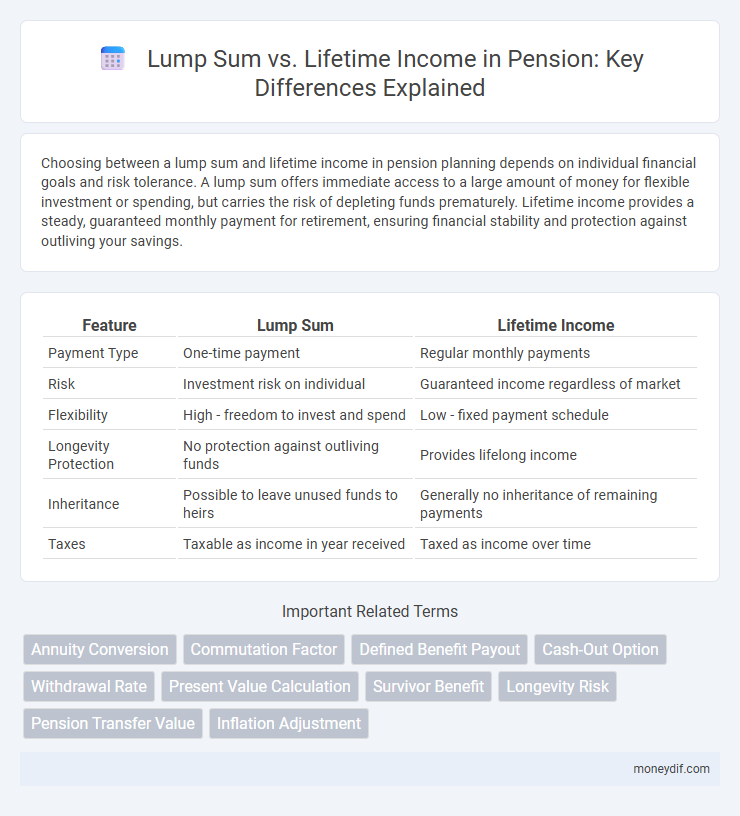

Choosing between a lump sum and lifetime income in pension planning depends on individual financial goals and risk tolerance. A lump sum offers immediate access to a large amount of money for flexible investment or spending, but carries the risk of depleting funds prematurely. Lifetime income provides a steady, guaranteed monthly payment for retirement, ensuring financial stability and protection against outliving your savings.

Table of Comparison

| Feature | Lump Sum | Lifetime Income |

|---|---|---|

| Payment Type | One-time payment | Regular monthly payments |

| Risk | Investment risk on individual | Guaranteed income regardless of market |

| Flexibility | High - freedom to invest and spend | Low - fixed payment schedule |

| Longevity Protection | No protection against outliving funds | Provides lifelong income |

| Inheritance | Possible to leave unused funds to heirs | Generally no inheritance of remaining payments |

| Taxes | Taxable as income in year received | Taxed as income over time |

Understanding Lump Sum vs Lifetime Income Options

Choosing between a lump sum and lifetime income in pension planning involves evaluating financial stability and long-term security. A lump sum provides immediate access to the entire pension amount, offering flexibility for investment or debt repayment but risks outliving the funds. Lifetime income options guarantee a steady stream of payments for life, reducing longevity risk but limiting access to the principal and potential growth opportunities.

Key Differences Between Lump Sum and Lifetime Income

Lump sum payments provide immediate access to the entire pension amount, enabling flexibility in investment and spending but posing a risk of depleting funds prematurely. Lifetime income offers guaranteed monthly payments for life, ensuring financial security and protection against outliving savings. Key differences include liquidity, risk management, and long-term financial stability, which heavily influence retirement planning decisions.

Advantages of Choosing a Lump Sum Pension

Opting for a lump sum pension allows for greater control over retirement funds, enabling personalized investment strategies and potential for higher returns. This choice provides immediate access to the full amount, offering flexibility to pay off debts, make large purchases, or support family needs. Tax planning opportunities arise as recipients can decide when and how much to withdraw, potentially minimizing tax liabilities compared to fixed lifetime income disbursements.

Benefits of Opting for Lifetime Income

Choosing lifetime income from a pension ensures a guaranteed, stable cash flow throughout retirement, effectively mitigating the risk of outliving savings. This option provides financial security and peace of mind by offering predictable monthly payments regardless of market fluctuations. Lifetime income also often includes inflation protection and survivor benefits, enhancing long-term financial stability for retirees and their families.

Financial Planning Considerations

Choosing between a lump sum and lifetime income in pension distribution requires careful financial planning to balance immediate liquidity with long-term security. Evaluating factors such as current debt levels, expected lifespan, market volatility, and inflation rates is essential for optimizing retirement income streams. Incorporating tax implications and beneficiary considerations can further align pension choices with individual financial goals.

Tax Implications of Both Pension Options

Lump sum pension withdrawals often trigger immediate income tax liabilities, potentially pushing retirees into higher tax brackets, while lifetime income plans typically spread tax payments over many years, resulting in more manageable annual tax burdens. Choosing a lump sum may also expose retirees to potential capital gains taxes if the funds are invested outside tax-advantaged accounts. Lifetime income often benefits from tax deferral and predictable distributions, minimizing the risk of large tax bills in any single year.

Assessing Risk Tolerance for Retirement Income

Assessing risk tolerance for retirement income involves evaluating the stability and predictability of lump sum withdrawals versus lifetime income streams. A lump sum provides flexibility but carries investment and longevity risks, while lifetime income offers guaranteed payments, reducing the chance of outliving assets. Understanding individual risk tolerance is essential to balance income security with growth potential in retirement planning.

Impact on Heirs and Estate Planning

Choosing a lump sum pension payment provides heirs with immediate access to inherited funds, facilitating flexible estate planning and potential tax advantages. Lifetime income options ensure guaranteed periodic payments, reducing the risk of outliving assets but typically limiting the residual value passed to beneficiaries. Careful evaluation of heirs' financial needs and estate goals is essential in selecting the optimal pension distribution strategy.

Real-Life Scenarios: Case Studies

Real-life scenarios highlight that lump sum payouts offer flexibility for immediate large expenses or investment opportunities, while lifetime income provides steady, guaranteed payments that mitigate longevity risk. Case studies reveal retirees choosing lump sums benefit from managing inheritances but face market volatility risks, whereas those selecting lifetime income secure predictable budgeting despite limited access to accumulated funds. Analyzing individual financial goals and health conditions ensures the optimal balance between liquidity and income stability in pension planning.

How to Decide: Factors to Weigh

When deciding between a lump sum and lifetime income for your pension, evaluate factors such as your life expectancy, financial needs, and risk tolerance. Consider the value of guaranteed monthly payments versus the flexibility and potential growth opportunities of a lump sum investment. Tax implications, inflation, and estate planning goals also play crucial roles in determining the best option for your retirement strategy.

Important Terms

Annuity Conversion

Annuity conversion transforms a lump sum into guaranteed lifetime income, providing financial security through consistent payments.

Commutation Factor

The commutation factor determines the lump sum value equivalent to a lifetime income by discounting future pension payments based on interest rates and mortality assumptions.

Defined Benefit Payout

Defined Benefit Payout options include choosing between a Lump Sum payment, which provides a one-time, upfront distribution, and Lifetime Income, offering guaranteed periodic payments for life to ensure financial stability during retirement.

Cash-Out Option

The Cash-Out Option enables recipients to choose between receiving a lump sum payment or lifetime income, balancing immediate access to funds with long-term financial security.

Withdrawal Rate

The withdrawal rate determines sustainable income by balancing lump sum investments against lifetime income annuities to optimize long-term financial security.

Present Value Calculation

Present value calculation compares the lump sum's current worth against the discounted lifetime income stream to determine the more financially advantageous option.

Survivor Benefit

Choosing a lump sum survivor benefit provides immediate access to a fixed amount, while lifetime income ensures continuous financial support to beneficiaries for their entire lifespan.

Longevity Risk

Longevity risk, the possibility of outliving one's financial resources, critically affects the choice between lump sum withdrawals and lifetime income options such as annuities. Lifetime income guarantees steady cash flow for life, mitigating longevity risk, whereas lump sum distributions require disciplined management to sustain funds over an unpredictable lifespan.

Pension Transfer Value

Pension transfer value represents the lump sum amount offered for transferring a defined benefit pension, which must be carefully compared to the projected lifetime income to determine the most financially advantageous option.

Inflation Adjustment

Inflation adjustment significantly impacts the real value of lump-sum payments versus lifetime income streams, with inflation-indexed lifetime income offering more reliable purchasing power protection over time.

Lump Sum vs Lifetime Income Infographic

moneydif.com

moneydif.com