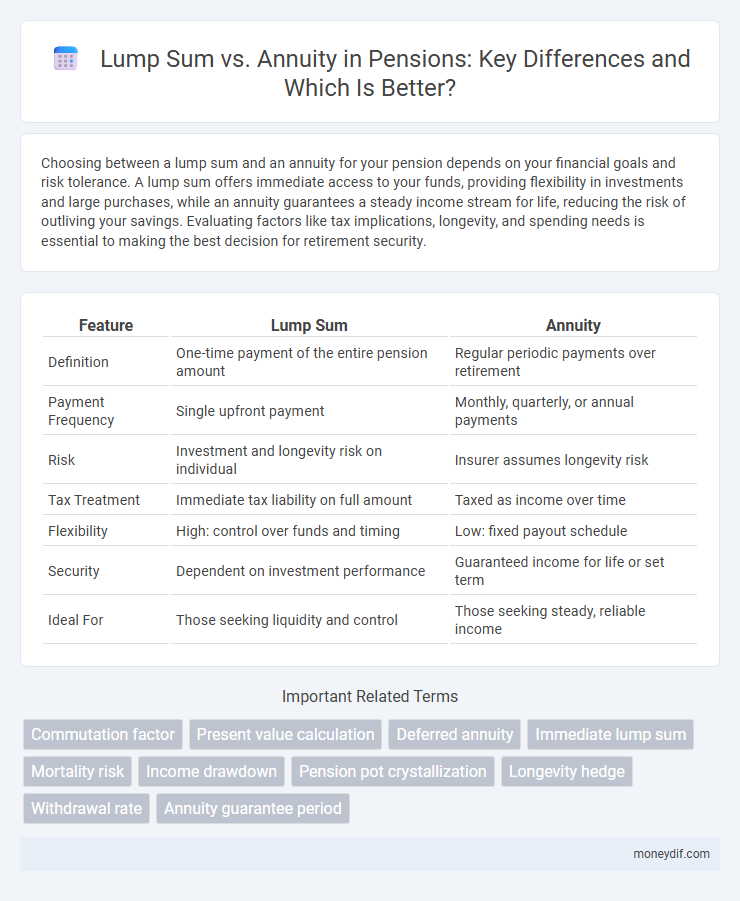

| Feature | Lump Sum | Annuity |

|---|---|---|

| Definition | One-time payment of the entire pension amount | Regular periodic payments over retirement |

| Payment Frequency | Single upfront payment | Monthly, quarterly, or annual payments |

| Risk | Investment and longevity risk on individual | Insurer assumes longevity risk |

| Tax Treatment | Immediate tax liability on full amount | Taxed as income over time |

| Flexibility | High: control over funds and timing | Low: fixed payout schedule |

| Security | Dependent on investment performance | Guaranteed income for life or set term |

| Ideal For | Those seeking liquidity and control | Those seeking steady, reliable income |

Understanding Lump Sum and Annuity: Key Differences

Lump sum payments provide a one-time payout allowing immediate access to the entire pension amount, offering flexibility but requiring careful financial management. Annuities deliver regular, guaranteed payments over a specified period or lifetime, ensuring consistent income and reducing the risk of outliving funds. Understanding these key differences helps retirees align pension choices with their financial goals and risk tolerance.

How Lump Sum Payouts Work in Pension Plans

Lump sum payouts in pension plans provide retirees with a one-time, tax-deferred payment representing the present value of their future pension benefits. This option allows individuals to take full control of their retirement funds, enabling flexible investment choices but also transferring investment and longevity risk to the retiree. Understanding the calculation methods, such as actuarial present value based on interest rates and life expectancy, is crucial for evaluating the lump sum offer against guaranteed annuity payments.

The Mechanics of Pension Annuities

Pension annuities convert a lump sum retirement savings into a steady income stream by purchasing an insurance contract that guarantees regular payments for life or a fixed term. The insurer calculates the annuity payments based on factors such as the retiree's age, gender, interest rates, and mortality assumptions to balance risk and ensure sustainability. This mechanism provides financial security by mitigating longevity risk, unlike lump sum withdrawals that expose retirees to the risk of depleting their savings prematurely.

Lump Sum vs Annuity: Pros and Cons

Choosing between a lump sum and an annuity for pension payouts depends on factors such as financial discipline, investment risk tolerance, and life expectancy. A lump sum provides immediate access to funds for investment or large expenses but carries the risk of depleting assets prematurely, while an annuity ensures guaranteed income for life, mitigating longevity risk but limiting liquidity and inheritance potential. Tax implications also vary, with lump sum withdrawals potentially resulting in higher tax burdens compared to structured annuity payments.

Tax Implications of Lump Sum and Annuity Choices

Lump sum pension withdrawals often face immediate taxation, with rates varying based on the total amount and tax jurisdiction, potentially pushing retirees into higher tax brackets. Annuity payments typically provide a steady income stream taxed as ordinary income over time, which can help mitigate large tax hits by spreading liability annually. Choosing between lump sum and annuity impacts tax planning strategies, influencing long-term financial stability depending on the retiree's tax bracket and cash flow needs.

Factors to Consider When Choosing Lump Sum or Annuity

When deciding between a lump sum and an annuity for pension payouts, consider factors such as current tax implications, life expectancy, and investment risk tolerance. A lump sum offers immediate access to funds but requires disciplined investment management, while an annuity provides guaranteed periodic payments that mitigate longevity risk. Evaluate personal financial goals, inflation protection, and potential legacy benefits before making a decision.

Impact on Retirement Security: Lump Sum vs Annuity

Choosing a lump sum payout from a pension plan offers immediate access to a large amount of money but transfers the risk of investment and longevity to the retiree, potentially endangering retirement security if funds are mismanaged. Annuities provide a steady, guaranteed income stream for life, enhancing retirement security by mitigating longevity risk and market volatility. Studies show that retirees with annuity income are less likely to outlive their resources compared to those relying solely on lump sum distributions.

Inflation and Longevity Risk: Annuity versus Lump Sum

Annuities provide a steady income stream that adjusts for inflation, helping protect retirees from the erosion of purchasing power over time, while lump sum payments risk losing value as inflation rises. Longevity risk is mitigated with annuities since payments continue for life, ensuring financial stability regardless of lifespan, whereas lump sum recipients must carefully manage funds to avoid outliving their savings. Choosing annuities over lump sums reduces the uncertainty of market fluctuations and longevity, offering a reliable hedge against inflation and life expectancy challenges in retirement planning.

Real-Life Scenarios: Case Studies of Lump Sum and Annuity Decisions

Lump sum payments offer retirees immediate access to a large sum, facilitating debt repayment, investment opportunities, or housing purchases, as seen in cases where individuals prioritize financial flexibility. Annuities provide steady, guaranteed income, proving beneficial in scenarios focused on long-term financial stability and managing longevity risk, as demonstrated by retirees relying on fixed monthly payments for budgeting. Real-life analyses reveal that the optimal choice depends on personal circumstances, risk tolerance, and future income needs.

Expert Tips for Making the Right Pension Payout Choice

Choosing between a lump sum and an annuity for pension payouts depends on individual financial goals, life expectancy, and market conditions. Experts recommend evaluating factors such as tax implications, investment discipline, and risk tolerance to optimize retirement income and ensure long-term financial security. Consulting a certified financial advisor helps tailor decisions to personal circumstances, maximizing the benefits of pension funds.

Important Terms

Commutation factor

The commutation factor quantifies the present value of future annuity payments, crucial for calculating lump sum settlements versus ongoing annuity payouts in actuarial and pension fund evaluations.

Present value calculation

Present value calculation determines whether a lump sum or annuity provides greater financial advantage by discounting future cash flows to their current worth using an appropriate interest rate.

Deferred annuity

A deferred annuity allows investors to accumulate funds tax-deferred until withdrawals begin, contrasting with a lump sum payment that offers immediate access but lacks ongoing income guarantees. Choosing between lump sum and deferred annuity depends on factors like retirement timeline, income stability needs, and tax implications.

Immediate lump sum

Immediate lump sum offers a one-time payment option that contrasts with annuity's spread-out disbursements, allowing for instant access to full funds but higher risk of depletion. Choosing between lump sum and annuity depends on financial goals, tax implications, and risk tolerance.

Mortality risk

Mortality risk significantly influences the decision between lump sum and annuity payments, as annuities provide lifetime income that mitigates longevity risk, while lump sums expose individuals to the risk of outliving their assets. Insurers price annuities based on expected mortality rates, ensuring steady payouts that adapt to mortality probabilities, whereas lump sum recipients must manage their funds prudently to avoid depletion during extended lifespans.

Income drawdown

Income drawdown allows retirees to withdraw variable amounts from their pension funds while keeping investments invested, offering more flexibility compared to annuities, which provide a guaranteed, fixed income for life. Choosing between lump sum withdrawals and annuities depends on factors like risk tolerance, life expectancy, and the need for predictable income versus potential investment growth.

Pension pot crystallization

Pension pot crystallization enables individuals to access their retirement savings, offering a choice between taking a tax-free lump sum of up to 25% and converting the remainder into a guaranteed income annuity or flexible drawdown options.

Longevity hedge

Longevity hedge strategies help mitigate risks associated with outliving lump sum investments compared to annuity payouts by securing guaranteed income streams over uncertain life spans.

Withdrawal rate

Withdrawal rate optimization depends on whether a lump sum or annuity is chosen, as lump sums require careful rate control to avoid depletion while annuities provide fixed periodic payments reducing withdrawal rate risk.

Annuity guarantee period

Choosing an annuity with a guarantee period ensures fixed income payments for a specified time, providing financial security compared to the immediate lump sum payout.

Lump sum vs Annuity Infographic

moneydif.com

moneydif.com