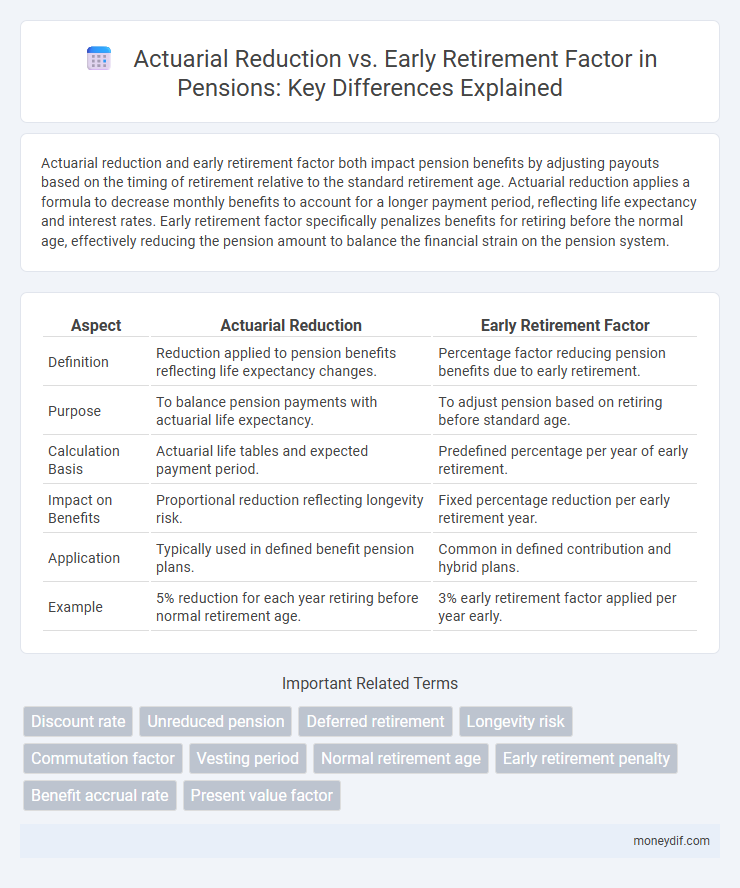

Actuarial reduction and early retirement factor both impact pension benefits by adjusting payouts based on the timing of retirement relative to the standard retirement age. Actuarial reduction applies a formula to decrease monthly benefits to account for a longer payment period, reflecting life expectancy and interest rates. Early retirement factor specifically penalizes benefits for retiring before the normal age, effectively reducing the pension amount to balance the financial strain on the pension system.

Table of Comparison

| Aspect | Actuarial Reduction | Early Retirement Factor |

|---|---|---|

| Definition | Reduction applied to pension benefits reflecting life expectancy changes. | Percentage factor reducing pension benefits due to early retirement. |

| Purpose | To balance pension payments with actuarial life expectancy. | To adjust pension based on retiring before standard age. |

| Calculation Basis | Actuarial life tables and expected payment period. | Predefined percentage per year of early retirement. |

| Impact on Benefits | Proportional reduction reflecting longevity risk. | Fixed percentage reduction per early retirement year. |

| Application | Typically used in defined benefit pension plans. | Common in defined contribution and hybrid plans. |

| Example | 5% reduction for each year retiring before normal retirement age. | 3% early retirement factor applied per year early. |

Understanding Actuarial Reduction in Pension Plans

Actuarial reduction in pension plans adjusts benefits to account for longer payout periods when retiring early, ensuring the plan's financial sustainability. This reduction is calculated based on actuarial assumptions such as life expectancy, interest rates, and retirement age, differing from early retirement factors which often apply fixed percentage cuts. Understanding the actuarial reduction helps participants make informed decisions about timing their pension benefits without risking underpayment or financial imbalance.

What Is an Early Retirement Factor?

An early retirement factor is a percentage used to adjust pension benefits when an individual opts to retire before the standard retirement age. This factor reduces the monthly pension payout to account for the longer expected payment period, reflecting the actuarial reduction based on life expectancy and interest rates. Understanding the early retirement factor is crucial for accurately estimating how early retirement impacts total pension value and long-term financial planning.

Key Differences: Actuarial Reduction vs Early Retirement Factor

Actuarial reduction adjusts pension benefits to account for the longer payment period when retiring early, typically based on life expectancy and interest rates to ensure actuarial fairness. The early retirement factor is a predetermined percentage applied to reduce pension benefits when benefits commence before the normal retirement age, often set by pension plan rules. Key differences lie in actuarial reduction's individualized calculation versus the early retirement factor's fixed reduction approach tied directly to early retirement age.

Impact of Early Retirement on Pension Amounts

Early retirement factor reduces pension amounts by adjusting benefits to account for longer payment periods, resulting in lower monthly payouts. Actuarial reduction calculates the precise decrease in pension based on life expectancy and financial assumptions, ensuring the plan's solvency. Both methods lead to reduced pension benefits when retiring before standard age, with actuarial reduction providing a mathematically balanced adjustment.

How Actuarial Reductions Are Calculated

Actuarial reductions are calculated using factors that account for the time value of money and increased payment duration due to early retirement, often involving mortality tables and interest rates to estimate expected pension payouts over the retiree's lifetime. These calculations adjust the pension benefit downward to reflect the longer period over which payments will be made, ensuring the pension fund's financial sustainability. Early retirement factors specifically quantify the percentage reduction per year of retirement before the normal retirement age, reflecting actuarial assumptions about longevity and investment returns.

Scenarios Triggering Early Retirement Factors

Early retirement factors are typically triggered by scenarios such as voluntary exit before the statutory retirement age, disability claims, or organizational restructuring including layoffs and redundancy programs. Actuarial reductions quantify the financial impact of these early withdrawals by adjusting pension benefits to account for the longer payout period and the reduced working years contributing to the pension fund. These adjustments reflect statistical life expectancy and investment return assumptions to ensure the fund's long-term solvency despite premature benefit access.

Financial Consequences of Retiring Before Normal Age

Retiring before the normal pension age usually triggers actuarial reductions to account for the longer payout period, directly decreasing the monthly pension benefit. The early retirement factor is a multiplier applied to the initial pension amount, reflecting the financial impact of accessing benefits sooner than planned. These mechanisms together ensure the pension fund's sustainability but result in significantly lower lifetime income for individuals opting for early retirement.

Strategies to Minimize Actuarial Reductions

Minimizing actuarial reductions involves strategic timing of pension claims and maximizing service years to enhance accrued benefits without penalty. Utilizing partial retirement options or phased withdrawal plans can reduce the financial impact of early retirement factors by spreading out pension benefits. Leveraging employer-sponsored pension credits and optimizing salary history data further offsets actuarial reductions, preserving higher retirement income.

Case Studies: Comparing Pension Outcomes

Case studies comparing actuarial reductions and early retirement factors reveal significant differences in pension outcomes, with actuarial reductions typically offering more precise adjustments based on life expectancy and retirement age. Early retirement factors often apply a fixed percentage decrease per year before the standard retirement age, which may not account for individual longevity variations. Analysis of diverse pension plans shows that actuarial adjustments can provide fairer, more personalized benefits, improving financial sustainability for retirees and pension funds alike.

Making Informed Decisions About Early Retirement

Understanding the differences between actuarial reduction and early retirement factors is crucial for making informed decisions about pension options. Actuarial reduction typically adjusts benefits based on life expectancy and the timing of retirement, reducing monthly payments to account for longer payout periods. Early retirement factors apply specific deductions to pension benefits when individuals choose to retire before the normal retirement age, impacting the total retirement income received.

Important Terms

Discount rate

The discount rate directly influences the calculation of actuarial reduction and early retirement factors by adjusting the present value of future pension benefits, thereby affecting the financial impact of retiring early.

Unreduced pension

Unreduced pension refers to receiving full retirement benefits without actuarial reduction typically achieved by qualifying for early retirement factors that do not penalize the pension amount.

Deferred retirement

Deferred retirement allows individuals to postpone claiming Social Security benefits beyond full retirement age, increasing their monthly payment through actuarial adjustments. Actuarial reduction typically decreases benefits if claimed early, whereas early retirement factors apply specific multipliers to reduce payments based on the number of months benefits are claimed before full retirement age.

Longevity risk

Longevity risk significantly impacts actuarial reductions and early retirement factors by increasing the uncertainty in projecting life expectancy beyond retirement age, thus requiring more conservative discount rates and higher early retirement penalties to ensure sustainable pension plan funding. Actuaries incorporate longevity risk by adjusting early retirement factors to account for longer payout periods, balancing the financial stability of pension funds while providing fair benefits to retirees opting for early retirement.

Commutation factor

The commutation factor quantifies the present value of future pension payments, directly influencing actuarial reductions and early retirement factors by adjusting benefits to reflect the financial impact of retiring before the standard age.

Vesting period

The vesting period determines eligibility for benefits, influencing actuarial reduction rates and early retirement factors that adjust pension payouts based on the timing of retirement.

Normal retirement age

The normal retirement age typically determines the standard age for full pension benefits, while actuarial reduction and early retirement factors quantify the decrease in benefits due to claiming retirement before this age.

Early retirement penalty

Early retirement penalty is calculated by applying an actuarial reduction to benefits based on the early retirement factor, which adjusts payouts to account for the longer expected payment period.

Benefit accrual rate

The benefit accrual rate decreases with actuarial reduction to adjust for early retirement factors, ensuring pension benefits remain actuarially fair.

Present value factor

The present value factor quantifies the actuarial reduction applied to pension benefits when calculating the early retirement factor, reflecting the discounted value of future payments adjusted for early withdrawal.

Actuarial reduction vs Early retirement factor Infographic

moneydif.com

moneydif.com